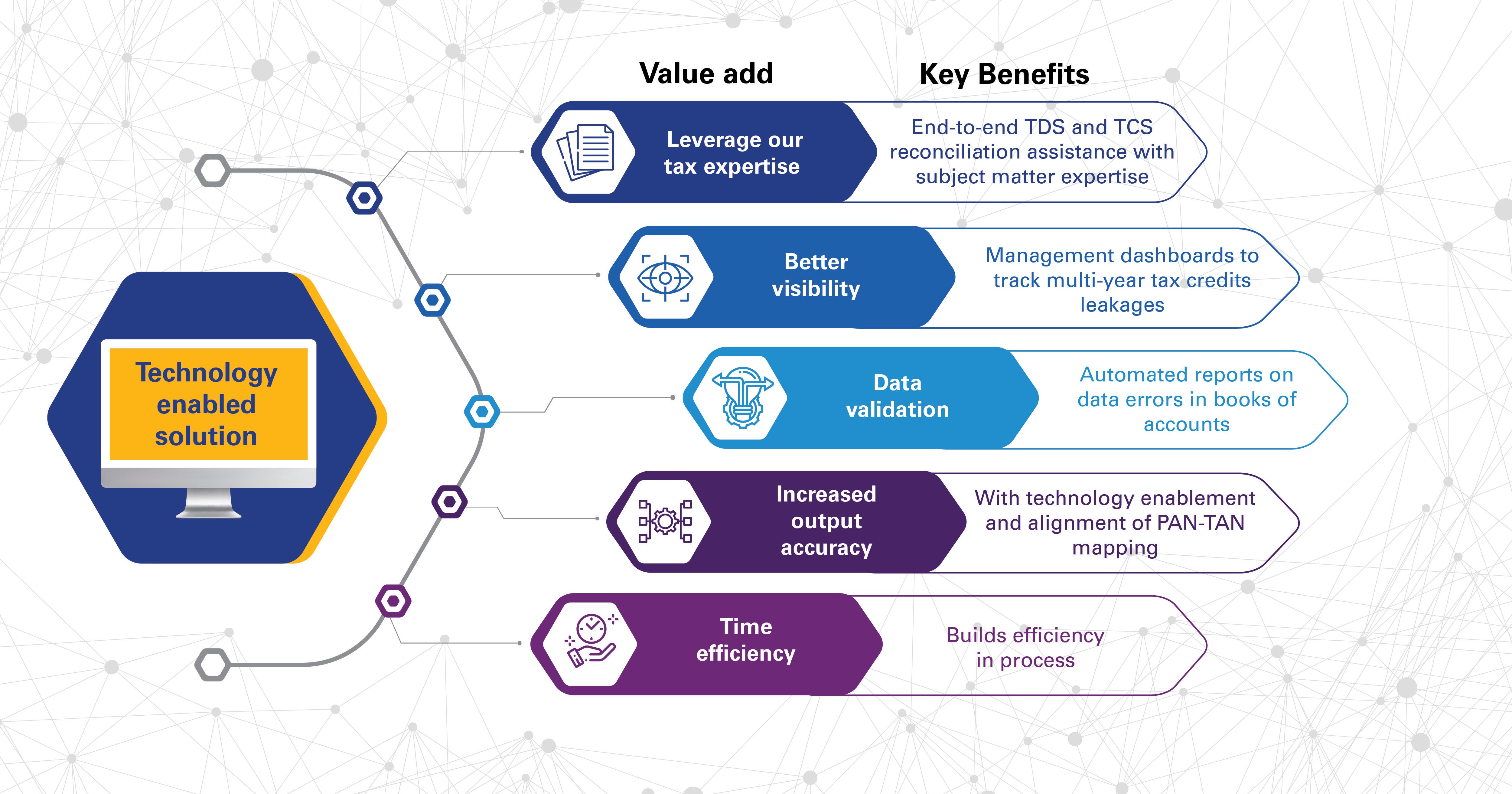

- Technology enabled Form 26AS reconciliation for multiple years

- Automatic identification of TDS deducted on GST component which improves working capital

- System based validations to identify data errors in books of accounts

- Relevant reasons for identifying potential mismatches

- Analytical dashboards with actionable reports

- Follow-ups with customers for rectification of returns or any other support

Enterprises often run the risk of losing tax credits due to lack of regular TCS or TDS reconciliation between books of accounts and the government records (Form 26AS) and process improvement framework. Manual efforts to reconcile voluminous data set further complicates the overall TDS reconciliation process to identify reasons for mismatches and take effective action for resolution. This also becomes a key risk area for levy of interest and penalties.

KPMG Form 26AS Reconciliation solution is our technology enabled managed tax service for managing TCS or TDS reconciliation as per Form 26AS and books of accounts. Analytical TCS or TDS reconciliation dashboards with actionable reports are enabled for digitally managing such TCS or TDS by identifying potential mismatches, mitigating cash flow leakages, and provide avenues for tax credit management and process improvements. It also enables your teams to be assessment ready for TCS or TDS reconciliation .

Key features

Connect with us

All rights of this Trade Mark are reserved with KPMG Assurance and Consulting Services LLP. The Trademark cannot be used, reproduced or transmitted in any form or means without written permission of the KPMG Assurance and Consulting Services LLP.