The Financial Stability Board has issued a new and unique Toolkit aimed at reducing misconduct risks. This complements a number of European initiatives focused on banking conduct and behaviour. Taking an active, self-critical approach to misconduct risks not only allows banks to reduce risks - it can help them to achieve a range of strategic benefits.

Misconduct in banking creates a wide range of potential risks. These range from adverse customer outcomes to weakening the resilience of individual institutions. More broadly, misconduct damages public trust in the banking sector and can even contribute to systemic instability.

It is these factors that have led the Financial Stability Board (FSB) to publish a new paper on financial misconduct. Issued in April 2018, the paper does not set out prescriptive rules or guidance. Instead, it provides firms and authorities with a suggested toolkit of measures designed to strengthen governance frameworks and reduce misconduct risks1.

The FSB's Toolkit covers three key areas, as follows.

- Cultural drivers of misconduct. For firms, suggested tools include articulating a suitable risk culture and using data analysis to identify possible drivers of misconduct. For authorities, they include culture-focused supervision, prioritising riskier firms and engaging with firms' leaders on misconduct.

- Individual responsibility and accountability. Suggestions from the FSB include assessing the suitability of key individuals, developing formal frameworks of responsibility, and holding individuals accountable for misconduct.

- The “rolling bad apples” phenomenon. To address the problem of individuals failing to tell new employers about past misconduct, the FSB suggests tools such as enhanced interview techniques, better background research and regular reassessments of employee conduct.

The FSB's publication builds on a series of recent initiatives by national and international bodies aimed at reducing misconduct in the financial sector. Within the European Union, examples focused specifically on the banking industry include:

- The EBA's SREP Guidelines2 and proposed revisions, which require supervisors to consider institutions' ethics, culture and approach to risk;

- National initiatives, such as the UK FCA's new plan to increase its focus on culture and behaviour3; and

- The ECB's has begun to trial the use of new cultural and behavioural supervision techniques, drawing on the experience of De Nederlandsche Bank.

Considering this background, the FSB's publication only strengthens our view that banks within the SSM should expect supervisory scrutiny on governance, culture and the mitigation of conduct risks to grow. Feedback from clients related to on-site inspections have shown us that joint supervisory teams are already placing increased emphasis on risk culture during on-site inspections.

In response, banks should take a pro-active approach to managing their conduct risks, if they are not already doing so. This should start with an active, self-critical review into whether any aspects of their culture, controls or compensation practices could encourage employee misconduct.

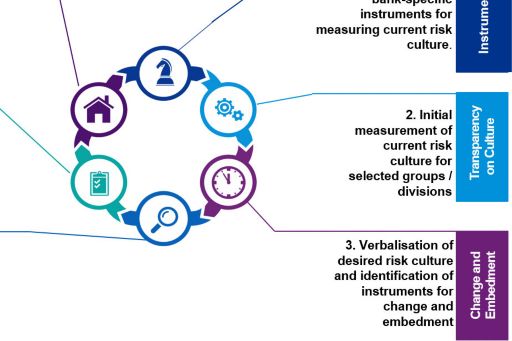

Banks should develop a risk culture framework (see Figure 1) that allows them to assess their current risk culture; to establish their desired culture; to identify tools for change; to develop tailored solutions in areas such as communication, training and controls; to set up suitable monitoring and reporting mechanisms; and to achieve continuous improvements in conduct risk management.

A succesful framework incorporates both hard controls and softer, intangible drivers of employee behaviour. We have drawn from scientific research into organisational misconduct to outline a model of soft controls which comprises eight elements:

- Clarity over desirable and undesirable behaviour

- Good role-modelling by management

- Commitment to desirable behaviour

- Achievability of goals, tasks and responsibilities

- Transparency of behaviour

- Openness to discussion and debate

- Accountability for undesirable behaviour; and

- Enforcement of behaviour.

Overall, banks should remember that preventing misconduct is not just about reducing risks or meeting supervisory goals. A risk culture that limits scope for misconduct represents a vital step towards process optimisation, better customer experiences, greater public trust and creating an environment that attracts and motivates high quality employees. It can therefore help banks to achieve a range of strategic objectives, positioning them for long term success.

Footnotes

1 FSB publishes toolkit to mitigate misconduct risk

2 Guidelines on common procedures and methodologies for the supervisory review and evaluation process (SREP)

3 FCA sets out its Approach to Supervision and Enforcement

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia