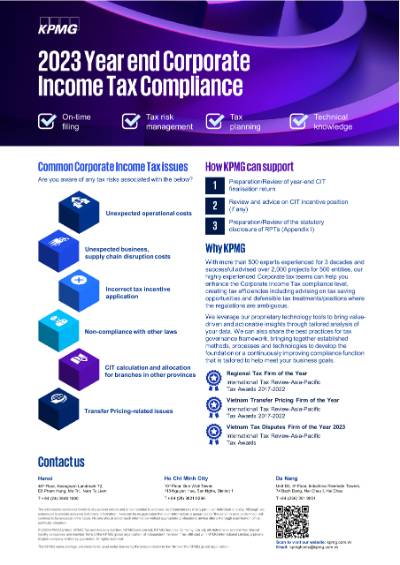

Common Corporate Income Tax issues

Are you aware of any tax risks associated with the below?

- Unexpected operational costs

- Unexpected business, supply chain disruption costs

- Incorrect tax incentive application

- Non-compliance with other laws

- CIT calculation and allocation for branches in other provinces

- Transfer Pricing-related issues

How KPMG can support

Preparation/Review of year-end CIT finalisation return

Review and advice on CIT incentive position (if any)

Preparation/Review of the statutory disclosure of RPTs (Appendix I)

Why KPMG

With more than 500 experts experienced for 3 decades and successful advised over 2,000 projects for 500 entities, KPMG in Vietnam highly experienced Corporate tax teams can help you enhance the Corporate Income Tax compliance level, creating tax efficiencies including advising on tax saving opportunities and defensible tax treatments/positions where the regulations are ambiguous.

We leverage our proprietary technology tools to bring value-driven and actionable insights through tailored analysis of your data. We can also share the best practices for tax governance framework, bringing together established methods, processes and technologies to develop the foundation or a continuously improving compliance function that is tailored to help meet your business goals.

Regional Tax Firm of the Year

International Tax Review-Asia-Pacific Tax Awards 2017-2022

Vietnam Transfer Pricing Firm of the Year

International Tax Review-Asia-Pacific Tax Awards 2017-2022

Vietnam Tax Disputes Firm of the Year 2023

International Tax Review-Asia-Pacific Tax Awards

Our 2023 Edition

Contact us

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia