As part of the latest revision of EU list of non-cooperative tax jurisdictions in February 2023, the Council of the EU agreed to add several jurisdictions to Annex I of the list, including Russia and Costa Rica. This further increases the importance of the list as well as the importance of the measures EU Member States are taking against listed jurisdiction.

Against this background, KPMG’s EU Tax Centre updated an internal survey of KPMG Member Firms to collect information on EU and domestic defensive measures applicable against non-cooperative jurisdictions. The information included in this article was collected with the participation of KPMG Member Firms based in the EU in February/March 2023.

Jump to: Background | Consequences of being placed on Annex I and/or Annex II | National defensive measures | Potential developments

Background

The fight against harmful tax competition and aggressive tax planning has been high on the European Union’s agenda in the past few years. Following calls from both Member States and the European Parliament, the European Commission included in their January 2016 Anti-Tax Avoidance Package a proposal for a common EU external strategy for effective taxation, which included a commitment for a common approach to third country jurisdictions on tax good governance matters The objective of this initiative was to coordinate the fight against base erosion threats from third countries, by replacing the various national tax haven or white-lists with a single EU listing system.

The outcome was the adoption on December 5, 2017 of the initial EU list of non-cooperative jurisdictions for tax purposes (the EU List – Annex I to the Council conclusions on the EU list of non-cooperative tax jurisdictions). The list is the result of an in-depth screening of non-EU countries that are assessed against agreed criteria for tax good governance by the Code of Conduct Group (‘CoCG’ or ‘Group’), which is composed of high-level representatives of the Member States and the European Commission. The current screening criteria are founded upon tax transparency, fair taxation, and the implementation of OECD anti-BEPS measures. Jurisdictions that do not comply with all criteria, but that have committed to reform are included in a state of play document – the so-called “grey list” (Annex II). The EU List is an on-going project and is updated and revised in February and October of each year.

Following this latest revision on February 14, 2023, the EU list of non-cooperative jurisdictions includes the following sixteen jurisdictions: American Samoa, Anguilla, the Bahamas, British Virgin Islands, Costa Rica, Fiji, Guam, Marshall Islands, Palau, Panama, Russian Federation, Samoa, Trinidad and Tobago, Turks and Caicos Islands, US Virgin Islands, Vanuatu.

In addition, the grey list now includes the following eighteen jurisdictions: Albania, Armenia, Aruba, Belize, Botswana, Curaçao, Dominica, Eswatini, Hong Kong (SAR) China, Israel, Jordan, Malaysia, Montserrat, Qatar, Seychelles, Thailand, Turkey and Vietnam. For more details, please refer to Euro Tax Flash Issue 506.

Consequences of being placed on Annex I and/or Annex II

Mandatory Disclosure Rules (DAC6)

The EU list of non-cooperative jurisdictions is relevant for the purposes of the EU Mandatory Disclosure Rules under DAC6, where recipients of cross-border payments are resident for tax purposes in a jurisdiction that is included in Annex I. Under Hallmark C1b(ii)) of DAC6, such payments may trigger a reporting obligation irrespective of whether the transaction is aimed at generating a tax benefit (i.e. the main benefit test does not apply). Note that consensus has not formed among Member States on the point in time at which the list should be tested (e.g. the triggering date, or the reporting date).

For more information on DAC6 reporting requirements, please click here.

KPMG observation

EU Public Country-by-Country Reporting Requirements (CbyC Reporting)

In addition, the EU list of non-cooperative jurisdictions has a direct impact under the EU Public CbyC Reporting obligations that generally apply in relation to financial years starting on or after June 22, 2024 (with the exception of certain early adopters, such as Romania).

Under the EU Public Country-by-Country Reporting Directive, EU-based MNEs and non-EU headquartered MNEs that operate in the EU (and that meet certain size criteria) will be required to make publicly available certain data points on a country-by-country basis for each EU Member State, as well as for:

- each jurisdiction listed on Annex I of the EU list of non-cooperative jurisdictions, and

- each jurisdiction that has been on the grey list (Annex II) for a minimum of two years.

Data for other non-EU jurisdictions is to be disclosed on an aggregate basis. For more information on EU public CbyC Reporting, please click here.

