Aircraft leasing companies have experienced a stellar year in 2023. With demand outpacing supply, leasing fundamentals have improved substantially, translating to a solid bottom line for many of the largest lessors.

“I cannot remember a time in my almost 40-year long career when I have seen such strong demand and such tightening supply,” says ALC’s Plueger. “Manufacturers are sold out for years ahead, which is causing all sorts of additional planning requirements for the airlines.”

ALC is now 100% placed for all of its deliveries to 2025, which includes all passenger widebody aircraft, and is also reporting strong demand for its older aircraft on the secondary trading market.

Most lessors have a much more positive outlook for airlines than equity investors and are confident that demand for air travel will continue to grow so long as they can access additional capacity even with continued production and delivery delays as well as aircraft groundings caused by manufacturing defects.

“There is no problem around demand,” says AerCap’s Kelly. “From speaking to airline CEOs, the demand is there. The question is at what price level. From an aircraft lessor’s perspective, whether an airline makes a billion dollars or zero doesn’t impact how much they pay a lessor. What we need to make sure is that demand is being serviced.”

The supply chain challenges and disruption caused by manufacturing and engines defects – discussed in detail in the following chapter – have created immense demand for aircraft from airlines keen to expand capacity to tap into that continued spike in demand.

“Providing a top class service to our customers is vital,” says Kelly. “The real issue with delays is when a customer has a flight schedule booked for next summer, they have hired pilots, ground crew, catering airport slots based on a certain level of capacity. If that capacity does not show up, if they don’t get the aircraft or if they get the aircraft and it breaks down, that’s a huge issue, because they can’t get out of their fixed cost base. That’s the real issue with the delays.”

Throughout the pandemic period, airlines have proven to be adept at dealing with adversity and pivoting quickly to continue generating revenue or raising debt even in the deepest crisis. However, dealing with such surprise delays is a big problem.

Kelly has called on the OEMs to ensure they inform customers of delays with as much notice as possible so they can plan on longer periods of downtown, something he says they have not been doing to date.

“[The OEMs] have a blatant disregard for their customers,” says Kelly. “They’re not going to hit the production targets at Airbus. Pratt & Whitney are not going to meet the turn times on their shop visits this year…. The most important thing for customers is to be able to plan with certainty. And the OEMs have to realise that there is a ceiling on what they can produce. The engine guys have to realise there is already tremendous strain in the MRO network. When you have a system that’s strained and piling more on top of it, things rarely go well.”

Cognisant of the continued supply chain pressures, airlines are seeking to secure capacity outside of their normal fleet plans to plug the gap caused by productions delays and AOGs due to the required engine maintenance. “On the new aircraft side, airlines are extending their commitment horizon up to 2030- 2032 to lock up slots,” says Avolon’s Cronin.

“We have seen manufacturers being more assertive around taking slots back from airlines that they don’t think need them. We are seeing scarcity of lessor orderbooks and rentals and asset values rise. We are also seeing enormous demand on the used end of the market, with the value of greentime in particular engines increasing. But also generally aircraft lives are being extended and residual values are rising across the board.”

The defining trend in aircraft leasing over the past year has been the proliferation of existing lessees seeking to extend leases rather than hand back aircraft at the conclusion of a lease term. Plueger reports 100% renewal rate for ALC’s leases as airlines seek to retain capacity.

The extension of existing leases has been a common theme in interviews with all chief executives of aircraft lessors for this report.

| Value | (HL$bn) | Jet | Prop | Portfolio | |||

|---|---|---|---|---|---|---|---|

| 1 | 52.0 AERCAP | 1,425 | 301 | 87 | 16 | 334 | 1,829 |

| 2 | 26.8 SMBC AVIATION CAPITAL | 667 | 75 | 265 | 742 | ||

| 3 | 19.6 AVOLON | 455 | 124 | 7 | 423 | 586 | |

| 4 | 23.5 AIR LEASE CORPORATION | 429 | 133 | 2 | 332 | 564 | |

| 5 | 16.5 ICBC LEASING | 433 | 55 | 39 | 130 | 527 | |

| 6 | 16.8 BBAM | 375 | 112 | 487 | |||

| 7 | 17.8 BOC AVIATION | 368 | 93 | 207 | 461 | ||

| 8 | 11.1 DAE CAPITAL | 301 | 53 | 67 | 63 | 421 | |

| 9 | 11.3 AVIATION CAPITAL GROUP | 369 | 15 | 108 | 384 | ||

| 10 | 7.8 CARLYLE AVIATION PARTNERS | 344 | 38 | 20 | 382 |

| FIG. 14: TOP 30 AIRCRAFT LEASING COMPANIES (BY PORTFOLIO NUMBER) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Rank | Operating Lessor | Single-Aisle | Twin-Aisle | Regional Jet | Turbo | Turbo Prop | Backlog | Total Portfolio |

