e-Tax alert 169 - Taiwan Customs Requirements when Making One-Time TP Adjustments

Taiwan Customs Requirements when Maki - e-Tax alert 169

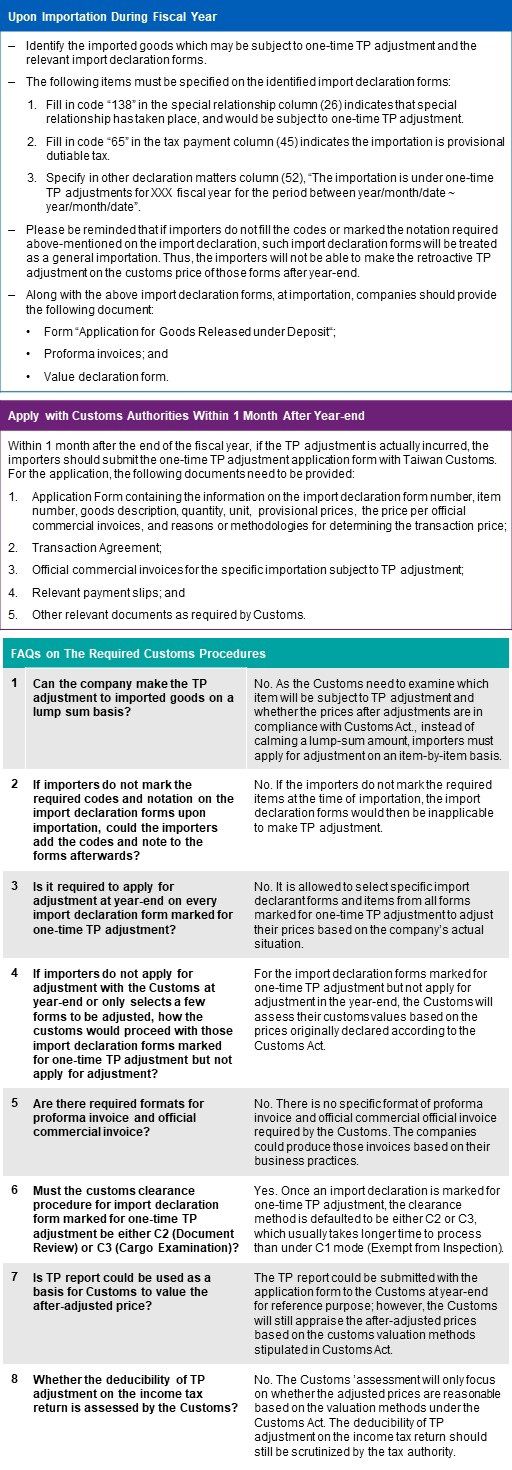

Since the TPA Ruling includes Customs compliance requirements for imported goods, Taiwan Customs released the “Guidelines on assessing one-time TP adjustment to determine the dutiable value” (the “Guidelines”), which clarifies the customs requirements for taxpayer who would like to make TP adjustment on the imported goods.

In November 2019, Taiwan Ministry of Finance (MOF) issued Tax Ruling No. 10804629000 (the “TPA Ruling”) that opens a door for the companies who conduct controlled transactions in Taiwan to make one-time TP adjustments prior to closing the accounts of the fiscal year. Read our e-Tax alert issue 139 for an introduction of the TPA Ruling.

Since the TPA Ruling includes Customs compliance requirements for imported goods, Taiwan Customs released the “Guidelines on assessing one-time TP adjustment to determine the dutiable value” (the “Guidelines”), which clarifies the customs requirements for taxpayer who would like to make TP adjustment on the imported goods.

Taiwan Customs Bureau also summarized some frequently asked questions on how to comply with the customs requirements in assisting companies in adopting the TPA ruling.

Based on the above KPMG briefly summarized the required customs procedures for making one-time TP adjustment as below:

KPMG Observations

The TPA Ruling offers an opportunity for MNEs to make the post-importation adjustment on the price of imported goods in Taiwan. However, whether companies can claim such TP adjustment for income tax purpose will also rely on whether customer procedures are met.

From practice KPMG observed that the required customs procedures under the Guidelines may differ from the procedure that the companies currently follow, it may require additional administration efforts, costs, and coordination among different parties for the companies to change the current practice in order to comply with the requirements.

If it is found that there is a possibility that the Taiwanese company may need to make one-time TP adjustments on purchase of goods from offshore related parties, the company should evaluate the actions and parties/departments need to be involved to obtain the required document, potential impact and obstacles to the logistic and business operation while applying the required customs procedures.

As Customs authorities reminded, companies cannot dump the amount TP adjustment to just one or few transactions as it could abnormally distorted the import values. KPMG suggest companies do not wait until last month but should take actions earlier to secure a position to claim the TP adjustment for income tax purpose.

Authors

Ellen Ting Partner

Sylvia Chiang Associate Director

© 2024 KPMG, a Taiwan partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

上列組織及本文內任何文字不應被解讀或視為上列組織之間有任何母子公司關係,仲介關係,合夥關係,或合營關係。 上述成員機構皆無權限(無論係實際權限,表面權限,默示權限,或任何其他種類之權限)以任何形式約束或使得 KPMG International 或任何上述之成員機構負有任何法律義務。 關於此文內所有資訊皆屬一般通用之性質,且並無意影射任何特定個人或法人之情況。即使我們致力於即時提供精確之資訊,但不保證各位獲得此份資訊時內容準確無誤,亦不保證資訊能精準適用未來之情況。任何人皆不得在未獲得個案專業審視下所產出之專業建議前應用該資訊。