Are you entitled to VAT refund?

- Investment stage

- Export goods or services

- Business restructuring (merger, conversion, split or liquidation)

- Projects funded by non-refundable ODA, non-refundable aid, or humanitarian aid

Have you concerned about…

- Cashflow improvement

- Risk and opportunity analysis

- Proper supporting documents

- Different opinions of the tax authorities and communication approaches

- The whole VAT refund process

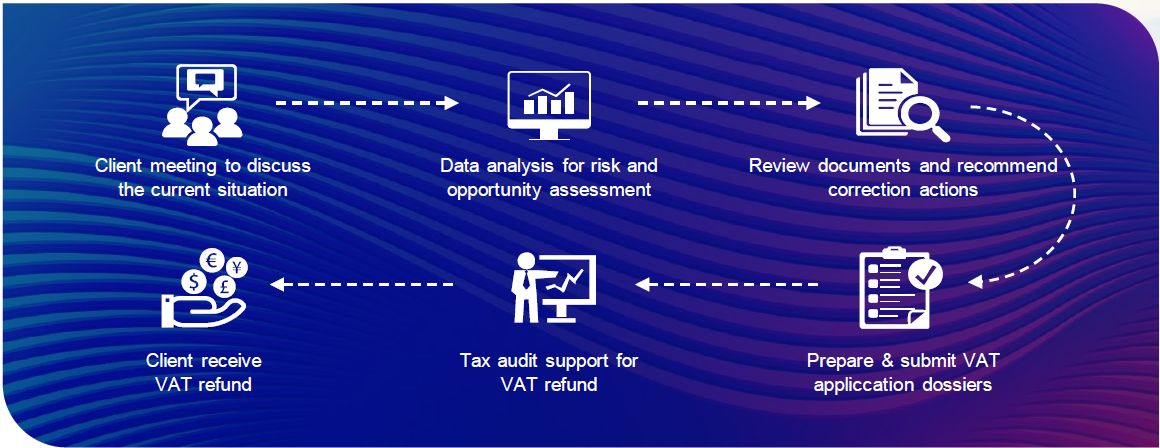

How KPMG can help

Why KPMG

KPMG in Vietnam and Cambodia is one of the leading professional services firms, with over 1,900 people working from our offices in Hanoi, Ho Chi Minh City, Da Nang and Phnom Penh. We work with our colleagues across Asia and around the world to provide a broad range of services.

We leverage our proprietary technology tools to bring value-driven and actionable insights through tailored analysis of your data. We can also share the best practices for tax governance framework, bringing together established methods, technologies and experience to improve your VAT compliance status, optimizing your VAT refund to help meet your business goal.

Contact us

Nguyen Thi Mai Anh

Partner

Corporate Tax

KPMG in Vietnam

M +84 (0) 90 439 8876

E anguyen9@kpmg.com.vn

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia