Where do Swiss hospitals and clinics stand in terms of finances and what are the challenges for the coming years?

How have Swiss hospitals performed in the past few years? What are the prospects for the future and what are challenges that need to be overcome?

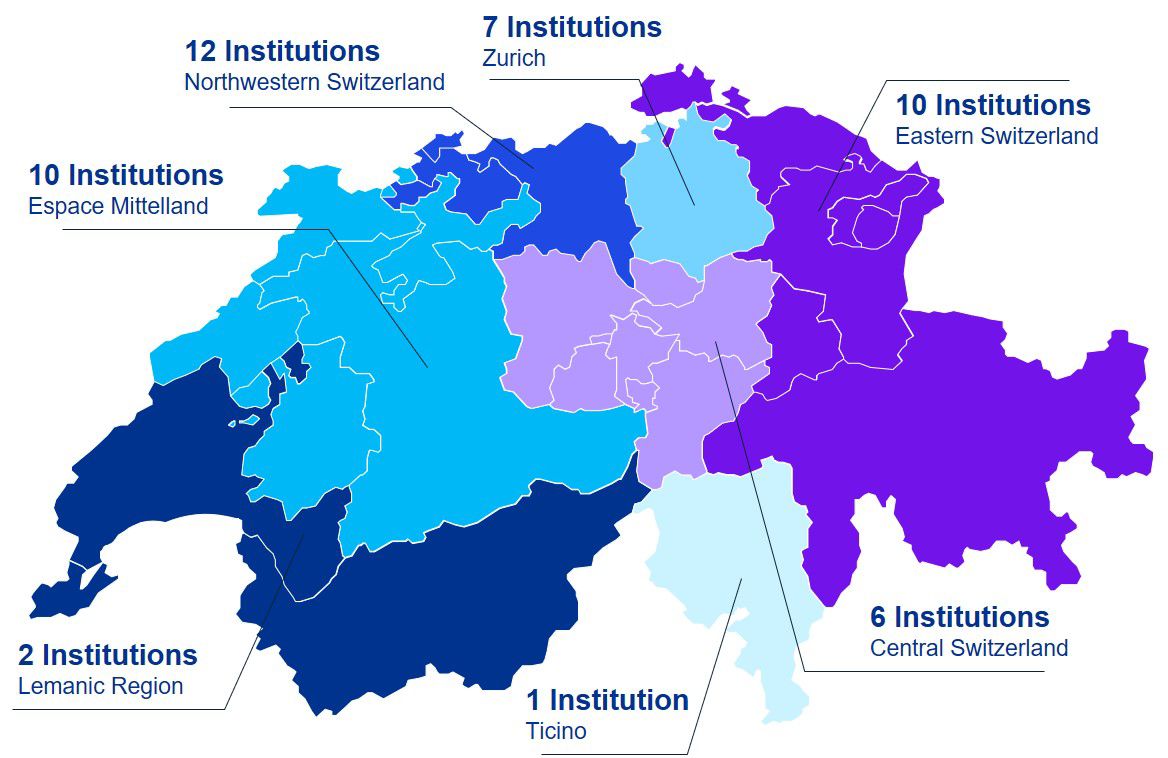

To answer these questions, KPMG analyzed the annual reports of 48 Swiss hospitals, rehabilitation clinics and psychiatric clinics and compiled the results of the study.

We complemented this perspective with collected data from a survey of the CFOs of Swiss hospitals and clinics, as well as in-depth interviews with notable representatives of the industry, with the aim of capturing the industry's expectations for the future. The key challenges and trends are summarized below.