| 1 | AERCAP | 1,425 | 301 | 87 | 16 | 1,829 | 334 | 52.0 |

| 2 | SMBC AVIATION CAPITAL | 667 | 75 | 742 | 265 | 26.8 | ||

| 3 | AIR LEASE CORPORATION | 429 | 133 | 2 | 564 | 332 | 23.5 | |

| 4 | AVOLON | 455 | 124 | 7 | 586 | 423 | 19.6 | |

| 5 | BOC AVIATION | 368 | 93 | 461 | 207 | 17.8 | ||

| 6 | BBAM | 375 | 112 | 487 | 16.8 | |||

| 7 | ICBC LEASING | 433 | 55 | 39 | 527 | 130 | 16.5 | |

| 8 | AVIATION CAPITAL GROUP | 369 | 15 | 384 | 108 | 11.3 | ||

| 9 | DAE CAPITAL | 301 | 53 | 67 | 421 | 63 | 11.1 | |

| 10 | BOCOM LEASING | 265 | 32 | 6 | 303 | 92 | 10.4 | |

| 11 | CDB AVIATION | 231 | 43 | 19 | 293 | 164 | 9.9 | |

| 12 | JACKSON SQUARE AVIATION | 192 | 25 | 217 | 21 | 8.2 | ||

| 13 | CARLYLE AVIATION PARTNERS | 344 | 38 | 382 | 20 | 7.8 | ||

| 14 | CES INTERNATIONAL FINANCIAL LEASING | 129 | 45 | 1 | 175 | 7.7 | ||

| 15 | AVIC INTERNATIONAL LEASING | 141 | 25 | 33 | 20 | 219 | 7.1 | |

| 16 | CASTLELAKE | 198 | 52 | 8 | 9 | 267 | 6.8 | |

| 17 | CMB FINANCIAL LEASING | 153 | 22 | 7 | 182 | 67 | 6.6 | |

| 18 | ORIX AVIATION | 167 | 37 | 204 | 6.2 | |||

| 19 | AIRCASTLE | 227 | 20 | 19 | 266 | 11 | 5.7 | |

| 20 | AVILEASE | 164 | 2 | 166 | 5.5 | |||

| 21 | CHINA SOUTHERN AIR LEASING | 111 | 35 | 7 | 153 | 5.4 | ||

| 22 | CHINA AIRCRAFT LEASING COMPANY | 175 | 16 | 2 | 193 | 158 | 5.1 | |

| 23 | CCB FINANCIAL LEASING | 134 | 18 | 152 | 110 | 4.8 | ||

| 24 | GRIFFIN GLOBAL ASSET MANAGEMENT | 47 | 14 | 61 | 5 | 4.0 | ||

| 25 | JP LEASE PRODUCTS & SERVICES | 80 | 11 | 91 | 3.7 | |||

| 26 | MACQUARIE AIRFINANCE | 185 | 12 | 2 | 199 | 66 | 3.7 | |

| 27 | ALTAVAIR | 45 | 68 | 4 | 117 | 3.5 | ||

| 28 | AERGO CAPITAL | 72 | 41 | 46 | 159 | 3.1 | ||

| 29 | ALM - AIRCRAFT LEASING & MANAGEMENT | 67 | 11 | 12 | 90 | 3.0 | ||

| 30 | NORDIC AVIATION CAPITAL | 13 | 104 | 167 | 284 | 34 | 2.7 | |

“Airlines are keeping the aircraft they have because they cannot get the new aircraft from the manufacturers,” says ORIX Aviation’s Meyler, who confirms that ORIX has extended the leases of approximately 50 aircraft over the past two years. “Airlines know if they don’t seize the opportunity to keep what they have, those planes will be taken up by other airlines,” he says.

Mike Inglese, chief executive officer of Aircastle, observes that in a normal cycle year, a ratio of extension to transition of an aircraft on lease is normally 40:60 but in the last year he says this has increased to 70:30.

“The number of customers looking to extend is a much higher percentage for us, which is a great outcome,” he says. “Transition costs are much less to extend an aircraft lease with an existing lessee. There’s no downtime; there are no surprises around engine borescopes and other things that can creep up.”

Inglese adds that extensions are even more welcome since transitioning leases is taking much longer to complete in this market due to the supply chain constraints in the MRO market, which is making shop visit lead times much longer.

Aircraft leasing company chief executives all refer to the production gap created during the pandemic of roughly 3,000 aircraft, and also acknowledge that with the continued supply chain delays and manufacturing defects, that shortage will only continue to increase.

“Airlines are going to have to keep midlife planes flying longer; aircraft that would have been returned, maybe with a balloon payment that’s due or which would have been sold to repay debts, will also be extended,” adds Meyler. “Debt terms will be refinanced and extended, which in general is a good situation for all parties, save for the manufacturers.”

Meyler notes that lease extensions for older equipment will be at a lower lease rate than new aircraft deliveries, a positive for airlines’ cost base and they will be able to extract more value from their existing fleet.

While the enhanced demand and trend for lease extensions is a positive for lessors in that lease rates and asset values are rising, Plueger says that he would trade some of that demand for “more stability and getting aircraft on time” to be able to deliver them to his customers.

His sentiments are echoed many times by his peers. “Growth will be a challenge. Access to metal will be a challenge; it’s just something we will need to manage,” says ACG’s Baker. “We are seeing increases in our asset values. We are seeing strong demand in our secondary market trades, despite higher interest rates, and very strong bids in the single aisle market. But we would prefer more orderly deliveries from the manufacturer.”

The GTF issues have created increased demand for spare engines and lease rates have also increased but the same issues have also resulted in a deficit of spare engines creating a challenge for engine lessors.

“The latest technology entry-to- service durability and reliability issues have made it very difficult for us to get our hands on new engines because the OEMs are channelling them to the customers that need them the most,” says Richard Hough, chief executive officer of Engine Lease Finance Corporation (elfc).

“It is not a properly functioning market. The engine OEMs are trying to keep as many of aircraft flying as possible. At present, we replace that inability to get new engines from the manufacturers by financing additional sale-leasebacks of engines that are being delivered to customers. The supply of used equipment has also dried up due to shortages of supply caused b a combination of greentime burnoff and blockages in the MRO supply chain, which has pushed up lease rates.”

Hough notes that engines have always been a very resilient product - they are liquid and retain their value well throughout cycles, which is why the sector has been attracting more investment over the years. Engine leasing has evolved with aircraft leasing but the number of dedicated engine lessors remains small due to the technical nature of the product raising the bar for entry and success.

“Engines are a proportionately much more technically challenging product to invest in than aircraft,” says Hough. “You can lose more of your total asset value very quickly through the engines maintenance and LLP [limited life parts] value, particularly if you don’t have the paperwork right, or the condition is compromised. You need specific technical expertise to be able to manage an engine portfolio.”