KPMG observation

As a result, groups may need to report jurisdictional information for those countries that have been listed on Annex I as at March 1, 2023 (i.e. the sixteen countries currently listed) and those countries that were included on Annex II as at March 1, 2023 and March 1, 2022 (i.e. Belize, Botswana, Dominica, Hong Kong (SAR) China, Israel, Jordan, Malaysia, Montserrat, Qatar, Seychelles, Thailand, Turkey and Vietnam).

Non-EU headquartered groups that operate in Romania should carefully examine the impact of Romania’s early adoption of the rules as well as future implementing legislation in other Member States. Deviations from the standard timeline as well as the options available to Member States under the Directive bring an additional layer of complexity.

National tax-related measures

On November 25, 2019 the Code of Conduct Group for Business Taxation (CoCG) published guidance2 on defensive measures in the tax area towards non-cooperative jurisdictions. The CoCG’s Progress Report to the Council was endorsed by the Council on December 5, 2019. Whilst the guidance is not binding, by endorsing the document Member States committed to apply at least one of the measures. The commitment is however far from being a full harmonization measure, as EU Member States are free to choose the type and scope of measures applied against jurisdictions on the EU List, in line with the framework of their national tax systems. The list of measures from which Member States are required to choose includes:

- Non-deductibility of costs: Member States that opt for this measure should deny deduction of costs and payments that otherwise would be deductible for the taxpayer when these costs and payments are treated as directed to entities or persons in listed jurisdictions. The measure should include for example interest, royalties and other concessions on intellectual property, assets and service fees.

- Controlled Foreign Company (CFC) rules: Member States that opt for this measure should include in the tax base of the taxpayer the income of an entity resident or a permanent establishment situated in a listed jurisdiction. Member States could apply this measure in accordance with to the rules laid down in Articles 7 and 8 of the Anti-Tax Avoidance Directive (EU) 2016/1164.

- Withholding tax measures: Member States that opt for this measure should apply withholding tax at a higher rate for example on payments such as interest, royalties, service fee or remuneration, when these payments are treated as received in listed jurisdictions. Alternatively or in combination with this measure Member States could consider applying specific targeted withholding tax on such payments.

- Limitation of participation exemption on profit distribution: Member States, which have rules that permit excluding or deducting dividends or other profits received from foreign subsidiaries when computing the relevant corporate income tax, could deny or limit such participation exemptions if the dividends or other profits are considered as received from a listed jurisdiction.

Under the commitment, the deadline to introduce one or more such defensive measures was January 2021. Countries encountering difficulties to enact the measures due to institutional or constitutional issues triggered by the national process of implementing the rules benefited from a six-month extension.

KPMG observation

Other (administrative) defensive measures:

In addition to the above, Member State also agreed in December 2018 to apply at least one of the following administrative measures.

Reinforced monitoring of certain transactions.

Increased audit risks for taxpayers benefiting from the regimes at stake.

Increased audit risks for taxpayers using structures or arrangements involving these jurisdictions.

KPMG observation

The EU List produces effects outside the tax area, impacting EU funding, the regulatory field, as well as potentially the foreign policy of Member States. As such, the EU itself restricts access to several EU funding instruments, if channeled through entities based in a listed jurisdiction. Member States were also invited to take the EU List into account when developing their foreign policy, as well as in their economic relations with third countries. Also, the general framework for securitization (Regulation (EU) 2021/557 refers to the EU List. Specifically, in the context of investments in third countries through Securitization Special Purpose Entities (SSPEs), SSPEs should not be established in a listed jurisdiction, while notification requirements apply in cases where an investor intends to invest through an SSPE based in a grey list jurisdiction.

