Transition reliefs and minor amendments

International Accounting Standards Board meeting, February 2020

IFRS 17 – Insurance acquisition cash flows

International Accounting Standards Board meeting, January 2020

Exposure draft of amendments to IFRS 17

International Accounting Standards Board, June 2019

Transition requirements – Applying the risk mitigation option

International Accounting Standards Board meetings, March and February 2019

Transition requirements – Additional practical relief for acquired claims liabilities

International Accounting Standards Board meeting, February 2019

Transition requirements – Further Board discussions

International Accounting Standards Board meeting, February 2019

International Accounting Standards Board meeting, November 2018

Identifying insurance acquisition cash flows when applying the fair value transition approach

TRG meeting, February 2018

Transition reliefs and minor amendments

International Accounting Standards Board meeting, February 2020

What’s the issue?

The exposure draft (ED) proposed several minor amendments and editorial corrections to IFRS 17 Insurance Contracts. Whilst there was overall support for many of these, some respondents expressed concerns or asked for clarifications.

Concerns included the challenges of applying the permitted approaches to transition. Feedback ranged from calls for more optionality and flexibility within the approaches to suggestions to provide specific modifications and reliefs.

| Subjects | Decision | Reference (to IFRS 17 unless otherwise stated) |

| Transition reliefs – investment contracts with discretionary participation features | Entities will be permitted to determine whether a contract meets the definition of an ‘investment contract with discretionary participation features’ using information available at the date of transition where information at inception or initial recognition is not available. | Paragraphs C9 and C21 |

| Transition reliefs – reinsurance contracts held | Entities should assume that a reinsurance contract held was acquired after the underlying insurance contracts were issued in situations where the entity does not have reasonable and supportable information to determine the date of acquisition of the reinsurance contract. This means the reinsurance contract held would not have a loss-recovery component representing the recovery of expected initial losses on the related underlying contracts. |

Paragraph C15A |

| Transition reliefs – interim financial statements | This applies for entities that make an accounting policy choice not to change the treatment of past accounting estimates made in previous interim financial statements. Under the modified retrospective approach, if the entity does not have reasonable and supportable information to apply the accounting policy choice retrospectively, the entities will determine:

at the date of transition as if the entity had not prepared any interim financial statements before the date of transition. |

Paragraph B137 |

| Distinct investment components | Entities will apply IFRS 17 to distinct investment components that meet the definition of an investment contract with discretionary participation features. | Paragraph 11 |

| Recognition of contracts | Entities will include only contracts that meet the recognition criteria of paragraph 25 of IFRS 17 in recognising a group of insurance contracts at a reporting date. The recognition date of a contract may be different from the issue date. | Paragraph 28 and to retain, unchanged, paragraph 22. |

| Insurance finance income or expenses | Changes in the measurement of a group of insurance contracts caused by changes in the value of underlying items (excluding additions and withdrawals) are changes arising from the effect of the time value of money and financial risk. | Paragraph B128c |

| Definition of investment component | To finalise the definition of an investment component referring to a repayment in all circumstances and clarify that policy loans are not necessarily investment components. | Appendix A |

| Adjustments to CSM under paragraph B96(c) | To clarify that, for insurance contracts without direct participation features, the CSM is not adjusted for changes in fulfilment cash flows arising from differences that relate to the time value of money and assumptions that relate to financial risk between:

|

Paragraph B96(c) |

| Policyholder loans and revenue | Changes to the liability for remaining coverage due to changes in cash flows from loans to policyholders do not give rise to insurance revenue. | Paragraph B123(a) |

| Experience adjustments for premium receipts | To specify that an entity should present experience adjustments for premium receipts that relate to current or past service as insurance revenue. | Paragraphs 106(a) and B124 |

| Adjustments to CSM under paragraph B96(d) | To clarify that, for insurance contracts without direct participation features, if an entity chooses to disaggregate the change in the risk adjustment for non-financial risk between insurance service result and insurance finance income or expenses, the entity should adjust the CSM only for the changes related to non-financial risk, measured at the discount rates determined on initial recognition. | Paragraph B96(d) |

| Variable Fee Approach (VFA) eligibility test | Confirmed that the eligibility test for the VFA is to be performed on a contract by contract basis. | Paragraph B107 |

| Consequential amendment to IFRS 3 Business Combinations | To clarify that an entity can continue to classify insurance contracts acquired through a business combination that occurred before the date of initial application of IFRS 17 (and only those business combinations) based on the contractual terms and other factors at the inception of the contract, rather than at the date of acquisition. | IFRS 3 |

| Consequential amendment to IFRS 9 Financial Instruments | Financial guarantee contracts issued (if not in scope of IFRS 17) are in the scope of IFRS 9, rather than financial guarantee contracts issued or held, as previously specified in the ED. | Paragraph 2.1 of IFRS 9 |

*Changes from proposed amendments are underlined.

The Board proposed no further amendments for additional topics raised by respondents relating to transition reliefs and modifications. These included level of aggregation requirements, application of the fair value approach and modifications for future cash flow estimates.

What’s the impact and what should preparers be doing now?

Now that the Board has confirmed these amendments, preparers can move forward with their implementation plans. While some of these amendments have been referred to as minor they may have a significant impact on implementation. For example, the confirmation that the VFA eligibility test is performed on a contract basis rather than at a group level and changes to the requirements for adjustments to the CSM may lead to changes in entities’ working assumptions. Preparers should review and adjust their working assumptions and implementation plans if necessary.

The amendment regarding interim financial statements follows from a previous decision made in January 2020 by the Board. This amendment may provide operational relief to preparers but can also have financial implications driven by the significance of changes in estimates, which affects the amount of CSM recognised on transition and released over time.

We now know that there will be no further changes to transition. Transition to IFRS 17 will be challenging and time-consuming and preparers should move ahead with executing their transition plans.

Insurance acquisition cash flows on transition to IFRS 17 and on acquisition

January 2020 International Accounting Standards Board meeting

What’s the issue?

In the exposure draft, the Board proposed several amendments to the recognition and measurement of assets for insurance acquisition cash flows (IACF). The Board received feedback that the amendments did not include how to recognise and measure an asset for IACF at transition. The feedback included suggestions that the Board provides transition relief and simplified methods to measure an asset for IACF at the transition date, regardless of which transition approach an entity uses.

What did the Board decide in January 2020?

| Subjects | Decisions |

| Asset for IACF at transition | The Board decided to amend IFRS 17 Insurance Contracts to require an entity to identify, recognise and measure an asset for IACF at the transition date.

|

Using the modified retrospective approach

|

The Board decided to amend IFRS 17 to require an entity applying the modified retrospective approach to measure an asset for IACF using information available at the transition date by:

In addition, the Board decided to require an entity using the modified retrospective approach to

|

| If no information is available | In circumstances where an entity does not have reasonable and supportable information to apply the modified retrospective approach, the Board decided that in respect of IACF:

|

The fair value approach

|

Under the fair value approach, the Board decided to require an entity to recognise an asset for IACF measured as the amount of IACF that the entity would incur at the transition date, if the entity had not already paid those IACF to obtain the rights to:

The Board indicated that the final revised standard will clarify how the above requirements should be applied.

|

Impairment

|

The Board clarified that for IACF assets recognised at transition, an entity is not required to apply the recoverability assessment retrospectively – i.e. for the periods that occurred earlier than the transition date.

|

Transfers and business combinations

|

The Board also decided to amend IFRS 3 Business Combinations and IFRS 17 to require an entity that acquires insurance contracts in a business combination within the scope of IFRS 3, or in a transfer of insurance contracts that do not form a business, to recognise a separate asset for IACF measured at fair value at the acquisition date. |

What’s the impact and what should preparers be doing now?

The clarifications are helpful for insurers that incur significant IACF for contracts where renewals are expected at the transition date. Insurers now have specific requirements to identify, recognise and measure an asset for IACF on transition, including certain simplifications. This means that:

- insurers need to assess what information will be available on IACF at or prior to transition – including how these cash flows would have been allocated to groups of insurance contracts, what expectations there were about renewals, and how these have changed over time;

- insurers will then need to determine whether they can apply the full retrospective approach to transition, or will need to apply the modified retrospective approach or fair value approach;

- if an insurer determines that it has no reasonable or supportable information available in respect of IACF on transition, then the asset for IACF will be zero on transition unless the fair value approach is applied;

- insurers should measure the asset for IACF on transition by applying the same systematic and rational allocation method that will be applied going forward, so entities will need to consider this as they develop their allocation methodologies; and

- insurers will need to use judgement to determine the amount of the asset for IACF where they have chosen to apply the fair value approach on transition and in any business combination or transfer of insurance contracts that does not form a business.

Exposure draft of amendments to IFRS 17

International Accounting Standards Board, June 2019

With the Board having published its exposure draft of the amendments to IFRS 17, you can find our latest insight and analysis at home.Kpmg/ifrs17amendments.

Transition requirements – Applying the risk mitigation option

March and February 2019 International Accounting Standards Board meetings

What’s the issue?

The risk mitigation option permits insurers to recognise the effect of some changes in financial risk for direct participating contracts in profit or loss rather than by adjusting the CSM – subject to certain criteria.

The option is prohibited from being applied for periods before the date of initial application of IFRS 17 (i.e. the beginning of the annual reporting period in which the insurer first applies IFRS 17) because it could involve the use of hindsight.

If risk mitigation activities were in place before the date of initial application of IFRS 17, then – according to some stakeholders – this prohibition may distort revenue recognised for groups of contracts in future periods and equity on transition.

This results from differences in accounting treatment between insurance contracts and related risk mitigation activities upon transition to IFRS 17.

At the February 2019 meeting, the Board voted to retain the requirements in IFRS 17 to prohibit retrospective application of the risk mitigation option. However, it agreed to discuss other potential solutions to this issue at a future Board meeting.

What did the Board decide?

At its March 2019 meeting, the Board tentatively decided to amend IFRS 17’s transition requirements in two ways.

Applying the risk mitigation option prospectively

The Board tentatively decided to permit an insurer to apply the risk mitigation option prospectively from the date of transition to IFRS 17 – i.e.:

- the beginning of the annual reporting period immediately before the date of initial application; or

- if adjusted comparative information is presented for any earlier periods, the beginning of the earliest such period.

This is permitted provided that the insurer designates the risk mitigation relationships to which it will apply the risk mitigation option no later than the date of transition to IFRS 17.

Using the fair value approach to transition

The Board also tentatively decided to permit an insurer to use the fair value approach to transition for a group of direct participating insurance contracts (even if it can apply a full retrospective approach), if certain conditions are met.

This is because an insurer can apply the risk mitigation option whenever the relevant criteria are met, as long as it:

- can apply IFRS 17 retrospectively to that group of contracts;

- applies the option as described above; and

- has also used derivatives or reinsurance to mitigate financial risk before the date of transition.

If an insurer uses the fair value transition option in this way, then it would measure groups of insurance contracts using current estimates of financial assumptions. Any derivatives1 would be measured at fair value, meaning that equity on transition will reflect both:

- previous changes in fulfilment cash flows due to changes in financial assumptions; and

- changes in the fair value of the derivatives providing risk mitigation.

What’s the impact?

In order to apply the risk mitigation option prospectively from the date of transition to IFRS 17, insurers will need to plan ahead. Relevant decisions and next steps include designating, implementing and appropriately documenting the risk mitigation relationships to which they wish to apply this amendment.

The availability of the fair value transition approach in these circumstances addresses some preparer concerns but will not address changes in non-financial assumptions – e.g. changes in demographic assumptions – which will be reflected in the CSM. The effect of this may need to be explained to users of the financial statements.

Insurers should carefully consider these proposed amendments to transition requirements – assessing which approach would be best suited to their business and provide users with the most useful information.

1. In January 2019, the Board proposed amending IFRS 17 to expand the scope of the risk mitigation option to apply when an entity uses reinsurance to mitigate financial risk. Because reinsurance contracts held are not eligible to apply the variable fee approach, changes related to financial risks are recognised in profit or loss similar to derivatives (or in other comprehensive income if an entity makes this election).

Transition requirements – Additional practical relief for acquired claims liabilities

February 2019 International Accounting Standards Board meeting

What's the issue?

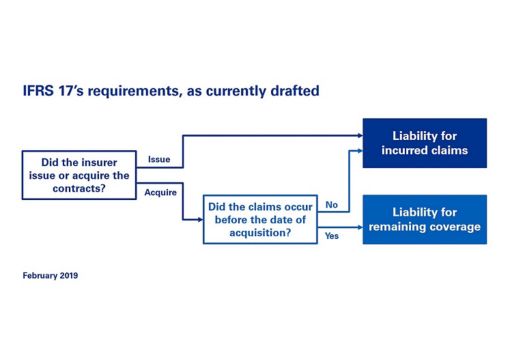

Under IFRS 17, liabilities relating to claims settlement are treated differently depending on whether the insurance contracts were issued by an insurer or acquired in a business combination or portfolio transfer, as shown below.

Click to enlarge diagram (JPG, 151 KB)

A challenge arises on transition with respect to the requirement to account for acquired claims liabilities as a liability for remaining coverage, because some insurers use a single system to manage all claims liabilities. As a result, it may be difficult to obtain the required data to separate and measure claims liabilities in two different ways.

What did the Board decide?

The Board proposes that a specified modification be added to the modified retrospective approach to transition for the treatment of claims liabilities acquired by an insurer in a business combination or portfolio transfer. Under the amendment, these liabilities would be accounted for as a liability for incurred claims.

An insurer would be permitted to use the specified modification only to the extent that it does not have reasonable and supportable information to apply a retrospective approach – i.e. to identify the acquired claims liabilities and account for them separately as a liability for remaining coverage.

The Board has also proposed an amendment to the fair value approach to transition so that an insurer applying this approach could also classify acquired claims liabilities as a liability for incurred claims.

What’s the impact?