Many of the engine lessors benefit from strong parent companies, which means they do not need to raise funding. Hough notes that elfc’s strong parentage with Mitsubishi HC Capital (MHC) has been an advantage for the company and facilitates access to the Japanese investor pool for JOLCO leases.

“The appreciation of the US dollar against the Japanese yen has, has seen the cost in yen increase,” he says, “which combined with the higher prices for latest technology engines, places those products in a sweet spot for small investors in Japan who want to put their money to work in this sector.”

Much has been discussed in recent months about the lag between the sharp rise in interest rates and the much slower increase in lease rates. The supply chain squeeze on capacity has served to accelerate the growth in aircraft and engine lease rates with all companies reporting a strong uptick.

“Lease rates are up 25-30% in dollar terms,” says SMBC Aviation Capital’s Barrett, “which has been driven by a number of factors including the rise in interest rates as well as the increase in demand for airplanes.”

The main costs for aircraft lessors are the price paid for aircraft and interest rates on debt. Those costs are then passed through to the airline customers. Lessors with leases expiring or on shorter leases have been able to successfully increase their rates following transition to new customers or in some instances when executing extensions, other companies have escalation policies written into their longer leases, which again enables costs to be passed on.

However, where lessors have placed aircraft on long leases with airlines before the interest rates spiked with no escalation policies, that dynamic has led to a lag in lease rate increases.

Although lease rates are rising, it remains a very competitive market for aircraft lessors, which makes passing on those higher interest rate costs more difficult. Moreover, the pace of the interest rate rises over the past two years made it even more difficult to pass on those costs to the customer.

“The question for many lessors is the pace for repricing leases and matching those rates with the cost of capital that has been moving rapidly,” says Griffin’s McKenna. “There is certainly demand for lease extensions given the constraints on new delivery volumes It will be interesting to watch how production rates move relative to fundamental market demand for aircraft.”

With interest rates now more stable, lease rate calculations are reported to be increasing. “Airlines are accepting that ultimately they do need to pay more for their leases based on the increase in interest rates,” says Meyler. “Those planes are delivering this year or next that have locked in those rises.”

He explains further that rates are now rising on sale-leaseback deals, which had been an anomaly to this trend since most deals continue to attract competitive bids from several lessors. Meyler says the current supply-demand challenge is altering the competitive dynamic with sale-leaseback rates, adding that they “have definitely moved up from where they were, but are not dollar for dollar where they should be” due to lessors with locked-in capital at low interest rates still able to outbid the market.

Engine lessor Willis Lease Finance, which has been experiencing increased demand for spare engines due to the issues with the GTF, follows a policy of keeping half of its fleet on shorter-term leases. “We have been taking advantage of the strong market to improve lease rates,” says chief executive Austin Willis.

“But not into a range that’s considerably higher than what it was pre-pandemic; it has just been more of a recovery. We have historically had about 50% of our portfolio on short-term leases, which has served us well. We are putting some more of the engines on longer term leases, but the intent is to really keep that balance of about 50% and it helps us in a few different ways. It keeps us in front of the customer, so we have our finger on the pulse of what’s going on with the customers all the time, which conversely enables us to be better buyers of assets. It also helps us to reprice our assets based on demand.”

Lease rates are ticking upwards but Meyler says many are accepting of the new rate environment due to the constrained supply. But it is also true that airlines still have a lot of options for securing aircraft rather than operating leases.

Robert Martin, who retired as chief executive of BOC Aviation at the end of 2023, noted that the Singapore- based lessor had seen a change in the preference for leasing aircraft once airlines again turned profitable. “Higher interest rates and the supply and demand element has pushed up lease rentals and lease rental factors,” he said.

“During the pandemic and post-pandemic, we have seen that the percentage of leased aircraft in fleets has ticked upwards and that proportion has grown… Our belief was during the pandemic and the period just after that the number of aircraft owned by lessors would go up significantly as it has. But once we reach the point of airlines turning profitable, particularly in the USA and UK, there are tax benefits for people owning their aircraft where they can take accelerated depreciation in the first year.”

Given this trend, during his time at BOC Aviation, he saw a lot of demand in 2023 for finance lease products. “There will be more of a balance between operating, leasing and owned aircraft going forwards,” he says. “I don’t see another big jump in operating leasing share because airlines are leaving tax benefits on the table if they just use operating vessels.”

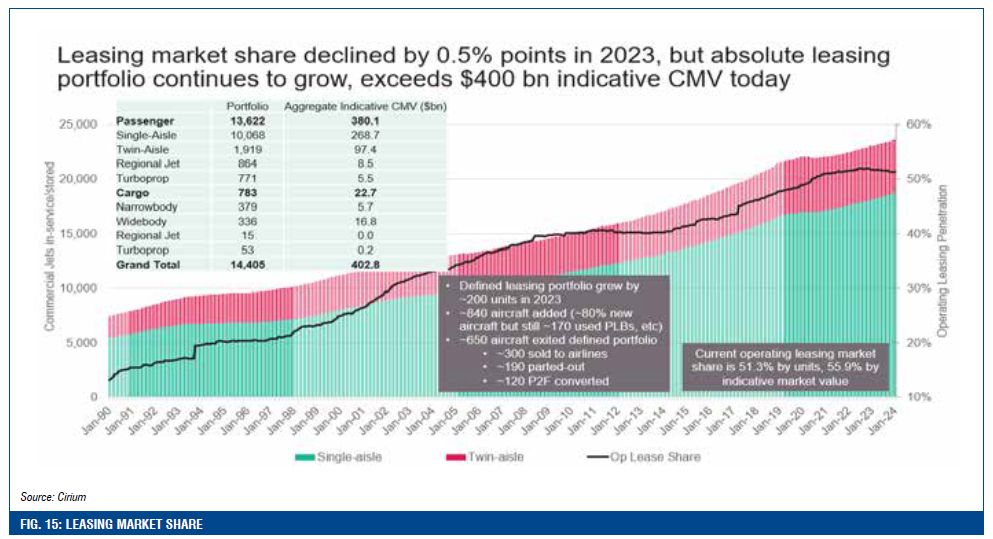

The leased proportion of the global fleet is generally considered to have exceeded 50%, with some saying it has reached as high as 60% during the pandemic. Cirium Ascend Consultancy measures the leased fleet by the number of passenger aircraft in leasing management compared to the global fleet. “For sure that exceeded 50% during the pandemic,” says Rob Morris, but notes that in 2023 the share reduced by 1.5 percentage points.