National defensive measures applied across EU Member States

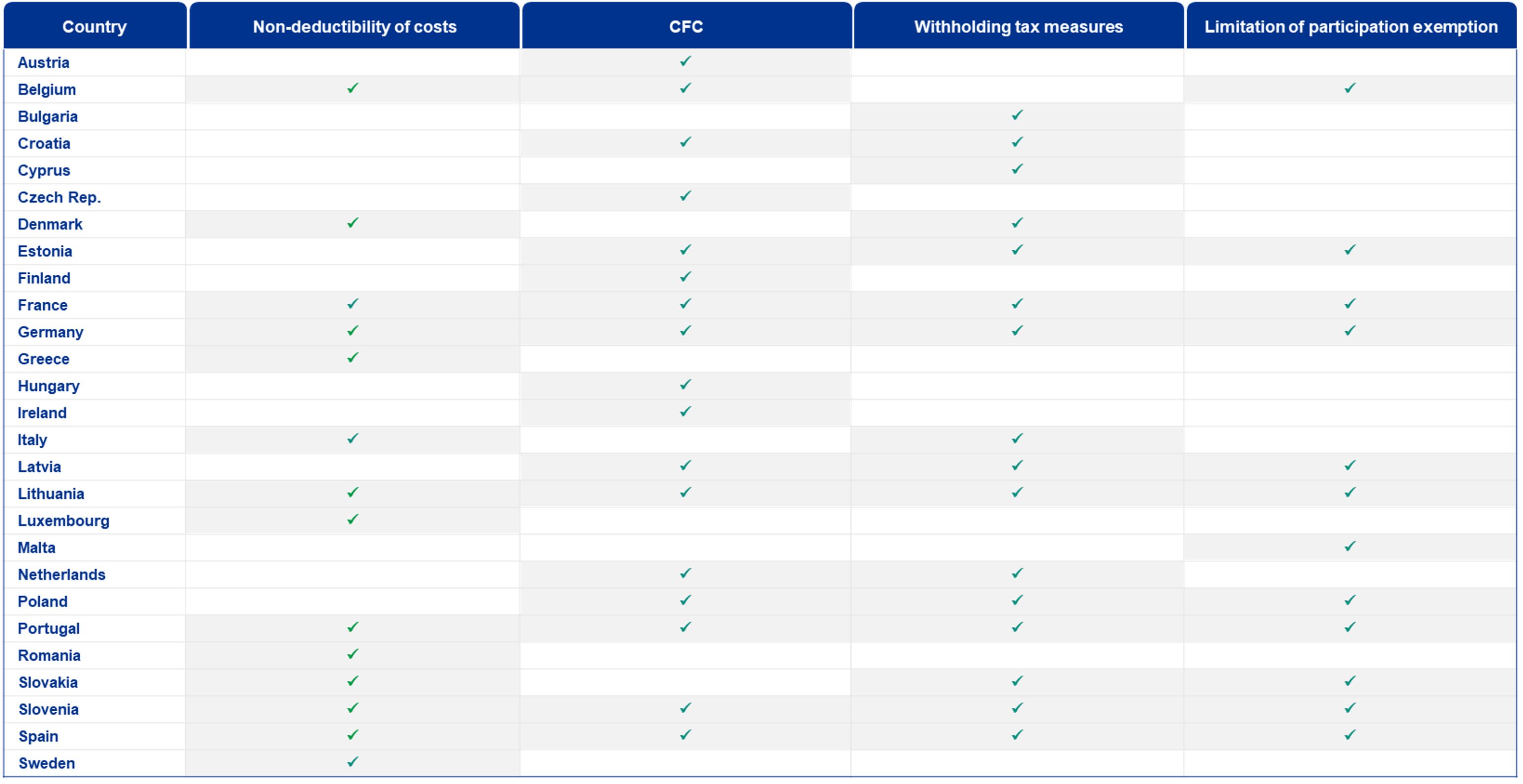

What tax defensive measures from the CoCG guidance are applied by EU Member States against listed non-EU jurisdictions?

The following table provides an overview of the tax defensive measures from the CoCG guidance that are applied by EU Member States.

As illustrated by the table, most Member States have implemented multiple measures from the CoCG’s guidance, with six countries having implemented all suggested legislative tax measures (France, Germany, Latvia, Lithuania, Portugal and Spain). In contrast, a suite of countries limited their reaction to only one type of measure, as follows:

Non-deductibility of costs:

Greece, Romania, Sweden

Withholding tax measures:

Bulgaria, Cyprus

CFC rules:

Austria, Czech Republic, Finland, Hungary

Participation exemption restrictions:

Malta

The list of measures applied above is far from being final and is constantly evolving. Member States continue to expand the scope of the measures or are investigating whether they should implement additional rules. A few recent local developments in relation to national tax defensive measures include:

- Cyprus enacted in December 2021 legislation introducing withholding taxation on certain outbound payments to EU listed jurisdictions, which entered into force on December 31, 2022. For more information, please refer to E-News Issue 146.

- In the particular case of Ireland, a consultation took place in November – December 2021 on whether additional defensive measures are required. Changes may be made in future Finance Acts if they are considered necessary (no changes were made in Finance Act 2022).

- As part of the Budget Law 2023, Italy introduced a deduction limitation in relation to the list of non-cooperative jurisdictions. As a result, expenses incurred from transactions with companies / professionals based in a non-cooperative jurisdiction will only be deductible up to the normal free market value (subject to certain exceptions). For more information, please refer to E-News Issue 168.

- In addition, Malta has committed in its Recovery and Resilience plan to analyze and potentially introduce additional defensive measures, to be implemented by September 30, 2024.

Which non-EU countries are impacted by the national defensive measures?

Several EU Member States apply national tax defensive measures only against those countries that are included on the EU List. This group includes: Austria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Germany, Hungary, Latvia, Luxembourg, Malta, Romania.

- In the Netherlands, the EU List is relevant for the Dutch CFC defensive measure. In addition, the Netherlands apply a conditional withholding tax on interest and royalties payments to affiliated companies in designated jurisdictions included on the EU List and on the Dutch tax haven list (i.e. jurisdictions without profit taxes or with a statutory rate of less than 9 percent).

- Slovakia maintains a list of cooperative countries (the “white list”) that are not subject to national tax defensive measures. The white list excludes countries from the EU List, as well as jurisdictions that do not impose a corporate income tax or that apply a nil corporate income tax.

- Belgium denies the deduction of payments to jurisdictions on the national tax haven list where the payments are not properly reported, are not at arms-length, or are made to artificial constructions. Special conditions apply for the deduction of interest and royalty payments that are paid to countries on the national tax havens list. These limitations are not directly linked to countries mentioned on the EU List. The national tax haven list was last updated by the Royal Decree of March 1, 2016. On the other hand, stricter CFC rules and participation exemption limitations are linked to the EU List.

- In France, the participation exemption limitation and the increased withholding tax rate of 75 percent on outbound payments only apply where the jurisdiction was listed due to failure to provide for an effective information exchange or where the jurisdiction facilitates offshore structures aimed at attracting profits that do not reflect real economic activity (EU criterion 2.2). In other words, the defensive measures do not apply with respect to jurisdictions that are listed due to non-compliance with other EU listing criteria.

- In Italy, expenses incurred from transactions with companies / professionals based in jurisdiction on the EU List will only be deductible up to the normal free market value (subject to certain exceptions), while the WHT defensive measure applies for countries that are not included on the Italian white list.

- Poland uses a national tax haven list that includes some of the jurisdictions on the EU List, as well as jurisdictions listed by Poland. Changes to the EU List are not automatically reflected in the national tax haven list. For this reason, Poland has a second list that covers those jurisdictions that are included on EU List but not on the national tax haven list. The national tax haven list provides for a broader scope of defensive measures compared to the second EU-related list (e.g. the WHT defensive measure only applies to those countries included on the national tax haven list).

- Sweden uses the EU List for deduction limitation purposes and a white list of countries where income is not considered to be subject to low taxation for CFC purposes.

- Greece distinguishes between non-cooperative jurisdictions and jurisdictions with a preferential tax regime. The list of non-cooperative jurisdictions includes non-EU jurisdictions which are included on the OECD list of uncooperative tax havens (not implementing the OECD's standards of transparency and exchange of information) and which (a) have not signed an agreement on administrative cooperation in the field of taxation with Greece or the Council of Europe/OECD Convention on Mutual Administrative Assistance in Tax Matters, and (b) have not committed to implementing the automatic exchange of information (AEOI) as of 2018, at the latest. The list of jurisdictions with preferential tax regimes are defined as jurisdictions with a nil corporate income tax rate, or jurisdictions taxing profits, income or capital at a rate which is equal to or less than 60 percent of the corporate tax rate applicable in Greece. The Greek list of countries with preferential tax regimes for the financial year 2021 was published on March 13, 2023. The Greek list of non-cooperative countries for the financial year 2021 was published on March 19, 2023. For more information, please refer to E-News Issue 173.

- Portugal operates a national tax haven list that was last updated in December 2020. This national tax haven list includes 80 jurisdictions and is not connected with the EU List, although it includes most of the jurisdictions included in Annex 1 (not Russia) and some included in Annex 2 of the EU list.

- In Spain, the government published a new list of jurisdictions that are considered to be non-cooperative or to have harmful tax regimes on February 10, 2023 (for more information, please refer to E-News Issue 171).

Are changes to the EU List directly applicable in EU Member States?

The complexity of navigating between the various tax haven lists applicable and the various measures applied by each Member State is compounded by the fact that not all countries take into account the changes to the EU List in the same way.

While the majority of Member States provide in local legislation for a direct reference to Annex I in a way that changes to the EU list do not need to be implemented locally3, some Member States require updates to the EU List to be adopted through a separate legislative act or ministerial order to become effective. Some of these Member States adopt the revised EU list in close proximity to the Council decisions in February and October of each year (e.g. Czech Republic, Denmark, Hungary). Other Member States adopt the revised EU list only once a year (e.g. France, Latvia, Netherlands).

Poland is a mix of both: measures applicable solely against EU-listed countries apply as from the effective date of the EU List update, whereas the broader defensive measures applicable based on the domestic tax haven list only apply once the Polish Ministry of Finance notifies the changes (generally within a few weeks after the Council updates the EU List).

For completeness, additional or separate national tax haven lists usually need to be adopted through a legislative act or ministerial order to become applicable (Belgium, Bulgaria, Greece, Netherlands, Poland, Portugal, Spain). The white list used by Slovakia only becomes effective once published on the website of the Slovak Ministry of Finance.

When do defensive measures become effective or cease to apply in case of changes to the EU List?

Where the EU List is used for purposes of applying national tax defensive measures from the CoCG guidance, national tax defensive measures by a number of Member States apply or cease to apply as soon as the updated EU List is effective for domestic purposes4. In other EU jurisdictions, the state of the EU List at the end of the respective taxation period or tax year is decisive for the application of defensive measures (Austria, Czech Republic, Netherlands).

- In Belgium, the deduction limitation for certain payments applies as soon as the respective country is added to the EU List (publication date in the EU Official Journal). For the other defensive measures, the state of the EU List at the end of the respective taxation period is decisive.

- In Germany, the defensive measures apply from the beginning of the year (or financial year) that follows the year in which the legislative decree became effective. However, the deduction limitation and the limitation of the participation exemption are subject to a deferred application, i.e. from the beginning of the fourth (financial) year after the entry into force of the decree (deduction limitation) and from the beginning of the third (financial) year after entry into force of the legislative decree (measures concerning dividends and sales of shareholdings). Where a jurisdiction is removed from the list, the defensive measures should cease to apply (retroactively) from January 1 of the respective year (or the beginning of the financial year).

- In France, concerning newly included jurisdictions, defensive tax measures will apply from the first day of the third month following the publication of the decree adopting the change. As regards jurisdictions removed from the list, the defensive measures cease to apply from the publication date of the decree.

- In Luxembourg, the state of the list at the beginning of the year (January 1) is decisive where a country is added to the EU list in a given year. In that case, the domestic defensive measures apply from January 1 of the following year. If a jurisdiction is removed from the EU List during the year, the defensive measures would cease to apply as soon as the respective country is removed from the EU List (publication date in the EU Official Journal).

- In Malta, the participation exemption is denied for countries that were on the EU List for a minimum of three months during the relevant year.

- In the Netherlands, no withholding tax will be withheld for payments towards jurisdictions on the Dutch list of low tax and non-cooperative jurisdictions for the first three years starting from the date when the jurisdiction was first designated non-cooperative.

