United States – New York Implements New Tax Rates for Top Earners

US – New York Implements New Tax Rates

New York’s recently-enacted budget legislation provides for $212 billion in state spending and temporarily increases the current top personal income tax rate of 8.82% to 10.9% for individual filers whose taxable income is over $25,000,000. The new rates are retroactive to the beginning of the 2021 tax year and are effective through the 2027 tax year.

On April 19, 2021, the Governor of New York, Andrew Cuomo, signed the FY 2022 budget bills (Chapter 59 of the 2021 Laws of New York) into law.1 One of the provisions contained in the enacted legislation, which provides for $212 billion in state spending, temporarily increases the current top personal income tax rate of 8.82% to 10.9% for individual filers whose taxable income is over $25,000,000. The new rates are retroactive to the beginning of the 2021 tax year and are effective through the 2027 tax year. Absent any additional legislation, the rates will revert back to the pre-2021 schedule beginning with the 2028 tax year.

WHY THIS MATTERS

The new marginal income tax rate brackets may require global mobility programs that have employees who work in, or are residents of, New York State to reassesses assignment costs, hypothetical income tax withholding, and gross-up calculations, especially considering that the new rates are retroactive to the beginning of the 2021 tax year.

New York City

New York City’s tax laws generally are not affected by New York State budget legislation. New York City’s fiscal year, which starts on July 1, is different than the state’s fiscal year that begins April 1. Whether New York City enacts any significant tax changes in the next few months remains to be seen.

Overview of Income Tax Rate Changes

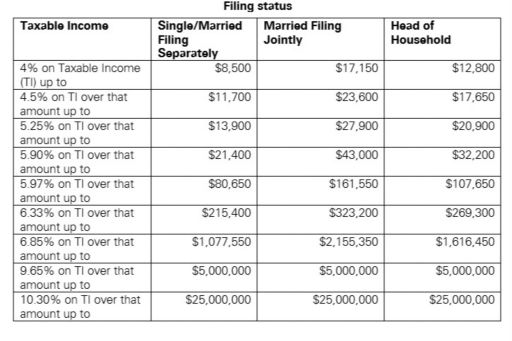

The legislation establishes three new marginal income tax rate brackets for individuals that are effective for the 2021-2027 tax years. Previously, the highest individual income tax rate of 8.82% was imposed on joint filers with income over $2,155,350 ($1,077,550 for single filers; $1,616,450 for head of household filers).

The new rate brackets and rates are as follows:

- 9.65% for joint filers with New York taxable income in excess of $2,155,350 ($1,077,550 for single filers; $1,616,450 for head of household filers) but not more than $5,000,000.

- 10.30% for all taxpayers (regardless of filing status) with New York taxable income in excess of $5,000,000 but not greater than $25,000,000.

- 10.90% for all taxpayers (regardless of filing status) with New York taxable income in excess of $25,000,000.

KPMG NOTE

The combined New York State and New York City maximum individual income tax rate imposed on residents is now the highest in the nation, at 10.90% (State) + 3.876% (New York City) = 14.776%. By contrast, California, until now the highest, tops out at 13.3% for income over $1 million.

New York State Income Tax Brackets (2021)

The table below2 contains the updated New York State individual income tax brackets and applicable income tax rates for the 2021 tax year.

FOOTNOTES

1 For the text and status of the legislation, see: https://nyassembly.gov/leg/?default_fld=%0D%0A&leg_video=&bn=A03009&term=&Summary=Y&Actions=Y&Memo=Y&Text=Y. For additional information on the tax provisions contained in the enacted budget bills, please see TaxNewsFlash No. 2021-174 (April 20, 2021), a publication of KPMG LLP (U.S.).

2 Amounts and rates per the New York Budget Bill for fiscal year 2022 (S2509-C/A3009-C).

The above information is not intended to be "written advice concerning one or more Federal tax matters" subject to the requirements of section 10.37(a)(2) of Treasury Department Circular 230 as the content of this document is issued for general informational purposes only.

The information contained in this newsletter was submitted by the KPMG International member firm in United States.

VIEW ALL

SUBSCRIBE

To subscribe to GMS Flash Alert, fill out the subscription form.

© 2024 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.