The chemicals sector is amongst the most important manufacturing industries across the globe, contributing to improvement in productivity, efficiency and quality across several end-use industries. Over the last two decades, the global chemical industry has been concentrated largely in China, EU and U.S. With the outbreak of the COVID-19 pandemic, there was a sharp decline in global production driven by demand slowdown due to lockdowns as well as supply chain disruptions in both feedstock and end-product movement.

India showcased continuous growth and outperformed the global industry in the past decade driven by strong domestic demand, export competitiveness and an enabling ecosystem owing to:

- Manufacturing growth driven by usage in construction, automotive, food and beverage (F&B) and consumer products

- Robust growth expected in packaging across consumer and industrial sectors driven by increase in domestic demand

- Government setting up PCPIRs (Petroleum, Chemicals and Petrochemicals Investment region) to promote investment

- Rising competitiveness of domestic production, investments in R&D and protection from cheap imports

- Increased exports to EU and the U.S. upon recognition as a reliable source for chemicals

- Significant investments in production of high-growth downstream specialty chemicals with substantial export potential.

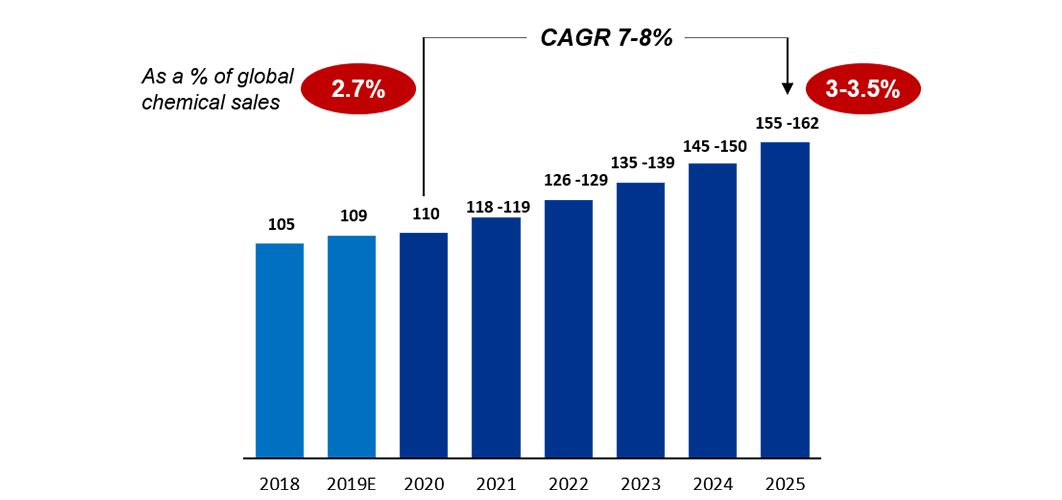

As a result, global companies have turned towards India to ensure continuous supply of high-quality chemicals at competitive prices, not just to meet domestic demand in India but also to serve export markets. India’s chemical industry is expected to grow at CAGR of 7 to 8 per cent to reach ~USD160 bn by 2025 and account for 3-3.5 per cent of the global chemical industry according to KPMG in India’s analysis.

KPMG in India analysis

Note: Constant exchange rate of 1 EUR = 1.18USD has been used across years

Key growth drivers

De-licensed and de-regulated industry

- 100 per cent FDI is allowed in the Indian chemical industry through the automatic route

- De-licensed manufacturing of most chemical products (organic and inorganic), dyestuffs and pesticides.

Growing chemicals infrastructure

- Dedicated regions in four states of India: Tamil Nadu, Gujarat, Andhra Pradesh and Odisha spread over 250 sq. km. with manufacturing facilities, logistics support, and other services2

- Plastic parks to synergise capacities and improve efficiencies.

Financial support and subsidies

- R&D incentives and weighted tax deduction for private and sponsored research expenditure at national labs and institutes

- Various export, state, and area-based incentives (SEZ/NIMZ).

Increasing availability of raw material

- Investments to increase local production to reduce import dependence

Location advantage and FTAs

- India is centrally located in the trans-Indian Ocean routes connecting Europe with east-Asian countries

- Proximity to Middle East provides access to petrochemical feedstock at a low cost

- India has 13 executed FTAs and 16 under negotiation, which is more than any other SEA country.3

How can KPMG in India help?

A leading professional services firm

- Currently servicing more than 140 clients in the chemicals industry

- A strong advisory practice that is well positioned to support clients across a gamut of strategic initiatives like product-market strategy development, major project advisory, M&A and deals advisory, supply chain optimisation and cost optimisation among others

- Robust credentials across areas like ESG and decarbonisation, which are increasingly gaining strategic importance among chemical manufacturers

- Digital transformation is also an integral part of our offerings, helping transform business models, operations, customer experiences and empowering workforces in the chemicals sector

- We are part of a global network: KPMG International’s member firms serve 92 of the 110 chemicals companies listed on the Chemical Week, Billion Dollar Club list.

Sources:

- KPMG in India analysis based

- PCIPR policy report, FICCI, May 2019

- Supply Chain Realignment, KPMG in India, May 2020

Guidance note to readers: We have relied on secondary sources which are considered reliable but have not independently verified the data and we will not incur any liability based on the content of the website