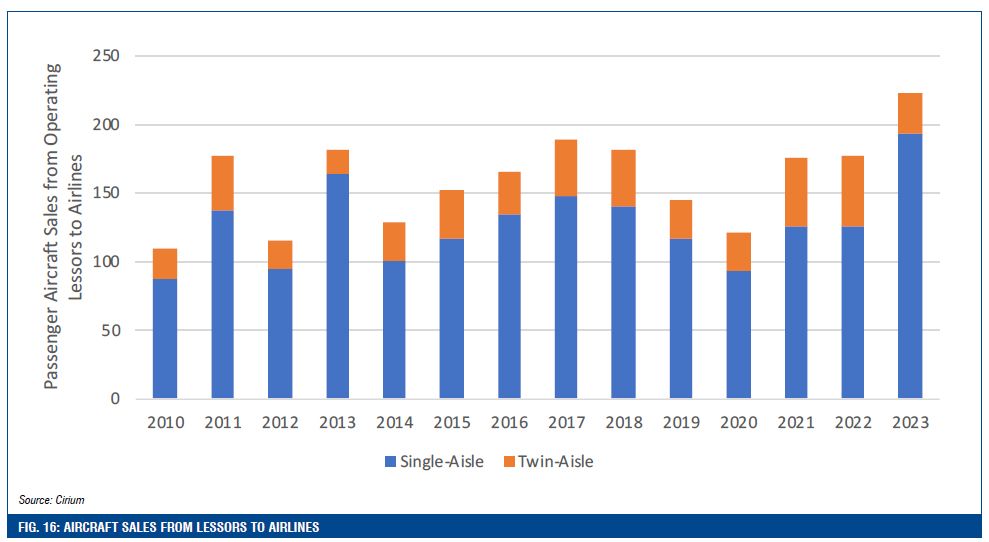

Morris attributes this decline to the recent trend of lessors selling aircraft off lease to airlines to provide airlines with certainty of a fleet and cost control. “Around three times as many aircraft were sold off lease to airlines in 2023 than were sold the same period in 2022,” says Morris. “That will drive a temporary blip downwards, but that’s measured in units, which is about 52.1%. Measured in value, the share is about five percentage points higher because lessors are typically owning new aircraft.”

Morris notes that leasing companies have been acquiring 60% of new technology equipment through new deliveries, about 25% as deliveries from their own orderbooks, and about 35% through sale and leaseback transactions. Due to the backlog in deliveries, however, Morris says it is unlikely that the leased share of the world fleet will reach 60% based on units “anytime in the next five, six, or seven years” but he expects it to continue to grow “incrementally”.

The chart (Fig.16) seeks to visualise the growth of sales of aircraft from operating lessors to airlines by drawing data from Cirium’s database that shows where the ownership of an aircraft has moved from a lessor to an airline. It should be noted that there is a lag in this data set as aircraft are re-registered and researchers identify new owners of aircraft. By the end of the first quarter of 2024, the data is expected to be higher than shown for 2023. But even in this chart shows clearly that there were 50% more single-aisle sales to airlines in 2023 than in the two preceding years.

Firoz Tarapore, chief executive officer of Dubai Aerospace Enterprises (DAE), recognises that airlines are rebuilding their capital profitability but believes that airlines strong multi- year performances for that profitability to translate to “deployable capital”, meaning they will seek to finance their own aircraft rather than lease. “If airline profitability continues on for another two or three years, we will see airlines flexing their capital muscle and at that point they will have many more choices.

In this interest rate environment and with new technology aircraft, they might decide to keep the metal exposure, or they might decide to fund themselves. It’s a little bit unclear to us as to whether this is a structural change or change that was necessitated by the marketplace. Either way, for us as an aircraft lessor, it doesn’t make too much of a difference because the pie keeps on growing.”

The growth in the leasing share of the world fleet has been boosted by a high volume of sale-leaseback (SLB) transactions between airlines and lessors following the pandemic, which is predicted to continue into the near- term future since access to the capital markets remain limited to investment grade players and as airlines seek to diversify their portfolios, while enjoying access to 100% financing that leasing offers.

“I see the leased share of the fleet continuing to creep up,” says Norm Liu, chief executive officer of Nordic Aviation Capital. “People recognise leasing as 100% financing. This isn’t just operating leases, for JOLCOs and finance leases as well are all growing in popularity. You can preserve your cash by leasing aircraft and also lessors have slots. Also a lot of those mega orders, from Indigo etc, have relied heavily on leasing for various factors but ultimately it is a residual risk game.”

Although some of the major airlines are flush with cash and have been seen to pay for aircraft deliveries without financing, the leasing channel will always form part of a diverse portfolio financing strategy, at least for larger airlines.

“Airlines do have a lot of cash,” says Marjan Riggi, managing partner StageWings, “but they are also much more leveraged. In a normal cycle, they probably would have done more share buybacks but they haven’t even though they are so flush with cash.”

Riggi points to the fact that although lessors own half of the world fleet, they only account for 20% of the orderbook with OEMs, which means sale-leasebacks with airlines will remain a major funding option for airlines.

