The past few months have seen a significant improvement in the co-ordination of European bodies’ approaches to reducing the continent’s levels of non-performing exposures (NPEs). Closer alignment between the prudential and supervisory backstop means that banks can move forward and develop a strategic approach to NPEs. There is much work to do, and more changes to come, but the direction of travel looks encouraging.

One of the key moments came on the 22nd August 2019 with the ECB’s publication of a communication on supervisory coverage expectations for NPEs (PDF 106 KB). This will complete the process launched in March 2018 with the ECB addendum (PDF 459 KB) leading to the implementation of minimum coverage by the banking industry.

Following the signposts revealed by Andrea Enria in his speech of June 2019, the ECB has decided to align its Pillar II approach to NPEs with the legally binding Pillar I provisioning requirements set out in the Regulation (EU) 2019/630 (PDF 416 KB) amending the CRR as regards minimum loss coverage for non-performing exposures.

Closing the gap between the ‘prudential backstop’ and the ‘supervisory backstop’ is great news for banks, and significantly clarifies what had previously been a potentially confusing picture.

There are two major changes to take into account for banks.

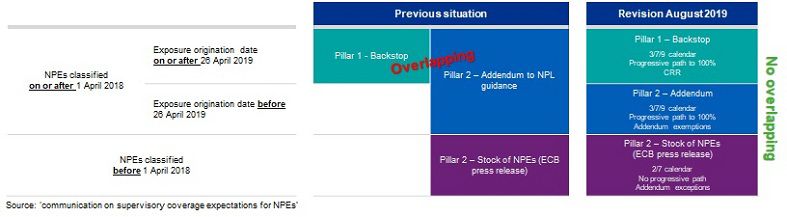

First, the scope of supervisory expectations for new NPEs1 will be limited to loans that were originated before 26 April 2019, and which are not subject to Pillar I treatment (see Figure 1)

Figure 1: Summary of previous and adjusted supervisory and regulatory approaches to NPE coverage

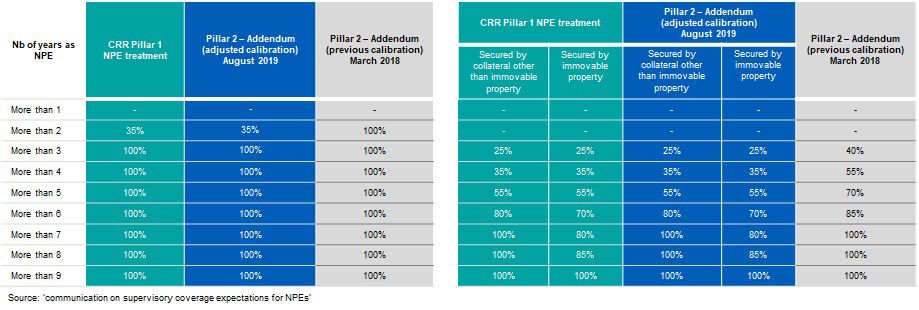

Second, the ECB's time frames for prudential provisioning, the path to full implementation and the split between secured and unsecured exposures have been aligned with the treatment under Pillar I (see Figure 2).

Figure 2: Adjusted calibration of coverage expectations for new NPEs subject to the ECB's NPL Guidance

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

This should go a long way towards simplifying the complex ‘provisioning calendar’ for new NPEs – featuring a variety of timelines, scopes of application, provisioning requirements and levels of detail – that banks were previously struggling to clearly understand and manage.

Supervisory expectations for the stock of NPEs (i.e. loan classified as NPEs on 31 March 2018) remain unchanged and have to be applied as requested by the ECB in the Supervisory Review and Evaluation Process (SREP) letters sent to banks.

The alignment of rules for new NPEs makes clearer the possibility of implementing the expectations efficiently and defining a clear strategic approach to NPEs. Depending on the origination date, non-compliance will lead to deductions from banks own funds (for new NPEs with an origination date on or after the 26th of April 2019) or additional capital requirements (for new NPEs with an origination date before the 26th of April 2019). Competent authorities could take supervisory measures (Pillar 2) on a case by case basis if they think that institutions’ NPEs coverage is insufficient. The On-site inspections 2018 key findings published by the ECB in August 2019, highlighted that "a significant proportion of the more severe findings in the area of credit risk concerned shortcomings in the identification of non-performing exposures and the calculation of loss provisions".

Challenges:

Banks will have to ensure a deep knowledge of their NPEs portfolio (e.g. keep accurate granular data available, identify the secured part and the unsecured part) set up action plans as released by the European institutions. They will still have to: analyse potential gaps and perform impact assessment; develop action plans to be prepared; determine the level of application (by portfolio/aggregate level); identify interdependencies with other projects (i.e IFRS9, new Definition of Default) and identify how to manage the important need of data (quality and availability) to fulfil the calculation. This should also lead banks to adjust their pricing incorporating the cost of calendar provisioning.

Furthermore, banks need to prepare themselves to transmit on a regular basis more detailed information as regards NPEs to the regulator as requested via the supervisory reporting changes to CCR2 and backstop regulation (reporting framework 3.0) published early October (which include three new templates for NPEs loss coverage into COREP) and the EBA Guidelines on disclosure of non-performing and forborne exposures which asks banks to provide, inter alia, information on credit quality of NPEs, collateral valuation, changes in the stock.

Interplay with EBA’s Guidelines:

To reduce misunderstanding of interpretation, the ECB’s communication on supervisory coverage expectations for NPEs (PDF 106 KB) published in August 2019 also contained some welcome clarifications on the supervisory front.

In particular, it provided additional guidance on how banks should interpret the interplay between the ECB’s NPL Guidance and the EBA’s Guidelines on the management of non-performing and forborne exposures, issued in October 2018.

- The EBA Guidelines do not specify a threshold for the individual valuation of immovable property, but the ECB Guidance does include an expectation for Significant Institutions, set at €300,000;

- Joint supervisory teams (JSTs) can in certain circumstances request an NPL reduction strategy from a bank and ask Significant Institutions (SIs) to implement NPL-related actions, even if the NPL ratio is under 5%. The circumstances are bank-specific but aligned to the criteria in the EBA Guidelines;

- Even if an SI falls below the 5% NPL ratio specified in the EBA Guidelines, it may still be required to submit an NPL reduction strategy;

- JSTs will determine an SI's ability to exit their obligation to implement an NPE reduction strategy on an annual basis; and

- Once the EBA's Guidelines on the management of non-performing and forborne exposures will become applicable (31 December 2019), banks will be expected to follow those Guidelines rather than the current Annex 7 of the ECB's NPL Guidance (PDF 1.98 MB).

What’s next on this topic?

Despite the significant progress made about the reduction of NPLs level across Europe, this remains a supervisory priorities for 2020. (PDF 75 KB).

Looking beyond the ECB’s expectations and priorities, banks should also keep an eye on the EBA’s Guidelines on Loan Origination and Monitoring which are expected to be published in December 2019. This represents the final piece of a puzzle initiated by European Institutions since 2014 to tackle NPLs and quality of loans. As set out in our new paper, these Guidelines aim to continue these efforts by taking a more pro-active view and ensuring that new loans are granted with a high level of quality. This should in turn reduce the level of NPL inflows.

Echoing the supervisory priorities, the EBA in its 2020 work programme indicates that they will “continue to support strengthened loan origination and management and contribute to the European Council’s action plan for tackling NPLs in Europe”.

Despite the continuing challenges posed by Europe’s responses to the NPL problem, we believe many banks will be encouraged by the direction of travel over the next years. There is increasing co-ordination between institutions and the result is a more coherent, joined-up approach. Above all, the picture is becoming significantly clearer for the banks in the front line. That must be an encouraging development.

Footnotes:

- Addendum to the ECB Guidance to banks on non-performing loans – March 2018: “new NPEs” are all those exposures that are reclassified from performing to non-performing in line with the EBA’s definition after 1 April 2018, irrespective of their classification at any moment prior to that date.

- Including:

- The 2014 comprehensive assessment (or Asset Quality Review - AQR) of 130 euro areas banks; and

- The adoption of the Regulation 2019/630 of the 17 April 2019 as regards minimum loss coverage for non-performing exposures.