To survive in a dynamic world, driven by ever-evolving industry trends and technological innovation, multinational corporations must find newer ways of conducting business for survival and growth. Further, geopolitical disruptions, rising protectionist policies, regulatory scrutiny, possible COVID-19-like disruptions, restrictions on foreign investments and increasing cybersecurity threats are directly impacting their supply chain strategies. From diversification to reshoring and regionalisation to risk mitigation, policies have been adapted and processes overhauled.

Now, more than ever, CXOs are making tactical and operational changes to navigate through this highly uncertain, fast-changing global environment and meet the needs of a vastly evolved business landscape. In this process, they are seeking expert advice to limit and manage disruption, mitigate risk, and build resilience and agility.

KPMG in India has been closely monitoring the shifting investment trends and supporting clients in their supply chain diversification strategies. Through focused efforts, we are helping clients identify key risk areas that complicate strategic transformation, aiming for business continuity and resilience. Our efforts are channelised to help clients get forward-looking perspectives on areas related to:

- Identifying new supply bases in alternative jurisdictions

- Shortlisting the right set of partners for sourcing/manufacturing

- Navigating complex tax and regulatory procedures across jurisdictions

- Devising risk mitigation strategies to reduce transition-related disruptions

- Building a supplier development roadmap for operating in a new jurisdiction

- Advising on investment in technology and processes to become future ready

Connect with us

Global production networks are complex, sophisticated, interdependent and deeply entrenched, making reconfiguration a challenging task. In an era of global volatility, supply chains are navigating uncharted waters. Businesses continuously need to assess risk exposure, supply alternatives, tax considerations and channel complexities. Further, issues such as governance and regulatory adherence, the use of digital technology and analytics, implementation priorities and roadmaps need a detailed study and domain knowledge. We are here to help as your advisor. At KPMG in India, we use our significant subject matter expertise and multidisciplinary advisory services to demystify the complex implications of a decision to rebalance supply chains.

India advantage

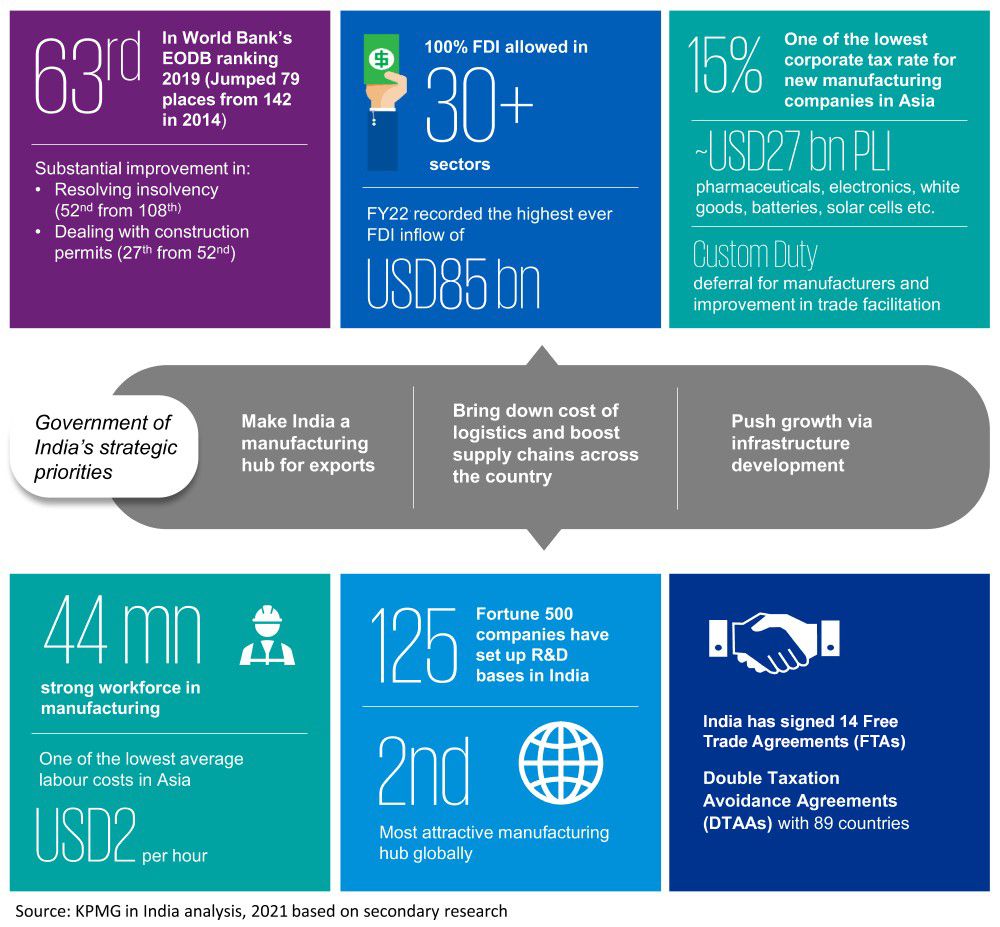

India, much like other emerging economies, is exploring ways to build its investment attractiveness and make it a viable contender for global manufacturing/sourcing. The government’s investment-driven policy measures along with corporate tax cuts, investment in infrastructure under the National Infrastructure Pipeline (NIP) and business-friendly changes to labour laws are likely to further underpin India’s attractiveness as a global manufacturing hub.

Notable government reforms*

- Atmanirbhar Bharat Abhiyan scheme launched at an estimated USD265 billion

- The Product Linked Incentive (PLI) scheme announced with an outlay of USD27 billion for 14 sectors

- A USD1.4 trillion National Infrastructure Pipeline (NIP) set up for infrastructure development

- Export Promotion Capital Goods (EPCG) scheme launched for duty-free import of capital goods

- Supply Chain Resilience Initiative (SCRI) launched, along with Japan and Australia, to build resilient supply chains in the Indo-Pacific region

- The PM Gati Shakti National Master Plan launched, which is powered by clean energy and driven by seven engines, namely roads, railways, airports, ports, mass transport, waterways and logistics infrastructure

- National Logistics Policy (NLP) announced to enhance business competitiveness and fuel overall economic growth by developing an integrated, efficient and cost-effective logistics infrastructure

What makes India a favourable manufacturing destination?

Sectors of strategic importance - An overview

Sectors of emerging importance in India

KPMG In India’s Supply Chain offerings

We understand the complexities of today’s volatile and high-risk business environment. Our team of experienced professionals work across geographies and sectors to support organisations with comprehensive offerings and a value-driven approach specifically revolving around the following areas:

Opinions from our experts

Webinars

KPMG in India contacts

Sources:

* Invest India, accessed on 5 April 2024

1. Invest India and Make in India, accessed on 5 April 2024

2. Report on Production Linked Incentive Scheme for Large Scale Mobile and Component Manufacturing by Ministry of Electronics & Information Technology, Government of India, September 2021, accessed on 5 April 2024

3. Press Information Bureau, Ministry of Textiles, accessed on 5 April 2024

4. Invest India report Inside India Production Linked Incentives Schemes: White Goods

5. Production Linked Incentive Scheme for Food Processing Industry, accessed on 5 April 2024

6. Nine PLI schemes have been approved by the cabinet so far, Ministry of Commerce & Industry, accessed on 5 April 2024

Note to readers: We have relied on secondary sources, which are considered reliable, but have not independently verified the data. KPMG shall not be liable and/or responsible for any reliance placed on the content of the website.