Integration

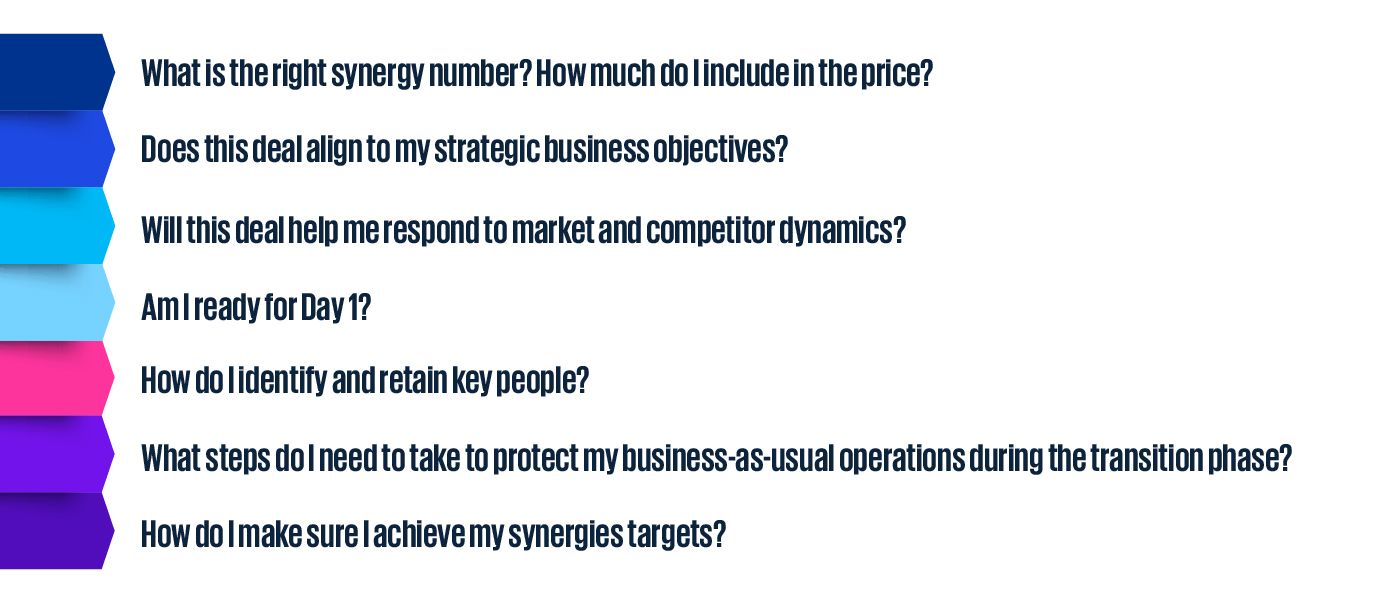

When it comes to integrating a business, getting it right in four areas is crucial: vision, control, people and value.

Without managing these, almost two-thirds of acquirers fail to realize synergy targets in today’s increasingly competitive M&A market. Nearly half of the synergy target, on average, is included in the purchase price.

KPMG’s member firms are focused on creating real, lasting value. We tackle key issues, eliminate unexpected surprises and identify synergies to help you minimize risk and maximize value. We help you focus on key questions at each stage of the process, working closely with you to overcome even the most challenging aspects of the deal.

Separation

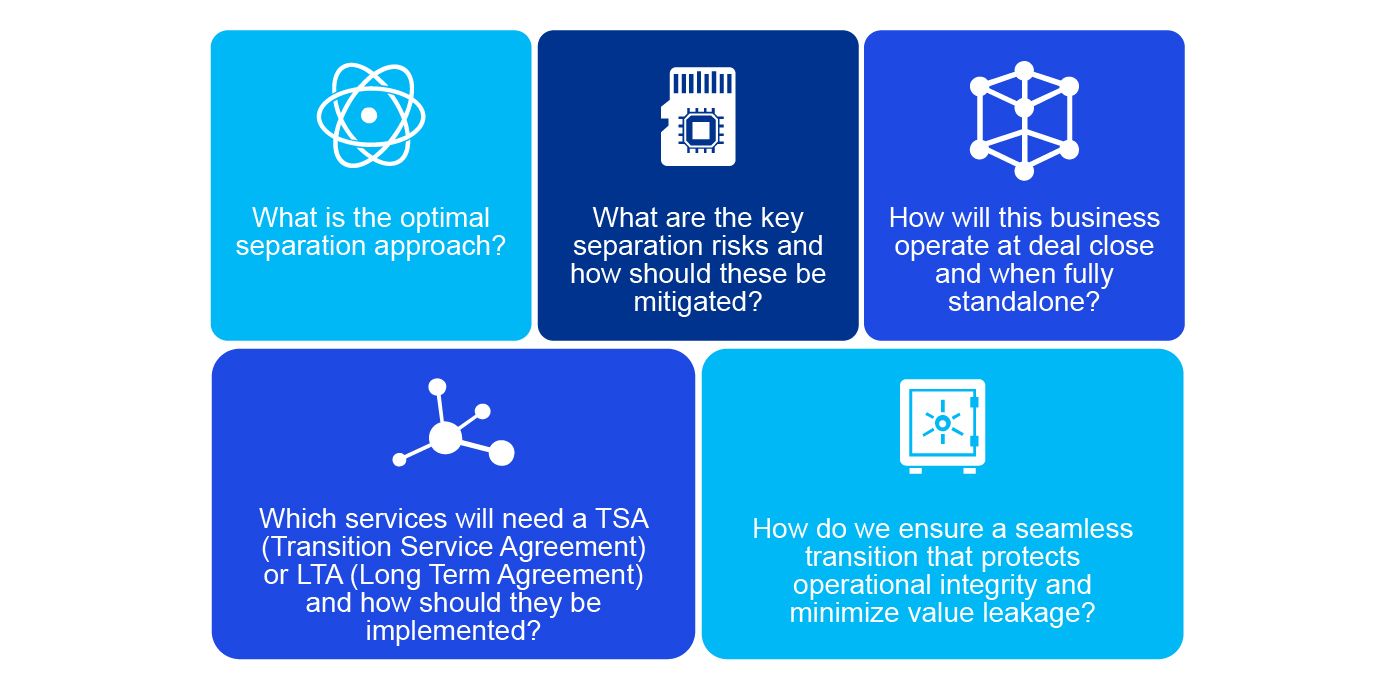

Whether it is to strengthen balance sheets by selling non-core businesses, simplify businesses by selling non-core brands, achieve a new strategic direction by spinning off a division, or sell a business unit as mandated by regulators, divestments and carve outs have generated a significant amount of value in the M&A market.

However, the carve-out road is not easy. Separation complexity should not be underestimated as it has a direct impact on deal price. To be successful, it requires a balance between maximizing value while mitigating risks, and quickly divesting while maintaining control of the process and protecting business-as-usual operations.

We help clients throughout the whole process, from defining separation options and understanding the potential impact on value through to developing and delivering successful separation plans.