The Future of Payments

The payments ecosystem is continuously evolving due to regulation, changing customer needs, technology advances, geo-political changes and the fact that the payments data now carried is central to the revenue payments can drive across the ecosystem. We understand that market changes such as RTGS renewal, the potential impact of the Future of Payments Review, ISO 20022 migration, Open Banking and Central Bank Digital Currencies (CBDC) all require banks and building societies to react.

Financial institutions must deal with the new Consumer Duty requirements, as well as tougher regulation on fraud, money laundering and sanctions detection. The development and delivery of any new payment rails in the UK will lead to improvements to the UK's existing interbank payment systems but will impact major banks and building societies across the UK. Firms must also consider how they evolve from Open Banking compliance to product development and commercialisation, or risk falling behind.

What is the future of payments?

Peter Harmston (Partner – Head of Payments Consulting, KPMG in the UK) explores what the future holds for the payments domain.

The easy approach to viewpoints on the payments ecosystem is to examine current and upcoming opportunities and challenges whilst also examining what has happened in the rear-view mirror. Whilst this approach remains fundamental to remaining resilient, compliant and relevant, we need to look further over the horizon to ensure the wider ecosystem is considered and we future proof our investments as much as possible. Here at KPMG we will bring those forward-looking viewpoints on the most important and thought-provoking topics.

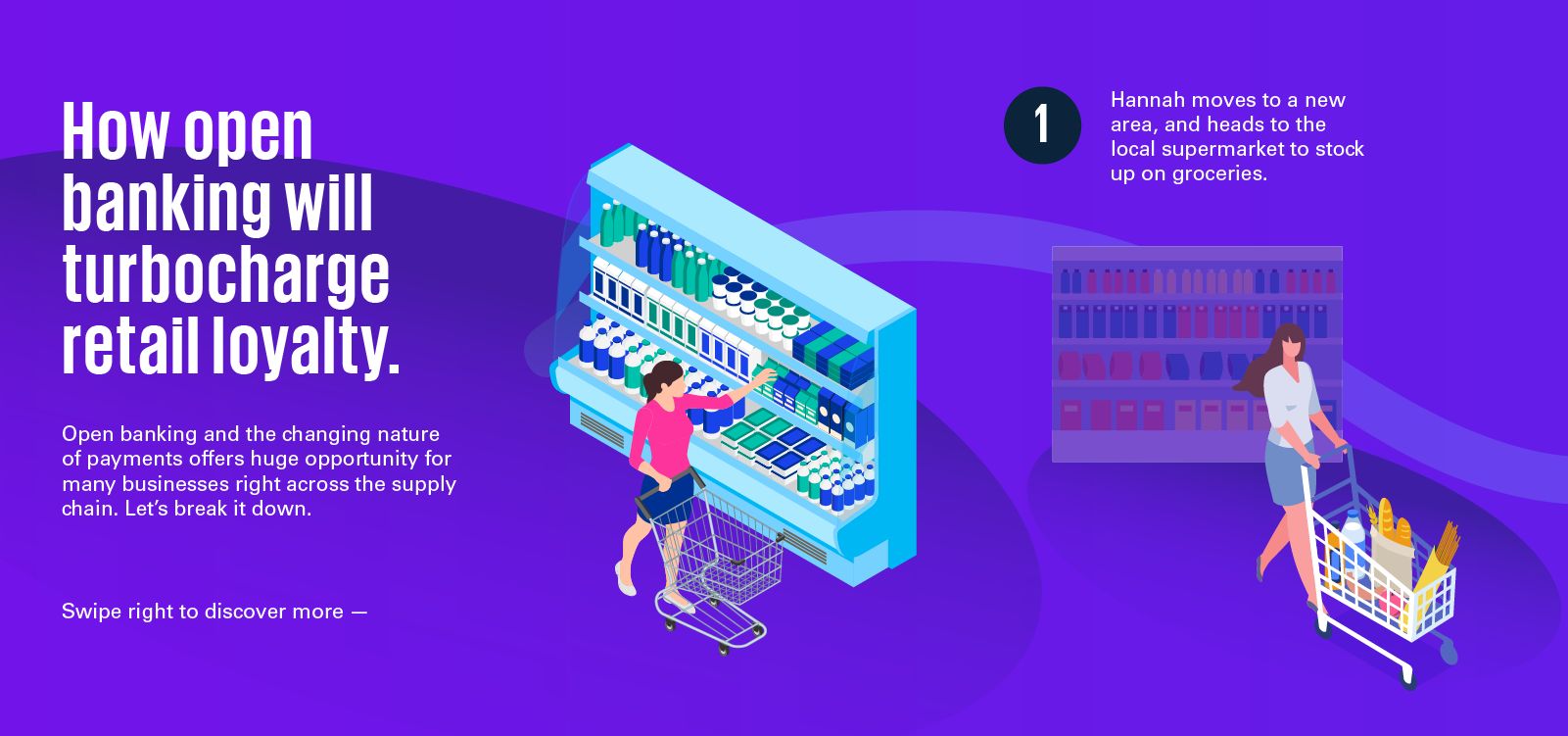

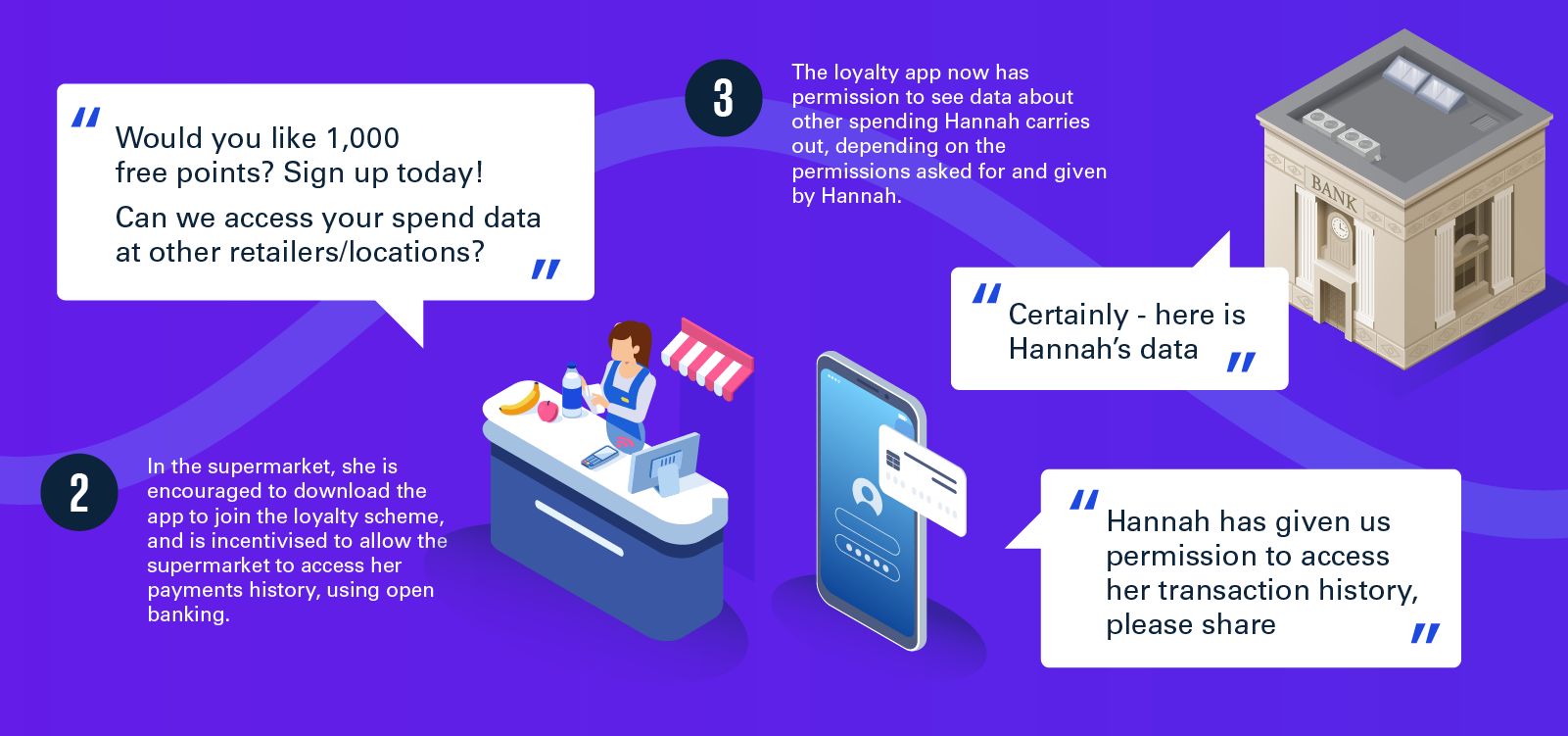

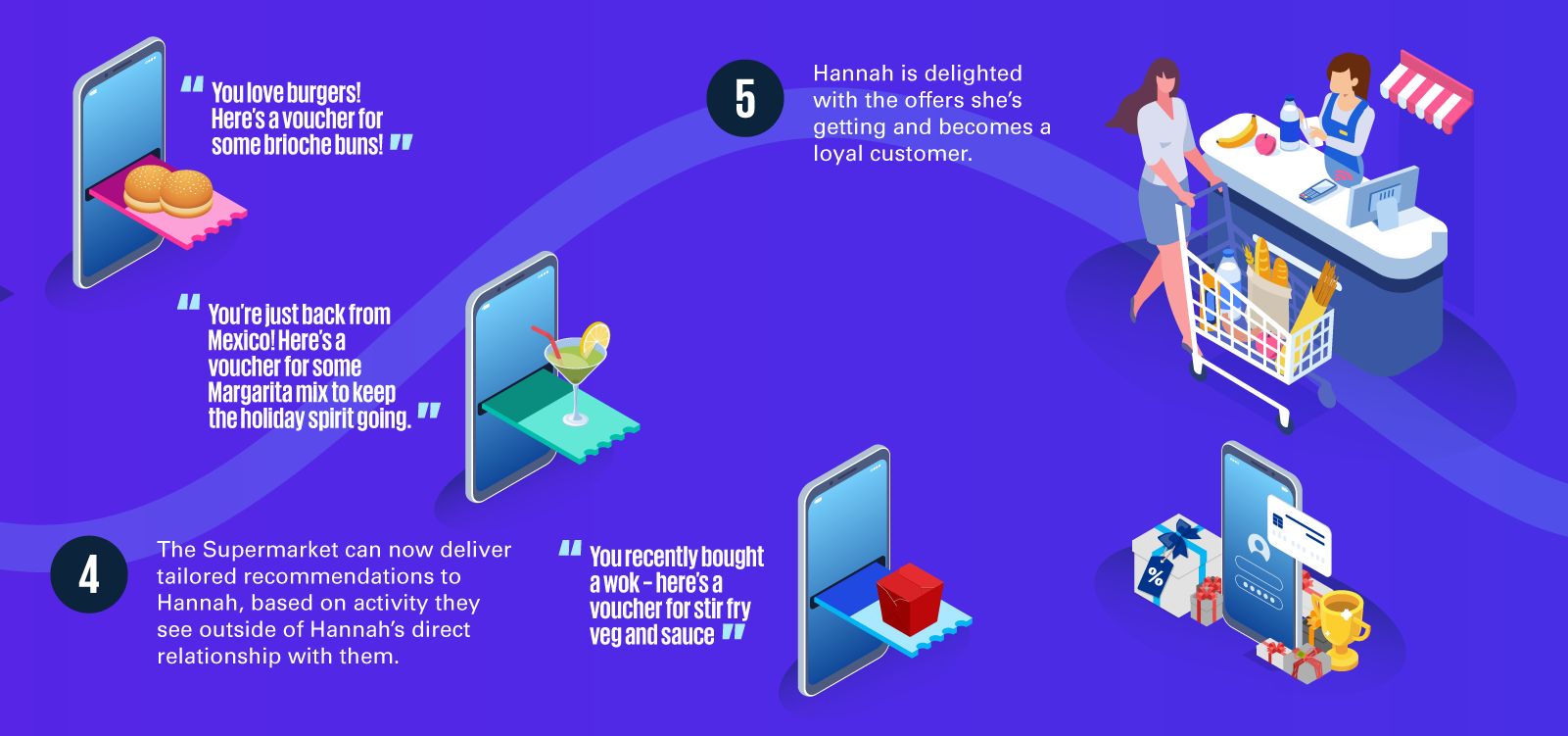

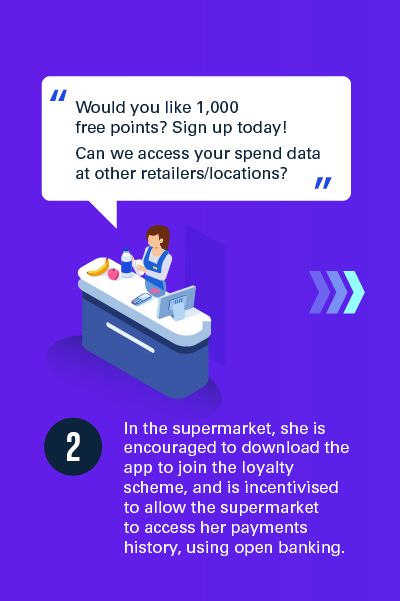

In our latest interactive infographic on Open Banking, we explore how you can bring your customers closer with embedded payments, using them as a tool to drive retail loyalty through improved customer experiences. We also delve deeper into insights gained from our Payments Modernisation report. Join our experts as they discuss key themes from the report including the role of people, dealing with technology change and regulation and compliance within payments modernisation.

Videos

Payments Modernisation

The role of people

How to recruit, develop and retain key resources for their payments modernisation programmes

Dealing with technology change

How to secure competitive advantage through technology in payments modernisation

Report

Payments Modernisation: What is the future of payments?

Charting the pace of payments modernisation in the UK banking

Download PDF (4.4 MB) ⤓Why KPMG?

Our UK Payments Consulting team have the experience and skillset to understand how to undertake successful payments modernisation programs. Our extensive work with a variety of payments companies including banks, FinTechs, and payments processors enables us to understand the complexities and challenges involved in modernisation and how best to overcome those.

We operate globally, working with clients across all geographies. We understand the regulatory pressures driving change, as well as customer and operational cost efficiency drivers. We also understand the benefits of modernisation and how the investment can give a return.

We work closely with our clients to understand their market, trends and forecasts, develop the right strategy and then help them implement it. Any modernisation program must be underpinned by the right strategy for your organisation.

Get in touch with us to discuss how we can help.