The pace of transformation in the payments sector and the corresponding impact on financial institutions is significant, rapid and ever evolving. Customers of all shapes and sizes are increasingly demanding payment capabilities that are more efficient, much faster, less costly, and offer greater resilience and security. Regulatory change, technology evolution, and fierce competition add to the pressure.

We have interviewed senior leaders from UK financial institutions with responsibility for shaping and influencing payments products or transformation. Our Payment Modernisation Report summarises the key challenges that senior leaders face in today‘s market. It sets out the latest thinking as organisations strive to navigate through these complex changes and capitalise upon the benefits of modernising their payments capability.

Key findings

84%

of banks and building societies surveyed already have a payments modernisation programme underway or have plans to launch one.

82%

of respondents with plans to launch a payments modernisation programme expect to do so in the next 12 months

£27 million. The average investment in a payments modernisation programme.

On average, respondents expect to take two years to complete their payments modernisation programme.

69%

of banks and building societies surveyed say the changing expectations of their customers is a key driver for payments modernisation.

57%

of respondents say regulatory change is a clear driver

Payments modernisation programmes are broad in scope, but 71% of respondents are focused on improving customer experience.

The leading expected benefits of payments modernisation programmes are:

- positive customer impacts

- operational and cost efficiency

- improved security and fraud measures

The most difficult challenges faced by respondents embarking on payments modernisation are:

- dealing with technology change

- managing regulatory requirements

- maintaining data and cyber security

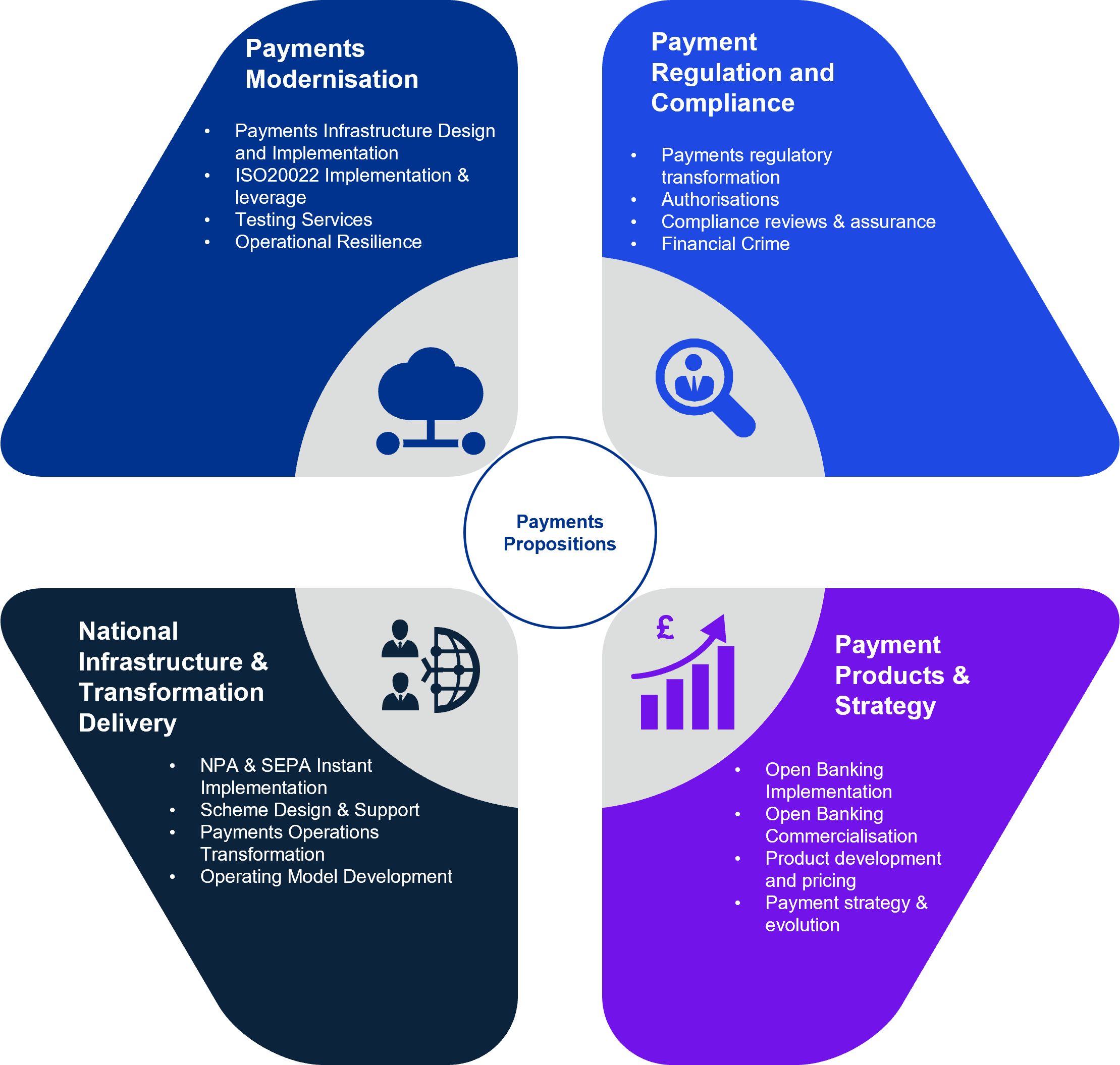

How KPMG can help

We are able to offer a wide range of solutions to support banks and building societies on their payments journey - from initial scoping through to the delivery and realisation of change.

Our extensive experience across all payment methods in different geographies allows for a comprehensive approach in meeting our client's requirements.