The energy industry continues to be an enabling and necessary resource as organizations across all industries begin preparing for a new reality and recovery from the impact of COVID 19.

Six months after the release of the KPMG 2020 CEO Outlook (COVID-19 edition), we have conducted a pulse survey to explore if and how the three-year outlook has changed.

Like other industries, the energy industry was forced to scramble to respond to the pandemic to ensure the safety of employees and operations and the safe and efficient delivery of energy that communities and organizations depend on. Now, even with the ongoing impact of the pandemic, the energy industry appears to be taking a leading role in the acceleration of the energy transition.

The 2021 pulse survey reveals that energy CEOs are embracing change, reprioritizing risks, and increasingly confident of the sector’s growth prospects.

Embracing change and the long-term impacts of COVID-19

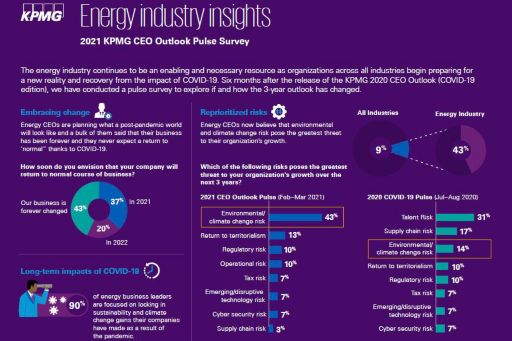

After navigating their businesses through a year dominated by the pandemic, shifting commodity prices, and severe weather events, one thing is certain: energy CEOs are embracing change. Some thirty-seven percent of the energy CEOs surveyed see a return to normalcy later in 2021, while forty-three percent said their businesses and operations have been changed forever as a result of the pandemic.

With the 26th United Nations Climate Change Conference taking place this year and the United States rejoining the Paris Agreement, nearly two-thirds (60 percent) of energy CEOs plan to put in place more stringent environmental, social and corporate governance (ESG) practices. A vast majority (90 percent) of them are focused on locking in sustainability and climate change gains their companies have made as a result of the pandemic. All global energy executives are looking to increase their focus on the social component of their ESG programs.

Reprioritized risks

As the energy industry begins to embrace the “new normal,” top risks to growth have returned to prepandemic stages. Since 2019, environmental and climate change has remained one of the greatest threats to organizational growth for energy CEOs, and it has climbed back to the top place again. Most notably, findings indicate that supply chain risk, had ascended from second to fifth place over the course of six months, while talent risk concerns, which topped the list in August 2020, has dropped off energy CEOs’ radar. Among the key trends, cyber security risk, which emerged as the number one risk across all industries in the 2021 CEO Outlook Pulse continues to be a moderate risk for the energy industry with only 7 percent selecting it as the greatest risk for their organization.

Which of the following risks pose the greatest threat to your organization's growth over the next three years?

Though many factors can influence CEOs’ forecasts, the perceived pace of vaccination distribution is prominent. More than half (57 percent) of energy business leaders state they are concerned that not all of their employees will have access to a COVID-19 vaccine, which could put their operations or certain markets at a competitive disadvantage. More than one-third (37 percent) of energy executives are worried about misinformation on COVID-19 vaccine safety and the potential this may have on employees choosing not to have it administered. As a result, most (90 percent) said they will ask employees to inform their companies once they’ve been vaccinated.

Confidence returns

Energy executives’ confidence appears to be increasing along with crude and gasoline prices. Energy CEOs are significantly more confident about the future of their company, the energy industry, and the global economy over the next three year horizon than they were just six months ago. The additional confidence can be attributed to the positive momentum of the COVID-19 vaccine rollout and positive forecasts for oil recovery and energy demand. All energy CEOs surveyed said they are confident in growth prospects of the energy industry, rising dramatically from less than half of those surveyed in August 2020. While concerns remain around the future performance of the global economy, most (93 percent) feel confident about the immediate growth prospects for their own business.

The positivity also flows into predictions energy leaders have on their organization’s earnings. In September 2020, over one-third of energy leaders predicted zero or negative earning for their organization. Fast-forward 6 month and a bulk of energy leaders said they anticipate growth rate up to 2.49 percent per year, with over a sixth (17 percent) predicting a growth rate over 5 percent.

With the pandemic’s economic upheaval and the volatility of equity markets, it looked like M&A activity would be depressed for a while. According to the energy respondents, some 83 percent expect low to moderate M&A activity over the next three years. Findings indicate that the primary driver for M&A will be to acquire disruptive technologies and to increase market share.

Digital transformation

Energy CEOs continue to plan to invest in emerging and innovative technology—with 63 percent of leaders prioritizing automation, 57 percent focusing on artificial intelligence, and 50 percent committed to digital communication, such as video conferencing and messaging capabilities. A sizable majority (73 percent) of energy leaders reported their desire to build on their use of digital collaboration and communication tools as a result of the pandemic.

Over two-thirds (71 percent) of energy business leaders report that their primary reason for investing more in these technologies is to help reduce costs. Energy CEOs will also pursue various avenues to bulk up their digital capabilities, since 53 percent state that their M&A appetite over the next three years will be driven mainly by the desire to acquire disruptive technologies that have the potential to transform energy organizations’ operating models.

Methodology:

The Pulse Survey asks CEOs from the world’s most influential companies to provide their three-year outlook on the economic and business landscape as well as the ongoing COVID-19 pandemic. This Pulse Survey looks at how their views have evolved since July/August 2020.

Five hundred CEOs from 11 key markets (Australia, Canada, China, France, Germany, India, Italy, Japan, Spain, the U.K., and the U.S.) were surveyed from 29 January–4 March 2021. The survey features insights from 500 CEOs at large companies globally, including 30 CEOs representing the energy industry, on the key challenges and opportunities in driving business growth over the next three years. All respondents represent organizations that have annual revenue over US$500M, and 35 percent of the companies surveyed have more than US$10B in annual revenue.

NOTE: some figures may not add up to 100 percent due to rounding.

Connect with us

The global upheaval brought on by the pandemic has tested energy companies, yet abundant opportunities lie ahead for the industry. For more information about this survey and risk management for today’s global energy industry, connect with us today.

Subscribe to the Global Energy Institute

Receive valuable insights covering critical business topics and industry issues.

Follow us on LinkedIn

View regular energy content on our LinkedIn showcase page