People’s Republic of China – IIT Preferential Treatment: Preparing for Change

CN – IIT Preferential Treatment: Plans for Change

There is continued uncertainty over whether preferential individual income tax (IIT) policy in the People’s Republic of China (“PRC”) will be extended beyond 2021. To aid companies and their employees with tax planning for tax year 2022, this GMS Flash Alert offers thoughtful analysis of the possible financial impact and the relevant considerations should the preferential IIT policy cease to apply. The authors look at the possible IIT treatment of annual bonuses, equity-based incentives, and certain expatriate fringe benefits-in-kind.

Highlights

As the second quarter of 2021 approaches, the uncertainty over whether preferential individual income tax (IIT) policy in the People’s Republic of China (“PRC”) will be extended beyond 2021 continues. To aid companies and their employees with tax planning for tax year 2022, we analysed the possible financial impact and the relevant considerations should the preferential IIT policy cease to apply. In particular, this article discusses the PRC IIT treatment applicable for annual bonuses, equity-based incentives, and certain expatriate fringe benefits-in-kind under the prevailing PRC IIT regulations, and provides an analysis of the trend of preferential tax policies in the PRC.

WHY THIS MATTERS

While preferential IIT policy provisions that may be elected for tax year 2021 are clear, uncertainties remain with the application of the relevant calculation method for certain income to be derived in tax year 2022 and beyond. Companies and individual taxpayers should consider whether to elect the applicable preferential policies based on their personal circumstances in accordance with the prevailing PRC IIT law and regulations.

Background

On 27 December 2018, the Ministry of Finance and the State Taxation Administration jointly released Circular 164 entitled “Notice of issues concerning the transitional policies on preferential tax treatments under the amended PRC IIT law.”1 In this circular, preferential calculation methods for determining IIT payable on annual bonuses, equity-based incentives and certain expatriate fringe benefits-in-kind were outlined and are applicable until 31 December 2021. (For prior coverage, see GMS Flash Alert 2019-12 (25 January 2019).)

Context and Scenarios

Below is an overview of the potential financial impact to individual taxpayers, should the preferential IIT policy cease to apply at the end of December 2021.

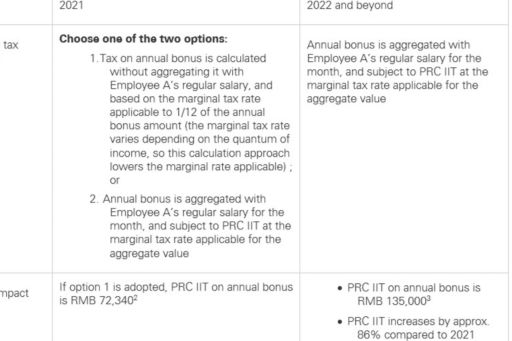

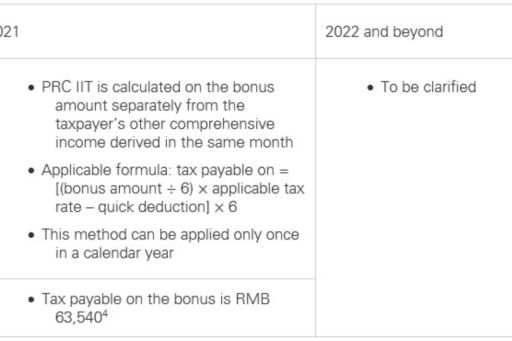

Annual Bonus

Case study 1: Employee A, who is a non-PRC-domiciled individual, earns a monthly salary of RMB 100,000, and receives an annual bonus of RMB 300,000 in December.

PRC IIT treatment

Employee A’s PRC tax residency in the year in which the income is received should be evaluated in advance based on contractual terms and the other factors, and the amount of tax payable should be calculated accordingly.

- The resident scenario

Case study 1: Employee A, who is a non-PRC-domiciled individual, earns a monthly salary of RMB 100,000, and receives an annual bonus of RMB 300,000 in December.

PRC IIT treatment

Employee A’s PRC tax residency in the year in which the income is received should be evaluated in advance based on contractual terms and the other factors, and the amount of tax payable should be calculated accordingly.

- The resident scenario

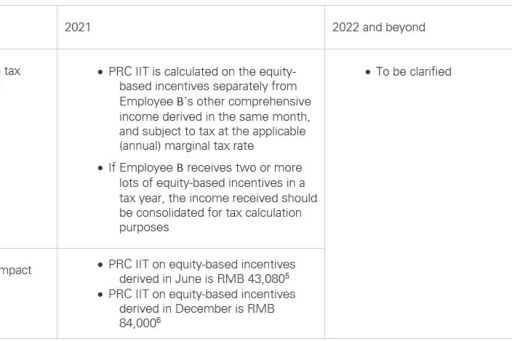

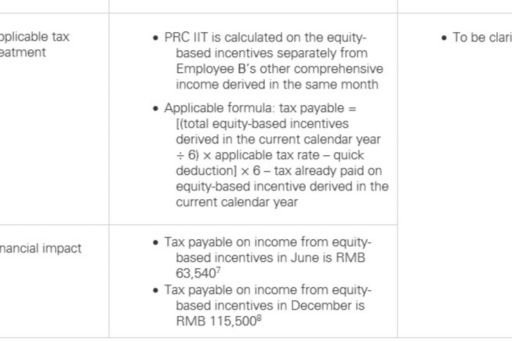

Equity-based Incentives

Case 2: Employee B, who is a non-PRC-domiciled individual, obtained equity-based incentives in the value of RMB 300,000 in June and another lot of RMB 300,000 in December. The relevant criteria for preferential IIT policy are fulfilled.

PRC IIT treatment

Employee B’s PRC tax residency in the year in which the income is received should be evaluated in advance based on contractual terms and other factors, and the amount of tax payable should be calculated accordingly.

- The resident scenario

- The non-resident scenario

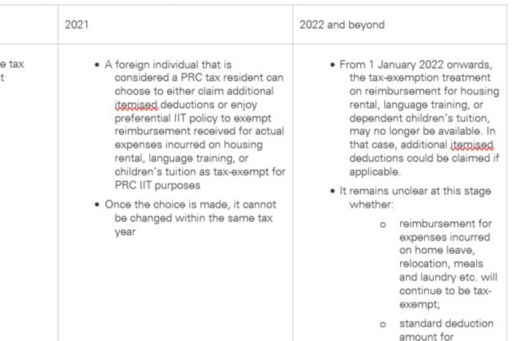

Certain Expatriate Fringe Benefits-in-Kind

Case 3: A foreign individual who is a PRC tax resident earns a monthly salary of RMB 100,000 and spends RMB 30,000 on monthly rent, and RMB 300,000 on the individual’s children’s education every year. These expenses are reimbursed by the employer based on valid supporting documents.

KPMG NOTE

While KPMG in the PRC anticipates that the Chinese authorities will announce policies or guidance in relation to the tax treatment of certain employment remuneration items discussed in this article in the coming months, we recommend that companies and individual taxpayers consider the following well in advance in preparation for tax year 2022:

- Keep abreast of policy updates to help ensure appropriate company and personal budgeting are performed on a timely basis;

- Perform a cost analysis based on policy updates, review and adjust the company policies to facilitate talent attraction and retention;

- Communicate with employees in a timely manner on regulatory changes, potential financial impact to foster workforce stability;

- Review and assess eligibility for existing financial subsidy programmes (such as preferential IIT policies for attracting highly-skilled talent to work in the Greater Bay Area, Shanghai Free Trade Zone Lingang New Area, and Hainan Free Trade Port) and apply accordingly to effectively minimise financial burden which may arise from cessation of preferential IIT policy.

In view of the complexity and technicality of tax-related matters, companies and individual taxpayers may also consider seeking support from professional institutions to make sure that they fulfil their obligations accurately and in a timely manner and avail themselves of the preferential policies they are eligible for.

We will monitor the latest developments in preferential IIT policies and discuss policy trends and practical cases with local tax authorities. Companies and individuals interested in learning more about the latest developments and hot topics are welcome to get in touch with us.

FOOTNOTES

1 Caishui [2018] No. 164 - Notice of issues concerning the transitional policies on preferential tax treatments under the amended IIT law (“Circular 164”).

2 Tax payable on bonus = RMB 300,000 x 25% - RMB 2,660 = RMB 72,340 (tax is borne by the individual).

3 Tax payable on bonus = RMB 300,000 x 45% = RMB 135,000 (tax is borne by the individual).

4 Tax payable on bonus = (RMB 300,000 / 6 x 30% - RMB 4,410) x 6 = RMB 63,540 (tax is borne by the individual).

5 Tax payable on equity-based incentives derived in June = RMB 300,000 x 20% - RMB 16,920 = RMB 43,080 (tax is borne by the individual).

6 Tax payable on equity-based incentives derived in December = (RMB 300,000 + RMB 300,000) x 30% - RMB 52,920 – RMB 43,080 = RMB 84,000 (tax is borne by the individual).

7 Tax payable on equity-based incentives derived in June = (RMB 300,000 / 6 x 30% - RMB 4,410) x 6 = RMB 63,540 (tax is borne by the individual).

8 Tax payable on equity-based incentives derived in December = [(RMB 300,000 + RMB 300,000) / 6 x 45% - RMB 15,160)] x 6 – RMB 63,540 = RMB 115,500 (tax is borne by the individual).

9 Tax payable on reimbursement received for housing rent and dependent children’s tuition = (RMB 30,000 x 12 + RMB 300,000 – RMB 1,500 x 12 (special additional deduction for rent currently applicable to taxpayers in Shanghai) – 1,000 x 12 (special additional deductions for children’s education currently applicable)) x 45% = RMB 283,500 (tax is borne by the individual).

RMB 1 = EUR 0.13

RMB 1 = USD 0.15

RMB 1 = GBP 0.11

RMB 1 = TWD 4.31

RELATED RESOURCE

This article is adapted, with permission, from “Current main preferential policies and changing trends of China's personal income tax” in China Tax Alert (Issue 5, February 2021), a publication of the KPMG International member firm in the People’s Republic of China.

The information contained in this newsletter was submitted by the KPMG International member firm in the People’s Republic of China.

VIEW ALL

SUBSCRIBE

To subscribe to GMS Flash Alert, fill out the subscription form.

© 2024 KPMG Advisory (China) Limited, a wholly foreign owned enterprise in China and KPMG Huazhen, a Sino-foreign joint venture in China, are member firms of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

KPMG International Cooperative (“KPMG International”) is a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.