In December 2016, the Annual Tax Act (Jahressteuergesetz) revised the entrepreneurial status of legal entities under public law (jPöR). As things stand, the new legal regulation will come into force on 1 January 2025. From then on, jPöRs will generally have to assess all activities separately from a VAT and income tax perspective and pay VAT where applicable. However, many jPöRs have still not implemented their project plans. There are many reasons for this, including the complexity of internal and external documentation due to the enormous number of individual activities and factual characteristics in the absence of staff expertise, the inconsistency of budget screening and the low level of digitalisation in many organisations.

With a view to the end of the transitional regulation on 31 December 2024, jPöR should urgently tackle the changeover, as a further extension is not to be expected. Delayed conversion may result in additional tax payments as well as possible penalties or fines for the bodies of the legal entities.

Thomas Schmidt

Director, Tax

KPMG AG Wirtschaftsprüfungsgesellschaft

Is your organisation ready?

The KPMG Health and Readiness Check provides you with an overview

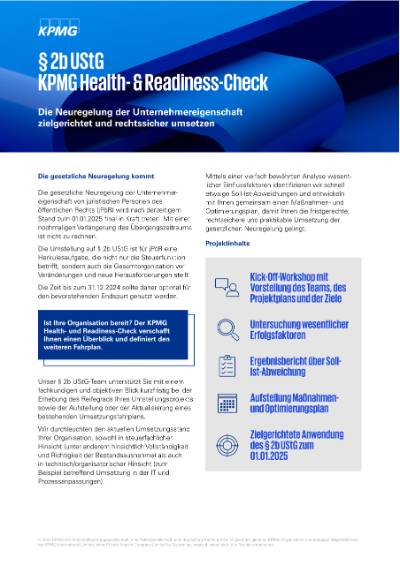

The conversion to Section 2b UStG is a Herculean task for jPöR, which not only affects the tax function, but also presents the entire organisation with changes and new challenges. Our § 2b UStG team supports you with an expert and objective view at short notice in assessing the maturity level of your conversion project and in drawing up or updating an existing implementation roadmap. We examine the current implementation status of your organisation, both from a tax perspective (including the completeness and accuracy of the inventory exemption) and from a technical/organisational perspective (e.g. regarding implementation in IT and process adjustments).

Product sheet: KPMG Health and Readiness Check

Talk to our experts for support:

Request KPMG support now

Digitalisation and automation as a solution for targeted implementation

With the KPMG § 2b UStG Assistant, we also offer you a solution for mastering the new legal regulation of § 2b UStG in digital and automated form. The assistant supports you in collecting information in a targeted, structured and standardised manner and making it available digitally for internal documentation and externally as proof to the tax authorities. The automated data analysis allows you to identify cases with risk potential and subject them to a qualified case-by-case review.

Users do not need any prior technical knowledge for this - and the Section 2b Assistant uses standard office applications or a digital collaboration platform. Additional software with lengthy authorisation and installation processes is not required.

SOS § 2b UStG - a breath of fresh air for your changeover project

Has your changeover project come to a standstill? Then you should familiarise yourself with our SOS § 2b UStG offer.

As part of project management, our experts ensure that your project gets back on track. They provide support in identifying potential gaps and their causes in the previous project plan and work with you to define optimised planning with suitable measures and the necessary resources. Structured project management ensures transparency and acts as a control and escalation instance. Due to the tax law background of the KPMG experts, the project team not only supports you with project management, but also actively helps you overcome the legal and procedural hurdles. The KPMG § 2b UStG assistant is also available on request.

Please do not hesitate to contact us.

Employee training by means of eTrainings

In order to correctly record tax-relevant activities and related information and to be able to collect it more easily, more comprehensively and in good quality, a corresponding basic understanding of VAT is required across the board among the employees of a JPöR. This can be achieved through the use of appropriate training measures. These are also a key component of tax compliance and contribute to the sustainable fulfilment of tax requirements by legal entities under public law.

From a certain number of employees to be trained, eTrainings offer the opportunity to keep costs and organisational effort low. Together with the award-winning provider of innovative online training, WTT CampusONE, KPMG has developed the "VAT for local authorities" training programme. On our website "Virtual learning that's fun" you will find further information, a demo video and the opportunity to request a free trial access. You can also watch the recording of our joint webcast "The new VAT obligation for local authorities".

Video: More information about our training programme