- In Spain, jurisdictions that were newly added to the national list in February 2023 will be considered non-cooperative jurisdictions six months following the day the ministerial order entered into force (February 11, 2023).

What other key differences need to be considered?

The CoCG report on potential defensive measures lacked further guidance on the practicalities of applying such defensive measures by Member States. This lack of harmonization, coupled with variations in the specifics of each MS’s national legal framework have led to uncertainty on a number of points regarding the application of the defensive measures.

-

It is often the case that jurisdictions considered non-cooperative by the EU do not have a practice of entering into bilateral tax treaties. Furthermore, when determining domestic tax havens list, the absence of a double tax treaty is often a condition for listing. Member States will therefore typically not have double tax treaties in place with listed jurisdictions. This is, however, not always the case. The question therefore arises whether a double tax treaty prevails over a domestic defensive measure, or if a treaty override is available, such that e.g. increased withholding tax rates on payments to non-cooperative jurisdictions / tax havens would apply even where a lower rate is available under an existing double tax treaty.

Some Member States – including Croatia, Cyprus, Denmark, Estonia, Finland, France, Poland, Spain, will generally disregard the national defensive measure and apply the lower treaty rate (all other things being equal and assuming any treaty anti-abuse provisions would not disregard the payment).

In other EU countries – e.g. Germany, Latvia, Portugal, Slovakia, an increased WHT under a national defensive measures would be applied irrespective of an existing double tax treaty with a non-cooperative jurisdiction, i.e. local legislation provides for a treaty override provision.

Additional consideration should be given to the impact of Russia’s decision to suspend double tax treaties with so-called “unfriendly” countries. This could potentially bring Russia in the scope of domestic tax haven lists – for countries where local lists are not linked to the EU one and could also impact countries where payments to Russia would have otherwise been outside the scope of certain defensive measures due to lack of treaty override provisions.

-

The CoCG guidance does not offer additional insights as to the determination of whether the recipient of a payment is resident in a non-cooperative jurisdiction. The question therefore arises whether, when applying defensive measures, Member States should look at the residence of the recipient, their place of establishment and/ or another criterion. The only type of defensive measure for which the answer to this question is clear is the application of CFC rules, which refer specifically to tax residence. For the other types of defensive measures, the identification criteria based on which the defensive measures apply differ among Member States.

- Belgium and France do not only refer to the aforementioned criteria but also apply defensive measures where the payment in question is made to a bank account held by a financial institution established in a listed jurisdiction (regardless of the domicile of the account holder).

- In Sweden, the interest deduction limitation uses the independent legal term “belonging to”, which is not further defined - it should generally follow tax residence but is also intended to apply to companies that have no tax residence.

For example, some Member States look at the country of tax residence of the recipient of a payment – Austria, Belgium, Croatia, Czech Republic, Finland, Germany, Greece, Hungary, Malta, Portugal, Poland, Spain. Other Member States refer to either the country of incorporation (Latvia, Luxembourg, Romania, Slovakia) or to both tax residency and country of incorporation (Cyprus, Denmark, France, Italy).

In addition, special nexus requirements are provided in certain EU countries, including:.

-

In a number of EU countries, the national tax defensive measures are subject to a purpose/motive test, i.e. the measures do not apply where the taxpayer proves that the underlying payment or transaction follows commercial reasons or has an economic purpose (France, Greece, Italy, Luxembourg, Portugal, Romania, Spain). In Malta, the participation exemption limitation does not apply where the recipient is able to prove that there are sufficient people functions in the non-cooperative jurisdiction.

In some EU Member States, the defensive measures apply based on a certain order of priority. For example, in Germany, the participation exemption limitation does not apply where it can be demonstrated that the dividends are derived from amounts which were subject to a deduction denial of operating expenses or a WHT defensive measure. In addition, the deduction denial does not apply where the underlying payments have been subject to the WHT defensive measure. In Italy, exceptions to the deduction limitation also apply where taxpayers can prove that the underlying transaction carried out with non-residents is covered by the CFC rules.

