Thailand - Taxation of cross-border mergers and acquisitions

Taxation of cross-border mergers and acquisitions for Thailand.

Taxation of cross-border mergers and acquisitions for Thailand.

Introduction

Thailand’s government is a constitutional monarchy. Executive powers are exercised by the Prime Minister and the Council of Ministers, legislative powers by Parliament, and judicial powers by a judicial system composed mainly of the Courts of First Instance, Court of Appeals and Supreme Court.

The principal taxation law of Thailand is the Revenue Code 1938. Royal decrees, ministerial regulations, ministerial notifications, and Board of Taxation directives and rulings that supplement the Code are also applied. The Director-General of Revenue Department administers the country’s tax legislation.

A separate income tax law applies to companies involved in the exploitation of naturally occurring Thai oil and gas assets.

Companies that receive Board of Investment (BOI) promotion may obtain special taxation incentives for a number of years from the commencement of operations.

Recent developments

Recently, Thailand has seen significant developments in both domestic and international tax laws. Among other things, Thailand has:

- enacted law to expand the scope of value-added tax (VAT) provisions to cover electronic services provided by foreign operators; the rules require foreign operators that provide electronic services to non-VAT registrants for consumption in Thailand, as well as foreign electronic platforms that foreign operators use to provide such electronic services, to register for VAT in Thailand

- provided temporary 90% tax reduction on land and building tax

- provided temporary transfer fee reduction on certain transactions

- introduced e-withholding tax system and provided reduction in withholding tax on domestic transactions.

Asset purchase or share purchase

An acquisition in Thailand generally takes the form of a purchase of the shares in a company, as opposed to acquisition of the target’s business and assets.

From a tax perspective, the likely recapture of capital allowances (i.e. taxable gains on sale of assets) is likely to make asset acquisitions less attractive for the seller. However, the benefits of asset acquisitions for the buyer should not be ignored, particularly given the potential step-up in the tax cost base of the assets to market value and the fact that purchased goodwill is tax-deductible generally over 10 years (although there have been some recent challenges from the Thai Revenue Department in certain circumstances). Some of the tax considerations relevant to each method are discussed below. The relative advantages are summarized at the end of this report.

Purchase of assets

A purchase of assets usually results in an increase in the tax cost base of those assets to the acquisition cost. An asset acquisition can be debt funded to offset interest expenses against future profits. In contrast, debt pushdown is not available in a shares acquisition. In addition, historical tax liabilities generally remain with the company and are not transferred with the assets.

However, the restrictions on foreign investment imposed under the Foreign Business Act may limit the ability to acquire the assets directly without setting up a Thai subsidiary and obtaining the relevant approvals (if available) or acquiring the assets through a majority Thai-owned structure.

Purchase price

For tax purposes, it is necessary to apportion the total consideration among the assets acquired. It is generally advisable for the purchase agreement to specify the allocation, which is normally acceptable for tax purposes provided it is commercially justifiable.

Goodwill

Intangible assets, including goodwill, formulae, trademarks, business licenses, patents, copyrights and any other right are generally depreciable for tax purposes at the rate of 10 percent per year, or if the period of use is limited, 100 percent divided by the years of useful life.

Depreciation

A company is entitled to depreciate capital expenditure by using its acquisition cost base. Depreciation commences from the date of acquisition and must be apportioned if the asset is acquired partway through a fiscal year.

The company may adopt its own depreciation method in accordance with its accounting policy; however, the useful life of the asset must not be shorter than that prescribed by the Thai Revenue Code.

Generally, the prescribed straight-line depreciation rates are as follows:

- machinery and related equipment — 20 percent

- permanent buildings — 5 percent

- temporary buildings — 100 percent

- depletable natural resources — 5 percent

- goodwill, formulae, trademarks, business licenses, patents, copyrights and any other right — 10 percent, or, if the period of use is limited — 100 percent divided by the years of useful life

- computer software, equipment and hardware — 33.33 percent

- other assets (excluding land or inventory) — 20 percent.

Tax attributes

Tax losses are not transferred in an asset acquisition. They remain with the original company in which they were derived. However, it may be possible for certain tax privileges obtained under Thailand’s BOI to be transferred to the acquiring company with the related assets.

VAT

VAT is payable by suppliers of taxable goods and in respect of services rendered in Thailand or performed offshore and used in Thailand.

VAT is currently levied at the standard rate of 7 percent on the taxable base for the goods or services rendered. Certain supplies are exempt from VAT or zero-rated.

Transfer taxes

Stamp duty is levied for certain instruments. For example, stamp duty is applicable at the following rates, depending on the circumstances:

- lease of land or building — 0.1 percent of the rent

- transfer of share, debenture or bond — 0.1 percent of the greater of the paid-up value of share and the transfer price

- hire of work agreement — 0.1 percent of the contract value

- monetary loan — 0.05 percent of the loan, with a cap at 10,000 Thai baht (THB).

Stamp duty may not be applicable in certain situations, or an exemption may be available. For example, stamp duty is not payable on share transfer documents in respect of securities listed in Thailand. In addition, any instruments liable to stamp duty executed offshore should not be immediately subject to stamp duty until their originals are subsequently brought back into Thailand.

In certain circumstances, the liability to pay the stamp duty to the revenue office may rest with another contractual party, such as when a non-resident provides services to a Thai recipient, the parties may agree to have the Thai recipient pay stamp duty instead of the non-resident service provider.

The acquisition of land also gives rise to a transfer fee on the transfer of the property (generally split equally between buyer and seller). The fee is equal to 2 percent of the Land Department’s assessed value. The transfer fee is reduced from 2 percent to 0.01 percent for the transfer of residential property with the price not exceeding THB3 million that are purchased by individuals until 31 December 2021.

Purchase of shares

There is no mechanism in Thailand’s tax legislation for the purchase price of a target company’s shares to be pushed down to increase the tax cost base of that company’s underlying assets.

Tax indemnities and warranties

In a share acquisition, the buyer is taking over the target company together with all related liabilities, including contingent liabilities. Therefore, the buyer normally requires more extensive indemnities and warranties than in the case of an asset acquisition. Where significant sums are at issue, it is customary for the buyer to initiate a due diligence exercise, which normally incorporates a review of the target’s tax affairs.

Tax losses

Tax losses incurred by a legal corporation may be carried forward for a maximum of 5 consecutive accounting periods and set off against profits of any nature (losses cannot be carried back). Tax losses are not foregone on a change in the company’s ownership or business; any carried forward losses should survive share acquisition.

Thailand has no separate capital gains tax. All losses are of a revenue nature and can be used to offset any types of income earned in the future. A company’s brought forward tax losses cannot be used to offset profits of other companies through group relief.

Pre-sale dividend

The seller may prefer to realize part of the value of their investment as income by means of a pre-sale dividend. The rationale here is that the dividend may be partially or fully exempt or taxed at a lower rate in the hands of the seller, and would reduce any gains on the disposal, which may be fully assessable.

Transfer taxes

An agreement for transfer of shares in a Thai private limited company is subject to stamp duty in Thailand at the rate of 0.1 percent of the greater of the paid-up value of the shares and the nominal value. The transferor has the prima facie liability to pay the stamp duty, but where the transaction is executed offshore, the liability rests with the first holder of the original share transfer document in Thailand.

Choice of acquisition vehicle

The most common form of entity in Thailand is the limited company. In general, foreign companies prefer to operate as limited companies rather than as branch offices in order to limit liabilities and, in certain circumstances, to obtain investment privileges and incentives otherwise not available to a branch. Thailand does not generally recognize flow-through vehicles, such as trusts.

Local holding company

A Thai holding company may be used. However, this option may not be attractive as no grouping rules are available to allow for the offset of any losses in a group with income from other entities.

A Thai holding company may also be relevant where the foreign ownership restrictions would not allow majority foreign ownership. A Thai private limited company may be wholly owned by foreign parties. However, for certain business activities reserved for Thai nationals, foreign participation is generally allowed below 50 percent.

Dividends paid from the underlying company should be exempt from tax for the holding company, provided it holds at least 25 percent of the voting shares in the company without cross-shareholding and holds the shares for at least 3 months both before and after the payment of the dividend.

Foreign parent company

Because of the restrictions on foreign ownership, a foreign company cannot hold land directly. In certain circumstances, a Thai limited company may be wholly owned by foreign parties. However, as noted previously, certain business activities are reserved for Thai nationals and foreign participation is limited to below 50 percent.

Thailand imposes withholding taxes (WHT) on dividends (10 percent on dividends paid to foreign companies) and interest (10 or 15 percent, tax treaty dependent). In addition, foreign parties may be subject to WHT in Thailand on disposal of certain local assets. A Thai buyer is required to withhold from the sale proceeds an amount equal to 15 percent of the gains derived by the foreign entity on disposal.

Non-resident intermediate holding company

Where the foreign country taxes foreign capital gains and dividends, it is not uncommon for a foreign intermediate holding company to be used to defer WHT. Potential tax benefits may also be attained on disposal; tax treaties with certain countries also provide for an exemption from local WHT on any gain derived on disposal.

Local branch

A company incorporated under foreign laws may establish a branch office to do business in Thailand.

As a condition for approval of a foreign business license for a branch of a foreign corporation, depending on the branch’s expenditure in Thailand, a minimum capital of THB3 million must be brought into Thailand.

For tax purposes, the branch of the foreign company should constitute part of the same legal entity as its head office. The branch is taxable in Thailand on net profits attributable to its business in Thailand. Any gains derived from the sale of branch assets are prima facie subject to tax in Thailand.

While a foreign corporation is not taxable in Thailand on foreign-sourced income, the same is not always true for a branch. Fees paid by a foreign entity to the branch in respect of work performed by the branch are subject to Thai tax.

Joint venture

Income from an unincorporated joint venture is subject to corporate tax under the Thai Revenue Code, which classifies a joint venture as a single tax entity.

Choice of acquisition funding

A buyer using a Thai acquisition vehicle to carry out an acquisition for cash needs to decide whether to fund the vehicle with debt, equity or a hybrid instrument that combines the characteristics of both. The principles underlying these approaches are discussed below.

Debt

The advantage of debt is the potential tax-deductibility of interest and the ease of repatriating the investment contribution through repayment of debt principal. By contrast, the payment of dividends is not deductible and returns of capital can be administratively difficult and time-consuming.

Because of the lack of grouping rules in Thailand, any debt held at the Thai company level should be held in the company earning the taxable profits to ensure tax-deductibility.

Although there are no debt-to-equity restrictions for income tax purposes, other regulatory requirements may require a certain level of equity (e.g. the BOI rules generally require a 3:1 debt-to-equity ratio).

Deductibility of interest

There is no formal definition of ‘interest’ in Thai tax law. Interest generally includes interest on bonds, deposits, debentures, bills and secured/unsecured loans.

Generally, interest expenses incurred on funds borrowed for the purpose of the business are deductible and include borrowings to fund share acquisitions and for the payment of dividends. Generally, a company’s accounting treatment of interest is followed for tax purposes (i.e. generally on an accrual basis, even where the interest is not actually paid for an extended period of time).

Although Thailand has no thin capitalization provisions, the Thai Revenue Department may apply the transfer pricing rules to restrict interest deductibility where the interest rate charged is higher than an arm’s length rate.

WHT on debt and methods to reduce or eliminate it

Interest payments offshore are subject to WHT at the rate of 15 percent of the gross amount. The rate may be reduced to 10 percent under an applicable tax treaty where the interest is paid to a bank or financial institution.

Although a deduction is provided in Thailand for interest on an accrual basis, WHT must be remitted to the Thai Revenue Department on payment. As such, timing benefits may be available where the debt is with an entity resident in a country that would only seek to tax the interest income on a cash basis.

Checklist for debt funding

- Interest payments offshore are subject to WHT at 15 percent of the gross amount.

- Due to the lack of thin capitalization provisions and the 28 percent effective tax rate on the repatriation of profits offshore by payment of dividends, debt funding may reduce the effective tax rate where the level of profits permits.

Equity

A buyer may use equity to fund its acquisition, and foreign investors may be required to use a certain debt-to-equity ratio in order to obtain certain BOI approvals.

Theoretically, a limited company can be set up with a minimal capital. However, a limited company’s capital should be sufficient to accomplish its objectives in practice. In addition, all shares must be subscribed, and at least 25 percent of the shares must be paid-up.

Using only equity funding may not be attractive because dividends are not deductible for Thai tax purposes, and the effective tax rate on the repatriation of profits offshore from Thailand is 28 percent (20 percent corporate tax plus 10 percent WHT). In addition, because of the difficulty in achieving a return of capital, it may be difficult for the investor to recover the funds it has injected.

Despite this lack of flexibility, equity may be more appropriate than debt in certain circumstances, such as where the target is loss-making or where no immediate tax relief is available for interest payments.

Hybrids

Generally, hybrid securities, including redeemable preference shares, are not available.

Discounted securities

The tax treatment of securities issued at a discount to third parties generally follows the accounting treatment (i.e. the discount accrues over the life of the security). The discount should constitute interest for WHT purposes.

Deferred settlement

The tax legislation is not clear on the treatment of deferred settlements. Each case should be considered on its facts.

Other considerations

Concerns of the seller

The seller may prefer to realize part of the value of their investment as income by means of a pre-sale dividend. The rationale here is that the dividend may be partially or fully exempt, or taxed as a lower tax rate, and would reduce any gain on the disposal, which may be fully assessable.

Where the seller is a non-resident of Thailand, the seller may prefer to dispose of the shares in a Thai resident company to another non-resident company and obtain the payment outside Thailand in order to avoid any potential WHT in Thailand.

Company law and accounting

Under Thai laws, there are two types of companies: limited companies and public limited companies. Incorporation and operations of limited companies are governed by the Civil and Commercial Code, while public limited companies are governed by the Public Limited Company Act 1992.

Additionally, the Foreign Business Act 1999 should be considered as the most important law for foreign investors. This legislation specifies the foreign ownership restrictions on certain activities that may require the permission from the authorities prior to engaging in the business.

The basic concept of the limited company is similar to a Western corporation. A limited company is a legal person with a registered capital that should be reasonably sufficient to achieve the company’s objectives. Currently, the minimum number of shareholders required at all times is three. The liability of shareholders is limited to the unpaid amount of the shares held by them, and the minimum payment for each share is only 25 percent of par value. In addition, non-voting rights are not permitted for either common or preference shares. The company may be wholly owned by foreign shareholders, provided the business is not reserved for Thai nationals by law, in which case foreign participation is normally allowed below 50 percent.

Although the procedure for incorporating a public limited company is not much different than it is for a limited company, the governmental regulatory requirement is more complex because a public limited company is allowed to sell its shares to the public. A limited company can be converted to a public limited company according to the relevant regulations. The advantage is that a public limited company may offer both its shares and debentures to the public. A public limited company wishing to list its shares on the Stock Exchange of Thailand (SET) must obtain the approval from the SET and the Securities and Exchange Commission of Thailand.

In Thailand, all new standards issued by the Federation of Accounting Professions are in line with International Financial Report Standards (IFRS). A non-listed company in Thailand can use either Thai Accounting Standards (TAS) or Thai Accounting Standards for Non-Publicly Accountable Entities (NPAE).

Audited financial statements of legal entities (including companies, branches and representative and regional offices) must be certified by an authorized auditor and lodged with the Thai Revenue Department and the Commercial Registrar for each accounting year. Documents may be prepared in any language, provided a Thai translation is attached.

A newly established company should close its accounts within 12 months from the date of registration. The accounting year is generally the calendar year. A company wishing to change its accounting period must obtain a written approval of the Director-General of the Thai Revenue Department.

Tax concessional reorganization schemes

Thailand entire business transfer, under which all the business assets and liabilities of one company are transferred to another company as an asset sale. Among other taxes, the Thai Revenue Code provides for corporate tax and VAT exemption on the entire business transfer. The transferee would inherit the historic tax bases of the assets acquired. One of the conditions of the entire business transfer is that the transferor must start liquidation procedures in the year of the transfer.

Thailand also has an amalgamation process whereby two companies can merge to form a new company. This transaction is free from Thai corporate income tax, but any tax losses in either of the original companies are lost. Both original companies are dissolved as part of the amalgamation.

Group relief/consolidation

Thailand does not provide a group relief or tax consolidation for corporate tax purposes.

Transfer pricing

A company or juristic partnership with related-party transactions and annual turnover of at least THB200 million has to file a transfer pricing discourse form annually with its corporate income tax return. The disclosure form requires stating the nature and value of the related-party transactions, and answering certain transfer pricing related questions.

A full transfer pricing report is required to be provided to the Thai Revenue Department upon their request, which can be made within 5 years after the filing of the transfer pricing disclosure form. A fine of up to THB200,000 is applicable for failure to comply with these requirements or submitting incomplete or incorrect information without a reasonable cause.

Dual residency

For Thai tax purposes, there are no real advantages in seeking to establish a dual resident company.

Foreign investments of a local target company

A Thai legal company is taxed on all foreign income, including foreign dividends, interest and gains derived from foreign investments. Thailand does not impose controlled foreign company or similar provisions that seek to tax the income earned offshore.

In addition, the foreign dividends may be exempt from Thai corporate tax where the Thai company holds at least 25 percent of the voting shares of the foreign company (for a period of at least 6 months prior to receipt of the dividend) and the underlying profits from which the dividends were paid were subject to tax in the foreign country at a rate of at least 15 percent.

Land and building tax

The owners of real estate are assessed annually in February of each year and pay tax on the assessed value of the real estate to the Local Administrative Organization by April. The tax is progressive and varies from 0.01 to 3 percent depending on the use and government’s assessed value of the property.

Exemption or reduction on land and building tax is provided for land or building used for agricultural or residential purposes under certain conditions.

The 90% reduction of land and building tax is provided to all types of real estate for the assessment year 2021. The deadline for land and building tax payment is also extended from the end of April to 2 months from the date of receiving the tax assessment, which could potentially be as late as the end of June 2021.

