An innovative and efficient way of processing invoices is high on the priority list for the majority of CFOs. The accounts payable process usually contains a lot of inefficiencies and complexities. The process typically consists of the following steps:

Receiving the invoice and extracting invoice data.

Matching the invoice with a purchase order and possibly a goods receipt.

Determining the general ledger account and cost center for expense invoices.

Obtaining approval if required.

The most common process exceptions are price and quantity differences with the PO, which usually require a lot of manual and time-consuming work. New intelligent solutions automate these repetitive tasks, including the ability to automate complex invoices.

How does Accounts Payable Process Automation work?

In this video, we describe our vision for accounts payable automation and how we can help you in mitigating inefficiencies in the accounts payable process of your company.

Benefits of Accounts Payable Process Automation

Through innovative technology, an automated accounts payable process can lead to significant benefits:

Cost savings. An efficient workflow can save on overhead and obviate other (outdated) solutions. In addition, invoices can be processed faster, which may positively affect payment terms and discounts.

High user-friendliness. A user-friendly application supports the user at every step of the process. Data is automatically read or completed, making the work for the accounts payable employee and/or approver easy and accessible.

A better controllable process. All steps in the process are monitored, and each step is recorded in a database. This makes it possible to trace all choices made by the employee or the system. In addition, you can easily assign roles and responsibilities to the right people.

Maximize deployment using Artificial Intelligence (AI) and Machine Learning (ML). Using self-learning AI technology for recognizing and processing invoices supports employees in their tasks.

Built-in management reporting/dashboards. The extensive logging allows for detailed dashboards to be generated and reports to be automatically sent. This enables the right decisions to be made to optimize the process further.

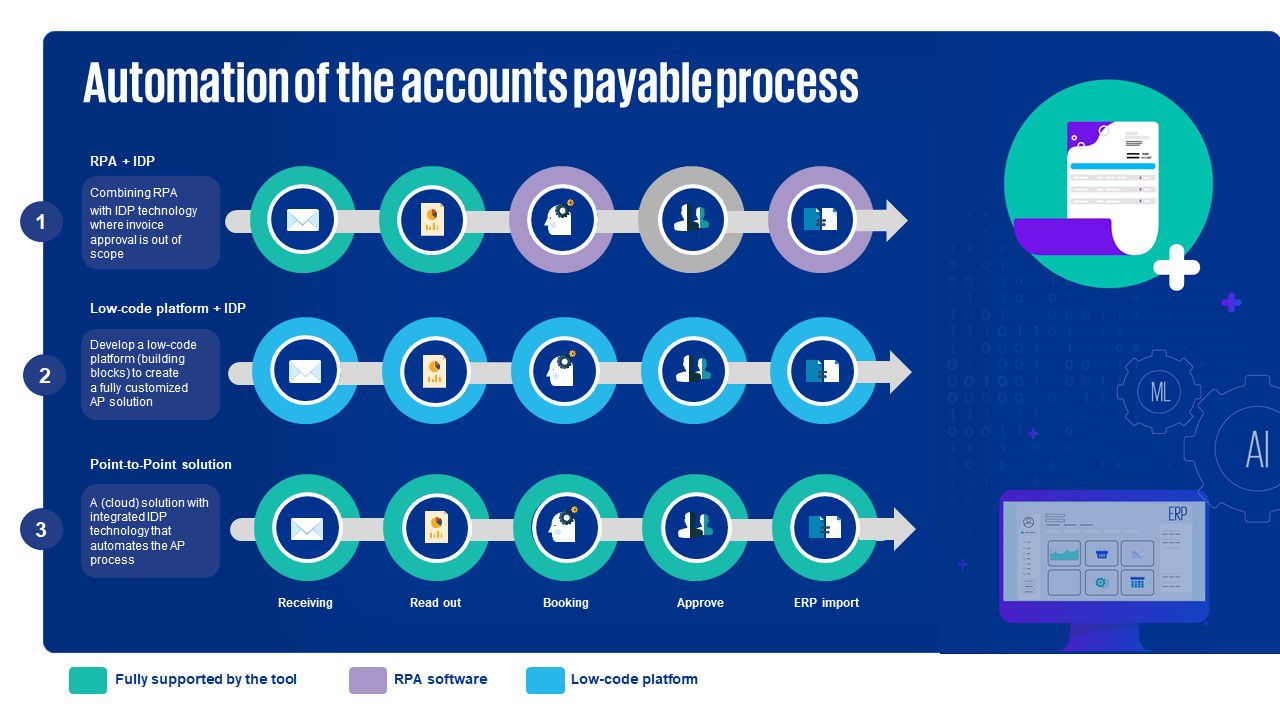

Automating the process in different ways

There is no ‘one-size-fits-all’ solution when it comes to automating the accounts payable process. This is mainly due to differences in the complexity of the current process, company-specific exceptions, and which technology best fits the company's long-term strategy. That is why KPMG has various options available to have a suitable solution for every situation.

- RPA in combination with IDP

The most time-consuming and complex step in the accounts payable process is validating, booking, and/or matching an invoice to the correct purchase order. Using RPA software combined with Intelligent Document Processing (IDP) tools, invoices can be processed faster. The IDP tool extracts invoice data and puts the information into a structured file. Based on historical data, RPA can also be used to make a proposed booking. - Self-developed accounts payable solution

Low-code platforms make it possible to assemble applications from ready-made and proven components on a built-in architecture. This gives organizations the ability to build a completely customized piece of software without using programming languages. More background information on Low Code can be found here. - P2P accounts payable solution

For an organization that aims to optimize its entire accounts payable flow, a Point-to-Point (P2P) solution is the best choice. By using state-of-the-art software technology, the invoicing process can be fully or partially automated from beginning to end. With the help of this intelligent technology, specifically designed for the accounts payable function, invoice verification, and matching can be automated and set up more efficiently. All steps in the process can be captured in a single application.

Featured

Contacts

Joris Juttmann

Partner

KPMG in the Netherlands

juttmann.joris@kpmg.nl

+31 20 656 7916

Dimitri Sloof

Partner

KPMG in the Netherlands

sloof.dimitri@kpmg.nl

+31 20 656 4456