Preview

The expectations that individuals have of their healthcare systems are rapidly changing. Increasingly patients are looking for the personalized and seamless interactions they have with other industries. This article explores how digital health can help to meet the demand for customer-centric healthcare, while unlocking value and addressing other sector challenges related to service access and demand, workforce and financial pressures.

Historically, healthcare organizations have not seen the populations they serve as customers. This has been reflected in the organizational design of many healthcare systems that require patients to navigate systems built to meet the needs and preferences of funders, policy makers and clinicians, rather than patients.

Healthcare leaders are well-aware that increased consumerism could change the sector globally. KPMG commissioned research found that the ability of organizations to engage with consumers and meet their expectations was seen to be the marketplace disruptor with the greatest potential to change today’s healthcare landscape. 1 A survey of 200 healthcare CEOs around the world, also found that two-thirds (67 percent) of CEOs believed that healthcare organizations will, in the future, face the same expectations for customer service, quality and accessibility that are seen in other consumer-focused sectors such as retail, entertainment and banking.2

Progress towards customer-centric care is beginning to happen in the sector, mainly sparked by the pandemic. Testing clinics sprang up in carparks and airports, vaccination centers in shopping malls, while access to more complex treatments shifted into low-cost settings like outpatient clinics. These examples, and others such as online mental health platforms and at-home fertility treatments, help demonstrate public readiness for consumer centric digital healthcare experiences and the abilities of healthcare organizations to adjust their approaches to meet their customers where they are at.

Unlocking value and addressing sector challenges

Consumer centric digital health also can help to unlock value and address sector challenges related to service access and demand, workforce and financial pressures.

- Evolving the role of patients: During the pandemic, provider organizations in Australia and England created virtual COVID-19 wards3 that evolved the role of patients from recipients of care to active healthcare participants. This approach also proved that if patients were empowered and given the right technology and trusted information, they could manage some illnesses themselves. In addition to empowering patients, this approach reduced demand on hospitals and healthcare workers.

- Easing workforce pressures: Modern digital services can also serve to ease staffing pressures amid the ongoing workforce crisis and its negative impact on healthcare innovation and service adoption. For instance, a large regional provider in the United States has digitalized its primary care pathways and provided patients with an app that allows them to self-schedule appointments, communicate with doctors, access test results, request prescription refills, etc.

- Diversifying revenue streams: Digital services can also open the door for more diverse revenue streams, with consumers electing to pay for services (either in whole or part) if they are ineligible for coverage or choose to pay for the value they receive. While there may be variations in access to services via these models, appropriate regulation and management have the potential to redefine the consumer experience, improve access and reduce the cost of care.

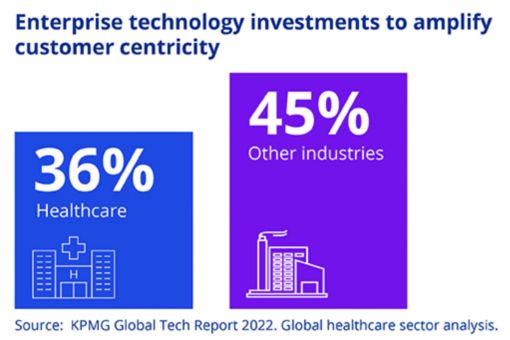

To navigate towards consumer-centric healthcare, organizations must place emphasis on understanding their customers. Harnessing the power of technology, data and analytics are expected to be key to understanding these needs. Unfortunately, the sector’s technology investments are not yet aligned with this ambition. According to results from the KPMG Global Tech Report 2022 healthcare organizations are less likely to be investing in enterprise technology with the goal of amplifying customer centricity (36 percent are doing so, versus 45 percent of organizations in the 11 other industries that were surveyed).4

Many providers will need to think differently about how they work with and beyond the healthcare ecosystem, such as partnering with new entrants from the technology, retail, consumer goods and wellness industries whose capabilities are already aligned with enhancing consumer experiences while providers focus on core competencies. For example, providers may employ logistics partners, such as large online retailers possessing expansive distribution networks for last-mile delivery.

Partnerships in action

In the United States, Uber Health, the non-emergency medical transport offshoot of the popular ridesharing service, has partnered with NimbleRx, an on-demand platform linking patients with local pharmacies to fill scripts online, thereby offering the convenience of a combined prescription delivery service.5 A pilot running in the Seattle and Dallas metropolitan areas has seen more than 15,000 deliveries made.6 The service assists consumers who are unable or unwilling to attend a pharmacy in person to access the pharmaceuticals they need, while also addressing some of the barriers faced by older or socially isolated consumers. Uber Health’s core offering has seen the company partner with a range of healthcare providers to offer patient transport, with a focus on reducing missed medical appointments while improving real-time tracking.

Care providers could also look to partners that provide on-demand food services and meal plans in institutions or for individuals recovering at home. Partners may also provide consumers with seamless access to funding sources, including traditional insurance, out-of-pocket payments from savings, and potentially debt-funded schemes such as buy now, pay later services.

Organizations should strive to ensure that they have certain core capabilities in place to establish and deliver consumer-centric digital healthcare models. The ability to turn timely data into valuable insights to inform strategies and service design will likely be key. Consumer experience should be at the heart of service design, so that consumers are engaged and have agency in both the design process and throughout every care journey. These journeys should deliver interactions with consumers that are seamless, irrespective of their entry point or preferred channel (virtual or in-person), plus integration with other care providers beyond the organization. Finally, the ability to work collaboratively and effectively within an ecosystem of alliances and partnerships is expected to be essential to leveraging third-party value for the benefit of consumers.

Key takeaways

- Consumerist future trends will likely cause healthcare organizations to adjust their approaches to stay relevant and meet their customers where they are today and where they will be in the future, to meet these needs may involve partnering with new healthcare market entrants.

- Consumer centric digital health can also help to unlock value and address sector challenges by evolving the role of patients from recipients of care to active healthcare participants, easing workforce pressures and diversifying organizational revenue streams.

- Core capabilities in the areas of data, service design, seamless interactions and collaborative working with partners will be needed to realize the potential of consumer-centric digital healthcare models.

Author: Lydia Lee, Global Co-Lead for KPMG Connected Enterprise for Health at KPMG International

Contact our healthcare experts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Explore

1 A commissioned study conducted by Forrester. Consulting on behalf of KPMG, October 2021

2 KPMG International. (2021). Healthcare CEO Future Pulse. Patience for patient-centricity. https://kpmg.com/xx/en/home/insights/2021/06/patience-for-patient-centricity.html

3 KPMG International. (2022 April). How healthcare organizations and their leaders have evolved through COVID. Healthcare Foresight. https://kpmg.com/xx/en/home/insights/2022/04/how-healthcare-organizations-have-evolved-through-covid.html

4 KPMG International. (2022) KPMG Global Tech Report 2022. Global healthcare sector analysis (unpublished).

5 Jaspen, B. (August 2020). Uber enters home drug delivery business with pharmacy partner NimbleRX. Forbes.com

6 NimbleRx. (2020 August 20). NimbleRx and Uber Health partner to expand accessibility to prescription delivery.