Sluggish deal activity masks the need for more consolidation

Despite a slow year for mergers and acquisitions in the Swiss private banking sector, there was a notable upswing in domestic transactions involving Independent Asset Managers (IAMs).

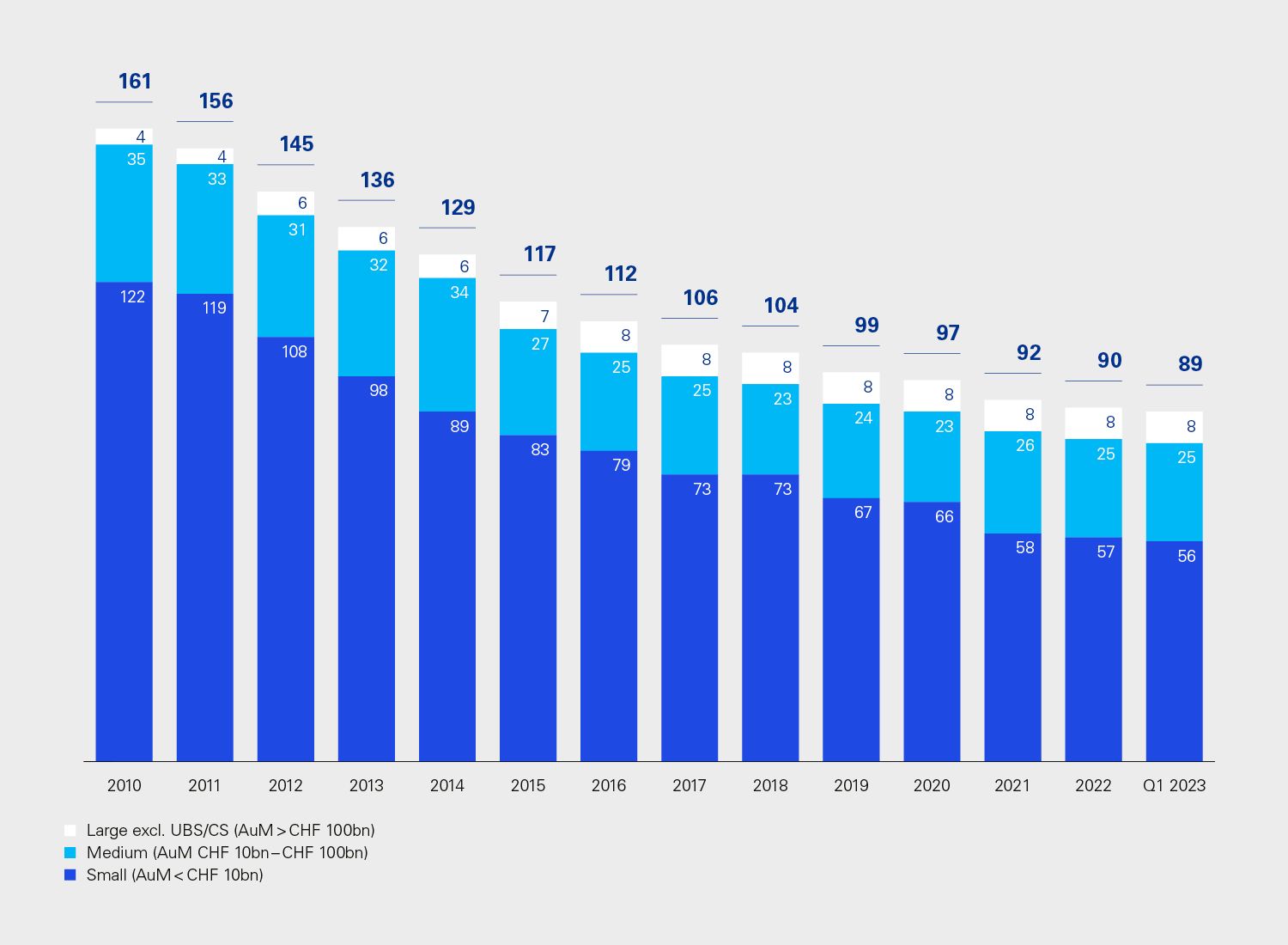

The number of Swiss private banks remained stable, with only a small drop from 92 at the end of 2021 to 89 at the end of March 2023.