Comparison of asset and share purchases

Advantages of asset purchases

- The purchase price of the relevant assets, including goodwill, may be depreciated for tax purposes.

- Liabilities and business risks of the seller company are not transferred to the buyer.

- Possible to acquire only parts of the business.

- Interest to fund the acquisition of assets should be tax-deductible.

Disadvantages of asset purchases

- Possibility of taxable gains derived from the assets for the seller.

- Possibility of significant transfer taxes on sale of property.

- Benefits of tax losses remain in the target company.

Advantages of share purchases

- Seller should not be subject to any taxable gains on the underlying assets.

- Buyer may benefit from any unused tax losses despite the change in ownership or possible change in the loss company’s business.

- Other tax benefits may also be acquired, such as deferred tax assets and tax credits.

Disadvantages of share purchases

- Buyer acquires historical tax cost base. There is no mechanism to reset the tax cost of the assets to market value for tax purposes.

- Buyer inherits historic tax liabilities and exposures.

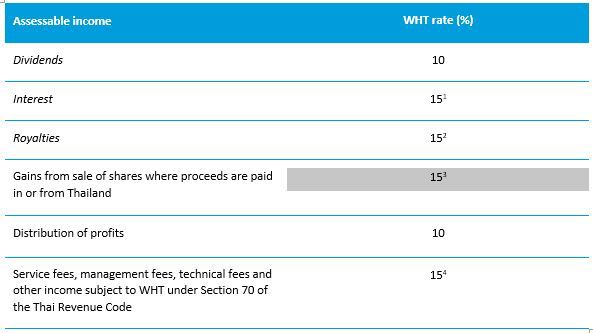

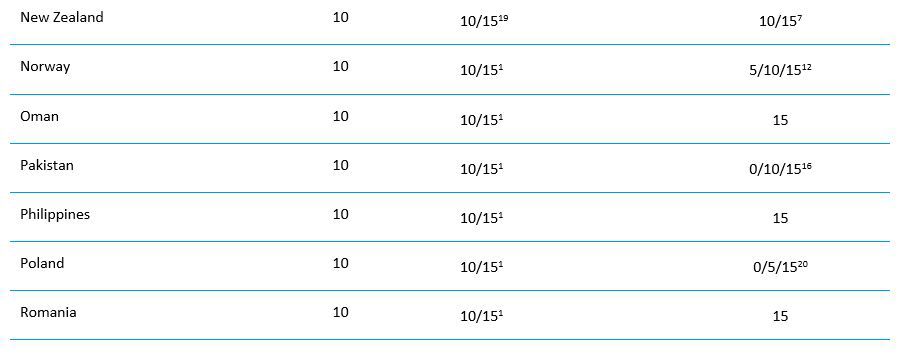

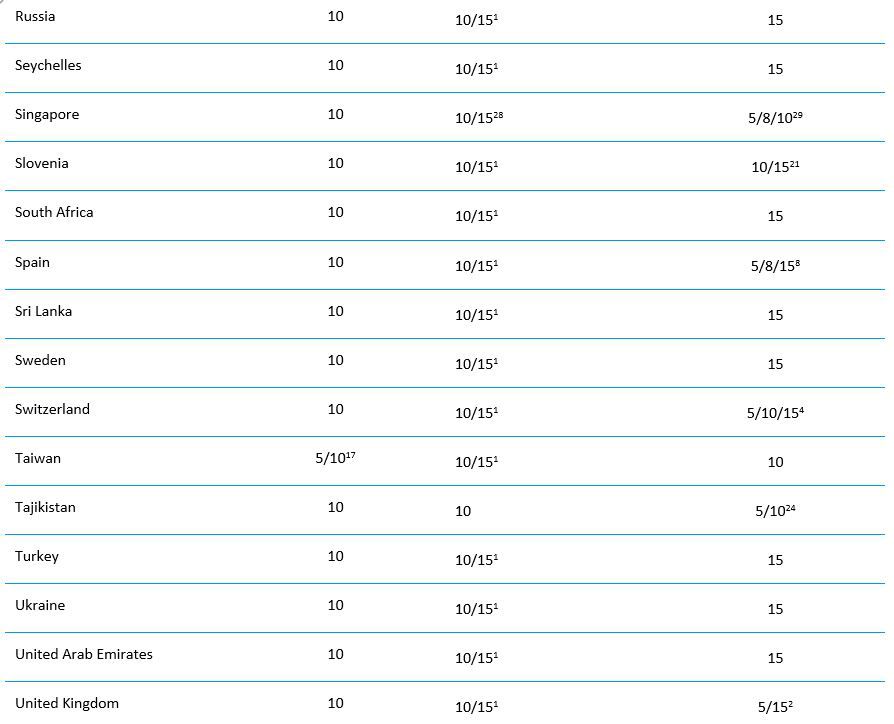

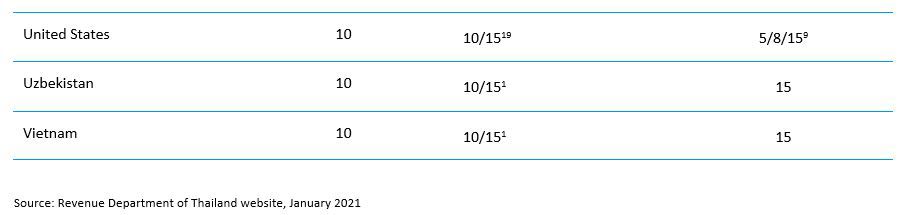

Thailand — WHT rates

All payers of certain types of assessable income are required to deduct tax at source from payments of such income to overseas resident individuals and corporations at the following rates.

Notes:

- A 10 percent rate applies to interest paid to foreign banks or financial institutions (including insurance companies) that are resident in a country having a tax treaty with Thailand.

- Lower rates of 5, 8 or 10 percent exist for royalties paid for the use of copyright of literary, artistic or scientific work or for the use of industrial, commercial or scientific equipment to residents of certain countries with tax treaties with Thailand.

- Certain gains are tax-free under the terms of certain treaties.

- Under Thailand’s tax treaties, provided such income is not specifically treated as a royalty and not excluded from the meaning of ‘business profits’, entities without a Thai permanent establishment are not subject to Thai WHT on such income.

