Japan – National Pension Insurance: Revised Upper Limit on Salary Base

Japan–Nat'l Pension Ins: Revision of the Upper Limit

Under new legislation passed in Japan, as of September 1, 2020, the upper limit of the monthly standard salary for employee’s pension insurance has changed. Employees will begin feeling the effects of the change in the October payroll.

Highlights

The Japanese government passed legislation revising the terms of the Employees’ Pension Insurance Law with respect to setting the standard classification of the monthly remuneration to which the national pension charge applies. The new law, and the change in the upper limit of the monthly standard salary, came into effect as of September 1, 2020.1

WHY THIS MATTERS

Though more employees will see a greater portion of their monthly salary subject to pension insurance, the changes will help ensure the financial stability of the pension insurance regime. Employers and payroll administrators should waste no time in making the necessary adjustments so that they are in compliance with this change in the rules. Employees will begin feeling the effects of the change in the October payroll.

Background

Pension insurance is one of the three components of the social insurance program in Japan. Any individual who meets the prescribed conditions is expected to participate in the system as an insured person regardless of his or her nationality, unless there is a totalization agreement between Japan and the expatriate’s home country.

KPMG NOTE

It is important to note that not all totalization agreements cover all three components of Japan’s social insurance program. Accordingly, employers should review the agreements closely to understand which components are covered.

Revision of the Upper Limit

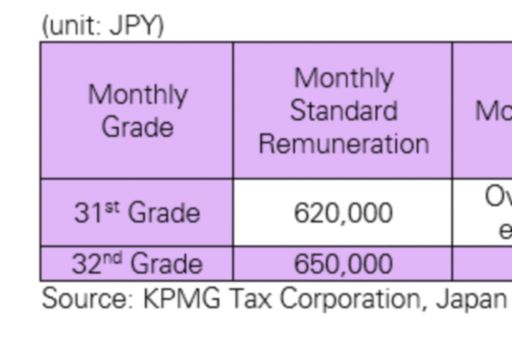

As of September 1, 2020, the upper limit of the monthly standard salary for employee’s pension insurance has changed from 31st grade/JPY 620,000 (approximately USD 5,8002) to 32nd grade/JPY 650,000 (approximately USD 6,165).

The information contained in this newsletter was submitted by the KPMG International member firm in Japan.

No notification is required from the employer regarding this revision. Furthermore, a revision notice will be sent from the Japan Pension Service to an employer who has a new class of insured person, at the end of September 2020.

FOOTNOTES

1 Additional information on this revision can be found at: https://www.nenkin.go.jp/oshirase/taisetu/2020/202009/20200901.html (Japanese only).

2 At USD 1.00 = JPY 105.42.

VIEW ALL

SUBSCRIBE

To subscribe to GMS Flash Alert, fill out the subscription form.

© 2024 KPMG Tax Corporation, a tax corporation incorporated under the Japanese CPTA Law and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.