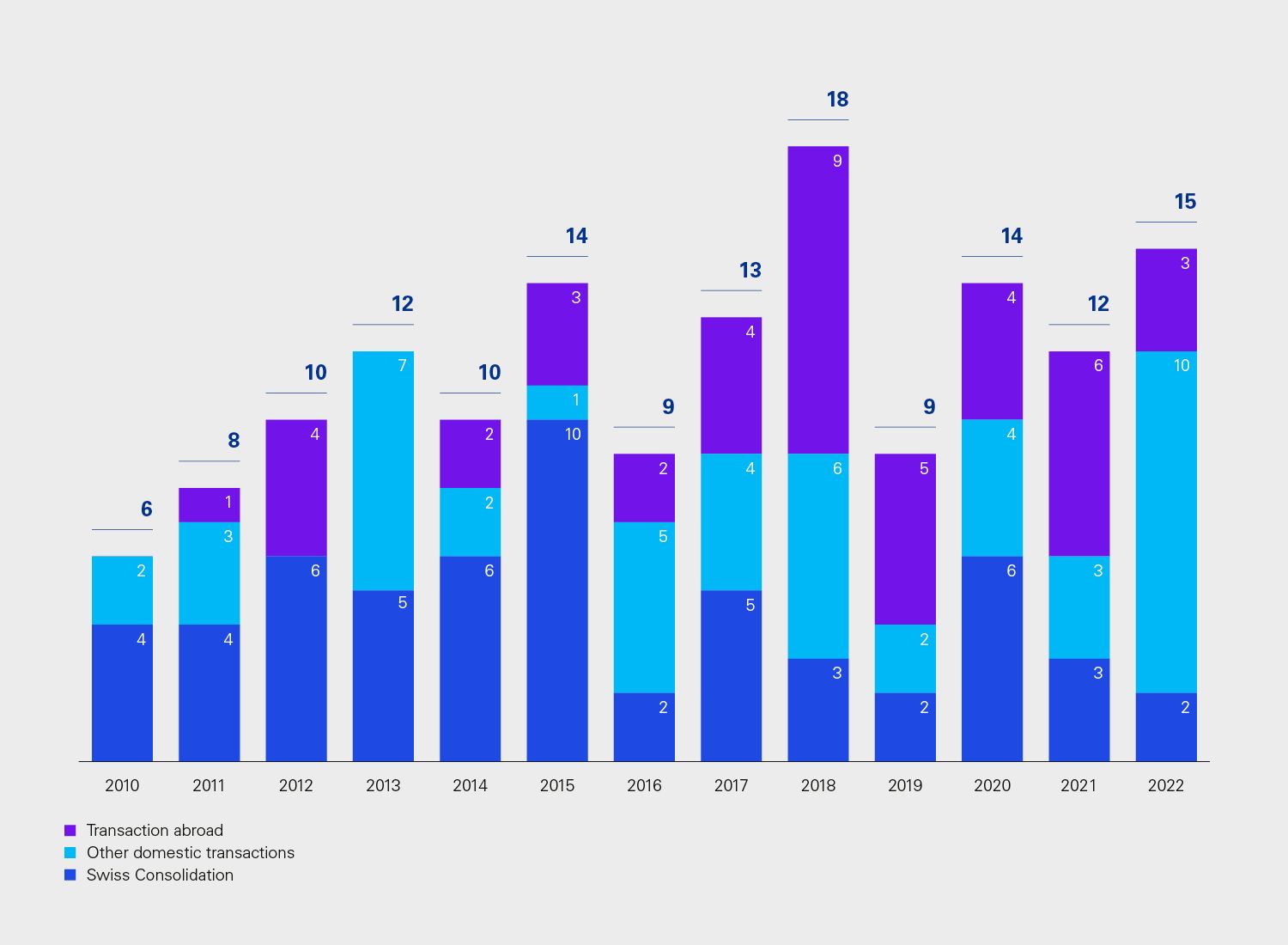

Limited consolidation and cross-border activity

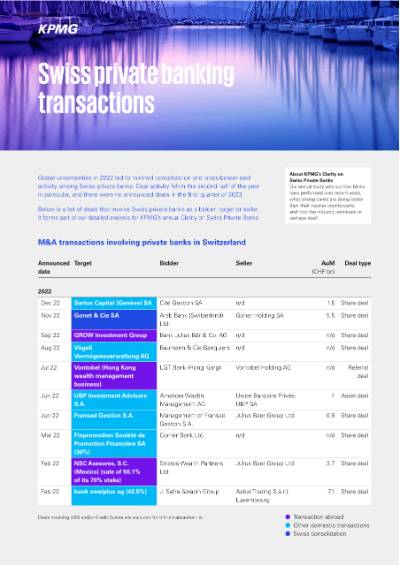

Robust financial markets in 2021 were followed by heightened global uncertainty in 2022. This led to minimal consolidation and cross-border deal activity in Swiss private banking. Deal activity fell significantly in the second half of 2022 and there were no announced deals in Q1 2023. The largest transaction was the sale of a majority stake in Gonet & Cie to Arab Bank (Switzerland).

Larger Swiss banks continued their focus on optimizing global footprints, with a few smaller M&A transactions. Julius Baer sold a majority stake in its Mexican wealth management business to Stratos Wealth Partners, for example. Vontobel sold its Hong Kong-based wealth management business to LGT.

Large increase in domestic deals with IAMs

The number of deals involving private banks and IAMs rose significantly. They included Syz's acquisition of BHA Partners in Zurich; management buyouts of independent wealth managers Wergen & Partner and Fransad Gestion, which were both owned by Julius Baer; Basle-based Baumann acquiring Vögeli Vermögensverwaltung; and Cité Gestion's acquisition of Sartus Capital in Geneva.

Outlook

2023 will see domestic M&A persist

The current environment means it is a challenge to generate organic AuM growth. AuM fell significantly in 2022 due to financial markets, and NNM also declined at many banks. M&A may be more important for banks going forward as a way to grow and benefit from economies of scale. The list of eager buyers is long.

Fewer private banks means the list of potential targets in Switzerland is much shorter. On top of this, struggling banks may postpone putting themselves up for sale as higher interest income helps profitability.

These banks still face challenges, however, and we anticipate a moderate number of deals in 2023 to involve smaller domestic transactions and local IAMs.

Meanwhile, the Big 8 banks will continue to optimize their internal set-ups and may also looking to scale up internationally.