The Ministry of Finance and State Taxation Administration for the People’s Republic of China (“PRC”) recently issued three important circulars extending some of the PRC individual income tax (IIT) treatment of annual bonuses, equity-based incentives, and certain expatriate fringe benefits-in-kind. The policies also encourage entrepreneurship by providing the grounds for income assessment methodology for income generated from sole proprietorships and partnerships.

There had been uncertainty over whether the preferential IIT policy would be extended beyond 2021. (For prior coverage, see GMS Flash Alert 2021-077, 10 March 2021.)

WHY THIS MATTERS

The circulars provide certainty by extending some of the major preferential IIT policies that benefit salary income earners and strengthen IIT compliance. Companies and individuals will want to consider these changes in their planning.

The Announcements

The Ministry of Finance and the State Taxation Administration jointly promulgated the three new policies at the end of 2021.

On 30 December 2021:

- Announcement No. 41 of 2021, the Announcement on Measures for Individual Income Tax (“IIT”) Administration on Operating Income from Equity Investment subjects all sole proprietorships and partnerships holding equity investments1 to audits for IIT assessment and reporting purposes starting from 1 January 2022.

On 31 December 2021:

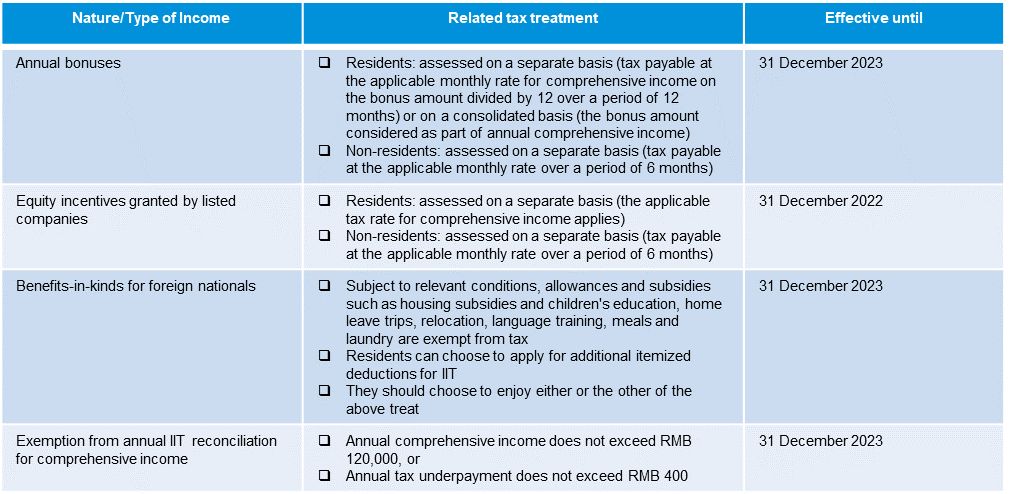

- Announcement No. 42 of 2021, the Announcement on Extending Preferential Individual Income Tax Policies on Annual Bonuses and Others extends preferential IIT policies on annual bonuses and equity incentives granted by public companies to 31 December 2023 and 31 December 2022, respectively.

- Announcement No. 43 of 2021, the Announcement on Extending Preferential Individual Income Tax Policies on Allowances for Foreign Nationals and Others extends the preferential IIT policy of tax exemption treatment of benefits-in-kind provided to foreign nationals working in the PRC to 31 December 2023.

Changes to Income Assessment Methodology for Operating Income from Equity Investment

Starting from 1 January 2022, sole proprietorships and partnerships holding equity investments will:

- be subject to audits for IIT assessment and reporting purposes;

- report any equity investment to the tax authorities within 30 days from the date of holding; and

- in the case of those already holding equity investment prior to 1 January 2022, report their equity investments to the tax authorities by 30 January 2022, and be subject to audits for IIT assessment and reporting purposes.

Continuation of Major Existing Preferential IIT Policies

A summary of provisions regarding the continuation of major existing preferential IIT policies is as follows:

KPMG NOTE

The changes to tax regulations reflect the authorities’ intent to reduce the IIT burden on salary income earners, while enhancing administration of IIT from high-income earners who derive income from sole proprietorships and partnerships.

Companies and individuals should consider the following in their planning:

- While the preferential IIT policies on equity incentives granted by public companies are extended to the end of 2022, and the preferential IIT policies on annual bonuses, benefits-in-kind for foreign nationals are extended to the end of 2023, companies and individuals should keep abreast of relevant policy developments and budget for future cost increases and talent retention programs before the policy extension’s expiry.

- The extension of the preferential IIT policy on equity incentives granted by public companies includes stock options, stock appreciation rights, restricted stocks, and other equity-based awards granted to individuals. Companies should comply with the tax reporting requirements for equity plans in order to secure the preferential tax treatment, and seek professional advice to assess appropriate tax treatment where in doubt.

- The existing IIT subsidy policy in the Greater Bay Area will also expire at the end of 2023 (for related coverage, see GMS Flash Alert 2019-116, 15 July 2019). Companies and individuals should also closely follow the developments on any possible changes and extensions to the policy, and devise plans to align corporate and talent strategies.

- Individual investors in sole proprietorships and partnerships should comply with the new income assessment rules for IIT reporting purposes in a timely manner.

- High-net-worth individuals should keep abreast of policy developments and may wish to seek professional advice on their tax compliance status and enlist assistance with complying with the relevant tax compliance requirements.

FOOTNOTE

1 Equity investments include holdings of equity, stocks, and shares in the property of a partnership.

RELATED ARTICLE

This article is excerpted, with permission, from “Recent developments on PRC IIT policies,” in China Tax Alert (Issue 1, January 2022), a publication of the KPMG International member firm in the People’s Republic of China.

The information contained in this newsletter was submitted by the KPMG International member firm in the People’s Republic of China.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

© 2024 KPMG Advisory (China) Limited, a wholly foreign owned enterprise in China and KPMG Huazhen, a Sino-foreign joint venture in China, are member firms of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

KPMG International Cooperative (“KPMG International”) is a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.