Additional Fiscal Benefits and Direct Aid due to COVID-19

Additional Fiscal Benefits and Direct Aid due to COVID-

Government of Serbia has issued the Conclusion, which grants additional Fiscal Benefits and Direct Aid to business entities due to COVID-19 pandemics

For more detailed regulation of the qualifying conditions for additional incentives, the Conclusion refers to the Decree on Fiscal Benefits and Direct Aid to companies in the private sector and monetary aid to citizens aimed at reducing economic consequences due to COVID-19 (Decree), which has defined initial set of measures.

More info on the Decree can be found in our Tax Alerts

Who is eligible for the extended benefits and aid?

All business entities (entrepreneurs, micro, small, medium and large entities, as well as branch offices and representative offices) which have qualified and received last payment of Direct Aid in accordance with the Decree in July 2020 are eligible for the additional benefits and aid.

In addition, all business entities which could qualify but did not apply for the initial set of measures, or which are registered or VAT registered after the deadline for application for the initial set of measures (15 March 2020), but no later than 20 July 2020 are also eligible for the benefits determined by the Conclusion.

Who is not eligible for the extended benefits and aid?

1) Entities which have downsized labor force for more than 10% in the period from 15 March 2020 to 10 April 2020

2) Users of public funds covered by the List of Beneficiaries of Public Funds as of 24 April 2020

3) Entrepreneurs who have registered temporary cessation of business activity before 15 March 2020

4) Banks, insurance and reinsurance companies, voluntary pension funds, financial leasing providers, payment institutions and electronic money institutions

5) Legal entities which lost right to the benefits because of failure to maintain conditions prescribed by the Decree (prohibition of dividend payment, downsizing in labor force for more than 10%)

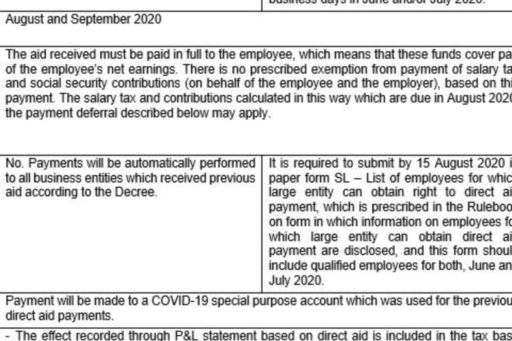

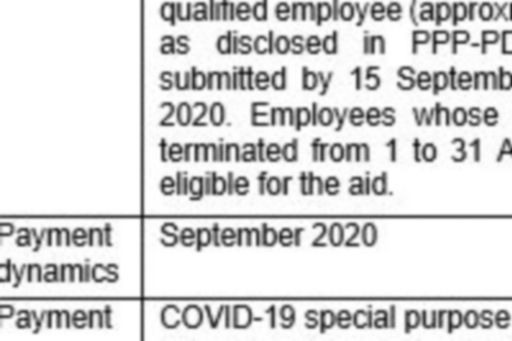

Direct aid to previous measures users

Direct aid to new measures users

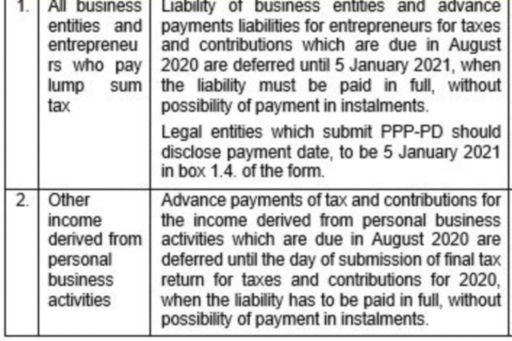

Deferral of payment of salary tax and contributions on salaries

How to opt out from additional fiscal benefits and direct aid?

If the company does not want to use the additional benefits and direct benefits provided by the Conclusion, it has an option of not using the funds paid into a special account, which will be automatically returned to the State Treasury after 31 October 2020. Additionally, it is necessary not to use the benefit of deferring the payment of taxes and contributions on salaries due in August 2020.

Loss of the right to fiscal benefits and direct aid

1) If the number of employees is reduced by more than 10% (excluding temporary employees with whom contract is concluded before 15 March 2020), in the period from 15 March 2020 until the expiry of the period of three months from the last payment of direct benefits (no later than 31 December 2020).

2) If user of benefits pays out dividends until 31 December 2020.

Consequence of the loss of the right to fiscal benefits and direct payments include liability to pay all deferred taxes and contributions increased for a late payment interest, and a repayment of received direct aid increased for late payment interest.

If you have any questions or you need assistance of our professionals, please contact us at tax@kpmg.rs

For previous editions of KPMG Tax Alerts please visit the following web page:

KPMG Tax & Legal Department

KPMG d.o.o. Beograd

Kraljice Natalije 11

11 000 Belgrade, Serbia

T: +381 11 20 50 500

F: +381 11 20 50 550

tax@kpmg.rs

home.kpmg/rs

© 2024 KPMG d.o.o. Beograd, a Serbian limited liability company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.