As highlighted in KPMG’s recent article, the banking landscape in Europe is changing, partly due to disruptive digital innovation and the threat of competition from both banks and non-banks. As competition continues to intensify and pressure persists on profitability, a new period of banks’ consolidation is expected.

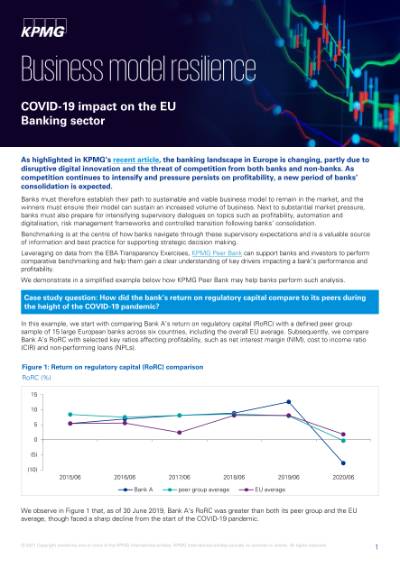

Banks must therefore establish their path to sustainable and viable business model to remain in the market, and the winners must ensure their model can sustain an increased volume of business. Next to substantial market pressure, banks must also prepare for intensifying supervisory dialogues on topics such as profitability, automation and digitalisation, risk management frameworks and controlled transition following banks’ consolidation. Benchmarking is at the centre of how banks navigate through these supervisory expectations and is a valuable source of information and best practice for supporting strategic decision making. Leveraging on data from the EBA Transparency Exercises, KPMG Peer Bank can support banks and investors to perform comparative benchmarking and help them gain a clear understanding of key drivers impacting a bank’s performance and profitability. We demonstrate in a simplified document how KPMG Peer Bank may help banks perform such analysis.

Register today for a demo session to find out more.

Get in touch

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia