South Korea – Filing and Payment Extensions for Individual Income Tax Returns

So. Korea–Extensions for Individual Income Tax Returns

Due to the global health pandemic caused by the coronavirus and COVID-19, South Korea’s government has postponed the tax payment due date for individuals filing tax returns. While for most people, tax returns must be filed by the original due date, taxpayers with confirmed COVID-19 diagnoses and individuals living in the “COVID-19 Emergency Area” will have deferred filing deadlines.

Due to the global health pandemic caused by the coronavirus and COVID-19, South Korea’s government has postponed the tax payment due date for individuals filing tax returns.1

Taxpayers will have until 31 August 2020 to pay both national income and local income taxes, as a relief measure in response to the pandemic. The extended deadline does not apply to tax return due dates.

WHY THIS MATTERS

Taxpayers or companies responsible for South Korean income taxes on behalf of their expats are granted three more months to pay both national income and local income taxes. Global mobility teams providing tax services should take the updated timetable into account when considering assignees’ tax compliance processes and related assignee communications.

The steps taken to delay the tax filing and payment deadlines generally give taxpayers some very welcome breathing room to preserve their cash-flow and take additional time to organise their financial and tax affairs in these trying times.

New Timetable for Income Tax Returns and Tax Payments

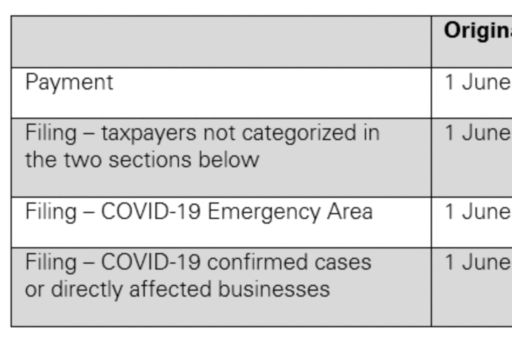

While the payment due date for all taxpayers has been extended, most taxpayers are still required to file their tax returns by 1 June 2020, the original filing due date.

The table below sets out the extension measurements in detail:

KPMG NOTE

We do not expect this measure will have a significant impact on the filing due date for the GMS population unless they are residing in the COVID-19 emergency area, i.e., Daegu, Gyeongsan, Cheongdo, and Bonghwa.

FOOTNOTE

1 For an announcement (in Korean) of the delayed filing timetable, see the website for South Korea’s Ministry of Economy and Finance at: http://www.moef.go.kr/nw/mosfnw/detailInfograpView.do?searchNttId1=MOSF_000000000033096&menuNo=4040500.

VIEW ALL

The information contained in this newsletter was submitted by the KPMG International member firm in South Korea.

SUBSCRIBE

To subscribe to GMS Flash Alert, fill out the subscription form.

© 2024 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.