Airlines have been busy repairing balance sheets and working to decrease debts accumulated during the pandemic period. Higher interest rates are redefining aviation finance.

There were modest levels of capital markets issuance during the first half of 2023, which only started to tick up again towards the end of the year.

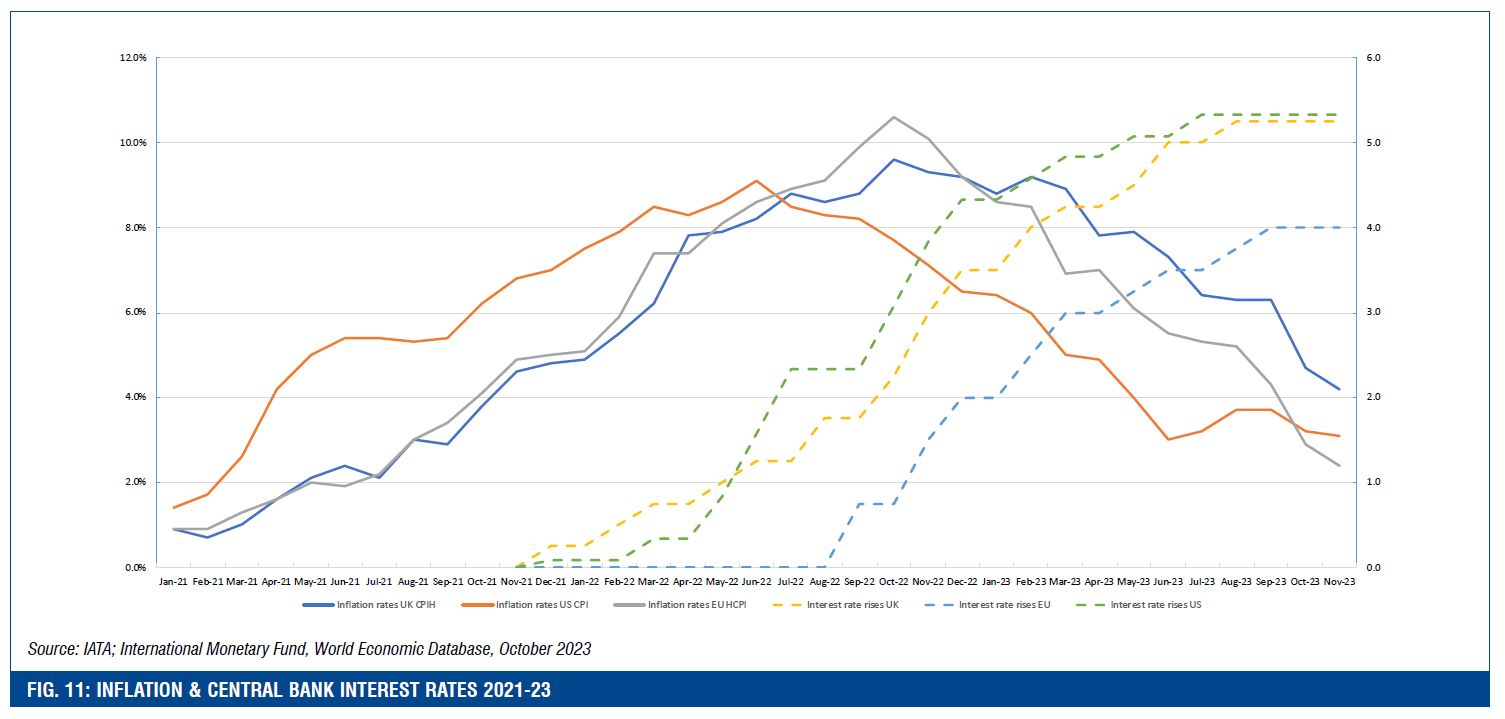

The interest rate chart shows central bank base rates from the US, the EU and the UK, which shows a steep increase from almost zero at the end of 2021 to the end of 2022, followed by a shallower increase to the middle of last year when central banks began to hold rates around 5% for the US and the UK, and at 4% in the Eurozone.

The consensus appears to be that interest rates will remain higher for longer and that they will remain stable for the near term so long as inflation remains under control. The chart shows the steep rise in inflation to mid-2022 when it started to decline as interest rate rose. The volatile geopolitical situation remains an inflationary risk, with fuel prices spiking on the back of escalating conflict in the Middle East and the Red Sea area, where Houthis rebels are restricting trade through the Suez Canal disrupting the supply of food and goods.

The steady rise in inflation has caused the cost of living to rise substantially. Even though inflation has begun to decline, that sharp rise is only now starting to feed into consumer loans and spending patterns. There is the concern that interest rate rises have not yet been materially passed through to consumers and that air travel spend may reduce to accommodate the general increase in borrowing. Low cost airlines – especially in the US – have referred to a softening of demand as the low fare sector is impacted by lower discretionary spending.

Air travel is expected to continue to grow with many industry experts very positive for the future, but that growth rate experienced immediately after the pandemic is expected to “normalise” to pre-Covid levels.

Towards the end of 2022, when interest rates were ticking up and inflation was increasing, many aviation professionals had expected demand to fall off as spending reduced. Vinodh Srinivasan, co-head of the Structured Credit Group at Mizuho Americas, admitted that last year he “underestimated the desire for everyone to spend this last summer” and that one of the main reasons interest rates have remained high is because “the US consumer has not stopped spending”. Srinivasan, along with many aviation bankers, believes that rates will stay at the current high level for longer.

“I don’t see it going up materially, but I don’t see it coming down either,” he says. Back in October when his interview was recorded, JP Morgan’s Streeter mentioned that the market was bracing for higher for longer (the 10yr Treasury in the US was near the cycle peak at ~5%).

Checking back in with him in January for this publication and clearly the forecast for rates has shifted down since the Fed “pivot” in December 2023. With rates “not as high for not as long”, the 10yr is now ~90bp below the October high and JP Morgan forecasts the 10yr to fall further from the current ~4.10% to 3.65% by YE24. 5yr all-in coupons for the lessors in the US$ bond market have correspondingly rallied with BOC Aviation recently printing a 5.0% coupon, Air Lease 5.1%, Avolon 5.75%, and Aircastle 5.95% amongst the deals issued year-to-date in 2024.

Ryan McKenna, chief executive of Griffin Global Asset Management (Griffin), has been forecasting higher- for-longer rates for some time but he has also been expecting recessions, which has not materialised thus far in the US or larger economies.

“It will be an incredible success for policy makers if large economies are able to avoid a recession given all of the macroeconomic headwinds,” says McKenna. “Inflation remains a serious problem and the geopolitical issues with Russia and Ukraine have been prolonged. The addition of the unfolding situation in the Middle East adds even more pressure to the global economy. Yet with all of that, global consumers – with US consumers leading the way – have continued to spend. That’s really amazing in the face of such high interest rates and the pressure from central bankers to cool the economy. The economy remains strong, but I am particularly concerned about the post Covid bounce back turning into a recession.”

Higher interest rates have impacted aviation finance product selection during 2023. Some companies have held back accessing financing, especially in the capital markets, with the expectation that interest rates were going to fall.

Since rates are poised to remain higher for longer and more stable, many aviation finance professionals expect to see more capital markets activity in 2024. In this new operating environment, airlines and lessors appear to have become more discerning in terms of the types of products they consider.

Many stronger credits even paid cash for assets last year as they remain focused on deleveraging and insulating themselves from exogenous events.

Tom Baker, chief executive of Aviation Capital Group (ACG), believes that the leasing industry can use the higher interest environment to better understand their real cost of capital. “A better understanding would create more discipline around pricing; more discipline around the competitive dynamic in sale leasebacks or repricing second or third leases. ACG is ready for higher rates; we believe they will accentuate our competitive advantage. When rates were compressed, it was very hard for disciplined lessors with flexible capital structures and disciplined pricing to differentiate themselves when spreads were so tight. Now that things are really starting to differentiate, we think we will outshine our competitors.”

| Issuer | ($MM) |

|---|---|

| AerCap | 4,250 |

| Griffin | 1,700 |

| Air Lease | 1,675 |

| BOCA | 1,650 |

| SMBC Aviation | 1,650 |

| Aviation Capital Group | 1,600 |

| Avolon | 1,150 |

| Aircastle | 1,025 |

| Macquarie AirFinance | 1,000 |

| FTAI | 500 |

| Castlelake | - |

| TOTAL | 16,200 |

Air Lease celebrates inaugural sukuk

ALC’s inaugural sukuk issuance represented the first ever offering of its kind into the Middle East market from a North American corporate and the largest sukuk from a US-based borrower in history. The issuance forms a part of ALC’s funding strategy to diversify its investor base and tap into new pools of liquidity.

The offering consisted of US$600 million 5.85% trust certificates due April 1, 2028, paid semi-annually, pursuant to Rule 144A and Regulation S. The notes are rated “BBB” by both S&P and Fitch with a Stable Outlook and listed on the London Stock Exchange.

“This inaugural sukuk offering is a testament to ALC’s strong credit profile and further evidence of our commitment to a well-diversified, global funding program,” Gregory

B. Willis, executive vice president and chief financial officer of Air Lease Corporation, said in an official statement upon closing. “We are grateful to our banking partners for their commitment and support in structuring and executing this landmark transaction.”

Bank ABC, DIB, Al Rayan, Citi, Deutsche Bank, Emirates NBD, JP Morgan, KFH Capital and Warba Bank served as joint lead managers. Allen & Overy and Clifford Chance provided legal guidance.

“We are proud to highlight the strong liquidity in this region and the opportunity for other investment grade borrowers to raise funds at cost efficient rates. This transaction complements our strong airline relationships in the Middle East and we look forward to further developing our funding presence in this region,” stated Verwholt at the time.

Bank ABC, one of MENA’s leading international banks, acted as the sole arranger, structurer as well as joint lead manager and bookrunner for the sukuk.

Bank ABC, along with a number of regional and international banks listed above, announced the transaction on February 27, which was followed by a deal roadshow covering investors in the UAE, Qatar and the Kingdom of Saudi Arabia (KSA).

As a 144A/Reg S issuance listed on the London Stock Exchange, the sukuk was also open to the global investor community. With the strength of the JLM group, strong market appetite for sukuks, and investment grade credit, the transaction closed 3.5x oversubscribed and priced successfully on March 6 at 5.85%.

Commenting on the landmark transaction, Christopher Wilmot, group head of treasury and financial markets at Bank ABC said on the deal’s closing: “With ALC’s robust aviation business and solid financial position, the issuance presented an attractive Shari’a compliant investment opportunity for regional investors. We are committed to opening this avenue of funding for our clients in our core US market, enabling them to access a wider pool of liquidity.”

Greg Willis noted that the “quality and depth of demand for the transaction” had exceeded ALC’s expectations, and that the deal highlighted the opportunities and strong liquidity that exist in the Middle East region.

The hugely successful sukuk, like so many new aviation deals, took several months to prepare and close, which was built on solid relationships and aligned strategies. Bank ABC, while active in aviation finance for the best part of two decades, traditionally had focused more on regional credits such as GCC flag carriers and airlines in the Middle East and Africa region.

However, the bank was eager to capitalise on its unique geographical footprint operating out of Bahrain with a global reach into the US and Asia to explore more deals that brought in clients from outside the region in order to connect them with local investors. “We had a natural link with ALC since it has 10% of its asset base deployed in the MEA region and was already a client with our US branch,” explains Wilmot, speaking to Airline Economics shortly after the deal was closed.

Verwholt notes that the ALC team had begun conversations with Bank ABC back in 2018 on future partnerships after the bank became part of the lessor’s group of lenders as part of the company’s annual extension to its revolving credit facility.

“The whole genesis of Bank ABC entering the credit facility was to enhance our Middle East banking relationships and the fact that they were open to investing in new companies at the time. Bank ABC’s team spent real time getting to know ALC as a company and understanding our financial needs.” The two companies continued to build upon their relationship until the global pandemic hit and discussions halted. Once the industry reopened, ALC realised that the Middle East region was flushed with liquidity and was worth exploring further.

“We had floated the idea [of a sukuk] to ALC before Covid but only got back in touch with them in September 2022 when we arranged a non-deal roadshow to gain feedback from local investors,” says Wilmot. “The response was encouraging that a deal was possible.”

“Bank ABC did a tremendous job shepherding us through the process and we found a very warm welcome from investors,” says Verwholt. Unlike a typical banking relationship that usually starts with a simple product like a loan, Bank ABC suggested a sukuk transaction that would get the market comfortable with ALC’s credit profile and open banks and other Middle East investors up to more unsecured deals in the future.”

Despite the warm investor reception, as Wilmot says, “the devil was in the detail”. What followed was several months of structuring work marrying an Islamic Shari’a format transaction with a US corporate entity as an issuer. “ALC’s large, unencumbered asset pool enabled us to structure a 100% tangible asset transaction, which is rare in the region where the average is between 30-50% tangible assets,” explains Wilmot.

Bank ABC brought in another bank, DIB, to work together on the complex structuring process, which had to consider multiple jurisdictions with the region. “Once we had a feasible structure in place, we were then in a position to go out to investors and have more concrete conversations with investors to better assess demand,” said Wilmot.

“Once we were assured of that interest, we brought in several banks to assist with a wide distribution around the region. For example, we brought in Masraf Al Rayan bank to broaden interest in Qatar.”

Following a true deal roadshow, the team was predicting a book size of around $1.2bn for an issue size of US$500 million. “We were pleasantly surprised that we built a book of $2bn and needed to upsize the issuance to US$600 million to keep all those investors onboard,” adds Wilmot.

With such a large book, the deal could have been upsized further but, as Wilmot attests, as a new entrant to the region, the emphasis was on ensuring those anchor and initial investors were happy with their ticket size and also allowing them and other investors to assess the deal’s secondary performance.

“Many investors were keen to ensure that this wasn’t a one-off deal, that ALC would become a repeat if not regular issuer in the region. We certainly hope that this is a starter programme for ALC, and we now have a proven programme for more lessors from outside the region to come and tap a new pool of investors,” says Wilmot.

“We raised $600 million and had over $2.25bn in demand – 90% of that demand came from investors and banking partners that we had never engaged with before and which had never invested into ALC before. This is true diversification. It makes a big difference if you can raise capital at or inside comparable levels without cannibalising demand.”

The sukuk priced at 5.85%, which based on ALC’s previous capital market issuance looks high, but in the new higher interest rate environment, the price is essentially flat to slightly inside ALC’s established issuance curve despite the expectation that there may have been a new issuer premium on this first deal in the region.

“The pricing was five basis points inside of what US banks were quoting for a conventional investment grade deal at the same time, and in line with money we raised in the capital markets at the end of last year when rates were lower,” says Verwholt. “We have had to reframe our expectations in the higher interest rate environment.”

The deal also paved the way for future US or other foreign investment-grade corporate issuers into the region.

Capital markets

There are two tiers of companies within the aviation finance sector – investment grade and non-investment grade airlines and lessors. The larger scale investment grade lessors have been able to continue to raise capital in the bond markets in 2023 despite the higher rate environment.

“Interest rates have climbed much faster than expected but the debt capital markets are still there for investment grade rated companies,” says ALC’s Plueger. In the first quarter of 2023, ALC issued $700 million of 5.30% five-year senior unsecured medium-term notes due 2028, and completed its inaugural US$600 million sukuk offering, consisting of 5.85% trust certificates due 2028. Later in the year, ALC went back to the capital markets to issue C$500 million of 5.4% senior unsecured medium-term notes.

“If you are investment grade rated, like in all other times, the money’s available,” says Plueger. “The global debt capital markets remain open; they are robust. You just have to willing to pay what the market will give you.”

BOC Aviation has been a prolific issuer in the capital markets and closed several large bond deals in 2023 – $500 million unsecured five-year notes, coupon of 4.5%, all-in yield of 4.627%, and $500 million unsecured ten-year notes, coupon of 4.875%, all- in yield of 5.015%, in May; followed by $650 million unsecured five-year notes, coupon of 5.75%, all-in yield of 5.917% in November. Rounded off with a $1.375bn club loan, the largest in its history, in October.

“We have that lowest incremental cost of borrowing of anybody in the market,” commented Steven Townend, the new chief executive of BOC Aviation, who took over the reins on January 1, 2024. “For investment grade lessors like ourselves, we see a very strong market. At the same time as raising funds in the bond market, we have also been in the bank market. What is interesting for both of our most recent issuances is the source of capital. Recently, we have seen a broader base in the bank markets. We have attracted investors from North America, Europe, Middle East and Asia in the bank facility, and for most recent bond issues, about 80% of investors were from Asian markets.”

On the equity capital markets, AerCap was the most active player since the company completed the sell down of all remaining shares owned by General Electric (GE) following the lessor’s acquisition of GECAS in November 2021.

The secondary offering of 26,721,633 of its ordinary shares by GE Capital US Holdings, a wholly owned subsidiary of GE, were sold at a price to the public of $65.25 per ordinary share. The 30- day option for a further 4,008,245 additional ordinary shares was exercised in full completing GE’s exit from AerCap.

Goldman Sachs, Citigroup, Deutsche Bank, BNP Paribas, BofA Securities, JPMorgan, Credit Agricole CIB, Mizuho, MUFG and Société Générale acted as joint bookrunners, with BBVA, ING, UniCredit, Santander, Academy Securities, R. Seelaus and Siebert Williams Shank acted as co-managers for the secondary offering.

AerCap’s Kelly said that the team had learned valuable lessons from the acquisition of International Lease Finance Corporation (ILFC) a decade earlier from AIG, which had also been structured as a share sale format with AIG owning a large stake in AerCap following the sale of ILFC. Those shares were subject to a nine to 15 month lock- up period but it was assumed that AIG would eventually sell its stake.

“We knew AIG was going to sell and we put an investor relations programme in place, but I don’t think we understood the impact of AIG selling 45% of the biggest lessor in the world into a market that wasn’t very liquid,” admits Kelly.

AIG shares were picked up by hedge funds looking for short-term returns by capitalising on the upside in the stock price. Kelly describes those hedge fund buyers as a “bridge between the strategic owner in AIG to longer-term” investors. However, he says, the company didn’t account for the volatility in the share price caused by hedge funds selling on any news item that deterred some longer-term investors.

Kelly explains that the AerCap team made a very significant effort in the years from 2017 to 2019 to attract more long-term investors to the stock and away from the volatility caused by the hedge funds. Leveraging on the hard lessons learned after the AIG sale, AerCap took a more measured approach to the GE share sale.

“For the last two years, a very significant effort has gone into broadening the investor base for aircraft leasing equity,” says Kelly. That effort has proven to be very successful since GE sold down close to $9bn in a relatively short eight month period, which needed a steady supply of investors.

“We needed to make sure that we weren’t in a situation where there was that much supply coming into a market where there were not natural buyers,” says Kelly. “What we really wanted were the long only investors and that has been the dramatic change and what has driven up the stock price post the GE sale, which is the outcome we all really wanted and worked very hard to achieve.”

At the same time as the GE share sale, AerCap completed a successful exchange offer for all holders of several existing notes due 2024 for new 6.450% senior notes due 2027. AerCap elected to exercise its option to adjust the cash component of the total consideration, in respect of the 1.750% senior notes due October 29, 2024, from $54.00 to $45.00 and, in respect of the 1.650% senior notes due October 29, 2024, from $68.00 to $57.50. As a result of the offering, AerCap also succeeded in smoothing out its debt maturities.

Airlines have continued to tap into the equity capital markets to raise capital. TUI Group was a substantial issuer in 2023 with a €1.8bn rights issue. TUI used the net proceeds from the fully underwritten capital increase to fully repay the remaining aid from the Economic Stabilisation Fund (WSF).

