KPMG report: Analysis of safe harbor for “incremental cost” under section 45W in Notice 2023-9

Safe harbor regarding the incremental cost of certain qualified commercial clean vehicles placed in service in calendar year 2023

Under section 45W in Notice 2023-9

The IRS on December 29, 2022, issued Notice 2023-9 [PDF 110 KB], providing a safe harbor regarding the incremental cost of certain qualified commercial clean vehicles placed in service in calendar year 2023 for purposes of the new credit for qualified commercial clean vehicles under section 45W, created by Pub. L. No. 117-169 (commonly called the “Inflation Reduction Act of 2022” (IRA)).

The amount of the section 45W credit for each qualified commercial clean vehicle placed in service by a taxpayer during the tax year is the lesser of (1) 30% of the taxpayer’s basis in the vehicle in the case of a vehicle not powered by a gasoline or diesel internal combustion engine (15% in any other case), or (2) the incremental cost of the vehicle. The maximum credit allowed is $7,500 in the case of a qualified commercial clean vehicle that has a gross vehicle weight rating of less than 14,000 pounds, and $40,000 for all other vehicles.

Section 45W(b)(2) provides that the incremental cost of a qualified commercial clean vehicle is the excess of the purchase price of such vehicle over the price of a comparable vehicle. A comparable vehicle with respect to any qualified commercial clean vehicle is any vehicle that is powered solely by a gasoline or diesel internal combustion engine and is comparable in size and use to such qualified commercial clean vehicle.

Safe harbor methodology

The Department of Energy (DOE) prepared an incremental cost analysis of current costs across classes of street vehicles. The variation across vehicle makes and models and the lack of a directly comparable vehicle in most cases makes it difficult to directly determine the incremental cost of vehicle electrification technologies by comparing two actual vehicles for sale. As costs of batteries, fuel cells, and hydrogen tanks decrease over time, DOE may update the analysis.

The DOE published 2022 Incremental Purchase Cost Methodology and Results for Clean Vehicles [PDF 493 KB], which sets forth the current approach for determining an incremental cost for a plug-in hybrid electric vehicle (PHEV), battery electric vehicle (BEV), or fuel cell electric vehicle (FCEV) using current costs. The DOE used the Autonomie model to estimate the current incremental cost for each electrified powertrain for the different representative vehicle classes. The Autonomie model is managed by the Argonne National Laboratory and allows a user to switch out powertrain components and analyze the key powertrain technologies that differ between conventional and electric powertrains.

Safe harbor results

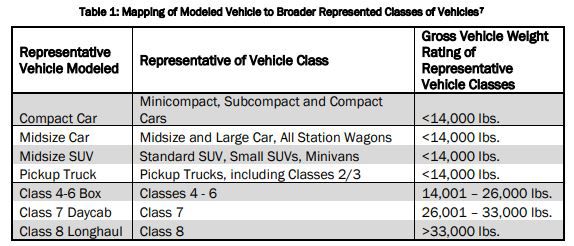

The DOE Analysis provides a roadmap for taxpayers to map a modeled vehicle to a broader represented class of vehicles by using the two tables below1. The taxpayer will first use Table 1 to identify the which class the vehicle is mapped to based on gross vehicle weight.

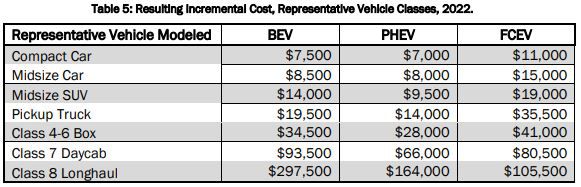

The taxpayer will then utilize Table 5 to identify the incremental cost assigned to the respective vehicle class for vehicles placed in service in 2023. As Table 1 indicates, vehicle classes 4 through 8 are vehicles with a gross vehicle weight of greater than 14,000 pounds. Table 5 has built in assumptions such as the battery size in the vehicle, the associated range of the vehicle, and other factors that impact the price of the vehicle.

Safe harbor for compact PHEVs

The DOE analysis calculated the incremental cost for compact car PHEVs, which include minicompact and subcompact cars, to be less than $7,500. The Treasury Department and IRS will accept a taxpayer’s use of the incremental cost published in the DOE Analysis to calculate the section 45W credit amount for compact car PHEVs placed in service during calendar year 2023.

Safe harbor for vehicles with a gross vehicle weight of less than 14,000 pounds other than compact PHEVs

For all street vehicles (other than compact car PHEVs) with a gross vehicle weight rating of less than 14,000 pounds, the DOE Analysis provides that incremental cost will not limit the available section 45W credit amount for vehicles placed in service. Accordingly, the Treasury Department and IRS will accept a taxpayer’s use of $7,500 as the incremental cost for all street vehicles (other than compact car PHEVs) with a gross vehicle weight rating of less than 14,000 pounds to calculate the section 45W credit amount for vehicles placed in service during calendar year 2023.

Safe harbor for vehicles with a gross vehicle weight of more than 14,000 pounds

The DOE Analysis provides an incremental cost analysis of current costs for several representative classes of street vehicles with a gross vehicle weight rating of 14,000 pounds or more. The Treasury Department and the IRS will accept a taxpayer’s use of the incremental cost published in the DOE Analysis for the appropriate class of street vehicle to calculate the section 45W credit amount for vehicles placed in service during calendar year 2023.

KPMG observation

The incremental costs concluded in the DOE’s analysis do not necessarily reflect the incremental cost a consumer may experience for a particular model but, rather, provide a standard incremental cost to be utilized as a safe harbor for a broader class of vehicles.

As addressed by the safe harbor for vehicles with a gross vehicle weight of more than 14,000 pounds, there are a number of factors that affect the price of the comparable vehicle, and the purchase price of the commercial clean vehicle eligible for the credit. This guidance attempts to simplify the analysis by allowing the taxpayer to utilize a safe harbor amount up to the limitations provided in the statute.

The guidance does not address how the taxpayer would properly document the incremental cost calculation if the taxpayer does not use the safe harbor. However, it is inferred that taxpayers can rely on the Autonomie model to estimate the current incremental cost for a qualified commercial clean vehicle, and that the IRS would accept this methodology outside of the use of the safe harbor.

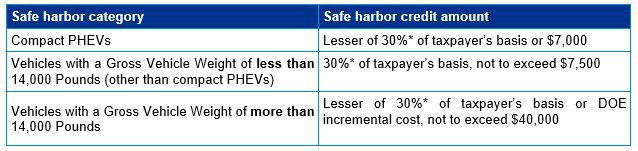

Additionally, below is a summarized table of the safe harbor results as a quick reference guide:

*30% is the applicable credit percent applied to vehicles not powered by internal combustion engines, otherwise replace with 15%

Conclusion

Prior to the issued guidance, taxpayers were left questioning what the IRS would accept as a “comparable vehicle” for the purposes of calculating the incremental costs of qualified commercial clean vehicles. The guidance offers clarity on this point by way of offering a safe harbor for taxpayers, and the model offers a simplified approach that affords certainty for both vehicle manufacturers and regulators. The guidance does not specifically state whether IRS will release similar notices annually, but by limiting the safe harbor to 2023 an update will be required for 2024 at least. However, it is also not clear from the DOE report how often their data will be updated.

For more information, contact a tax professional in KPMG Washington National Tax:

Hannah Hawkins | hhawkins@kpmg.com

Katherine Breaks | kbreaks@kpmg.com

Julie Chapel | jchapel@kpmg.com

Kelsey Latham | kcurcio@kpmg.com

The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. For more information, contact KPMG's Federal Tax Legislative and Regulatory Services Group at: + 1 202 533 3712, 1801 K Street NW, Washington, DC 20006.