We understand the critical importance of climate change and sustainability in today's business landscape. As stakeholder expectations continue to soar, it is imperative for companies to adopt a proactive approach to assessing and managing the risks and opportunities linked to climate change.

At KPMG, we specialize in climate risk assessments, offering practical tools and solutions for businesses to comprehend and address the profound impact of climate change on their operations. By embracing these assessments, companies can mitigate risks and uncover new avenues for growth and innovation.

Our team of experts is dedicated to helping your organization navigate the complexities of climate change, empowering you to make informed decisions that drive sustainability and long-term success. Together, we can pave the way for a resilient future and contribute to a better world.

Why did we form the alliance?

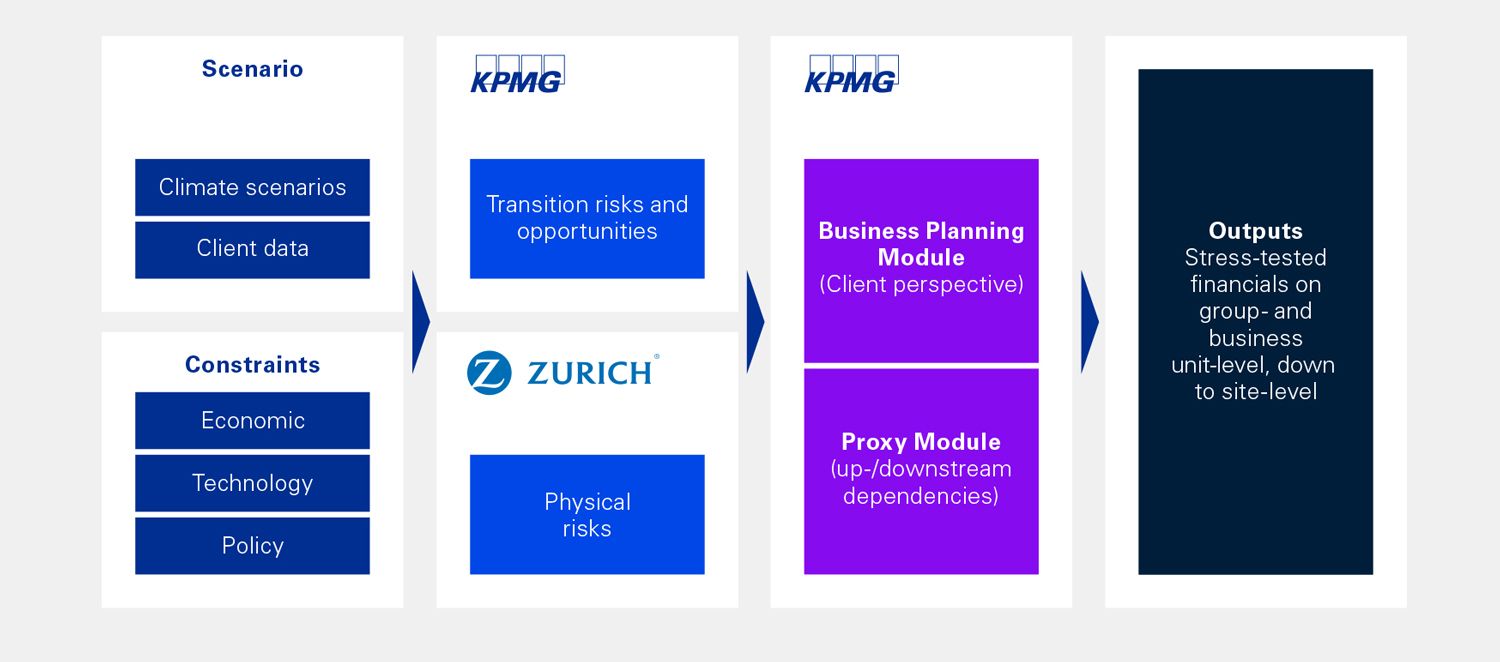

KPMG and Zurich Resilience Solution (ZRS, is part of the Zurich Insurance Group) have allied, recognizing that climate risk is a major challenge for businesses. To effectively manage this risk and take advantage of opportunities that arise from this transition, companies require a comprehensive and integrated approach. By combining the capabilities of KPMG and ZRS, we can provide a more comprehensive and holistic climate risk assessment, which provides a solid baseline for risk assessment, strategic decision-making, and managing disclosure requirements.

ZRS's contribution to the alliance is on physical risks, which are climate change-related impacts on physical assets and operations at group and site levels, such as extreme weather events, sea level rise, and wildfires.

On the other hand, KPMG's contribution is on transition risks, which are business-related risks that follow societal and economic shifts toward a low-carbon and more climate-friendly future. These risks typically include policy and regulatory risks, technological risks, market risks, and reputational risks. KPMG brings advanced quantitative and modelling skills, as well as a track record in modelling climate impacts for our clients.

