Our European Life Sciences deals overview summarizes the notable European deals and trends of 2023 and provides an outlook for 2024.

Our deal paper will be published quarterly to keep you updated on the latest trends in in the life sciences sector.

What to expect from this article

The publication covers M&A, VC & growth capital, and IPO & and follow-on deals for European companies.

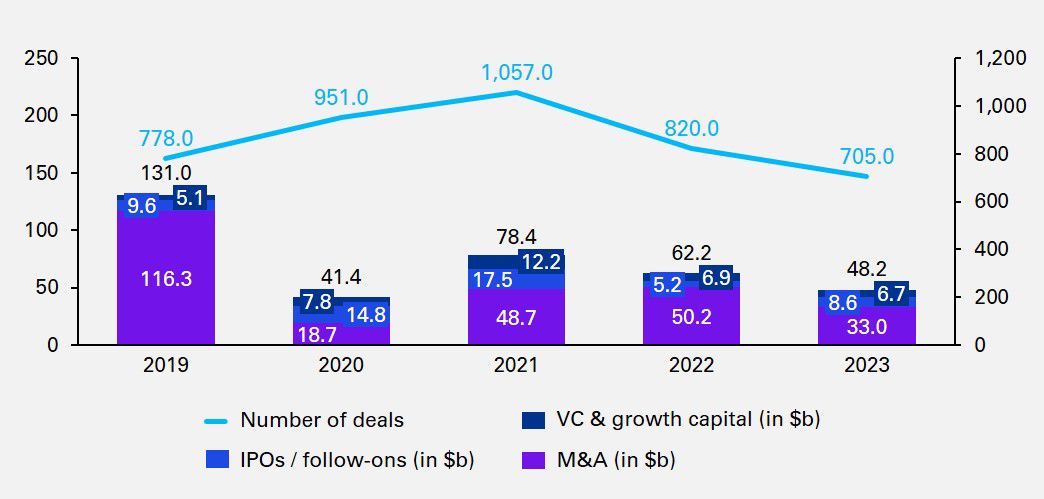

How have life sciences deals performed in terms of number and value over the last few years? We discuss the downturn in the M&A market, the slightly lower VC & growth capital activity and provide a breakdown of notable IPO listings. Further, we have compiled an outlook for 2024, which is cautiously optimistic.

Key Insights

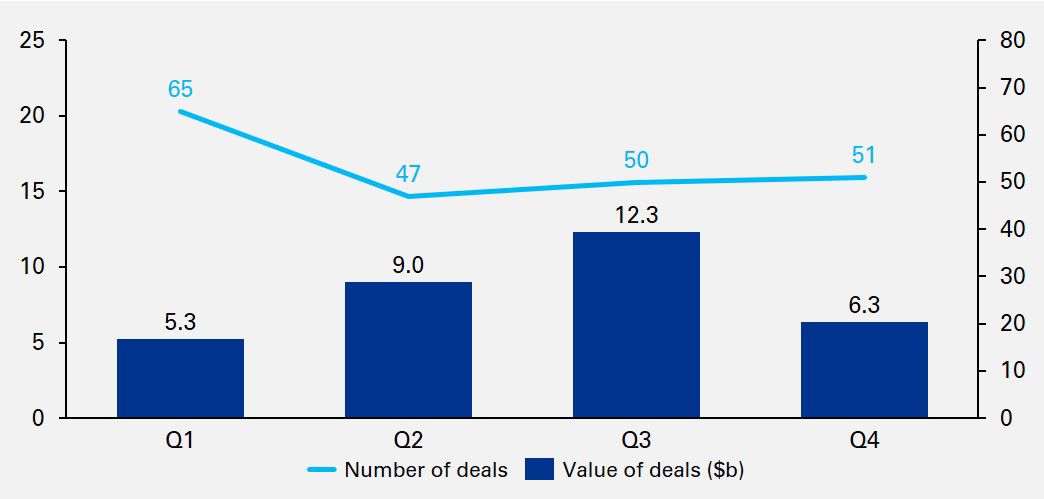

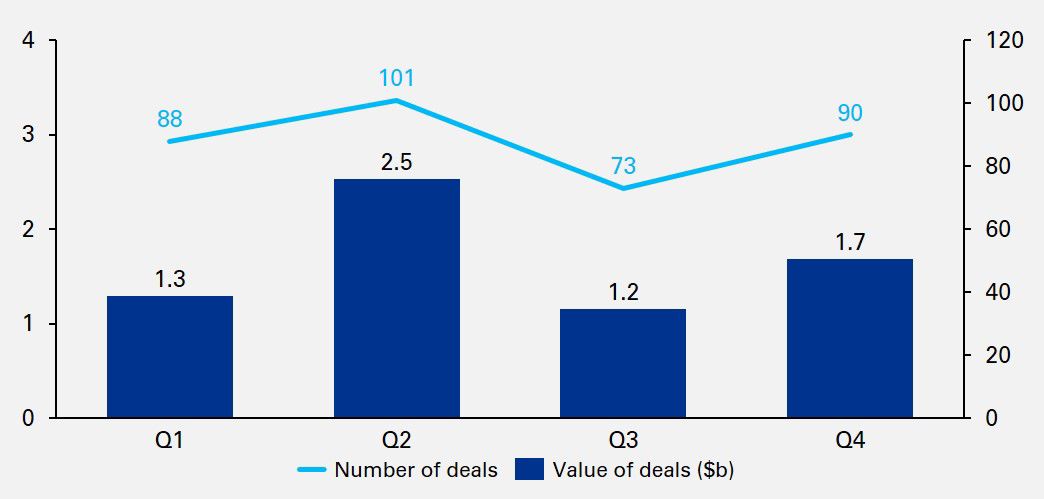

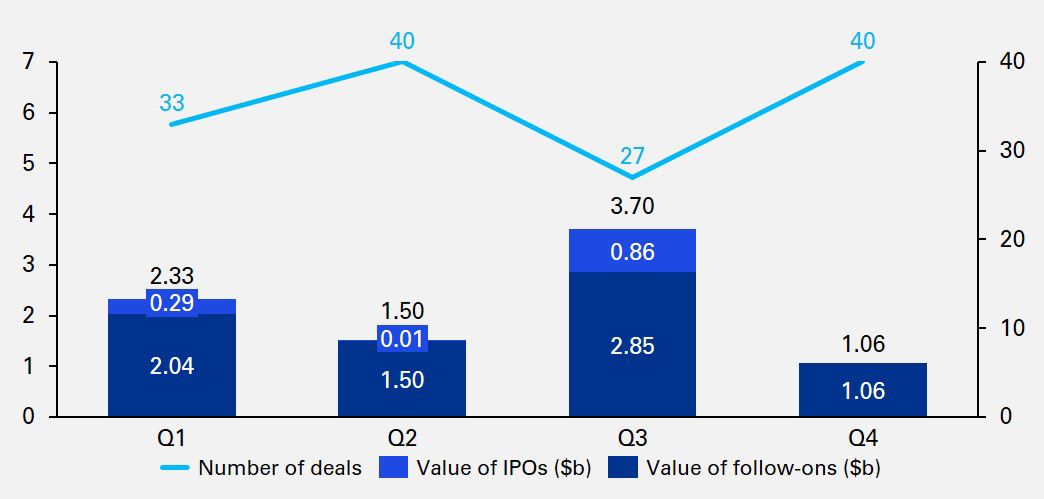

We saw a mixed performance in life sciences deals involving European targets. The 2023 M&A deal value declined, VC & growth capital deals remained stable, follow-on deals increased significantly compared to 2022 amid a brightening public market outlook.

VC & growth capital deal volume remained steady over the year, exceeding $1b in value and 70 transactions per quarter.

European life sciences deals outlook 2024

In 2024, M&A levels are expected to rebound despite macroeconomic challenges, given the expected interest rate cuts and positive market conditions.

A cautiously optimistic outlook for 2024 may create an opening of the IPO window for several European biotechnology companies that are ready to go public.

Continued growth in the follow-on market is expected as returning investors target quality biopharma assets.

Key investment trends such as the focus on the advanced technologies (e.g. ADC, RNA modalities), attention to large indications in the cardiometabolic, inflammation & immunology, oncology and neurology therapeutic areas, and outsourcing of biopharma services are expected to drive the life sciences deal market in 2024.