TUI paid off €420 million WSF’s Silent Participation I – the group had already repaid the €671 million Silent Participation II in 2022 - and the remaining €59 million Warrant Bond was also redeemed. WSF received a final amount of €750 million including compensation for the conversion rights and accrued interest and coupons. TUI’s payments to the German state for providing the WSF stabilisation measures during the pandemic for interest, coupons and as compensation for conversion rights amount to around €381 million.

Sebastian Ebel, CEO of TUI Group, described this as a pivotal moment for the company, which had been “strengthened” and is now focused on “profitable growth”.

In a quasi-equity raise, Air France- KLM monetised its Flying Blue loyalty programme with a $1.5bn transaction in November in 2023.

Under the deal, Apollo-managed funds subscribed to perpetual bonds issued by a dedicated operating affiliate of Air France-KLM that holds the trademark and most of the commercial partners contracts related to Air France and KLM’s joint loyalty program (Flying Blue) as well as the exclusive right to issue “Miles” for the airlines and their partners. The perpetual bonds will bear a coupon of 6.4% for the first four years, with the ability to redeem with an overall financing cost of 6.75% on the first call date.

Air France-KLM will continue to manage and operate its loyalty program Flying Blue, and Air France and KLM will keep full ownership rights of their customer database.

The financing is accounted for as equity under IFRS. Air France-KLM said that this deal “materialises the steps implemented by the Group to restore its IFRS equity to positive by year end”.

The transaction was upsized from €1.3bn to €1.5 billion on the back of what the issuers said was “strong investor confidence and the quality of Air France-KLM Flying Blue Miles issuance activity”.

Steven Zaat, Air France-KLM chief financial officer, said that the upsizing of the quasi-equity financing represented a “significant step further to strengthen Air France-KLM’s balance sheet at attractive funding terms” as well as “a strategic milestone and clear recognition of our successful Flying Blue program miles activity as well as its potential scalability”. Apollo partner Jamshid Ehsani said at the time the deal closed: “We are very pleased to be part of this inaugural European mileage capital investment with Air France-KLM. The transaction was well received by our investors, both those within the broad Apollo platform as well as select third-party investors, including sovereign wealth funds and multinational insurance companies.”

As part of the transaction, Air France-KLM also committed to spend €100 million on sustainable aviation fuel over the next four years.

Ashland Places closes inaugural loan ABS

Ashland Place Finance (Ashland Place) priced its inaugural aviation loan asset backed securitisation (ABS), APL Finance 2023-1, in December, which offered four tranches of notes secured by a static pool of aviation loans.

The quality of the portfolio of aviation loans resulted in tranches A through C being rated investment grade by KBRA, and the deal being oversubscribed. A healthy mixture of traditional aviation ABS investors as well as investors new to the asset class are reported to have bought into the deal.

Formed in September 2021, the Ashland Place platform, backed by Davidson Kempner Capital Management LP (DKCM), was set up with the specific aim of originating aviation loans. The team, led by veteran aircraft leasing and banking executive Jennifer Villa, has built up the Ashland Place portfolio with well- structured loans to quality borrower and underlying lessee credits and the specific long-term view of eventually securitising sections of the loan book. “This was always the plan,” says Villa, speaking to Airline Economics on the day the deal priced. “We intend to be a continuing issuer in this space.”

DKCM had this strategy in mind ahead of the formation of Ashland Place and has been pleased to see this idea come to fruition. Villa commented, “We see many opportunities for Ashland Place – we are continuing to originate and underwrite new loans even in this heightening interest rate environment. There is a need for the type of lending provided by Ashland Place, as demonstrated by our repeat customers.”

The $324.3 million securitisation includes $238.2 million A notes, rated AA by KBRA, with a 67.9% loan- to-value (LTV) ratio based on the securitisation loan balance and 38.9% based on the collateral balance, with a weighted average life (WAL) of 1.61 years, which priced at I-curve +285 basis points (bps) with a 7% coupon and 7.705% yield. The $53.32 million B notes, rated A-, have a loan balance LTV of 83.1% and collateral LTV of 47.6%, a WAL of 2.93 years, and priced with a +355bps spread, 7.86% coupon and 7.99% yield.

The $21.92 million C notes, rated BBB-, have a loan balance LTV of 89.3% and collateral LTV of 51.2%, a 2.93 year WAL, which priced at a +475bps spread and 8.5% coupon/9.19% yield. The BB- rated D tranche, worth $10.87 million in total, has a loan balance LTV of 92.4% and a collateral LTV of 53.0%, a 2.93 WAL, which priced with a 5% coupon/12.69% yield, an +825bps spread and sold at 81.96% of par. All four tranches of notes have a final maturity of July 2031. Affiliates of both Ashland Place, which remains as the servicer of APL Finance 2023-1, and DKCM are retaining 100% of the equity of the subject transaction at closing.

The proceeds of the notes will be used to acquire a portfolio of 11 limited recourse loan facilities comprised of 26 loans, which are secured by 19 narrowbody aircraft, three widebodies and four narrowbody host aircraft engines on lease to 12 lessees located in 11 jurisdictions. The three largest lessees by loan balance are Corsair International, TUI Airways and Ethiopian Airlines.

The collateral has a weighted average age of 10.0 years (excluding the engines) and an initial appraised value of approximately $612.2 million based on the average of half-life base values provided by three third-party appraisers as of the second quarter of 2023. The appraisers are Collateral Verifications, Avitas and Morten, Beyer & Agnew.

As of the deal’s cut-off date, the loan portfolio had an initial aggregate loan balance of approximately $350.8 million, an average asset balance of $13.5 million and a weighted average remaining loan term of approximately 2.8 years. The portfolio has a weighted average seasoning of 18 months. The initial portfolio balance includes $6 million for incremental extensions, and advances for certain assets that have taken place after the cut-off date.

ATLAS SP Partners is the sole structuring agent. Pivotal Corporate AMS is the managing agent, with UMB Bank acting as back-up servicer and trustee. Allen & Overy served as legal advisor to Ashland Place, and Milbank served as legal advisor to ATLAS SP Partners.

APL Finance 2023-1 will also feature an esteemed group of board members, including: Elizabeth Barry, former director & head of corporate affairs at Airbus Financial Services; Anthony Diaz, former president at CIT Aerospace; and Mark O’Kelly, group chief financial officer at ASL Airlines.

All loans in the portfolio were originated under the Ashland Place platform and are limited recourse, first lien, senior secured loans. The loans are structured with maturities shorter than or equal to the lease maturity of the underlying aircraft. There are also additional protections in place for the A note holders.

“We’ve sought to structure the underlying loans conservatively relative to what you often see in this space,” says Villa. “The underlying airline counterparties are mainly flag carriers and tier one credits, with strong borrowing counterparties across the spectrum of the leasing community, each with equity in the assets. Furthermore, there is no remarketing risk in the portfolio like you typically face in vanilla lease ABS, as these loans are all either shorter than or co- terminus with the underlying leases.”

The static loan pool is one of the main appeals of the Ashland Place aviation loan ABS and what assisted with the investment grade rating for the first three tranches including the subordinated C notes – a major achievement. “We received investment grade ratings for the A, B and C tranches, with the D rated BB-; you don’t really see that in the lease ABS transactions,” says Villa. “What we believe really resonated with investors from a risk-reward perspective is that on a metal LTV basis, the entire capital stack of this loan ABS fits inside the A note of a traditional lease ABS, and why the transaction has been so well received in the market.”

Ashland Place 2023-1 is only the second aviation loan ABS to come to market. The first aviation loan ABS (SALT) was issued by Bellinger Asset Management and Stonepeak Partners LP in 2021, which secured the portfolio of aviation loans they acquired from National Australia Bank (NAB). APL Finance 2023-1 is an ABS loan structure but is a very different transaction. The NAB book acquired by the issuers in SALT had more loans of varying sizes, with minority lender and a mix of secured and unsecured.

APL Finance 2023-1 was designed with the capital market refinancing in mind and, as such, has been carefully constructed with strictly secured loans, with one sole lender and primary originator in Ashland Place and, thus, similar documentation throughout which spoke to the rating agencies and ultimately the investors.

The transaction priced on December 12, 2023, with competitive yield across the debt stack despite the choppy market environment.

Structured finance

Structured aviation finance deals are still not back to full force and issuance is likely to remain subdued for some time in the higher-for-longer interest rate environment. There was a single aviation asset backed securitisation transaction closed in 2023 from Willis Lease Engine Finance, with the seventh iteration of its WEST series of engine financings.

Austin Willis, chief executive of Willis Lease, says that the ABS deal was “very well received” by investors because “our ABS deals have historically outperformed almost any other deal in the market through the pandemic, which is a testament to the performance of the company”.

The broader ABS market is open but the economics for aviation assets – due to the high interest rate and lagging lease rates – currently do not compare to commercial banking products or alternative lenders.

For leasing companies, the environment is still not conducive to a successful aviation ABS issuance. “The ABS markets, unfortunately, are still not fully functioning,” says Goldman Sachs’ Lee. “There is some private placement issuance, but that market is very dependent on the quality of the underlying lessees, the age of the aircraft and the structure of the leases. This has made options for the sub-investment grade leasing companies pretty limited.”

Mizuho’s Srinivasan explains the problem with new aviation ABS issuance in more detail: “Prior to the pandemic, lessors could issue single-A bonds at 65% LTV at 2.5% yield,” he says. “Today, you can barely get to 65% LTV on an on a decent aircraft portfolio at 7.5% yield.

The cash flows coming in have not really changed because lease rates haven’t gone up enough to compensate. The only places where you could see an ABS deal is on older aircraft, where you can still find enough yield. Structural enhancements aren’t going to move the needle; it’s a matter of how much cash the aircraft generate.

There’s just a dearth of cash flow to support a higher amount of debt.” Until those economics change, Srinivasan notes that banks are being very understanding and have been supporting the sector by providing warehouses that are being “renewed andrenewed again”.

Although lessors are struggling to tap into the ABS market, financiers have found success using the loan version of the secured transaction. Following in the footsteps of SALT, which closed in 2019, Ashland Place came to market at the end of 2023 with a new loan ABS product, which it expects to have an enduring future in the aviation finance stable of products (see section on previous page for more detail on APL Finance 2023-1).

Sub-investment grade lessors have opted mainly for warehouse financings, which Lee comments, is “effectively buying time for another market where rates are more constructive”. He also sees other determined leasing companies that have been willing to “take near-term hits to their P&L with higher interest rates so that they can get to an investment grade rating”.

Griffin is one of those companies seeking to both fund its growth trajectory as well as place the company on a first footing on that journey to investment grade. In 2023, Griffin began the year with an upsizing of its $1.5bn warehouse facility to $2bn with 12 leading banks.

Soon after, Griffin began its corporate ratings process with Fitch and S&P resulting in the company’s inaugural corporate ratings of BB and BB-, respectively. The financing team led by chief financial officer John Beekman, also negotiated the terms of Griffin’s inaugural unsecured bond issuance.

The $1bn unsecured notes issuance closed in June, which is significant volume for a debut issuance by an aircraft lessor. Soon after the inaugural bond, Griffin also closed an inaugural corporate unsecured Revolving Credit Facility (RCF), which had commitments from 12 leading banks for $575 million. In the meantime, the company closed a $400 million credit facility in August with four banks dedicated to a new partnership with Rolls-Royce that acquired 17 engines.

The team rounded of the year with its second unsecured bond offering for $400 million, which closed in November and was subsequently followed with a $300 million tap to that security at the very end of the year.

“We tried to navigate a challenging market for raising capital, but guided by a clear objective of achieving investment grade ratings, ” says Griffin’s McKenna. “We took meaningful steps towards unencumbering our balance sheet with an unsecured funding structure and remain committed to our investment grade financial metrics.”

McKenna notes that Griffin’s portfolio metrics with a long average lease term and a young average age, are already in step with the company’s investment grade peers, the issue is scale.

“The agencies have made it very clear that getting larger is required for investment grade issuers and we are going to add scale in a very methodical way,” he says. “We don’t need to do something transformational to get there. We have a very clear path for growth with the new aircraft delivering in our pipeline and we will continue to focus on our unsecured funding structure.”

With the resumption of new aircraft deliveries, it was assumed that airlines – specifically US carriers – would again turn to raising debt using the tried-and-tested enhanced equipment trust certificates (EETCs). However, over the past few years cash rich airlines have chosen to use cash to fund new deliveries or existing debt stacks.

This trend continued into 2023, with only one largescale EETC being issued by United Airlines in June, although there was a private deal closed by first-time issuer Republic Airways secured on a portfolio of spare parts in July. ASL Aviation also raised $155 million with an enhanced equipment trust loan transaction in April, which was a unique structure that supported the conversion of passenger aircraft to freighters.

Commercial banking market

Airlines and lessors have continued to develop relationships and issue more debt in the commercial banking market in 2023, despite the increase cost. As Greg Lee notes there has been an abundance of warehouse facilities closed over the past year.

However, the cost of debt using these structures is also rising, which Castlelake’s McConnell comments is creating challenges for some leasing companies.

“The warehouse market is challenged,” says McConnell. “The ABS market is extremely challenged and it is unclear if it will really come back. We believe that many investors that are reliant on that funding model are struggling to close transactions. We have seen or heard of many differenttransactions that fail to close after LOI execution due to funding issues.”

McConnell sees these companies losing access to sources of both debt and equity, leading in some cases to the forced sale of assets.

This situation has increased the importance of execution risk for aircraft transactions, which favours larger players with a strong track record and certainty of execution. This is essential in such a hot trading market where airlines are clamouring for lift.

Alternative lenders have been filling the void for both equity and debt financing, which has continued over the past year as certain banks retrench to protect balance sheets and focus on fuel efficient new equipment and relationship clients.

There is the sense that these alternative lenders tend to play in more niche areas where there are higher yields.

Greg Lee believes that a gap remains between where “the alternative or private credit sources of capital need to earn their cost of capital and what economically makes sense given the low these rate factors”, which he says is what has prevented alternative capital from becoming a bigger part of the market to date.

Non-payment insurance (NPI) products have also continued to grow in popularity, in some cases replacing the export credit-backed transactions that are popular for lower tier credits.

Several companies now offer NPI products from Marsh’s AFIC and Balthazar products, to newcomer Itasca Re as well as ACG’s Aircraft Financing Solutions (AFS) guarantee.

These are complementary to the bank financing market and are now widely regarded as a substitute for export credit financing, which is becoming more selective and export credit agencies are now acting within their original missions as lenders of last resort.

Both NPI and export credit supported transactions require banking support, which has continued over the past year. These products are popular with tier two airlines and alternative lenders have also recognised a market opportunity.

Castlelake has invested in this product family with the creation of Itasca Re. “Itasca Re is an NPI provider that enables what we believe to be the lowest cost of debt financing to airlines and leasing companies through an insurance wrapped structure with a single A rating,” explains Joe McConnell.