Together, we deliver a more comprehensive and robust climate risk assessment that covers both physical and transition risks and integrates the analysis into enterprise risk management. This enables our clients to better manage their exposure to climate risk and identify opportunities for sustainable growth.

By collaborating with ZRS, KPMG can leverage their deep expertise in physical risks, while ZRS can benefit from KPMG's strong track record in assessing business-related risks coming from the transition to a low-carbon economy, regulatory reporting, and developing and implementing ESG strategies. Ultimately, our joint offering enhances business resilience and supports clients in achieving their sustainability goals.

Our collaboration with KPMG Switzerland is a great example of how we are delivering on our commitment to effectively leverage our capabilities to support our customers in navigating the complexities of climate change. By working together with a like-minded organization and combining our strengths, we can extend our reach and amplify our collective impact, driving meaningful change towards a more sustainable future.

In the current landscape, effective climate risk management has developed into a paramount concern for businesses. The imperative lies in fortifying resilience across the entire value chain. By bringing together Zurich's strong physical risk capabilities and the specialized expertise of KPMG professionals, we empower our clients to craft judicious and sustainable choices, underpinned by a comprehensive climate risk assessment that takes into account the broader picture.

What are we offering?

Regulatory changes, shareholder pressure, and the manifestation of climate risk have made climate-related risk assessments increasingly important. Large firms across all sectors will need to conduct scenario-based climate risk assessments in the coming 2-3 years.

- Our joint offering allows us to identify, quantify, and consult solutions on both physical and transition risks.

- Our collaboration is suited for companies across industries.

- Our sector specialists across the network provide detailed insights and methodological customization for every client need.

We are offering a comprehensive and holistic climate risk assessment that covers both physical and transition risks helping businesses align with SBTi, TCFD, CDP, GRI, SASB, and CSRD requirements.

SBTi: Science Based Targets initiative

TCFD: Task Force on Climate-related Financial Disclosures

CDP: Carbon Disclosure Project

GRI: Global Reporting Initiative

SASB: Sustainability Accounting Standards Board

CSRD: Corporate Sustainability Reporting Directive

This includes climate risk analysis along the entire value chain to identify material impacts, qualitative findings summarized in a heatmap to assess key-drivers, financial impacts of physical and transition risks assessed for key hotspots, integration of climate risk analysis into enterprise risk management, and actionable mitigation measures development and control.

We provide an end-to-end climate risk and opportunity offering which can include any or all of the above components. We deliver reports in line with regulatory requirements and provide recommendations regarding integrating these processes into the permanent ERM framework.

We can additionally deliver a reusable methodology to permit the client to recalculate climate risk impacts under different scenarios and considering changes to the balance sheet and various mitigation options. We can also offer a methodology to integrate the outputs into the risk management process.

Our solution: Comprehensive Climate Risk Management

Together with ZRS, we provide a collaborative and comprehensive approach to managing physical and transition risks driven by climate change effectively.

Through our expertise, we conduct thorough climate risk analyses across your entire value chain, from the group and business unit to the site level. This allows us to identify material impacts and provide you with suggestions for actionable adaptation and mitigation measures.

We understand that climate risk management should be integral to your enterprise risk management and business strategy. That's why we seamlessly integrate our climate risk analysis into your existing frameworks, ensuring a robust and comprehensive approach to managing climate risks. Our reporting process helps you align with international sustainability reporting frameworks and regulations, including the Task Force on Climate-related Financial Disclosures (TCFD).

We help you navigate through the complex landscape of climate risks, elevate your risk management strategies, and demonstrate your commitment to sustainability and resilience.

Our Collaborative Advantage: Empowering Sustainable Resilience

At KPMG, we recognize collaboration's power and diverse expertise's value. We work with ZRS to provide an exceptional approach to managing climate risks

Collaborative efforts

Our collaborative efforts come together in our innovative solution, which integrates transition and physical risks. By combining our complementary expertise, we offer a holistic view of climate risks, equipping you with the knowledge and insights needed for strategic decision-making.

Transition risk modelling

We are specialized in transition risks. These risks emerge from societal and economic shifts toward a low-carbon, climate-friendly future. They encompass regulatory and policy risks, market and technology risks, and reputational risks. We make use of our advanced Integrated Assessment Model (IAM) to create a detailed and self-consistent scenario, simulating the interactions of countries and economic sectors under various warming assumptions.

Customization

The solution can be customized to meet the specific needs of different industries and clients. KPMG and ZRS have experience working with a wide range of industries and sectors and can provide detailed insights and methodological customization to meet client needs. In addition, the joint offering can be tailored to take into account the level of client maturity and can include any or all of the components outlined in the offering.