Pressures on aircraft supply are driving up asset values. With the larger lessors unable to access a steady stream of new deliveries since the pandemic, secondary market trading seized up initially but it has eased in recent months.

Over the past year, the largest lessors have all reported strong gains on sales of used aircraft due the asset values being boosted by the short supply of aircraft.

“Aircraft values are strong,” says SMBC Aviation Capital’s Barrett. “The tightness in the market is flowing through to aircraft values, even in a high interest rate environment. This is informing our aircraft trading strategy. We have always been an active trader of aircraft – we have an excellent trading team based around the world – and we will lean into that market if we think there’s good value represented in the market relative to the long-term cycle but we will try to strike a balance. If prices are good, we will continue to trade into that market.”

There is a sense that the rapid escalation in interest rates and inflation that made it difficult for owners to accurately price their assets, leaving buyers and sellers wary about taking on interest rate risk, has abated somewhat with the stabilisation in rates. “People are starting to be more active,” says Aircastle’s Inglese. “They are using age- old tricks to contain the movement in price between agreement and actually closing transactions.”

Goldman Sachs’ Lee offers a reminder that there are two sides to every trade and that even though lessors are reporting strong trading activity and gains on sales, buyers that can afford those higher prices will be fewer than pre-pandemic. “The numbers of buyers interested in buying aircraft are lower given higher interest rates; the prime buyers of aircraft in this market are companies that have strong balance sheets and access to investment grade debt,” he says. “When values are higher, volumes are lower.”

Spot market prices for aircraft depend very much on the asset type but also its remaining lease term, says Carlyle Aviation’s Korn. “Values have certainly gone up, but whether they have gone up by 1% or 20%, neither buyer nor seller has found to answer that question,” he says.

“There is definitely upward pressure on lease rates and upward pressure on prices due to the supply- demand situation. Selling an aircraft with a five or six year lease remaining – with that contracted cashflow – the buyer is buying a residual that will be normalised in the next five or six years so it shouldn’t have a significant effect on the value of the asset. If you’re selling an aircraft that has a one year remaining lease, it could certainly have an effect on its value given the demand for aircraft.”

For Cirium, the recovery in asset values has been slower but they are now back to levels seen pre-pandemic on a fleet weighted constant age basis, but values of lease encumbered assets are more difficult to estimate since it depends when the lease was negotiated. “A significant number of the leases that are committed today were either written pre-Covid or restructured during Covid,” says Morris.

“If lessors had their time again and knew what they know today, they might have preferred not to agree to such a long extension of that restructured lease because of the opportunity today to place aircraft into leases at much higher rents, which will bring lease encumbered valuations up.”

Castlelake’s McConnell recognises the complexities with aviation asset values. “Lease rates are a lot higher today than they were over the last few years but that does not mean that asset values should automatically be higher,” he says. “It is true for aircraft that are coming off lease within the next 12 to 24 months, but interest rates are a lot higher, some 300 or 400 basis points higher. When you own long-term contractual cash flows, if you’re not hedged on the liability side, that creates a real compression in your net interest margin and as liabilities mature and need to be refinanced. So you need to really take a holistic approach to investing in this industry.”

This is where match funding is so important for lessors, says McConnell. “We are not going to speculate on interest rates. We believe that is a fool’s errand,” he says.

“We feel good about the assets we own today, long term contractual cash flows and interest rates being hedged. Inflation in this industry is real. OEMs are increasing prices; LLPs [life limited parts] in the engines are increasing by ten or 12% per year and so we do think residual values will continue to rise for the foreseeable future. But you need to take that holistic approach to understand that discount rates are also higher. Financing costs for new aircraft are also more expensive. And so at Castlelake, we look across the entire capital stack and what we are seeing today, in some situations, is unlevered asset yields pricing inside the cost of debt financing. That doesn’t make a whole lot of sense.”

SKY Leasing chief executive Austin Wiley believes that trading levels in the midlife and the secondary market are driven by sellers “trying to both manage their portfolio metrics for a weighted average age at lease term, and their debt maturities and profitability metrics”.

Wiley sees this trend continuing into 2024 with sellers trading aircraft because they need to generate liquidity, manage refinancing or their P&L, or if they are exiting the industry. “Ultimately this is creating an attractive buying opportunity for us,” adds Wiley.

Consolidation is always a feature of the aircraft leasing market and in 2023 there were three significant M&A deals along with other large portfolio sales. The largest of these was Standard Chartered’s sale of its aviation business.

Standard Chartered announced in January 2023 that it was searching for strategic options for its global aviation finance business, which included the sale of aircraft leasing business, its secured aviation lending portfolio and its 10% shareholding in joint investment company, SDH Wings International Leasing.

At the end of August last year, Standard Chartered announced that it had reached an agreement to sell the leasing business to AviLease, the Saudi Arabian new market entrant backed by the Public Investment Fund (PIF), the Saudi sovereign wealth fund, along with its 10% share of SDH Wings for $3.6bn, while its $900 million aviation secured debt portfolio was sold to Apollo and PK Airfinance. Both deals closed on November 2 for total sale proceeds to Standard Chartered of $4.5bn.

On the date of the official closing, Edward O’Byrne, chief executive officer of AviLease said that the day marked an important milestone for the company. “With the completion of this acquisition, we are strengthening our position in the global aircraft leasing sector, in line with our ambition to become a top-10 global lessor by 2030,” he said. “Through the expanded scale and synergies, we aim to accelerate our path towards an investment-grade rating. We are pleased to welcome our new colleagues to the AviLease team.”

The $3.6bn landmark deal has catapulted AviLease onto the global leasing stage only 16 months after its formation. The combined business now owns and manages 167 latest technology, fuel efficient aircraft leased to 46 airlines worldwide, with market rumours swirling that it remains interested in other leasing portfolio or platform acquisitions.

AviLease has acquired an all- narrowbody portfolio that features new technology Boeing 737 Max and A320neo aircraft as well as classic aircraft types. O’Byrne sees the older vintage of the book as a major positive for AviLease. “We have a committed aircraft portfolio of 40 aircraft – and have delivered 30 to date – all of which are brand new aircraft,” he says.

“Adding the maturity of the Standard Chartered book to our portfolio was a positive exercise since it improves yields and accelerates the maturity of the P&L as well as other benefits for the company in terms of technical skills inherent in managing older aircraft.”

AviLease financed the acquisition with a $2.1bn bridge financing, arranged by BNP Paribas, Citibank, HSBC and MUFG, which that was syndicated to a group of ten banks: Al Ahli Bank of Kuwait, Abu Dhabi Commercial Bank, First Abu Dhabi Bank, Mizuho Bank, Natixis and Standard Chartered Bank. Allen and Overy were the legal advisors, with KPMG Ireland providing tax and accounting advice.

Apollo Global Management (Apollo) and PK Airfinance acquired Standard Chartered’s portfolio of secured aviation loans, comprising 46 loans backed by 46 underlying aircraft (across 14 obligors), with 76% commercial loan and 24% JOL/JOLCO loans. The transaction has added significant scale and airline reach to Apollo’s aviation finance businesses.

The deal was financed with a $491 million senior secured, non-recourse facility. The facility, which has an 80% loan-to-value ratio (LTV) with an additional advance via a Class B loan, includes a drawdown and amortisation period and various step-ups in margin over time. Mizuho Americas served as lead arranger and advisor on the PK Airfinance transaction, while Redding Ridge Asset Management served as structuring agent and Milbank served as lead counsel.

In June 2023 Macquarie AirFinance UK (MAFUL) closed a $2.2 billion acquisition of 52 aircraft from the Kuwaiti lessor Alafco.

The acquisition was part of Macquarie’s plan to decrease its fleet age, enhance earnings performance, and transition its capital structure to unsecured with the goal of eventually reaching investment grade ratings.

This deal was funded with a $1.65bn three-year financing facility that supported the acquisition and refinanced two newly-delivered 737 MAX aircraft. BNP Paribas, Citi, MUFG, Natixis were lead arrangers and underwriters, with 11 other banks in syndication. Lead legal advisors were Clifford Chance and Vedder Price.

In July, it was revealed that Voyager Aviation Holdings (VAH) had reached an agreement with Azorra to sell substantially all of VAH’s assets and for Azorra to assume and maintain ongoing employee and business arrangements with VAH’s employees and aircraft lessees. VAH entered Chapter 11 with the sale agreement with Azorra in place. At the time VAH’s executive chairman, Hooman Yazhari said that the “agreement with Azorra presents the best opportunity for our airline customers and employees”.

The combined fleet melds a widebody fleet on lease with “prominent” passenger airlines with a solid fleet of regional jets and A220s.

VAH’s client base includes Air France, Breeze Airways, Cebu Pacific, ITA, Philippine Airlines, Sichuan Airlines, and Turkish Airlines. Azorra currently owns and manages a fleet of 83 aircraft on lease to 25 operators in 19 countries around the world, with total commitments of more than 140 aircraft including orders for new Airbus A220-100/300 aircraft and Embraer E190/195-E2s.

Yazhari was replaced at the helm by Robert Del Genio from FTI Consulting who took over as chief restructuring officer. VAH was advised by Milbank, Vedder Price, Greenhill & Co, and FTI Consulting.

Azorra financing the acquisition of the VAH aircraft with a $300 million limited recourse, six-year term loan, underwritten by BNP Paribas and Deutsche Bank, which acted as global coordinators and bookrunners, as well as mandated lead arrangers with MUFG.

John Evans, Azorra’s CEO and founder, described the strategic financing as marking a “significant milestone in Azorra’s continued growth and diversification as we respond to market opportunities”, adding that by expanding Azorra’s portfolio, it is “meeting the rising demand seen for widebodies as airlines rebuild their international capacity”.

This was one of the more distressed transactions that closed during 2023, where Azorra – backed by Oaktree Capital Management – successfully navigated its way through the acquisition and transfer of assets and people from VAH amid a complex Chapter 11 bankruptcy process.

There were also a number of large portfolio sales during 2023. Castlelake acquired Wings Capital’s assets, while DAE acquired China Aircraft Leasing Group’s (CALC) orderbook.

DAE acquired the rights, interests, and obligations of a portfolio of 64 Boeing 737 MAX aircraft from a wholly-owned subsidiary of CALC, which included 737-8, 737-9 and 737- 10 variants. Delivery of the aircraft is scheduled to occur between 2023 and 2026. DAE was advised by Milbank and KPMG Ireland.

On August 14, DAE announced that the company had agreed to novate the purchase agreement to DAE of 64 Boeing aircraft by transferring its interest in 12 special purpose vehicles for a payment determined by the pre-delivery payments already paid. Approximately 20% of the acquired portfolio is on lease to airline clients that are also existing clients of DAE allowing the company to expand those relationships.

At the time DAE’s Tarapore said that the deal increased the percentage of new technology, fuel efficient aircraft in DAE’s owned fleet to approximately 66% from 50%.

“This transaction will add certainty to our growth trajectory,” said Tarapore. “This transaction will also allow us to further deepen our existing relationship with Boeing and CFM International. Since inception and including this transaction, DAE has acquired and is committed to acquire approximately 500 Boeing aircraft.”

At the time, CALC declared that the novation arrangement represented a “good opportunity for the Group to adjust its Boeing fleet portfolio so as to provide flexibility to the Group’s existing operations and contribute to its long-term sustainable development”.

CALC added that it would still “continue to consider from time to time the acquisition of further aircraft from Boeing (pursuant to any future agreements or otherwise) or other aircraft manufacturers”.

DAE has made no secret of its desire to build scale in a competitive marketplace. Tarapore believes that scale is becoming even more important given the growing size of the top ten leasing companies. “Scale allows us to have more of a relationship or a solutions-based discussion with our clients, and also gives us the opportunity to have a different kind of discussion with each of our counterparties like the OEMs,” he says.

“There is still potential left for the top 10 lessors to grow even larger by inorganic methods, but even organically the orderbooks are all stacked in favour of top 10 lessors. Inorganic growth is also going to play a much larger role because there are still platforms that would benefit by being part of a much larger organisation where that size advantage can translate into a better financial return.”

As the world’s largest lessor, AerCap already realises the full benefits from its scale but from its vantage point observes that opportunities remain for smaller lessors to become more competitive and for larger lessors to attain that all- important investment grade rating.

“There will always be room for leasing specialists in used aircraft, engines or certain types of freighters,” says AerCap’s Kelly. “But those niches are becoming more and more specialised, and require a higher level of expertise... Like a lot of industries, we are moving toward larger scale businesses.”

Larger scale opens the door to investment grade ratings, which is a game-changer in the world of aircraft leasing that can considerably cut costs of funding, enhancing competitiveness in a very crowded marketplace. SMBC Aviation Capital is one of the largest lessors in the world, owned by two of the largest corporations in Japan, and enjoys a BBB+/A- rating. The company acquired Goshawk in 2022 and has continued to integrate the business last year and grow organically.

Peter Barrett, commented: “Being investment grade makes a difference; being able to raise funds at competitive rates makes a difference,” he says. “Twenty-plus years ago, the barriers to entry were much lower in this business and getting to scale has become much harder. That will continue. In another five or ten years, there will be a much smaller number of large lessors.”

For ACG’s Tom Baker, scale is much more than the size of the aircraft portfolio. “Scale speaks much more to that,” he says. “It speaks to a global technical and global marketing capability, with access to and understanding of different markets. Scale is really the quality of a global platform to be able to support that kind of complexity and sophistication.”

Investment grade rated lessors are all large scale entities relative to the rest of the market, which is essential for accessing the debt capital markets to raise large amounts of capital and for exercising influence with suppliers: “If you’re going to go out and raise benchmark bond issuances of half a billion dollars and above, then you need scale,” says Robert Martin. “You can’t do that if you’re a $2bn to $3bn lessor. Scale is also required to be relevant to the two biggest stakeholders, Airbus and

Boeing. Then you also need to operate in scale to be able to take a significant number of deliveries directly from the manufacturers, but also be able to support them in other ways using either sale leasebacks or all financed lease product or even our engine finance lease product.”

The size of the top five aircraft lessors has grown exponentially over the past decade as the industry has matured. With AerCap ahead of the pack with an estimated portfolio value of $40bn-plus, the top tier lessors all control between $10bn to $20bn in assets.

Reaching such a scale by organic methods is difficult, which leads new entrants or smaller lessors seeking to enhance market share seeking to grow via acquisitions of larger portfolios or other platforms.

As demonstrated by its recent acquisition of Standard Chartered’s leasing business and rumours swirling that the Saudi company is targeting another large lessor, AviLease is forging a market share via in organic growth and is also pursuing that investment grade rating once it reaches a certain age and size. Other companies, with strong backers, are following a different path.

“The rating agencies have made is clear than to reach investment grade you need the right scale and the right age,” says Griffin’s McKenna. “We have crossed the four year mark and are looking to reach that goal step by step.” McKenna stresses that Griffin did not set out to build specific scale, “we set out to make thoughtful investments and the team has grown organically, which will continue to evolve over time”.

S&P’s Snyder says that the rating agency has “always thought of scale as important, even in a low interest rate environment, and that hasn’t changed”.

She also notes that the agency also does not have a specific size that would constitute the right scale for an investment grade rating: “It’s hard to say because it could be $6bn but what if that portfolio is all widebody aircraft? We look at the composition of the fleet and the average age, for example. The portfolio size in terms of dollars is not what we focus on. We also look at the level of unencumbered assets in the portfolio, which is very important. The whole rating agency community typically requires no more than 30% of [a lessor’s] assets encumbered. Many of the non-investment grade lessors still have a lot of secured debt in their capital structures.”

A good example of a company reassessing the mix of portfolio to secure an investment grade rating is Macquarie’s acquisition of Alafco.

Another determining factor for lessors chasing investment grade is the ownership of the company. Investment grade lessors today are characterised by either a strong parent in the case of SMBC Aviation Capital and ACG, or they are public like AerCap and Air Lease Corporation.

In the higher-for-longer interest rate environment, access to cheaper funds will be essential for leasing companies going forward as they refinance existing debts or seek to raise new capital to fund growth.

Snyder observes that given the amount of M&A activity in the leasing sector over the past few years, the only targets remaining are more medium-sized portfolios that would not require a large- scale investment unless, she says, some more bank portfolios come up for sale. There are a number of bank portfolios up for sale – Helaba and KFW are seeking an exit from the space – which could be a tempting acquisition for smaller lessors if they can access funding at the right price.

Mizuho’s Srinivasan agrees that the majority of large lessor M&A activity has already happened, with new start-ups now competing for scale. “The question is whether they can get to a point where they are sustainable,” he says.

“Many have capital behind them to allow them to grow and there will be some further consolidation because of the interest rate environment. There is going to be a squeeze, and some of the equity backers will exit the market at some point.” He adds that the geopolitical situation could cause “more seismic acquisitions” but most likely that consolidation will remain among the smaller players.

Investor appetite has remained strong for the leasing sector but the type of investors has ebbed and flowed with the macroeconomic environment. Over the past year, as previously mentioned, there

have been a number of commercial banks seeking to exit the market, which some say could continue given the constraints European banks are operating under in regards to both balance sheet limits and ESG policies. The good news for the sector is any lost capital is being replaced rapidly by new entrants to the space.

“It is striking that we keep seeing new equity coming into the sector,” says MUFG’s Trauchessec. “We see sovereign wealth funds, private asset managers, all setting up new entrant lessors. This means that the market will continue to be fragmented and there will be some consolidation but more in specific situations where lessors have taken on too much leverage or haven’t been able to grow enough.”

Aircraft leasing demonstrated its resilience throughout the pandemic and even when many assets were trapped in Russian following sanctions imposed after the invasion of Ukraine. Although the write-downs booked in 2022 for the trapped Russian aircraft did little to deter investors at the time, the fact that many leasing companies are now beginning to receive payouts from their insurance companies is another demonstration of the long-term resilience of the sector.

Aircraft leasing is a long-term business and one that is constantly looking many years ahead to be able to predict demand for airplanes and to ensure the industry will remain sustainable in the years to come. The emphasis on sustainability, but also more about the social and governance aspects of the sector, has continued throughout the past year as lessors increasingly realise the need to embrace ESG concepts to future-proof their businesses.

Although airlines are the prime source of carbon emissions, sustainability and broader ESG challenges remain front and centre issues for aircraft lessors. Many of the larger lessors are already committed to investing in the most fuel-efficient new technology aircraft and engines, but many are also investing in additional programmes and products to further aviation’s decarbonisation journey.

“The lessor community has done a nice job rallying recourses around ESG initiatives and have internalised a commitment to driving changes,” observes ACG’s Tom Baker.

SMBC Aviation Capital has put a lot of work and thought into its ESG programme, initiating investments in carbon credits, SAF and work around improving diversity and inclusion in the industry. “We are very focused on all three letters of ESG [environment, social and governance],” says Barrett. “We create financings, structures and incentives that are all focused on ESG, be it the carbon intensity of our fleet or around gender diversity in our business.”

SMBC Aviation Capital – and the entire aircraft leasing community – has been a prolific supporter for the adoption of sustainable aviation fuel (SAF). “SAF is the pathway that can make the most difference as an industry,” says Barrett. However, as explained in detail over recent years, SAF production is constrained and nowhere near the levels the airline industry needs on an annual basis, which also makes SAF prohibitively expensive for most airlines.

Many lessors are investing in joint venture agreements to invest in SAF production. Aircraft Leasing Ireland’s (ALI) Aircraft Leasing Ireland (ALI) announced the funding of a new four- year research project on SAF production during the association’s second Global Aviation Sustainability Day Conference at the Convention Centre Dublin in November. The study was created to investigate potential avenues for manufacturing SAF in Ireland.

Air Lease Corporation set up a joint venture agreement with Airbus in 2021 that has a dedicated funding level for sustainability, including providing SAF for its aircraft deliveries.

Willis Lease Finance has gone one step further and directly invested in a power-to-liquid (PtL) SAF production facility in the UK, which forms part of the company’s broader strategy to contribute towards the decarbonisation of aviation.

Chief executive Austin Willis shares the thinking behind the investment: “We believe PtL is more scalable, and by investing in it, we can help deliver meaningful volumes of SAF in the years to come.”

One of the determining factors for Willis Lease’s investment in the plant was the funding provided by the UK government, which Willis says made it clear that the UK “wants to be a leader in the production of SAF and PtL” and which “shares our vision that it’s going to be a very important component to the delivery of SAF in the future”.

Switching to the S in ESG. Helicopter leasing company, LCI has created the first social loan framework for the aviation industry. LCI is a signatory of ALI’s Sustainability Charter and has a commitment to driving forward and achieving ESG related goals. LCI and Sumitomo Mitsui Finance and Leasing (SMFL) have developed the world’s first social loan framework for helicopter leasing, finance and operations.

LCI with SMFL have their own ESG programmes that reflects SMFL’s long term commitment to the UN’s Sustainable Development Goals as part of the company policy ‘The SMFL Way’. The framework, which has been established initially for LCI’s joint venture leasing operation with SMFL, has been developed in accordance with the internationally agreed Social Loan Principles developed in 2023 by the Loan Syndications and Trading Association (LSTA).

The LTSA Social Loan Principles require any funds to be used for eligible and verified Social Projects, which in LCI’s case will include search and rescue (SAR) and emergency medical services (EMS).

LCI and SMFL, led by Alan O’Rourke, chief financial officer of LCI, have been working on this framework since the beginning of the 2023 and have liaised closely with the LTSA as well as the Japan Credit Rating Agency.

“We wanted to design the framework to be as internationally focused as possible, which is why we based it on the LTSA Social Loan Principles, but given our relationship with Japanese investors via the SMFL joint venture, we also worked very closely with the Japan Credit Rating Agency to explain what roles the assets play and how they fit into the social principles.”

LCI and SMFL’s Social Loan Framework has received the highest rating of “Social 1(F)” from the Japan Credit Rating Agency. Social finance products specifically raise funds for projects or assets that are utilised for positive social outcomes. Helicopters financed by LCI and SMFL will be exclusively used for search and rescue and emergency medical services, providing affordable essential services.

The ESG focus will continue to be foremost within all aviation sectors as the industry is pressured to delivered on its targets to decarbonise in line with net zero agreements. “ESG policies and strategies are critical for lessors,” says NAC’s Liu.

“Lessors need to ensure they have the most fuel-efficient fleets and also have a long-term understanding of the developing technological shifts from a residual value standpoint. Because we’re in the residual management business, the fleet and the technology shifts directly to the lessors. We also need to understand the whole SAF situation, because we have to be very realistic about the issues with supply availability, refinery capacity and cost.”