Philippines – COVID-19: Enhanced Community Quarantine and Income Tax Filing Extensions

Philippines –Cmty Quarantine & Income Tax Filing Exts

Due to the continuing pandemic, the Philippine government has laid down measures that (i) extend the Enhanced Community Quarantine (ECQ) in Metro Manila to 15 May 2020 and (ii) extend filing and payment due dates for 2019 annual income tax returns. Moderate-risk and low-risk areas will be under General Community Quarantine (GCQ).

Due to the continuing pandemic, the Philippine government has laid down measures that (i) extend the Enhanced Community Quarantine (ECQ) in Metro Manila to 15 May 20201 and (ii) extend filing and payment due dates for 2019 annual income tax returns2.

WHY THIS MATTERS

The extension of the ECQ to another fifteen (15) days and consequent extension of tax filing and payment deadlines will be welcome as they afford taxpayers and mobility teams an opportunity to adjust their information gathering, filing, and payment submission timelines. Also, it will help companies with assignees who are on tax equalization manage their cash flows in the short-term.

Enhanced Community Quarantine Extension, Other Areas under General Community Quarantine

The ECQ in the National Capital Region (NCR) and other high-risk areas is extended to 15 May 2020, while moderate-risk and low-risk areas will be under General Community Quarantine (GCQ). Under the GCQ, certain establishments and public transport will be allowed to operate.

All existing circulars, orders, and advisories on travel restrictions and government operations will remain effective until the end of the extended ECQ. (For prior coverage, see GMS Flash Alert 2020-115, 25 March 2020.)

Extension: Tax Filing/Payment and Withholding Exercise for the Months of March and April 2020

In view of the quarantine extension, the BIR issued Revenue Regulations (RR) No. 11-20203 which amends certain provisions of RR No. 10-20204 to further extend the filing and payment deadline for 2019 annual income tax returns to 14 June 2020, without imposition of penalties to taxpayers.

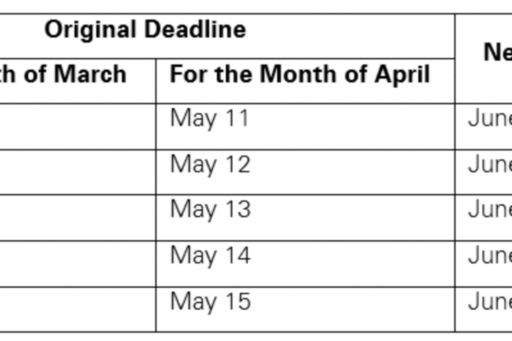

The deadline for the manual tax filing of March and April 2020 payroll withholdings is further extended to 9 June 2020. On the other hand, taxpayers registered in the Electronic Filing and Payment System (eFPS) shall electronically file their tax returns and pay the taxes due thereon based on their industry categories as follows:

(For prior coverage, see GMS Flash Alert 2020-172, 15 April 2020.)

FOOTNOTES

1 See the 24 April 2020 Office of the Presidential Spokesperson press release.

2 See more about this on the website (in English) of the BIR.

3 See the Revenue Memorandum Circular No. 11-2020 dated April 29, 2020.

4 See the Revenue Memorandum Circular No. 10-2020 dated April 14, 2020.

VIEW ALL

The information contained in this newsletter was submitted by the KPMG International member firm in the Philippines.

SUBSCRIBE

To subscribe to GMS Flash Alert, fill out the subscription form.

© 2024 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.