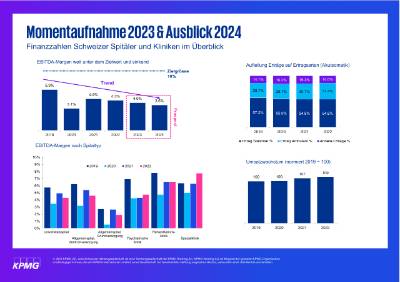

Operating result well below target and still declining despite rising revenues

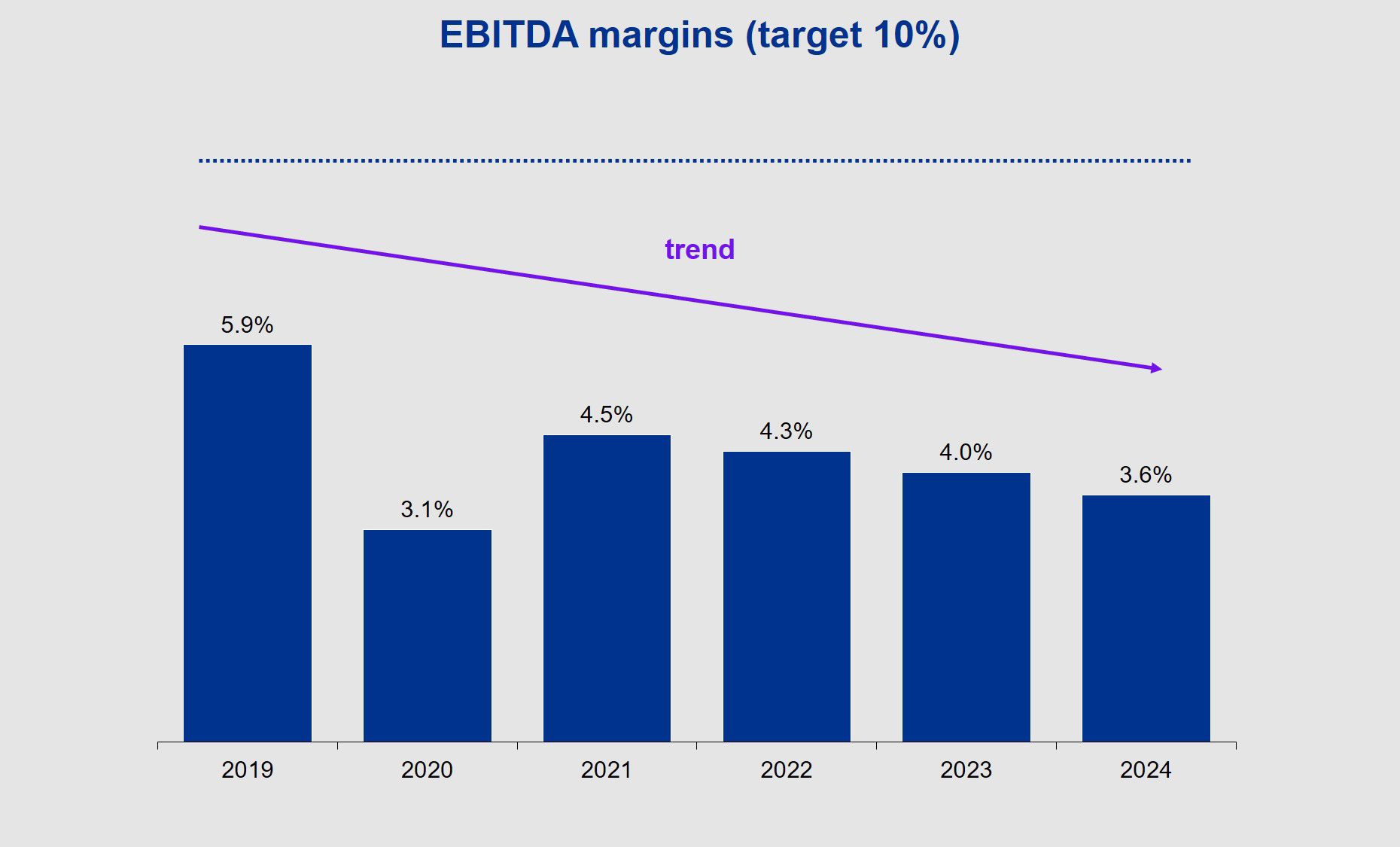

Achieving an EBITDA margin of around 10% is regarded as the target for refinancing necessary investments.

As the figures show, this target value has been significantly undershot over the last four years, with a continuing negative trend. We venture a look into the crystal ball drawing on a survey of more than half of the institutions evaluated as well as interviews.

The trend of declining EBITDA margins will continue. As early as next year, the average EBITDA margin will fall below the 4% mark. With the exception of specialty hospitals, all other facility categories show significantly lower EBITDA margins on average than before the pandemic.

Compared with 2021, a downward trend is also evident, particularly in acute care. These developments present major challenges for university, cantonal and regional hospitals.