This amendment will provide a meaningful practical solution when insurers do not have the necessary information to identify acquired claims liabilities on transition and classify them appropriately. In these cases, all claims liabilities on the date of transition would be classified as a liability for incurred claims.

The accounting for a liability for incurred claims uses a less complex measurement approach compared with a liability for remaining coverage. There would be no need to determine a contractual service margin at transition for acquired claims liabilities, meaning that no insurance service revenue would subsequently be recognised in the statement of profit or loss.

This amendment would only apply to contracts acquired before the date of transition to IFRS 17 – any contracts acquired after the date of transition would need to be treated as if the acquirer had issued them on the date of acquisition. This means that any acquired claims liabilities going forward would be classified as a liability for remaining coverage.

Transition requirements – Further Board discussions

February 2019 International Accounting Standards Board meeting

What’s the issue?

Stakeholders’ expressed various other concerns about transition requirements– mostly about comparability, optionality and providing useful information to users of financial statements. The Board discussed eight of these topics but proposed no amendments in these areas, noting that it believes they do not meet the criteria set by the Board at their October 2018 meeting.

The Board reminded stakeholders that the disclosure requirements on transition should help reduce some of these concerns. The Board also indicated that they would like to explore other ways to address insurers’ concerns about the transition requirements.

What can insurers learn from the Board discussion?

Using the modified retrospective approach

The Board considered several stakeholder concerns about the complexity and challenges of the modified retrospective approach, proposing only one amendment They provided some clarity around the use of estimates, reminding insurers that they are permitted to make estimates when retrospectively applying an accounting policy as described in IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. This principle equally applies to specified modifications in the modified retrospective approach.

Given that only one amendment has been in this area, some insurers may wish to reconsider whether the fair value approach to transition would be simpler.

Restating comparative information

Under IFRS 17, insurers are required to restate comparative information about insurance contracts for the annual reporting period immediately preceding the date of initial application. However, IFRS 9 does not require financial assets to be restated for that same period.

Some stakeholders expressed concern that some insurers would restate comparative information about insurance contracts but not about financial assets, and that this could distort users’ understanding of those insurers’ performance.

Preparers will need to balance managing the costs and resources of restating their financial assets’ accounting with users’ needs.

Identifying cash flows that are known to have occurred

Stakeholders have expressed concerns about identifying actual cash flows that are known to have occurred when estimating future cash flows at the date of initial recognition on transition. The Board clarified that if data is not available about the actual cash flows that occurred, then insurers are required to use reasonable and supportable information to estimate those amounts.

Using reasonable and supportable information

The Board reminded stakeholders that determining whether information is reasonable and supportable when transitioning to IFRS 17 may require assessment and careful consideration, and that practice would need to develop in this area.

Effective date of IFRS 17

International Accounting Standards Board: November 2018 meeting

Proposed one-year deferral to 2022

The IASB has voted to propose a one-year deferral of the effective date of IFRS 17, and the fixed expiry date of the optional temporary exemption from applying IFRS 9 Financial Instruments granted to insurers meeting certain criteria.

The Board's tentative decision means that all companies preparing financial statements under IFRS would be required to apply both IFRS 9 and IFRS 17 for annual periods beginning on or after 1 January 2022.

Read our web article to find out more.

Update, April 2019: The Board has reiterated its tentative decisions to defer the effective date of IFRS 17 and extend the temporary exemption from applying IFRS 9 to 1 January 2022.

Identifying insurance acquisition cash flows when applying the fair value transition approach

February 2018 TRG meeting

What's the issue?

Insurance acquisition cash flows are generally included in the measurement of the CSM, and a portion of the insurance revenue and expense recognised in a period includes amounts related to them.

When applying the fair value approach to transition, an insurer determines the CSM for a group of contracts at the date of transition based on the difference between the fair value of the group and the fulfilment cash flows of the group at that date.

A question has arisen over whether insurance acquisition cash flows that occurred before the date of transition are required to be identified and recognised as revenue and expense in reporting periods after the date of transition.

What did the TRG discuss?

TRG members appeared to agree that when applying the fair value approach on transition to IFRS 17, the measurement of the CSM does not include insurance acquisition cash flows that occurred before the date of transition. Therefore, these cash flows are not included in insurance revenue and expenses in reporting periods after the date of transition.

What's the impact?

This discussion should alleviate any concerns that an insurer would be required to identify insurance acquisition cash flows that occurred before the date of transition when applying the fair value approach.

About this page

This topic page is part of our Insurance – Transition to IFRS 17 series, which covers the discussions of the International Accounting Standards Board and its Transition Resource Group (TRG) regarding the new insurance contracts standard.

You can also find more insight and analysis on the new insurance contracts standard at IFRS – Insurance.