“This is a unique product and this business is rapidly scaling and when banks are pulling back and when alternative lenders in many cases are relatively expensive, we believe Itasca Re is a great solution for owners and buyers of aircraft that want a lower cost of debt financing, and they want it from a party that can provide closing credibility and a creative, custom tailored structure.”

Engine assets have increased in popularity with investors and there have been some very large engine portfolio financings in 2023.

Shannon Engine Support (SES) – a 50/50 joint venture between AerCap and Safran – concluded an $875 million engine portfolio financing in a club-deal of eight banks. This landmark transaction, which is the largest aircraft engine portfolio financing closed in the market to date, finances a pool of the latest technology LEAP-1A and LEAP-1B engines, designed to meet the challenges of decarbonising air transport.

This was the first secured financing by SES. Credit Agrciole-CIB acted as global coordinator on this deal and was mandated lead arranger and bookrunner with Natixis-CIB; BNP Paribas, CIC, Natwest, Société Générale, and SMBC were also MLAs, with Bank of America as a lead arranger.

Griffin and Bain Capital Special Situations (Bain Capital) have also entered the engine market with an agreement to acquire 17 new technology Rolls-Royce Engines, including Trent XWB-84s, Trent XWB-97s, Trent 1000s, and Trent 7000s. The engines will be owned by a newly-formed standalone entity and used as spares by the Rolls-Royce global customer base.

Bank of America led the acquisition financing of the engines, with key commitments to the facility from Mizuho Bank, Citibank, and Goldman Sachs Bank.

Sustainable financing

Sustainability-linked loan financing has expanded in the past year and is being driven by the commercial aviation banks.

In December 2023, CDB Aviation, a wholly owned Irish subsidiary of China Development Bank Financial Leasing (CDB Leasing), entered into an inaugural Sustainability Linked Loan (SLL), anchored with a $625 million syndicated term loan facility.

“This innovative facility marks a landmark transaction for the aviation finance space,” said Jie Chen, CDB Aviation’s Chief Executive Officer. “We’re thrilled to have leveraged our comprehensive sustainability strategy, with a particular focus on the activities across the Environmental and Social aspects of our operations, to secure this first major sustainability- linked loan syndicated facility among aircraft lessors.”

The SLL parameters of the facility are contingent on the satisfaction of Sustainability Performance Targets (SPTs), which are based on the lessor’s three Key Performance Indicators (KPIs).

These include two strong Environmental and one Social KPIs related to reducing the carbon intensity of CDB Aviation’s fleet, focusing on the most fuel-efficient aircraft; increasing the share of new generation aircraft in the lessor’s fleet, pursuing its target to reach 60% of new generation aircraft (by number of aircraft) by the end of 2025; and increasing the level of Diversity, Equity, and Inclusion (DEI)-related training for the workforce.

Moody’s Investors provided the Second Party Opinion as to the appropriateness of the KPIs and SPTs, confirming the conformity of the facility with the Sustainability Linked Loan Principles (SLLPs), with a best-in-class SQS2 rating.

The facility was financed by a group of mandated lead arranger banks, including: Crédit Agricole-CIB (CA- CIB), BNP Paribas, HSBC, Natixis, China Minsheng Banking Corp., China Guangfa Bank and China Construction Bank.

CA-CIB acted as sole sustainability agent, as well as lead sustainability structuring advisor jointly with BNP Paribas and HSBC. Natixis acted as sustainability structuring bank. CA-CIB also acted as agent of the facility. Milbank acted as counsel to the lessor, while Allen & Overy (London) acted as counsel to the lenders. JunHe and Matheson acted as PRC and Irish counsel, respectively.

“Delivering on our platform’s ESG vision and responsibilities, this facility advances the sustainability of our business and enhances our ability to contribute to progress in reaching the industry’s net-zero target. We’re committed to being a leader on ESG matters and efforts, managing our impact as a business and maximizing our influence to help drive positive change in the aircraft leasing community,” said Chen.

Other issues in the SLL space this year have been Turkish Airlines, Cathay Pacific, Wizz Air with a sustainability- linked Japanese Operating Lease with Call Option, Air France-KLM with a sustainability-linked RCF, and easyJet with an ESG-linked EDG facility, which has KPIs related to a reduction in the carbon emission intensity of easyJet in line with the Group’s SBTi validated target. And many more.

Mainstream banks are committed to sustainability targets and, in line with this strategy, are focused almost exclusively on new technology assets.

“Some lenders have set targets to finance only new, fuel-efficient, more environmentally-friendly equipment,” says Carlyle Aviation’s Korn. “If you want more accessibility to finance, you will need to focus on those assets that are in demand. We see strong push back from the banks to encourage us or provide benefits for purchasing and financing new technology aircraft. But we need to take a step back and realise that the industry doesn’t have enough assets to service demand so premature retirement of older aircraft is not feasible.”

Many of the larger aviation commercial banks are signed up to the Climate Aligned Finance Initiative with RMI and the Renewable Low Carbon Fuel Alliance roundtable sponsored by EU Commission, which will reveal its framework later this month solidifying sustainability financing measures for aviation assets.