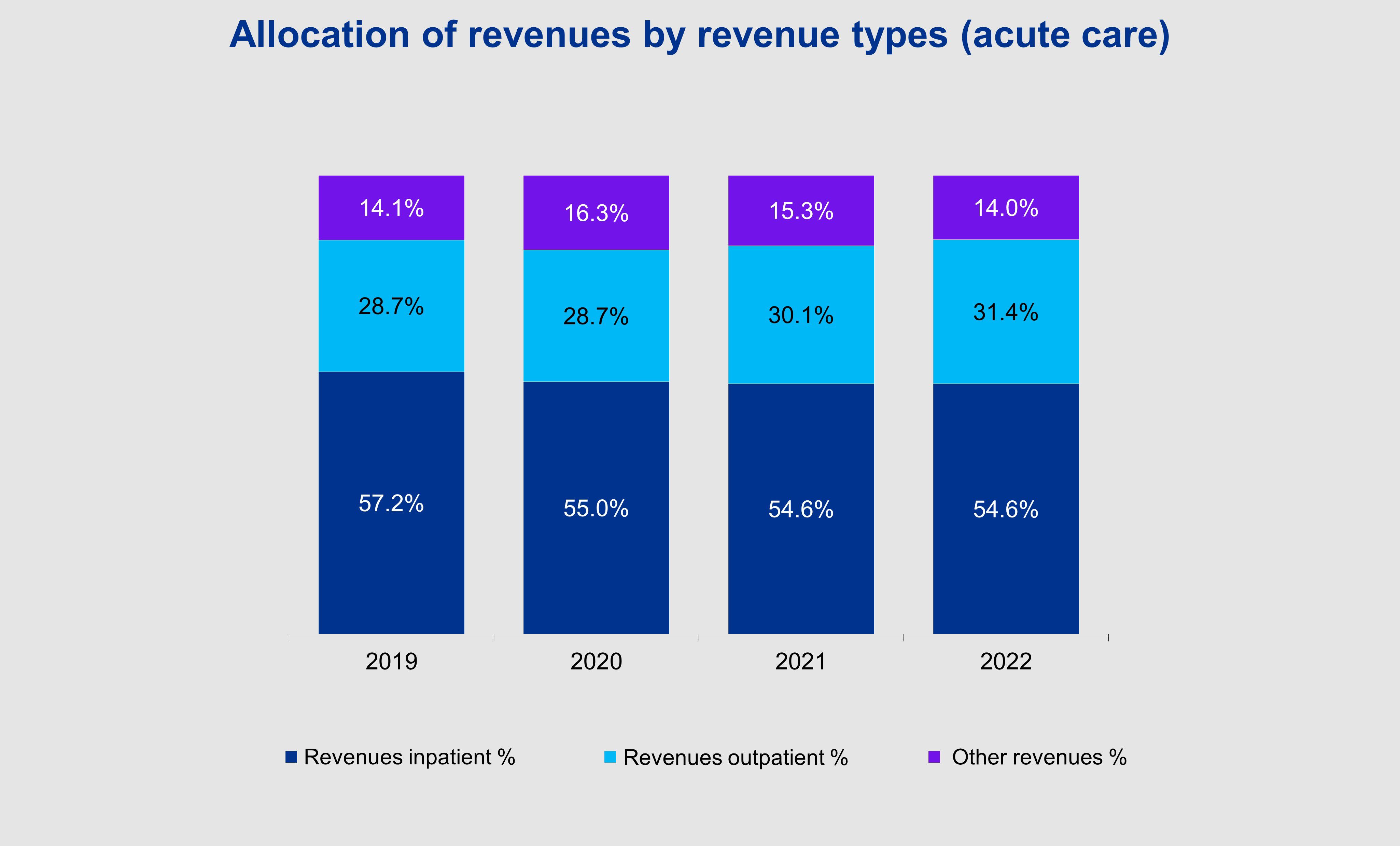

Revenues have been trending positively since 2019. After the decline in inpatient treatments during the COVID pandemic, a return to pre-pandemic levels is evident, and in line with the "outpatient before inpatient" approach, there is a relative increase in the share of outpatient revenues.

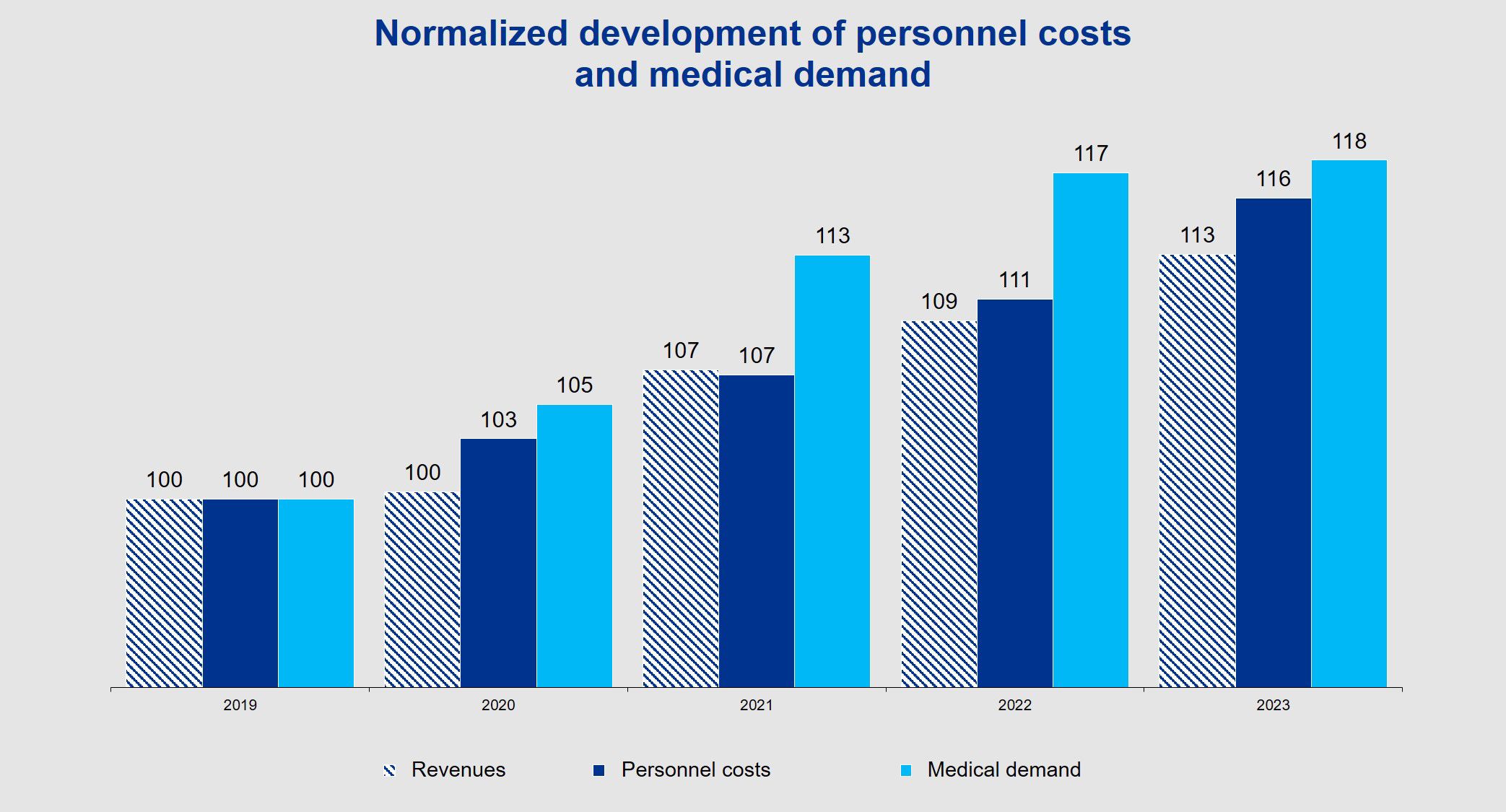

Rising costs put pressure on equity

Compared to revenues, costs are rising too sharply, partly because tariffs, especially in the outpatient business, do not cover costs. In relative terms, personnel costs (as a percentage of revenue) have remained mostly constant, but medical expenses have been on the rise (+17% since 2019, revenue only +9%, personnel expenses +11%).

Emerging from the CFO survey and executive interviews: Much of the impact of inflation (e.g., energy costs) and the shortage of skilled labor (e.g., cost-of-living adjustments) on costs has yet to materialize. For 2023, hospitals and clinics expect personnel costs to increase by an average of 5%, with an average revenue increase of "only" about 3%.

So while medical demand was the driver of cost increases from 2019 to 2022, in 2023/2024 personnel costs will further erode EBITDA margins. Much has been said about rising personnel costs and cost-of-living adjustments for salaries over the past almost two years, but we will not see the financial consequences of this in the income statements until 2023.

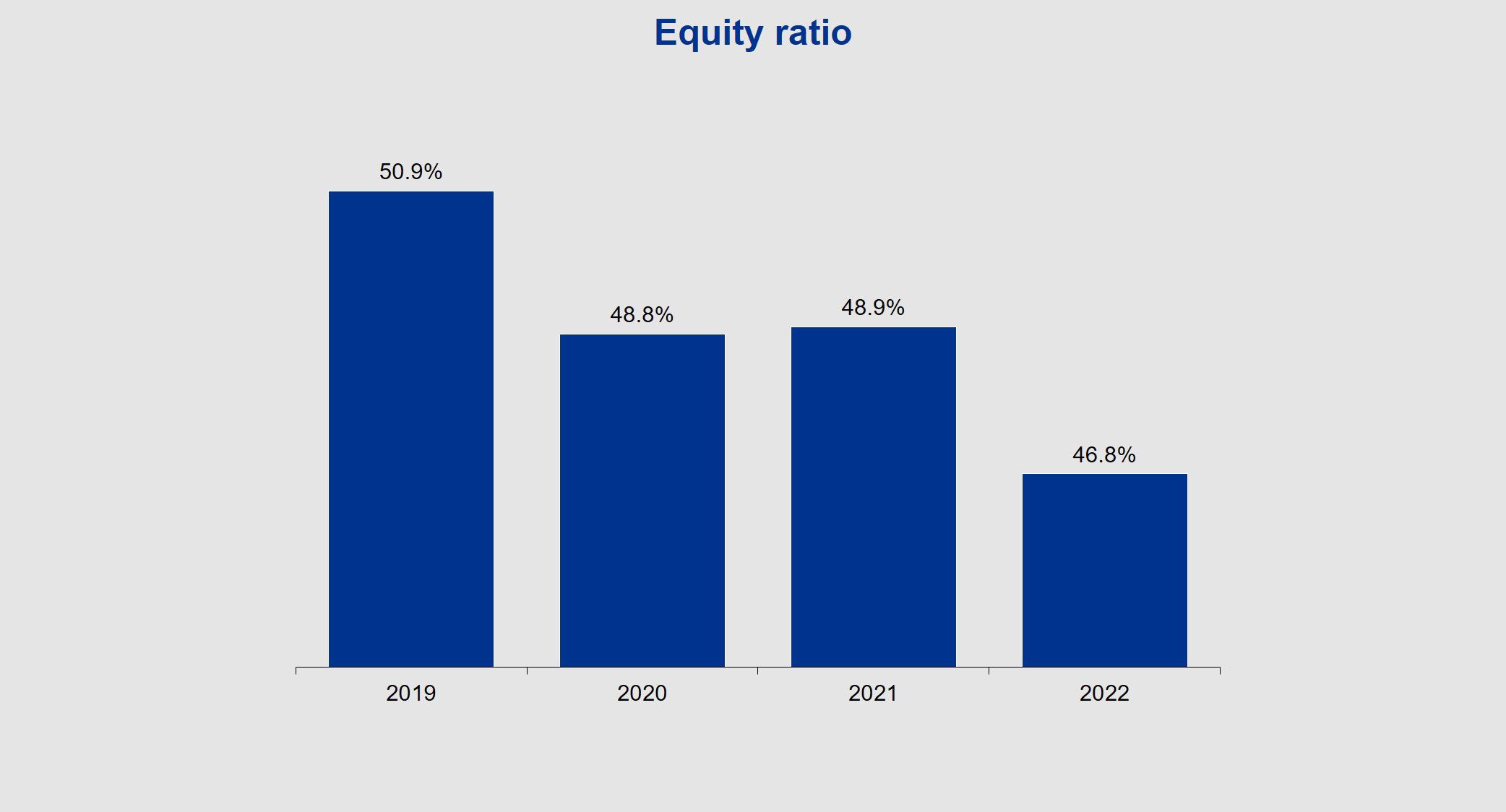

This negative development in profitability indicators is also having an impact on capitalization and liquidity. There has been an industry-wide decrease in capitalization and liquidity as a result of the Covid-19 pandemic – despite isolated increases in equity by cantons.

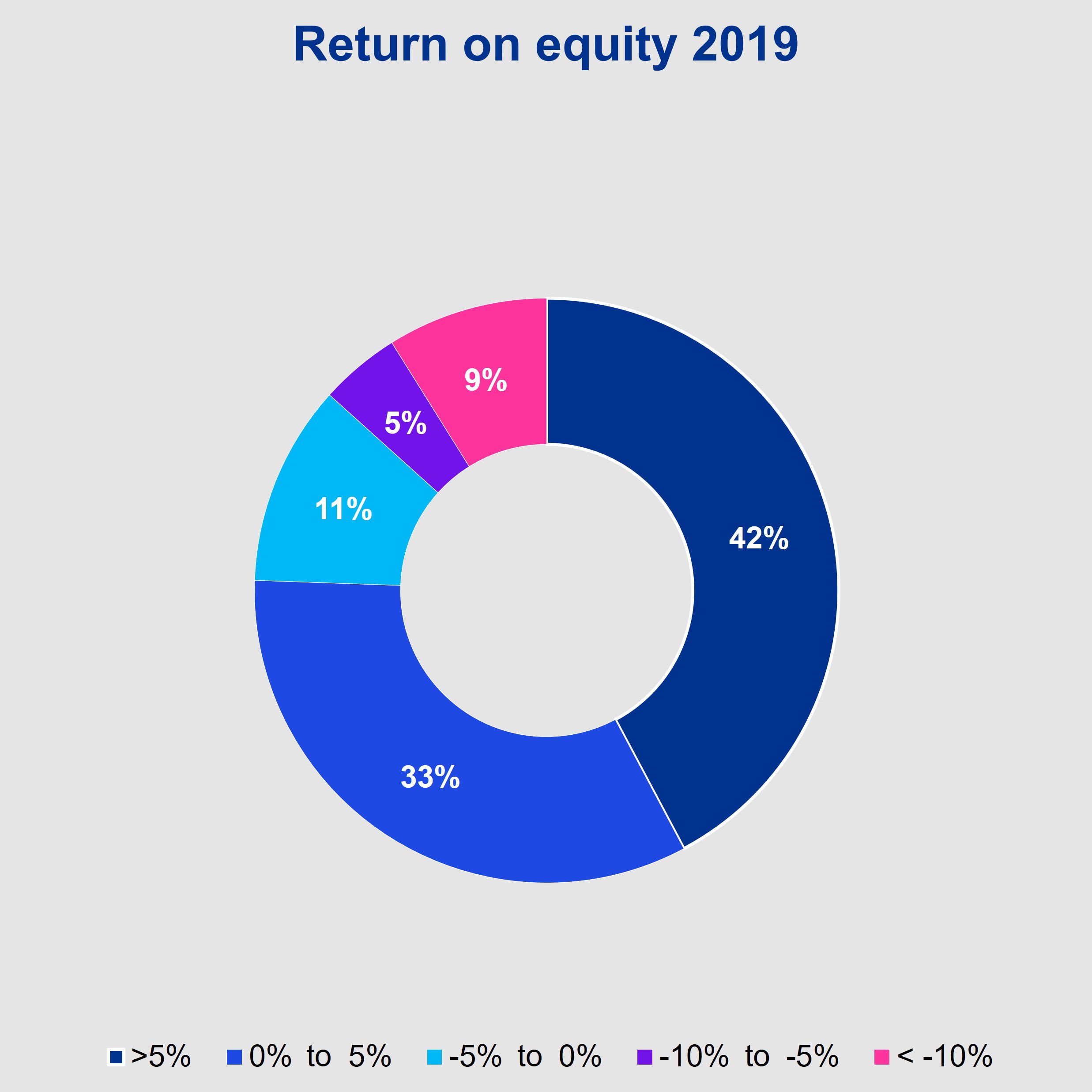

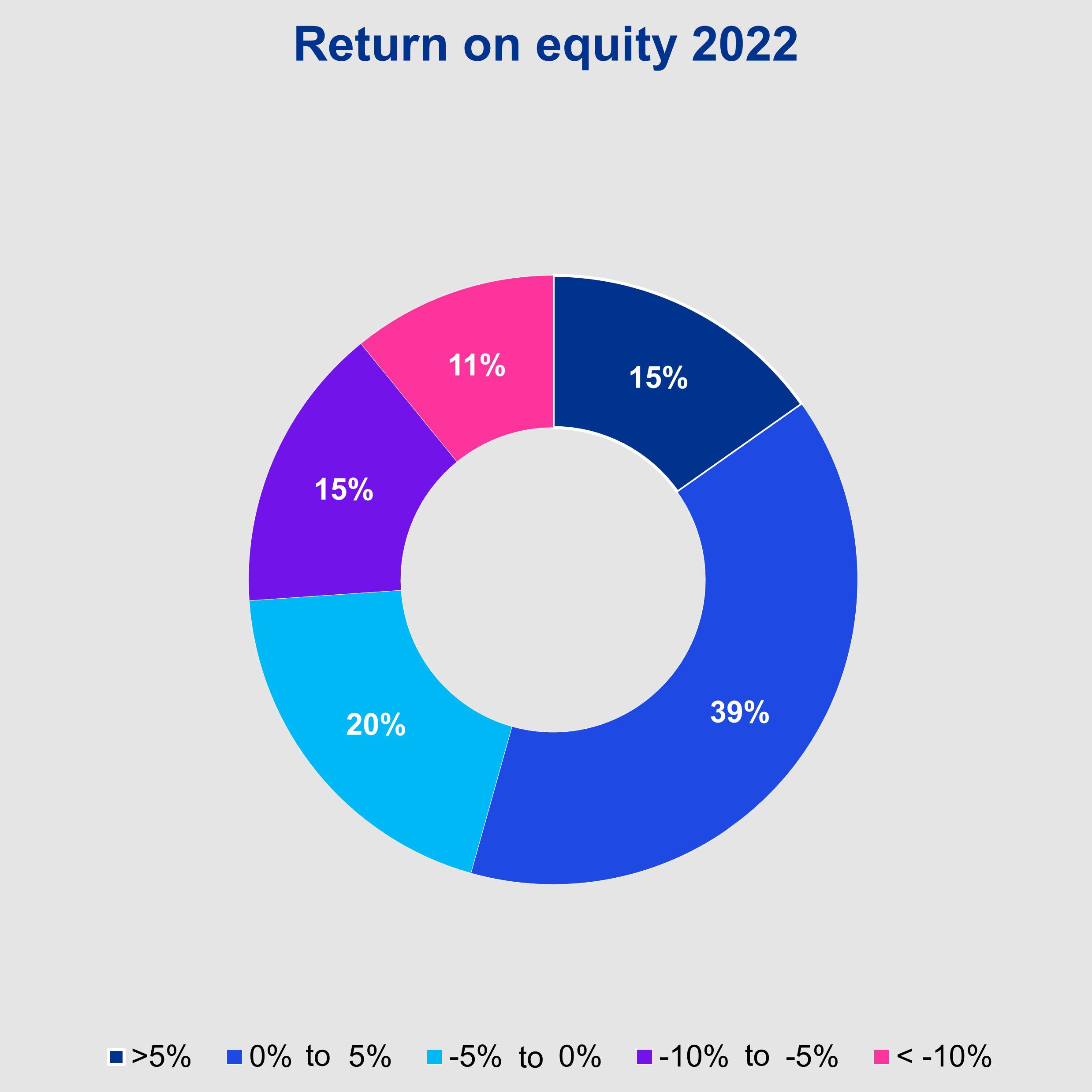

A total of 26% of institutions have a return on equity of less than -5%, of which 11% have a return on equity of less than -10%. Despite currently generous equity capital in some cases, these institutions will deplete their equity capital within 10 to 20 years if losses remain unchanged. As KPMG anticipates further declines in EBITDA margins, as mentioned above, this problem will most likely be exacerbated.

Compared to 2019, the share of institutions with a negative return on equity has risen dramatically. Decreasing equity financing and rising prime rates also lead to an increasing financial burden in (re)financing debt capital: a vicious circle.

Topics and trends

In 2022, after three years, the state of emergency related to the Covid-19 pandemic was overcome. The pandemic brought many challenges to the healthcare system. Looking ahead, however, healthcare providers' perceptions of the ongoing problems vary widely.

That said, there are common themes and trends that can be identified across all healthcare institutions that are directly related to the financial challenges facing hospitals:

Inflation exacerbates tariff situation

Inflation increases costs

Many hospitals have adjusted employee wages as a result of cost-of-living increases. On top of that, many products became more expensive due to the (late) effects of Covid and inflation.

Pressure from high energy prices

As a result of the war in Ukraine, energy prices rose sharply. As large energy consumers, hospitals were strongly affected by this in 2022. Rising energy costs have brought energy conservation to the forefront and made sustainability an economic component.

Tariffs still too low

Although costs have increased due to inflation and high energy prices, tariffs have not been automatically adjusted to inflation. And, negotiations on tariffs with health insurers have not been successful. As a result, the pressure on hospitals will continue to build in 2022.

Shortage of skilled workers as a major challenge

Focus on nursing

The shortage of specialists is particularly noticeable among graduates and other well-trained nursing professionals.

Financial aspects

Several hospitals have had to cut beds, losing crucial revenue. In addition, higher outlays for temporary nursing staff are impacting personnel costs.

Global problem

Although hospitals tend to be in the same boat, they have no choice but to compete for nurses.

Recruit & Retain

Hospitals are increasingly focusing on recruiting skilled nursing staff (e.g., through campaigns such as LUKS's "Magnet"). On top of that, many hospitals have taken measures to improve the employment conditions in the nursing sector.

Cooperation and projects within the organization

Partnerships are gaining in importance

Partnerships and collaborations among hospitals as well as between hospitals and smaller service providers have gained momentum in 2022.

Integrated Care

By entering into collaborations, many hospitals are looking to close gaps in (regional) health care and be perceived as an integrated provider.

Organizational investments

Virtually all hospitals were working on projects for new management models, forward-looking strategies or reorganizations in 2022.

Digitalization as a megatrend

Several hospitals bolstered the role of digitalization in 2022, for instance by establishing it as a business management area.

Shortage of skilled staff leads to bed cuts and lost revenue potential

Of the hospitals that reported bed cuts in their 2022 annual report, a large proportion said they had temporarily cut beds.

For 2023, 43% of the institutions surveyed also expect to have to or already have had to cut beds. The institutions concerned cut an average of 6.5% of their beds in the first half of 2023.

As a result, KPMG estimates the untapped revenue potential in acute care hospitals across Switzerland to be more than half a billion Swiss francs*.

* Assumptions: Average case weight per inpatient case 1.08, average length of stay 5.2, base rate CHF 9,500, 2.75% of beds cut (0.43*6.5%), 37,845 beds, 365 days per bed, at 75% bed occupancy rate

