e-Tax alert 145 - Alleviating the Impact of Coronavirus Epidemic – Overview of Supportive Tax Measures in Taiwan

e-Tax alert 145 - Alleviating the Impact of Coronavirus

Aiming at alleviating the impact of the coronavirus (COVID-19) pandemic, the Taiwan government introduced several supportive tax measures covering a wide range of different aspects. This e-tax alert summarizes the major ones relevant to foreign investors including: (1) Deferral of tax payments or by installments for affected enterprises and individuals; (2) Extension of tax filing and payment deadline under special circumstances (e.g. quarantine or isolation) and (3) Corporate income tax 200% deduction on certain salary expenses.

1. Deferral of tax payments or by installments

On March 25, 2020 Taiwan Ministry of Finance (MOF) announced a special guideline allowing taxpayers having difficulties to make tax payments to apply for deferral of tax payments or by monthly installments.

1.1 Applicable period

The special guideline is applicable to tax payments due date fall between January 15, 2020 to June 30, 2021.

1.2 Applicable taxpayers

Taxpayers having difficulties to make tax payments by the statutory deadline due to COVID-19 may apply for deferral of tax payments for a maximum of 12 months or by monthly installments of up to 36 months, without late payment interest, if meeting any of the following conditions:

For Business entities

- Entitle to supportive measures under the relevant COVID-19 special relief and restoration regulations as announced by the relevant central competent authorities; or

- Having significant decline in business revenue – for instance, monthly turnover dropping by 15% or more for two consecutive periods since January 2020, comparing to the average in past 6 months or 12 months.

For Individuals

- Entitle to supportive measures under the relevant COVID-19 special relief and restoration regulations as announced by the relevant central competent authorities;

- Under no paid or part paid leave scheme implemented by employer affected by COVID-19

- situation with prior notification to the local labor affair authorities in-charge; or

- Suffering from other situations due to COVID-19 (e.g. wage cut, lay off or having monthly working days dropped by 50% from original schedule for two or more months).

1.3 Application procedures

Taxpayers should submit the prescribed application form together with relevant supporting documents with the competent tax authorities by the original tax payment deadline as stipulated.

1.4 Applicable taxes

Individual income tax, individual house and land transactions income tax, corporate income tax, VAT, commodity tax, liquor & tobacco tax, specifically selected goods and services tax, house tax, land value tax, vehicle license tax, and relevant interest and penalty of these taxes.

1.5 Points to note

This special relief is only for granting deferral or installment payment of tax. If there is any tax return needs to be filed (e.g. income tax, VAT, etc), the returns should still be filed within the original statutory deadline.

Tax payments should be made on time following the revised timeline further to the grant of the above deferral or installment scheme. If fail to make the payments on time, the tax authority will demand for one-off settlement on all outstanding balance within 10 days.

2. Extension of tax filing and payment deadline under special circumstances of quarantine or isolation

On March 5, 2020 Taiwan MOF announced a tax ruling which grant affected taxpayers an extension to file and pay their taxes.

2.1 Applicable period

This ruling is applicable to tax filings or payments originally due between March to May 2020.

2.2 Applicable situations

For individual taxpayers or company taxpayers whereas the representative person, in-charge accountant, or the CPA, booker engaged for filing the returns is under isolation or quarantine due to COVID-19 during the original prescribed time limit of tax filing and payments.

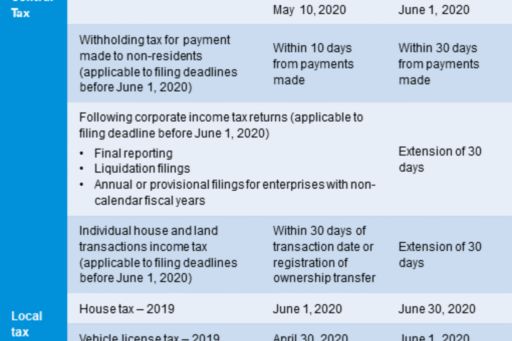

Relevant tax filing and payment deadlines may be extended under the following schedule without late payment interests:

2.3 Application procedures

No pre-application is required but taxpayers should attach the notice of isolation, quarantine, medication or other relevant documents during the tax filing procedures under the extended deadline. For taxes levied under special assessment basis (e.g. compared to self-reporting mechanism), taxpayers may also provide the above supporting documents to the relevant in-charge tax authorities before the above extended deadline to facilitate relevant tax assessment arrangements.

2.4 Points to note

In case the above personnel is still under isolated medication by the extended deadline, further 20 days extension is granted following the end of the isolated medication period.

3 .Corporate income tax 200% deduction on certain salary expenses

As part of the Special Act on COVID-19 Prevention, Relief and Restoration announced on February 25, 2020 to alleviate the social and economic impact, Taiwan MOF also announced a tax ruling on March 10, 2020 to provide guidance on how companies can deduct additional salaries expenses for employees who are affected by COVID-19.

3.1 Applicable period

The Special Act is applicable from January 15, 2020 to June 30, 2021

3.2 Applicable expenditures

Salaries, wages, service pay and other regular compensations paid to employees during their statutory leave period falling under any one of the following reasons:

- Under quarantine or isolation order from the various level of health department and authorities;

- Taking care of dependent family members who is under quarantine and isolation order; or

- Upon receiving special instructions from the epidemic command center of the central government.

3.3 Application procedures

The following information and documents should be provided under prescribed format during corporate income tax filing:

- Notice of isolation, quarantine and/or other relevant documents issued by the relevant health department and authorities or epidemic command center for the affected employees (or dependent family members);

- Quarantine leave application, records or other relevant supporting documents of the relevant employees;

- Documentary evidence on the remuneration amount; and

- Calculation breakdown on the super-deduction amount being claimed.

3.4 Points to note

- The amount of 200% deduction is limited to the taxable profit of the relevant year, therefore should not giving rise to additional tax losses.

- The above relief measure cannot be simultaneously applied with other existing tax incentives (e.g. salary expenditures falling under the R&D credit pursuant to the Statue for Industrial Innovation)

4. Other relief measures

Apart from the above, the Taiwan government also released other relief policies covering VAT and customs supportive measures on certain medical supplies (e.g. protective masks, medicinal alcohol and its raw materials); temporary relief on house tax and vehicle license tax during its idle period in light of the current COVID-19 situation; and pro-rata exemption on VAT and amusement tax for taxpayers levied under special assessment basis during its business suspension period.

KPMG Observations

The Taiwan government announced different supportive measures to encounter the impact of the coronavirus pandemic situation.

In light of the different applicable conditions, procedures and timelines on these policies, taxpayers should evaluate the particular supportive measures that are applicable to them, together with supporting documents and relevant preparations going ahead.

Authors

Ellen Ting, Partner

Niki Yam, Associate Director

© 2024 KPMG, a Taiwan partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

上列組織及本文內任何文字不應被解讀或視為上列組織之間有任何母子公司關係,仲介關係,合夥關係,或合營關係。 上述成員機構皆無權限(無論係實際權限,表面權限,默示權限,或任何其他種類之權限)以任何形式約束或使得 KPMG International 或任何上述之成員機構負有任何法律義務。 關於此文內所有資訊皆屬一般通用之性質,且並無意影射任何特定個人或法人之情況。即使我們致力於即時提供精確之資訊,但不保證各位獲得此份資訊時內容準確無誤,亦不保證資訊能精準適用未來之情況。任何人皆不得在未獲得個案專業審視下所產出之專業建議前應用該資訊。