Malaysia – Various Tax Deadlines Extended Due to COVID-19

Malaysia – Various Tax Deadlines Extended Due

The Malaysian Inland Revenue Board (“MIRB”) has set out a new timetable for certain personal tax filing and employer compliance obligations (including due date extensions) in light of the COVID-19 crisis. Also, the MIRB has closed all its office premises until 14 April 2020 – but is providing some limited services.

In line with the announcement by Prime Minister Tan Sri Muhyiddin Yassin of Malaysia on the implementation of the Movement Control Order (“MCO”)1 to limit the outbreak of COVID-19, the Malaysian Inland Revenue Board (“MIRB”) has closed all its office premises from 18 March 2020 until 14 April 2020.2 Nevertheless, the MIRB will continue to provide phone services and its online services (e.g., if there any queries regarding taxation, taxpayers may use the Customer Feedback Platform available at the MIRB’s Official Portal, the e-filing password can be reset using “Forgot Password Menu” at ezHAsiL).

WHY THIS MATTERS

The policies ushered in by Malaysia’s government offer deadline delays for certain submissions of returns/forms/documents/notifications, tax payments, and other compliance obligations, and generally give taxpayers some very welcome breathing room to preserve their cash-flow and take additional time to organise their tax affairs in these trying times.

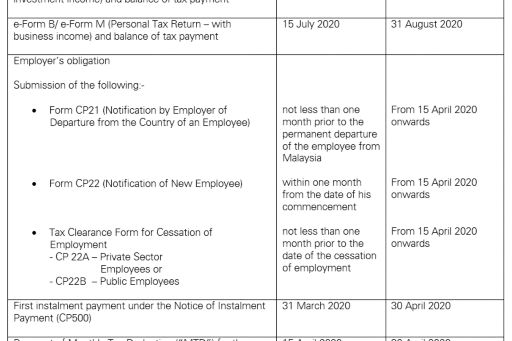

New Timetable for Certain Personal Tax Filing, Employer’s Obligations

The extension of time is set out in the table below.3

KPMG NOTE

To facilitate taxation matters during the MCO period, the extension of time for submissions of returns/forms/documents/notifications, tax payments, and applications to the MIRB, has been granted by the MIRB.

FOOTNOTES

1 For prior coverage, see GMS Flash Alert 2020-107 (25 March 2020).

2 See Frequently Asked Questions (PDF 558 KB).

3 See the extension of time (PDF 1 MB).

RELATED LINKS

The information contained in this newsletter was submitted by the KPMG International member firm in Malaysia.

SUBSCRIBE

To subscribe to GMS Flash Alert, fill out the subscription form.

© 2024 KPMG Tax Services Sdn Bhd., a company incorporated under the Malaysian Companies Act 1965 and a member of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.