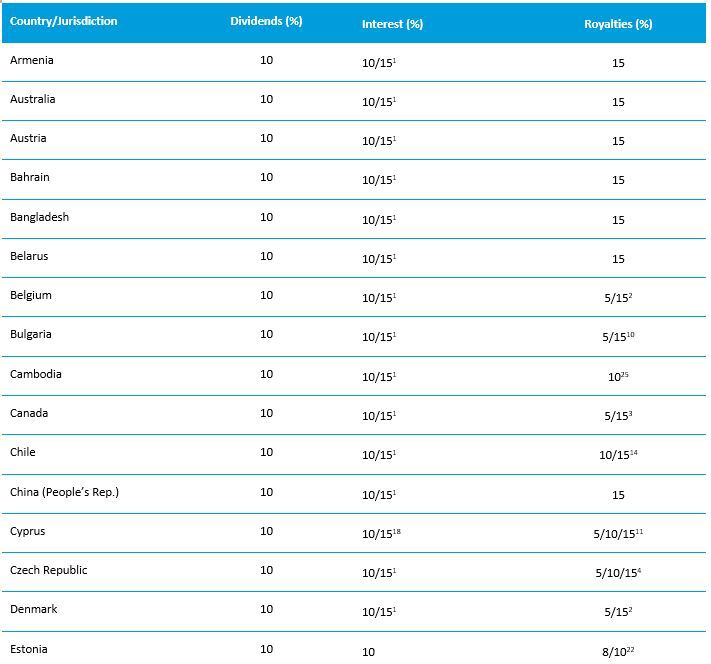

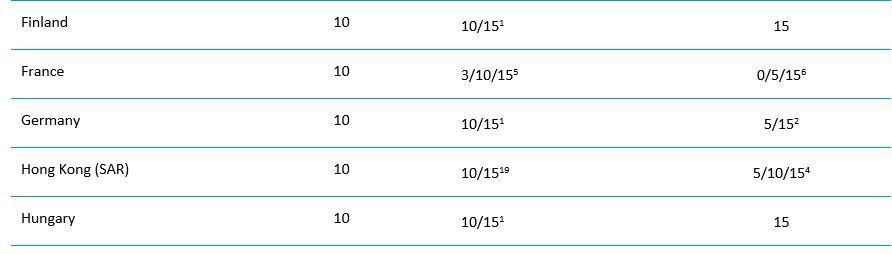

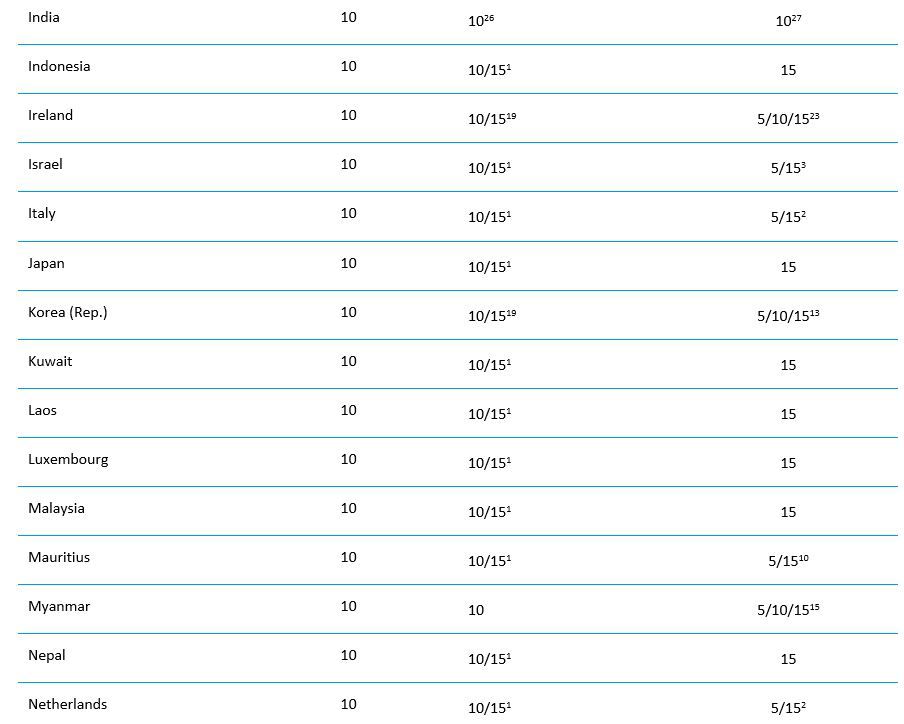

As of January 2021, Thailand has signed tax treaties with 61 countries and jurisdictions. The following WHT rates apply to recipient countries/jurisdictions that do not have a permanent establishment or fixed base in Thailand.

Notes:

- 10 percent applies to a recipient that is a bank or financial institution (including an insurance company); 15 percent for other interest payments.

- 5 percent for the use of or the right to use any copyright of literary, artistic or scientific work; 15 percent for other royalties.

- 5 percent for production or reproduction of any literary, dramatic, musical or artistic work (but not including royalties in respect of motion picture films and works on film or videotape for use in connection with television broadcasting); 15 percent for other royalties.

- 5 percent for alienation or the right to use any copyright of literary, artistic or scientific work, excluding cinematographic films or tapes used for radio or television broadcasting; 10 percent for alienation of any patent, trademark, design or model plan, secret formula, or process; 15 percent rate for other royalties.

- 3 percent for interest paid on loans or credits granted for 4 years or more with the participation of a financing public institution to a statutory body or to an enterprise in relation to the sale of any equipment or to the survey, installation or supply of industrial, commercial or scientific premises, and public works; 10 percent applies to a recipient that is a financial institution; 15 percent for other interest payments.

- 0 percent for payment in respect of films or tapes (payable to a contracting state or state-owned company); 5 percent for the use of or the right to use any copyright of literary, artistic or scientific work; 15 percent for other royalties.

- 10 percent for the use of or the right to use any copyright, any industrial, commercial or scientific equipment, any motion picture film or film or videotape or any other recording for use in connection with television, or tape or any other recording in connection with radio broadcasting; the reception of, or the right to receive, visual images or sounds or both and the use in connection with television or radio broadcasting, visual images or sounds, or both, transmitted by satellite or cable, optic fiber or similar technology; 15 percent for other royalties.

- 5 percent for the use of or the right to use any copyright of literary, dramatic, musical, artistic or scientific work, excluding cinematographic films or films or tapes used for radio or television broadcasting; 8 percent for the use of or the right to use industrial, commercial or scientific equipment; 15 percent for other royalties.

- 5 percent for the use of or the right to use any copyright of literary, artistic or scientific work, including software, and motion pictures and works on film, tapes or other means of reproduction for use in connection with radio or television broadcasting; 8 percent for the use of or the right to use industrial, commercial or scientific equipment; 15 percent for other royalties.

- 5 percent for the use of or the right to use any copyright of literary, dramatic, musical, artistic or scientific work, excluding cinematographic films or films or tapes used for radio or television broadcasting; 15 percent for other royalties.

- 5 percent for the use of or the right to use any copyright of literary, dramatic, musical, artistic or scientific work, including software, cinematographic films or tapes used for radio or television broadcasting; 10 percent for the use of or the right to use industrial, commercial or scientific equipment, or for information concerning industrial, commercial or scientific equipment or information concerning industrial, commercial or scientific experience; 15 percent for other royalties.

- 5 percent for the use of or the right to use any copyright of literary, artistic or scientific work; 10 percent for the use of industrial, commercial or scientific equipment; 15 percent for other royalties.