Potential future developments

On January 30, 2023, the European Commission issued a position paper for enhancing the EU listing exercise and enforcement of defensive measures. According to the paper, the EU listing exercise has been successful in recent years but – according to the EC, the Pandora Papers revelations show that problems persist. The paper also notes that five of the currently listed jurisdictions have been on the list since 2017 suggesting that the EU listing exercise has not had sufficient impact on these jurisdictions.

- Incorporation of an additional criterion 1.4 on the exchange of beneficial ownership information that was already approved by the ECOFIN Council in November 2016 but delayed as a result of the Covid-19 pandemic. While the scope and application of this criterion has not yet been agreed at EU level, the European Commission is considering a reference to the Anti-Money Laundering (AML) listings, and ratings by the Global Forum on Tax Transparency and Exchange of Information for Tax Purposes. Note that a link to the EU AML list or the FATF AML lists would potentially result in an EU listing (for tax purposes) of jurisdictions such as the Cayman Islands and the United Arab Emirates. In addition, the European Commission is considering requiring non-EU countries with 0 percent corporate tax rates to exchange information automatically on an annual basis on EU persons on those countries' beneficial ownership registers.

- Evaluation of the possible impact of Pillar 2 on the listing criteria, including those relating to preferential tax regimes (criterion 2.1) and schemes facilitating the creation of offshore structures or schemes designed to attract profits that do not reflect real economic activity in the jurisdiction concerned (criterion 2.2). According to Benjamin Angel, director of the DG TAXUD division, it is currently discussed that the CoCG Group could link its listing approach to the Inclusive Framework Pillar Two peer-review framework. Peer-reviewed countries failing to implement the Pillar Two GloBE Rules adequately could land on Annex II of the EU list (grey list).

- Development of a strengthened monitoring process to ensure the effective implementation of economic substance for legal entities in no or nominal tax jurisdictions (criterion 2.2).

- Development of a prioritization list to expand the geographical scope of the EU list.

And this is not the end, as the defensive measure themselves are expected to evolve in the future. As mentioned in the introductory comments, the CoCG has conducted a review of existing national legislation implementing EU guidance on tax and administrative defensive measures. The intention of the CoCG is to take a step further and conduct an in-depth follow-up review of how Member States apply the measures in practice and whether they meet the Group’s expectations in terms of efficiency. This additional investigation would offer the CoCG a good overview of the practical impact of the defensive measures and could serve as a starting point for potential additional guidance to better coordinate existing measures as well as to introduce new types of defensive measures. This could include a common withholding tax on dividend, interest and royalty payments made to non-cooperative jurisdictions.

Conclusion

The next update of the EU List is expected in October 2023 and will reflect progress made by jurisdictions that have made commitments to the EU. This may include, amongst others, the 2023 Inclusive Framework peer review results on CbyC reporting and re-assessments of harmful foreign source income exemption regimes that have previously been considered harmful.

Entities that operate in or make payments towards jurisdictions that have been deemed non-cooperative (either by the EU or by individual Member States) or that are under monitoring, should seek to understand whether any defensive measures may apply and when. As outlined in this article, taxpayers need to consider different lists, different defensive measures, different application timelines and other varying requirements that are applied across EU Member States. Therefore, it is advisable to integrate these considerations into existing internal compliance management procedures.

KPMG’s EU Tax Centre will continue to monitor developments related to the EU list of non-cooperative jurisdictions and its impact and report on events via our publications.

Connect with us

Key Contact

Raluca Enache

Head of KPMG’s EU Tax Centre

Key Contact

Ana Puscas

Manager, KPMG's EU Tax Centre

Key Contact

Marco Dietrich

Manager, KPMG's EU Tax Centre

Related Content

1 Medium or larger subsidiary / branches as defined by the Romanian bill implementing the EU Accounting Directive (Directive 2013/34/EU).

2 https://data.consilium.europa.eu/doc/document/ST-14114-2019-INIT/en/pdf (689 KB)

3 e.g. Austria, Belgium, Croatia, Cyprus, Estonia, Finland, Italy, Luxembourg, Malta, Romania, Sweden.

4e.g. Croatia, Denmark, Estonia, Finland, Italy, Latvia, Poland, Romania, Slovakia, Sweden.