The implications of COVID-19 continue to grow for banks globally, and the additional workload of maintaining operational continuity has pushed banks to reprioritise their project work in the context of resolution planning. Moreover, in Europe we see banks struggling to build up MREL as per the requirements recently set, in particular from the Single Resolution Board (SRB) under its MREL policy. In a recent blog post from Elke König, Chair of the SRB, the SRB’s response to the COVID-19 crisis is summarised, reiterating their commitment to supporting the steps already taken by the ECB, the SSM and national competent authorities to help banks deliver their services to the real economy, and in particular to keep lending. In this article, we discuss recent publications that clarify the SRB’s expectations for banks regarding resolution planning and MREL, challenges that banks must now face, and what the SRB has so far communicated to banks regarding their response to the impacts of the pandemic in the context of the above topics and how they are working closely with banks to mitigate these effects.

It seems to be fitting that Elke König’s blog post on the SRB’s response to the COVID-19 crisis was published on the same day as the SRB finalised their ‘Expectations for Banks’, following a half-year consultation, thereby further demonstrating the SRB’s commitment to working together with banks in both the short- and long-term through the COVID-19 process. This paper and the Work Programme for 2020 published in October 2019 marked a major change in the European approach to bank resolution.

The Work Programme for 2020 set out an ambitious agenda for 2020, with the first two of the SRB’s five strategic priorities carrying the greatest significance for banks.

The first of these is ‘Strengthening the resolvability of SRB entities and LSIs’. This includes:

- Realigning all SRB banks to a 12-month resolution planning cycle;

- Adopting 117 resolution plans, 114 binding external MREL decisions and 340 internal MREL decisions; and

- Communicating bank-specific expectations for resolvability and requesting that banks address any impediments to resolvability.

The second key strategic priority is ‘Fostering a robust resolution framework’. This includes:

- Implementing rule changes required by the new banking package (CRR2, CRD5, BRRD2 and SRMR2);

- Issuing new guidance on bail-ins, continuity, market access and resolvability assessments; and

- Preparing guidance for future OSIs by the SRB.

As banks work to enhance and demonstrate their resolvability, they need to adhere to the new rules set out in ‘Expectations for Banks’, which marks a major push for greater harmonisation. For the first time, this paper gives banks a detailed, standardised set of resolution requirements to implement - following phase-in rules – by 31 December 2023 (except where indicated otherwise). It clarifies the respective roles of the SRB and banks; outlines best practices across seven dimensions of resolvability; and sets out an iterative process for resolution planning, with regular dialogue between banks and IRTs.

We now look at two areas of the new standards that could prove challenging for banks, especially in the context of the COVID-19 crisis.

1. Operational Continuity in Resolution (OCIR)

Evidently, the current crisis is proving to be a difficult environment for banks to continue their operations, operational continuity is once more thrust into the spotlight of banks, supervisors and regulators. One evident problem was the transition of staff to working from home, despite in some cases, shortages of secure hardware and software, and the difficulties some banks have experienced in identifying and prioritising essential processes and the necessary people were another immediate challenge to overcome.

These factors alone make parallels to a resolution situation, in which banks must be able to maintain their core operations and services – including those delivered in partnership with third parties. This underlines the importance of the SRB’s actions around OCIR. The SRB has set some minimum OCIR expectations for banks in 2020, which include:

- Identifying services, operational assets, staff, related contracts and operational interconnections necessary to maintain the continuity of critical functions and core business lines;

- Making a comprehensive assessment of the risks to maintaining OCIR;

- Taking action to address any risks to OCIR, and improving preparedness for resolution;

- Maintaining adequate MIS, databases and reporting processes to support OCIR;

- Implementing adequate governance arrangements over OCIR; and

- Achieving resolution-resilient contracts.

These expectations pose significant practical challenges, as the scope is not limited to critical functions but also comprises core business lines. Due to the high degree of internal operational interconnections of banks, this essentially requires the entire bank to be covered by the analysis. Furthermore, the risk assessment must be comprehensive, meaning that risks and potential events that may result in disruption or discontinuance of the business and possible mitigation measures in their entirety, must be identified and considered. These objectives are far from restricted to resolution situations and make OCIR relevant for the management of all kinds of crises including that of COVID-19.

What are the expectations for European banks?

Regarding specific challenges, banks must identify critical, essential and other relevant services and their key resources (operational assets and staff) using tiered taxonomies and assessing the impact of failures and degrees of substitutability. For the risk analysis, close cooperation between units responsible for operational and financial scenario analyses is necessary to ensure a uniform view of risks and their drivers. Furthermore, the OCIR data must be documented on a searchable database and continuously updated, which will in many cases result in a database that covers the entire operating model of the bank.

Banks must include these OCIR expectations in their resolvability assessments and develop work plans detailing when and how they intend to meet any shortcomings. With the agreement of IRTs, some requirements still may be postponed in response to the crisis, but the SRB intends to maintain its overall work programme and focus on OCIR.

As of now, the COVID-19 crisis will most likely increase the regulatory momentum behind operational resilience in general. In this context, we could expect authorities in the Banking Union to take a closer look at the lessons learnt from the current crisis and take into account consultation papers on operational resilience in the UK which show striking similarities to the requirements on OCIR. We recommend banks consider and further develop OCIR in the overall context of operational resilience in order to leverage existing synergies and build a uniform and sustainable operational resilience framework.

2. MREL, loss absorbing and recapitalisation capacity

The minimum requirement for own funds and eligible liabilities (MREL) aims to ensure that failing banks have the financial capacity to absorb losses and to be recapitalised without the use of public funds. The definition of MREL-eligible liabilities and the methodology to determine minimum requirements on MREL has been under constant revision by the SRB for the recent years, with annual updates to the policy and reporting templates adding complexity to the process.

The latest revision of the MREL framework was published as a public consultation in February 2020. This updated version considers the new MREL methodology which was defined in the new banking package (CRR2/BRRD2/SRMR2). MREL decisions implementing the new framework will be taken based on this policy in the 2020 resolution planning cycle by Q1-2021.

Some of the key areas altered by the MREL policy 2020 include:

- MREL requirements for G SIIs – especially the overlay with TLAC requirements;

- Updates on the subordination requirements;

- Changes to the calibration of MREL, including introducing MREL based on the Leverage Ratio Exposure (LRE) and Total Risk Exposure Amount (TREA)

- Changes to the quality of MREL (e.g. third-country law liabilities etc.);

- Further details on the definition of internal MREL; and

- Transitional arrangements for the phasing-in of MREL targets (intermediate targets in 2022, transitional targets in 2023 and final targets in 2024).

The revised MREL policy poses various challenges for banks. The MREL minimum ratio will no longer be based on the Total Liabilities and Own Funds (TLOF), resolution entities now must fulfil MREL requirements that are based on LRE and TREA. Due to new methodology on calibrating the MREL and subordination requirements, treasury departments are required to once again review the timing and product structure of their current funding plan.

The allocation of MREL instruments within a banking group will be another challenge based on the new regulatory framework with its introduction of the concept of internal MREL. Whereas the external MREL requirement is set for a resolution entity using a hybrid approach (i.e. eligible liabilities issued by the resolution entity and the group’s own funds are attributed towards MREL requirement), non-resolution entities within the banking group are subject to internal MREL. In the 2018 and 2019 resolution planning cycles, the SRB issued binding targets for non-resolution entities of banking groups. This concept will now be rolled out based on the new regulations to an expanded scope of entities within the banking group.

While applying MREL for several years, the industry has significantly strengthened its loss absorbing and recapitalisation capacity, but the COVID-19 pandemic could hinder the positive development for many European banks. During the first few weeks of the pandemic in Europe, banks’ highest priority was to focus on their short-term liquidity, which took precedent over the volume of long-term issuances.

In recent weeks, we have seen credit spreads widen markedly and it seems that investors are especially wary of subordinated bank debt. This is making it increasingly difficult for institutions to issue MREL eligible subordinated debt.

Combined with the latest impact assessment of the SRB, European banks currently report a shortfall of 150 bn to 200 bn EUR to fulfil their MREL requirements (SRB banking industry dialogue meeting - 16 December 2019. The path to compliance with the MREL requirements could be very complicated for some banks.

The SRB’s continued focus to support financial stability and bank resolvability

Both of these documents should be read however in the context of Elke König’s statements on the SRB’s commitment to supporting banks during the COVID-19 crisis. She clarifies that the SRB’s approach is to support banks by using flexibility in the resolution framework, and building on the work already done to foster strong communication channels between bank and authority;

This has already been shown via their letter (PDF 278 KB) sent to banks under their remit on the 25 March. In this letter, the SRB reconfirms their plans to work on the 2020 resolution plans as well as issuing 2020 MREL decisions according to the deadlines of early 2021, but confirms a “pragmatic and flexible approach in order to consider, where necessary, postponing less urgent information or data requests related to this upcoming 2020 resolution planning cycle”

Furthermore, the letter recognises challenges from resource constraints and adverse market conditions, and states that IRTs will assess any difficulties banks may have in either reporting or achieving their work plans on a case-by-case basis.

With respect to MREL, the SRB maintained that it will carefully monitor the market conditions in the next months and analyse the potential impact on transition periods needed for the build-up of MREL, and made further clarifications in another blog post from 8 April, stating:

- For the implementation of the 2020 resolution planning cycle, including, changes to MREL decisions under the new banking package (BRRD2/SRMR2), new MREL targets will be set according to the transition period in SRMR2, i.e. setting the first binding intermediate target for compliance by 2022 and the final target by 2024. The decisions will be based on recent MREL data, and reflect changing capital requirements.

- For existing binding targets from 2018 and 2019, the SRB intends to take a forward-looking approach to banks that may face difficulties meeting those targets before new decisions (with 2022 intermediate targets) take effect. She confirms the SRB’s focus will be on the 2020 decisions and targets, again asking for banks to meet relevant data reporting requirements.

Therefore, what is clear is that the SRB is treating the COVID-19 as a moving target, ready to use the flexibility allowed in the resolution framework to ensure a level-playing field and banks are able to operate to support the economy.

Looking ahead

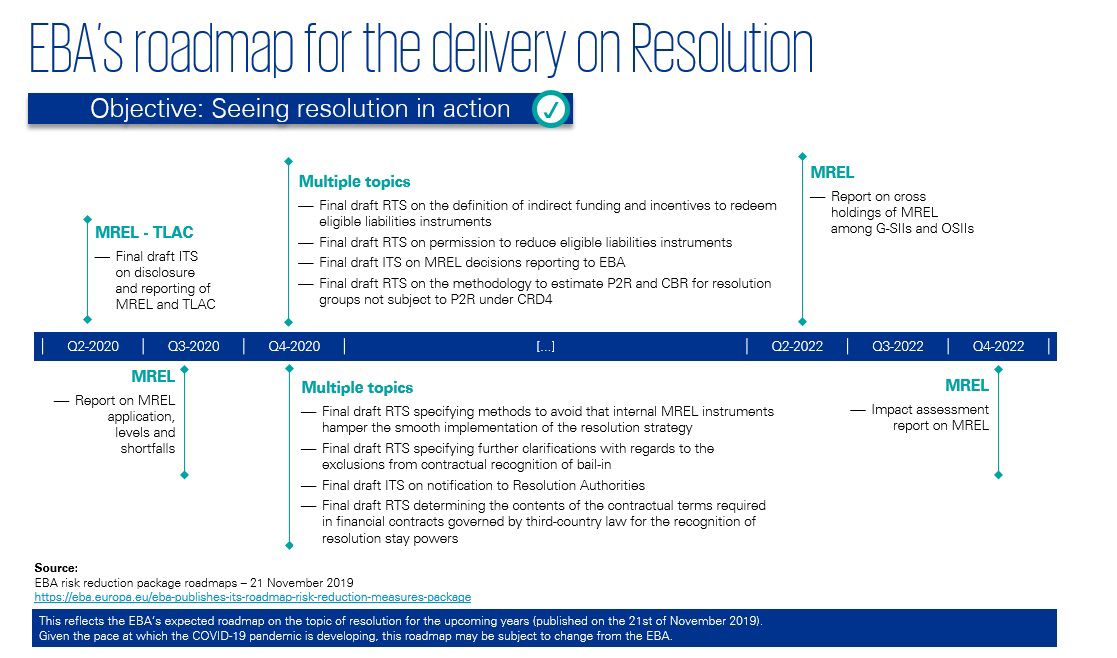

In closing, it is worth remembering that the SRB is not the only body driving changes to resolution mechanisms. While allowing for some potential adjustments due to the pandemic, banks should take note of the EBA’s roadmap (PDF 2.24 MB) for upcoming actions on resolution. This includes a plan to release multiple regulatory technical standards (RTS) during the last quarter of 2020 (see Figure 1), in order to “contribute to implement some outstanding elements to progress and complete the European post-crisis regulatory reforms, in particular in order to achieve an effective and credible bail-in tool through a strengthening of the MREL framework”.

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

In short, banks are beginning a new cycle of resolution activity, with the focus firmly on implementation. The current situation is disruptive and calls for a flexible response, but it also underlines the need for banks to maintain their focus on resolution. The next five years will be busier than the last - especially considering the effect of COVID-19 on the industry.