Business Model Assessments

Business Model Assessments

Like shareholders and creditors, supervisors are paying growing attention to the strength of banks’ business models. Assessments are becoming more rigorous, and now include pan-European peer group benchmarking. Banks need to understand how demanding assessments can be, and prepare accordingly. That means making detailed, credible projections that align with other internal and external statements about the future.

Recent years have seen European banks’ business models come under increasing pressure from a range of factors including ultra-low interest rates, changing customer behaviour and the emergence of FinTech.

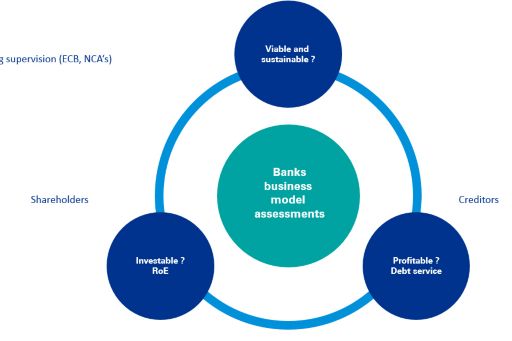

Different stakeholders assess banks’ business models in different ways, but the interaction between business models and profitability is a consistent area of focus. For example, a creditor’s interest in profitability is focused on a bank’s need to service its debt (see The profitability of EU banks) (PDF 1.43 MB). In contrast, a shareholder’s interest is focused on a bank’s return on equity (RoE) and the potential for RoE to rise or fall in future (see Are European banks investable?).

Today, a third group of stakeholders – supervisors – are also paying increasing attention to banks’ business models. The ECB views this as a key area of banking sector risk, and identified business models and profitability drivers as one of its three supervisory priorities for 2017 (and most likely for 2018 as well).

There are clear similarities between the approaches taken by supervisors and other stakeholders (see Figure 1). For example, like creditors and shareholders, supervisors consider a broad range of external factors including geo-politics, interest rates, developments in digital technology, overcapacity in the banking market and the impact of regulation.

Figure 1: Business model assessments – different stakeholder perspectives

However, the supervisory approach to business model assessments (BMAs) is also becoming more demanding and more harmonised as the SSM matures. For example:

- The ECB is concluding a thematic review of business models and profitability drivers. The review’s overall goal is to conduct an in-depth assessment of Significant Institutions’ business models, improving supervisors’ understanding of business model and profitability risks.

- The thematic review is helping the ECB to improve its quantitative tools for BMAs. Recent working papers1 have highlighted the evolution of new approaches to peer benchmarking, based on the clustering of banks into comparable groups. Sabine Lautenschläger has also spoken about the ECB’s increasing use of pan-European business model benchmarking2. The nine current peer group categories are:

- G-SIB

- G-SIB universal bank

- Universal bank

- Diversified lender

- Wholesale lender

- Retail lender

- Sectoral lender

- Custodian

- Asset manager

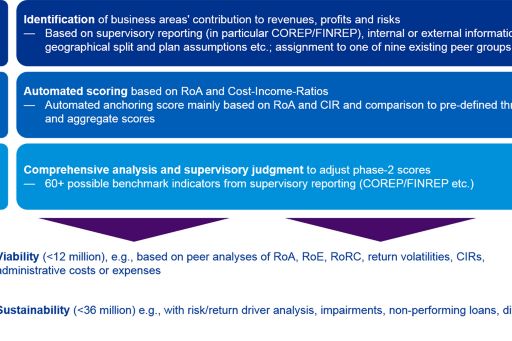

- The BMA that comprises one of each SREP’s four building blocks is becoming increasingly standardised. Some banks may view this process as a ‘black box’, but it is more formalised than the assessments made by other stakeholders. The SREP BMA is forward looking, and requires joint supervisory teams (JSTs) to form a view on a business model’s viability (within a 12 month period), sustainability (within 36 months) and sustainability over the cycle (beyond 36 months). It follows a three step approach (see Figure 2) and uses a combination of analytic tools and subjective judgements, harmonised through the EBA’s SREP guidelines (see Figure 3).

Figure 2: The ECB’s 3-phase approach to business model assessments

Figure 3: EBA’s guidelines for SREP scoring of business model assessments

These developments make it vital for banks to prepare for the practical requirements of future BMAs. Significant Institutions that have already gone through BMAs under the thematic review or during an On-Site Inspection should expect a similarly demanding process during the 2018 SREP [refer to SREP 3.0 article]. Other banks should ensure that their understanding of BMA methodology – and how it is applied - is up to date. More specifically:

- BMAs are comparable to a full scope due diligence by a potential investor. Banks need to be ready to provide detailed, credible projections for different businesses, geographies, product areas and customer groups.

- As when compiling a data room during a transaction, banks will need to think carefully about what information to include. This is not just about meeting JSTs’ requirements. Banks need to ensure their projections are fully consistent with their risk management assumptions - including recovery and resolution planning - and with the guidance provided to creditors and shareholders.

- Banks clearly need to break-up silo-structures and uncover existing processes how business data becomes CFRO information and how these affect current and future business strategies. This might be painful for banks in cases of ‘partially Excel-supported expert judgments’ of future income sources with little documentation, but helps to organize a banks response to ECB's Joint Supervisory Team or On-site inspection team.

Significant Institutions need to understand that BMAs are becoming a permanent and increasingly rigorous feature of European supervision. They are only likely to become more searching as the ECB develops its understanding of banks’ business models. Clearly, banks are well advised to anticipate ECB’s information requests on banks’ business models to prepare its internal organization accordingly.

Footnotes

1ECB WP 2070 – Business models of the banks in the Euro area, Farnè & Vouldis, May 2017; ECB WP 2084 – Bank business models at zero interest rates, Lucas, Schaumberg & Schwaab, June 2017

2Banks’ business models: Keeping pace? Statement at the Seventeenth Annual Conference on Policy Challenges for the Financial Sector, Washington D.C., 1 June 2017