- 5 percent for the use of or the right to use any copyright of literary, artistic or scientific work, including software, and motion pictures and works on films, tapes or other means of reproduction for use in connection with radio or television broadcasting; 10 percent for the use of or the right to use any patent, trademark, design or model, plan, secret formula or process; 15 percent for other royalties.

- 10 percent for the use of or the right to use any copyright of literary, artistic or scientific works and any industrial, commercial or scientific equipment; 15 percent for other royalties.

- 5 percent for the use of or right to use any copyright of literary, artistic or scientific work; 10 percent rate for the consideration for any services of a managerial or consultancy nature, or for information concerning industrial, commercial or scientific experience; 15 percent for other royalties.

- 0 percent for films or tapes (payable to a contracting state or state-owned company); 10 percent for the use of or the right to use any copyright of literary, artistic or scientific work; 15 percent for other royalties.

- 5 percent for dividend if the beneficial owner directly holds at least 25 percent of the capital of the company paying dividend; 10 percent for other dividend payments.

- 10 percent for interest received by a financial institution (including an insurance company), or paid by in connection with the sale on credit of any industrial, commercial or scientific equipment or the sale on credit of any merchandise by one enterprise to another enterprise; 15 percent for other interest.

- 10 percent for interest paid to a financial institution (including insurance company) or with respect to indebtedness arising as a consequence of a sale on credit of any equipment, merchandise or services, except where the sale was between persons not dealing with each other at arm’s length; 15 percent for other interest.

- 0 percent for payment in respect of films or tapes (payable to a contracting state or state-owned company); 5 percent for the use of or the right to use any copyright of literary, artistic or scientific work (excluding cinematographic films or tapes for television or broadcasting); 15 percent for other royalties.

- 10 percent for the use of or the right to use any copyright of literary or artistic work, including motion pictures, live broadcasting film, tape or other means of the use of reproduction in connection with radio and television broadcasting or industrial, commercial or scientific equipment; 15 percent for other royalties.

- 8 percent for the right to use industrial, commercial or scientific equipment; 10 percent for other royalties.

- 5 percent for the right to use any copyright of literary, artistic or scientific work, including software, and motion pictures and works on films, tapes and other means of reproduction for use in connection with radio or television broadcasting; 10 percent for the right to use industrial, commercial or scientific equipment and patent; 15 percent for other royalties.

- 5 percent for the right to use any copyright of literary, artistic or scientific works; 10 percent for other royalties.

- 10 percent for the use of or the right to use any copyright of literary, artistic or scientific works, including software, motion pictures, live broadcasting, film, tape or other means of the use or reproduction in connection with radio or television broadcasting, any patent, trademark, design or model, plan, secret formula or process, or for the use of or the right to use industrial, commercial or scientific equipment, or for information concerning industrial, commercial or scientific experience.

- 10 percent if the beneficial owner of the interest is a resident of the other Contracting State.

- 10 percent for the use of or the right to use any copyright of literary, artistic or scientific works, including cinematographic film or films or tapes used for television or radio broadcasting, any patent, trademark, design or model, plan, secret formula or process, or for the use of or the right to use industrial, commercial or scientific equipment, or for information concerning industrial, commercial or scientific experience.

- 10 percent of the gross amount of the interest if the interest is beneficially owned by any financial institution or insurance company; 10 percent of the gross amount of the interest if the interest is beneficially owned by a resident of the other Contracting State and is paid with respect to indebtedness arising as a consequence of a sale on credit by a resident of that other Contracting State of any equipment, merchandise or services, except where the sale was between persons not dealing with each other at arm’s length; and 15 percent of the gross amount of the interest in all other cases.

- 5 percent of the gross amount of the royalties if they are made as consideration for the use or the right to use any copyright of literary, artistic or scientific work, including cinematographic films, or films or tapes used for radio or television broadcasting; 8 percent for the use of or the right to use any patent, trademark, design or model, plan, secret formula or process, or for the use of or the right to use industrial, commercial or scientific equipment; 10 percent of the gross amount of the royalties in all other cases.

KPMG in Thailand

Tatiana Bespalova

KPMG Phoomchai Tax Ltd

49th Floor, Empire Tower 1 South Sathorn Road, Yannawa, Sathorn, Bangkok 10120

Thailand

T: +66 2677 2697

E: tbespalova1@kpmg.co.th

This country document does not include certain COVID-19 tax measures and government reliefs announced by the Thai government. Please refer below to the KPMG link for referring jurisdictional tax measures and government reliefs in response to COVID-19.

Click here — COVID-19 tax measures and government reliefs

This country document is updated as of 31 January 2021.