Panama - Taxation of cross-border mergers and acquisitions

Taxation of cross-border mergers and acquisitions for Panama.

Taxation of cross-border mergers and acquisitions for Panama.

Introduction

The signing of several free trade agreements (FTA) and the ambitious Panama Canal expansion are tangible signs that Panama is opening its economy to the global market. As a result, Panamanian companies are working to increase their competitiveness. Mergers and acquisitions (M&A) are increasingly common in Panama in recent years, and they are seen as the best way for companies to position themselves in the regional and global economies. Panama’s largest banks have merged during a period of strong growth in practically every industrial sector, and this growth is expected to continue.

Merger procedures in Panama are mainly governed by Law No. 32 of 1927, which regulates corporations in general, and also by Executive Decree 18 of 1994, which sets out the accounting procedures that must be applied to effect a tax-exempt merger.

Spin-off procedures are governed by Law 85 of 2012, which is applicable to corporations regulated by the Commerce Code. These provisions allow for tax-free spin-offs if taxpayers meet certain conditions, basically that:

- corporations involved in the spin-off procedures are owned by the same shareholders

- any assets involved in the spin-off procedures are transferred at book value.

Recent developments

Some recent legal developments relating to M&A include the opinion to spin off corporations based on Law 85 of 2012 and the entry into force of a number of conventions for the avoidance of double taxation.

In the last several years, Panama has signed such tax treaties with the following countries: Barbados, Czech Republic, France, Ireland, Israel, Luxembourg, Mexico, the Netherlands, Portugal, Qatar, Singapore, South Korea, Spain, United Arab Emirates, United Kingdom and Italy (all of which are now in effect). The provisions of these treaties may benefit merger procedures involving companies that are resident in states with which Panama has signed tax treaties.

On 24 January 2018, Panama signed the Multilateral Convention to implement Tax Treaties related to prevent Base Erosion and Profit Shifting (BEPS). With this signing, Panama has shown its intention to comply with OECD standards and cooperate with the international community regarding tax matters. The law was ratified in late 2020 and will be effective as of March 2021.

Asset purchase or share purchase

Sales of shares and assets are subject to a 10 percent capital gains tax. However, there are certain advance taxes that may reduce even further the capital gains tax.

In Panama, most acquisitions take the form of share purchases. This usually results in lower taxes because buyers are required to withhold 5 percent of the transfer price as an income tax advance. The seller can regard this advance as the final tax, which is often lower than the tax that would have been paid if the 10 percent rate were levied on the actual gain arising from the sale of shares or assets.

In some cases, 10 percent of the gain from the sale of the assets can be less than 5 percent of the purchase price of the shares. In these circumstances, tax refunds are available if certain conditions are met. Also, acquisitions by means of an asset purchase are preferable in these circumstances unless a tax treaty provides for a lower capital gains tax on the sale of shares or exempts the transaction altogether.

Please note that article 117-D of the Panamanian Fiscal Code establishes that when transfers of shares which do not generate any income (without consideration) are performed, such transfers will not be subject to capital gains tax; therefore, it will not be required to withhold, provided that the characteristics of the operation matches the criteria listed in said article (i.e. the transfer benefits the government or a public institution).

This would be applicable as well for the dispositions contained on Article 117-D, subparagraph “e”, which addresses the instances in which a transfer of shares is made for consideration, but the operation did not generate any income (gains). In such instances, the parties are required to explain the reasons for which the operation did not perceived any gains by means of an affidavit.

Purchase of assets

The taxable income in a real estate purchase is the purchase price less the basic cost of the asset, the value of the improvements made to it and the costs associated with the sales operation. As of 17 September 2009, taxpayers are obliged to pay an income tax advance equivalent to 3 percent of the total value of the transfer or the cadastral value, whichever is higher. This advance can be considered as the final tax; however, if the advance is higher than the result of applying the 10 percent rate to the profit arising from the transfer, the seller could file a tax refund or tax credit request.

If such tax is paid, the income from the sale is not considered as part of the company’s taxable income subject to the ordinary 25 percent corporate tax rate. This provision aims to protect natural persons from being taxed at inappropriately high rates because of abnormally high personal income resulting from the sale of a property. For companies, the provision establishes a sort of preferential regime for the transfer of real estate.

Purchase price

Previously, Panama imposed no rules to set the prices at which such transactions should be made. Panama enacted transfer pricing legislation that largely follows the Organization for Economic Co-operation and Development (OECD) transfer pricing guidelines. Compliance with these rules should be considered when setting the price of transactions between related parties.

Goodwill

Income tax regulations allow the deduction of certain intangibles, although not specifically goodwill. Certain challenges made by the Tax Administration in this regard are currently under review by the Administrative Tax Court. The main requirement for the deduction of the intangible’s amortization is that the transaction must be taxable for the party that has transferred the intangibles.

Depreciation

Panamanian tax regulations allow three main methods of depreciation calculation. Taxpayers are not required to apply the same depreciation method to all of their assets. The three methods are:

- straight-line method

- decreasing balance method

- sum-of-digits method.

Taxpayers could also use other methods for some or all of their assets, provided the method is considered as appropriate for the specific industry.

Buildings and improvements have a minimum depreciation period of 30 years, while the period is 3 years for other fixed assets.

Tax attributes

In most situations, mergers have no effect on fiscal rights or benefits or on the amortization of assets that can be used by the new company in the future. However, any losses carried forward by the absorbed entity are not deductible by the surviving company.

Value Added Tax

The sale of real estate is not subject to Panama’s Value Added Tax (ITBMS by its Spanish acronym), which is levied at a rate of 7 percent on the transfer of movable goods and the provision of services. Asset purchases are generally subject to ITBMS if assets other than immovable property are involved in the transaction (e.g. equipment, machinery, vehicles). Mergers that take place in accordance with Executive Decree No. 18 of 1994 are specifically excluded from ITBMS.

Transfer taxes

Mergers in accordance with Executive Decree No. 18 of 1994 are not subject to stamp tax. The transfer of real estate is subject to a 2 percent transfer tax of the sale value or the updated cadastral value (whichever is higher).

Mergers under a share purchase agreement are subject to stamp tax. The tax does not apply to mergers under an asset sale agreement, provided ITBMS has been applied.

Purchase of shares

The sale of shares, bonds and other securities is taxable if they relate to entities that have activities in Panama that generate taxable income or capital economically invested in the country. Income from a public stock offering is treated as capital gains and taxed at a fixed rate of 10 percent.

The buyer must withhold 5 percent of the purchase price and remit it to the tax authorities within 10 days of the payment date as an advance income tax payment. The seller is entitled to consider the withheld amount as the final income tax payment.

If the advance sum exceeds 10 percent of the capital gain, the seller can submit a request to the tax authorities for the excess to be deemed an income tax credit for the year in which the sale of shares took place.

On the other hand, Panamanian Tax Law provides an exemption for the capital gains withholding tax mentioned above. In case the share transfer is made at no consideration, or if such transfer is made equal or below the share´s book value, there is no obligation to withhold and pay the capital gains tax. Nevertheless, in order to apply for this exemption, a filing containing a certification by a certified accountant must be presented before the Tax Authorities.

Also, the tax treatment may be affected by the application of a tax treaty, which may grant a more favorable result.

Tax losses

Capital losses are not considered deductible against ordinary income. The tax loss carry forward of a company that is absorbed in a merger may not be applied by the absorbing entity.

Pre-sale dividend

If a company with undistributed profits is about to be sold, in some cases, it may be better to distribute such profits, pay the corresponding dividend (10 or 5 percent) tax and deduct the profits from the sale price. Distributing the profits reduces the taxable basis for the 5 percent capital gains withholding.

Since, in most cases, the company has already paid the dividend tax advance (known as complementary tax), the applicable dividend tax is a maximum of 6 percent (rather than 10 percent). This may result in a lower overall tax than would have been the case if the company were simply sold without distributing the retained profits. The dividend tax may be reduced or exempted by an applicable tax treaty.

Transfer taxes

The share purchase agreement would be subject to stamp tax at a rate of 0.10 per 100 US dollars (USD) of the purchase price stated in the agreement.

Choice of acquisition vehicle

There are several possible acquisition vehicles, but some are more convenient than others. The characteristics of each vehicle are summarized below.

Local holding company

A Panama holding company must pay dividend tax at the rate of 10 or 5 percent on the dividends it received from the purchased company depending on the source of the profits. The tax is withheld at source. The holding company can then distribute the profits to its shareholders without further tax payments.

Foreign parent company

A foreign company is subject to a dividend tax on the acquired Panamanian entity’s distributed profits. Panamanian corporate law does not allow mergers between local and foreign entities unless the foreign entity is itself registered in Panama.

Panama has signed tax treaties with a number of countries (see recent developments earlier in this report and the table at the end of this report). Panama’s tax treaty network should be considered when establishing a foreign parent company.

Non-resident intermediate holding company

A non-resident intermediate holding company is also subject to the dividend tax and cannot be merged with the Panamanian entity.

As noted, Panama’s tax treaty network should be considered when establishing a foreign parent company.

Local branch

For corporate law purposes, the local branch of a foreign entity is not considered as a Panamanian company, so a merger cannot be accomplished. The foreign company would need to change its domicile to Panama for corporate purposes in order to be a part in a merger process.

Joint venture

Joint ventures are considered in Panama’s commercial law as sociedades accidentales, and they are typically used as non-corporate vehicles for the development of infrastructure projects. Joint ventures are not considered as persons from a legal standpoint, which limits their usefulness for holding purposes.

Choice of acquisition funding

The buyer may choose to fund the acquisition with either debt or equity. The characteristics of each option are summarized below.

Debt

When funding a merger with debt, interest deductibility and withholding taxes (WHT) are key factors that must be taken into account.

Interest on loans provided for the acquisition of shares is not deductible because the holding company would generate dividend income subject to a special regime (i.e. dividend tax withheld at source).

For asset purchases, interest is deductible for the entity bearing the financing and taxable for the recipient.

Deductibility of interest

The acquiring company cannot deduct the interest paid on a loan obtained to purchase the shares of the acquired company. Merging both entities may create an opportunity to deduct interest incurred in the acquisition.

Withholding tax on debt and methods to reduce or eliminate it

Interest, commissions and other charges paid to foreign creditors on loans or financing are subject to a 12.5 percent effective income tax rate, which the debtor must withhold. Since Panama now has a number of tax treaties in force, it is possible to reduce the withholding.

Equity

Capital contributions are not taxable, but any capital reduction shall be preceded by a distribution of any retained earnings.

Note that Panama does not tax the issue of shares or corporate capital contributions.

Deferred settlement

If the shares will be paid in several installments over a period of time, it could be agreed that such shares are to be transferred in separate packages, with capital gains tax assessed on each batch.

Other considerations

The buyer is obliged to withhold 5 percent of the transfer price as an income tax advance. If not, the tax authorities can demand either the selling company or the target company to pay the corresponding tax.

Concerns of the seller

The seller’s main concern is the lengthy process to obtain a tax refund where the 5 percent withholding made by the buyer turns out to be higher than 10 percent of the actual gain.

Company law and accounting

Mergers that do not comply with the above provisions are considered as taxable transactions. The merger agreement between the merging companies must comply with the provisions of Law 32 of 1927, which regulates companies. For the merger to become effective, the agreement must be registered at the public registry.

All registered properties of the merging companies should be registered under the name of the surviving or merged company, according to the merger agreement and subject only to the payment of the applicable public registry rates.

The Directorate General of the Revenue should be informed of a merger within 30 days of its registration at the public registry. The surviving or merged company acquires the tax obligations of the merging companies but cannot deduct the merging company’s losses.

Mergers by creation (consolidation) are subject to the rates for registering a new company, and mergers by absorption are subject to the rates for registering the increase of authorized capital, if any, of the surviving company. Where there is no increase in capital, the applicable rate is the rate for registering company minutes.

Shareholders of the extinguished company are not subject to income tax, income tax on dividends or complementary tax if they only receive share certificates in return for the shares they held in the extinguished company. They are also exempt from the above-mentioned taxes where they receive small cash payments to avoid the elimination of the surviving company’s stock, as long as the payments do not exceed 1 percent of the value of the shares received by the shareholders in return of their shares in the extinguished company.

Demergers governed by Law 85 of 2012 are tax-free if certain conditions are met by taxpayers, basically that:

- corporations involved in spin-off procedures are owned by the same shareholders

- any assets involved in the spin-off procedures are transferred at book value.

Foreign investments of a local target company

Mergers involving one or more foreign companies are recognized by the Commercial Code, subject to the condition that those companies are registered with the Public Registry of Panama. Where the surviving company is a foreign company, a 5-year period of registration is required after the merger has taken place.

Comparison of asset and share purchases

Advantages of asset purchases

- If the capital gain is low, the 10 percent tax on the gains would be lower than the 5 percent tax that would apply on the total value of a share transfer.

Disadvantages of asset purchases

- The transfer of real estate is subject to a 2 percent transfer tax.

- The transfer of movable property (e.g. machinery, equipment, vehicles) is subject to the 7 percent ITBMS (Panama’s Value Added Tax).

- The tax is ultimately levied on the capital gain at a rate of 10 percent. The taxpayer is still obliged to pay 3 percent of the total value of the transfer as capital gains tax; where this amount is higher than 10 percent of the actual gain, a refund or a tax credit may be requested from the Tax Administration.

Advantages of share purchases

- Seller may choose to treat the 5 percent withholding on the purchase price as the final tax.

- Transfer is not subject to any other taxes.

Disadvantages of share purchases

- In some circumstances, the 5 percent withholding on the transfer value exceeds the 10 percent of the actual gain. The withholding must still be made and the seller must then apply to the Tax Administration for a refund. The refund process may be lengthy.

- Challenges related to the pushdown of goodwill and/or debt should be carefully analyzed.

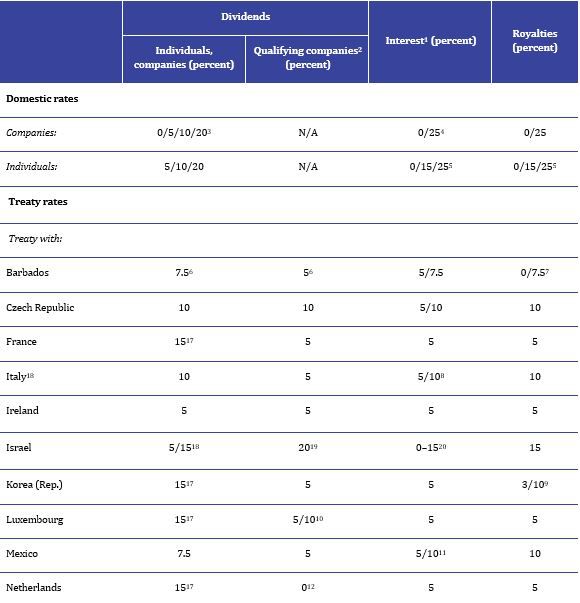

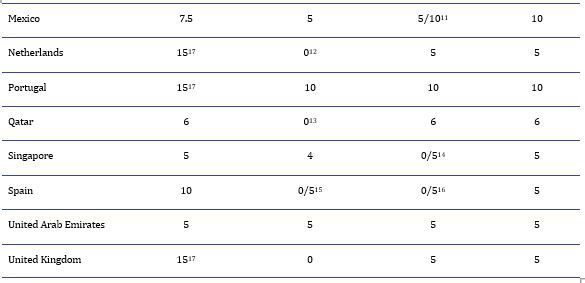

Panama — Withholding tax rates

This table sets out reduced WHT rates that may be available for various types of payments to non-residents under Panama’s tax treaties. This table is based on information available up to February 2018.

Source: Double taxation treaties signed by the Revenue Office of Panama, 2018

Notes:

- Many treaties provide for an exemption for certain types of interest (e.g. interest paid to the state, local authorities, the central bank or specific credit institutions).

- These rates generally apply when a minimum participation in the voting power or capital is met by the beneficial owner.

- The 0 percent rate only applies when the company does not carry out any taxable activities in Panama and only generates foreign source income. The 5 percent rate applies to dividends arising from foreign source profits. The 10 percent rate applies to dividends arising from Panamanian source profits. The 20 percent rate applies to bearer shares.

- Subject to (final withholding) taxation at the general corporate or personal income tax rate on 50 percent of the gross amount. Effective corporate WHT rate is 12.5 percent.

- Individuals are subject to progressive tax rates ranging from 0 to 25 percent, which is applied on 50 percent of the gross amount.

- This rate does not apply to dividends paid on bearer shares.

- The 0 percent rate applies to royalties, including scientific work related to the biotechnology industry, literary work and cinematographic work.

- The 5 percent rate applies to interest paid to the banks.

- The 3 percent rate applies to royalties from the use of, or the right to use, industrial, commercial or scientific equipment.

- The rate applies with respect to direct participations of at least 10 percent of capital.

- The lower rate applies to interest paid to banks.

- The 0 percent rate applies with respect to participations of at least 15 percent of the capital of the company paying the dividends, and to participations of pension fund.

- The 0 percent rate applies to dividends paid to the other state or local authorities, the central bank, pension funds, investment authorities or any other state-owned institution or fund.

- The 0 percent rate applies to interest (i) paid to the government, and (ii) paid to banks.

- The 0 percent rate applies with respect to participations of at least 80 percent of the capital (additional specific conditions apply). The 5 percent rate applies with respect to participations of at least 40 percent of the capital.

- The 0 percent rate applies to interest (i) paid to (or by) the state, local authorities or the central bank, (ii) paid to specific credit institutions, (iii) interest paid on sales on credit, and (iv) pension funds.

- Although these treaties allow a rate of 15 percent, Panamanian domestic law only allows for a rate of up to 10 percent. Dividends paid out of bearer shares could be subject to a 15 percent rate instead of 20 percent, but in some treaties, dividends are not covered by treaty benefits and are therefore taxed at the ordinary 20 percent rate.

- The 5 percent rate applies to pension plans.

- For direct participations of at least 10 percent of capital, the rate cannot exceed the 20 percent rate. However, Panamanian domestic law only allows for a rate of up to 10 percent.

- The 0 percent rate applies to (i) contracting state, central bank or any local authority if they are the effective beneficiary, (ii) if the interest is paid by the government, central bank or local authority, (iii) pension plan, and (iv) corporate bonds listed on a stock market of the contracting state.

KPMG in Panama

Luis Laguerre

KPMG

PDC Tower, 8th Floor

56th St. Samuel Lewis Ave.

Panama City,

Republic of Panama

T: +507 208 0710

E: llaguerre@kpmg.com

This country document does not include COVID-19 tax

Click here — COVID-19 tax measures and government reliefs

This country document is updated as on

1 January 2021.