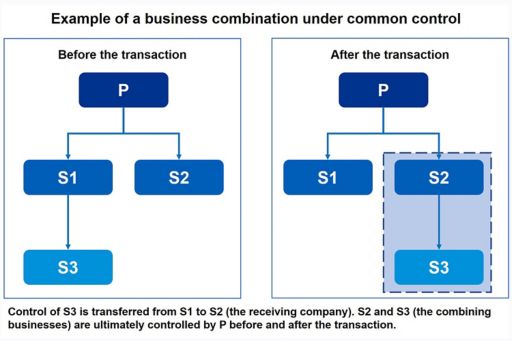

Currently, there is no guidance in IFRS® Standards for business combinations under common control – i.e. transactions in which the combining businesses are ultimately controlled by the same party both before, and after the combination – as shown in the diagram below.

These transactions are outside the scope of IFRS 3 Business Combinations and significant diversity has emerged in how the receiving company accounts for the transaction in its financial statements – some companies use the acquisition method (i.e. apply IFRS 3) and others use a book-value method.

The International Accounting Standards Board (the Board) has published a discussion paper, which includes proposed reporting requirements for such transactions. The Board’s objective is to reduce diversity in practice and improve comparability and transparency.

The DP is an important step towards consistent reporting of business combinations under common control. The Board’s proposal that “one size does not fit all” means that some transactions are measured using the acquisition method and others using book values. Now is the chance to have your say.

Should the receiving company use the acquisition method or a book-value method?

The Board is exploring two possible measurement methods:

- the acquisition method (i.e. applying IFRS 3); and

- a specific book-value method.

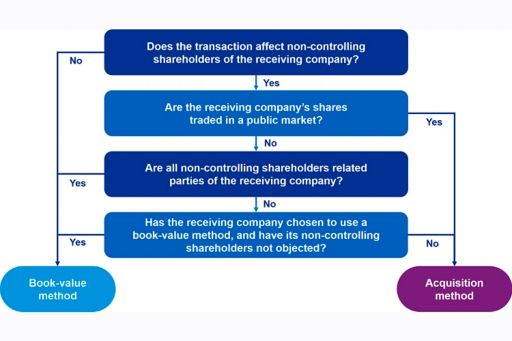

Under the proposals, the method the company uses would depend on the type of transaction.

The acquisition method would be used for transactions that affect non-controlling shareholders because those transactions are similar to business combinations in the scope of IFRS 3. However, the Board is proposing certain exceptions to this rule – e.g. if the company’s shares are not publicly traded, and the non-controlling shareholders are related parties of the company.

The book-value method proposed would be used for all other transactions because such transactions only move economic resources within the group and are not like those covered by IFRS 3.

The Board’s proposal is summarised in the following flowchart.

Which book values should be used?

Although the acquisition method is set out in IFRS 3, IFRS Standards do not specify a book-value method and do not define how such a method would be applied. Currently a diverse range of book values are used in practice, including using the transferred company’s book values and the controlling party’s book values. These book values often differ – e.g. if the transferred company had previously been acquired from a third party.

The book-value method proposed by the Board would require the receiving company to measure the assets and liabilities received using the book values of the transferred company, not the controlling party’s book values.

Should pre-combination information be restated?

No. The Board is proposing to prohibit the restatement of pre-combination information. This means that the financial information of the transferred company would be included in the financial statements of the receiving company prospectively – i.e. from the date of the transaction.

This would represent a change from current practice for some companies.

Explore

© 2024 KPMG Central Services, a Belgian general partnership ("VOF/SNC") and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.