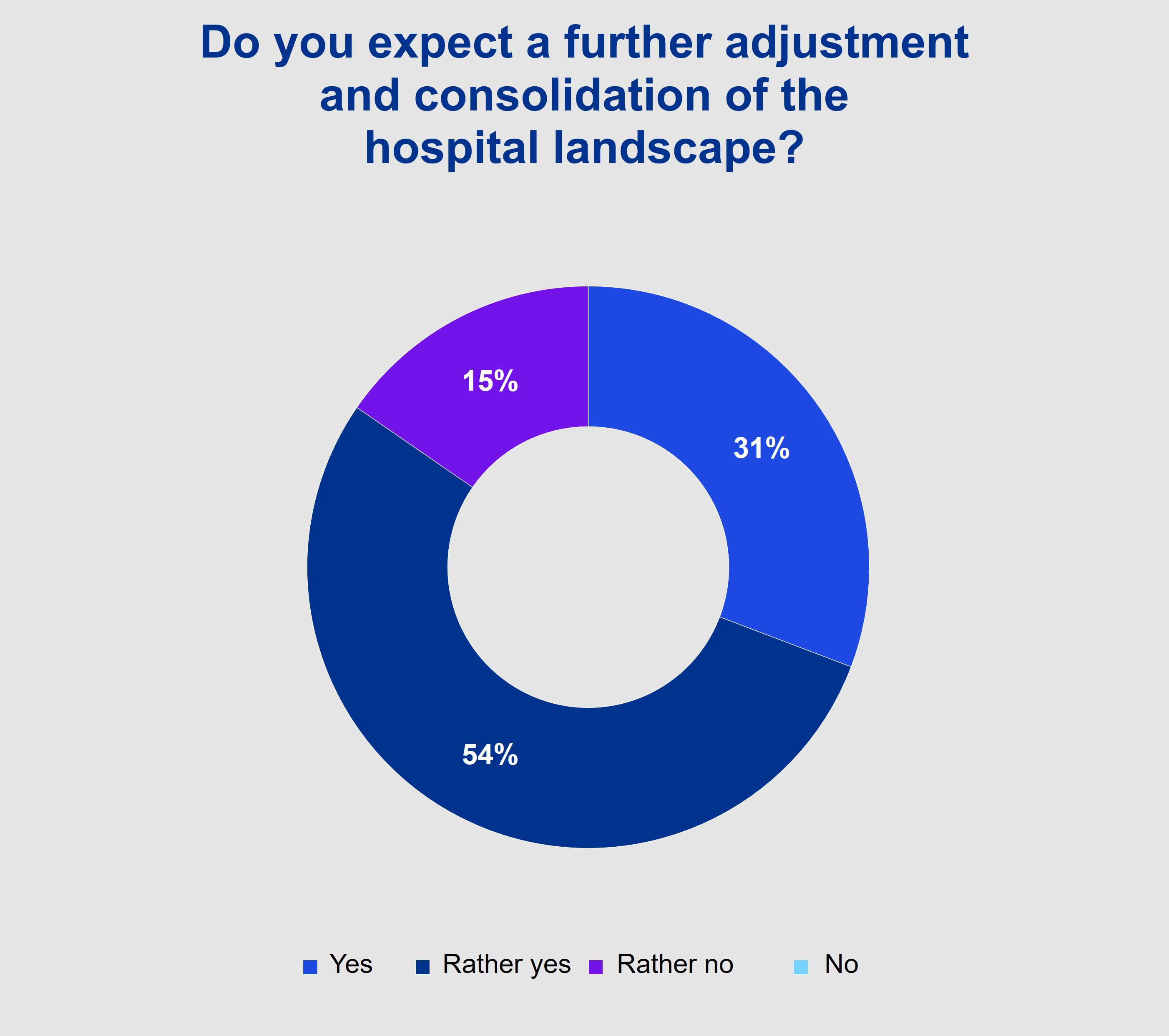

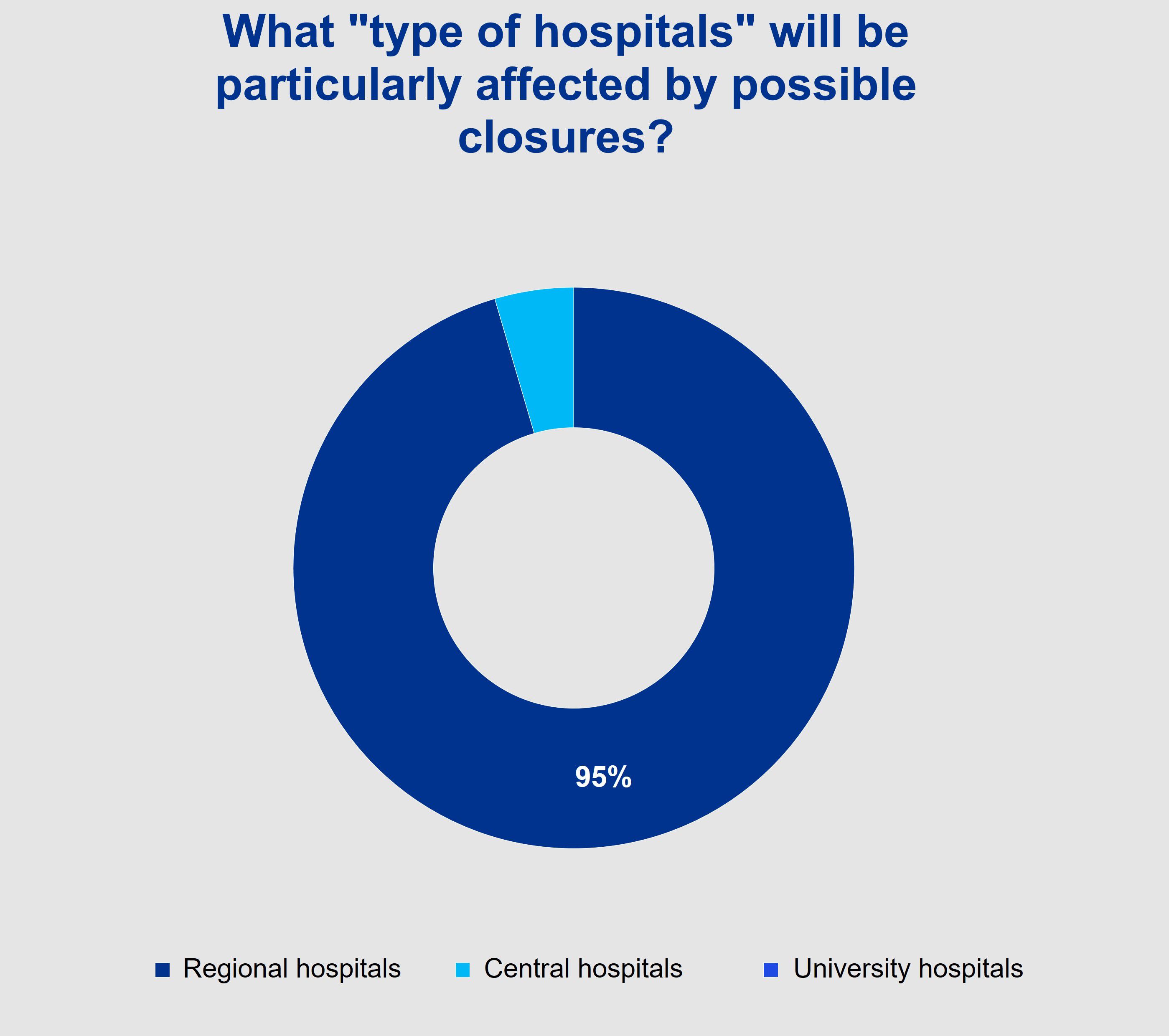

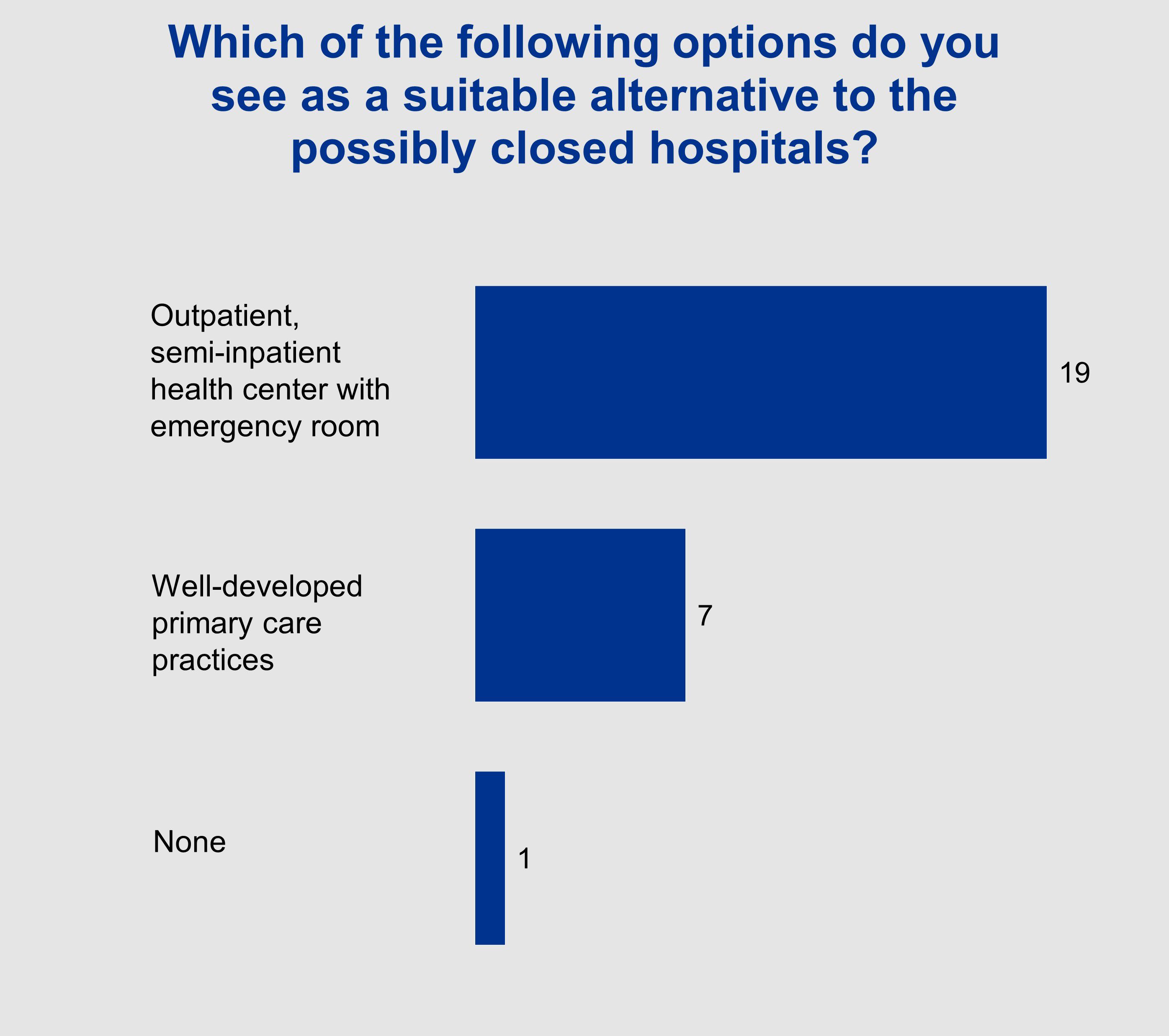

Outlook: Consolidation within the Swiss hospital landscape

As outlined above, the challenges facing Swiss hospitals and clinics are numerous, pressing and complex. Given this ongoing development, KPMG asked the CFOs in charge how they see the future of the Swiss hospital landscape. The trend is clear: the polled CFOs deem the situation to be so critical that they expect further consolidation.

About the study

The study on the financial situation of Swiss hospitals and clinics and the most important challenges was presented by KPMG at the Healthcare Event on 30 August 2023.

Our study lead Florian Schmid is available to answer any questions or concerns you may have.

Contacts

Have you found an answer to your question? We look forward to supporting you in your next challenge and are available to you as a sparring partner without obligation.

We look forward to hearing from you.