The ECB adopts AnaCredit Regulation

The ECB adopts AnaCredit Regulation

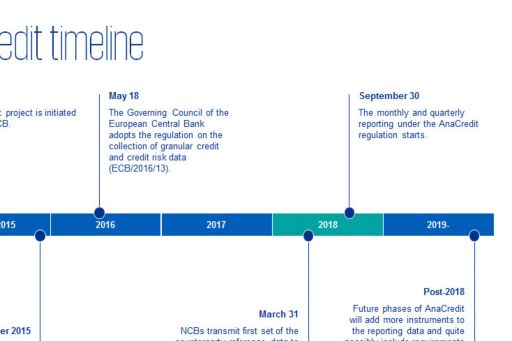

On 18 May 2016 the Governing Council of the ECB adopted the Regulation on the collection of granular credit and credit risk data (“AnaCredit”). This is currently, the largest project undertaken by the statistics team of the Central Bank. The aim of AnaCredit is to set up a dataset containing detailed information on individual bank loans in the euro area, harmonized across all Member States.

On 18 May 2016 the Governing Council of the ECB adopted the Regulation on the collection of granular credit and credit risk data (“AnaCredit”). This is currently, the largest project undertaken by the statistics team of the Central Bank. The aim of AnaCredit is to set up a dataset containing detailed information on individual bank loans in the euro area, harmonized across all Member States.1

Prior to this final version – now Regulation – there was a public consultation that brought industry views to the table. As a result of the comments received in the consultation, approximately 40 amendments were incorporated into the draft ECB Regulation, mainly impacting data attributes definitions, implementation timeline and scope of data.

Some examples of where the Regulation was modified to meet industry’s request include:

- A new sentence was added in Recital 12 in order to clarify that personal data will not be collected in the first stage of AnaCredit reporting.

- The first reporting date has been delayed by six months. The new reporting deadline will be September 2018 (formerly March 2018). Smaller banks will be able to report only once per quarter until late 2020.

The Central Bank also shifted away from its original plan to force banks to declare any non-performing loan with a value of more than €100. Banks must now only declare non-performing loans of more than €25,000.

However, the frequency of reporting specified for each of the relevant datasets remains the same for big banks as defined in the draft regulation.

In terms of data, while the data model in the draft regulation comprised 11 datasets describing a total of 94 attributes, the final regulation comprises 10 datasets describing a total of 127 data attributes. However, the number of actual variables is fewer than 127. For instance, the borrower’s address alone contributes seven data attributes.

The ECB has published, together with the approved Regulation, a feedback statement2 describing how the comments received were reflected in the revised text and in other follow-up actions taken. The ECB has also published an explanatory note to provide background information on the collection of data, as set out in the Regulation.3

Given current supervisory reporting requirements, the introduction of AnaCredit reflects a paradigm shift in the statistical reporting from a template-based reporting of summary statistics to the reporting of entire harmonized and granular credit registers. As such, AnaCredit underlines the ECB's intention of a more quantitative supervisory approach that will allow increasing the link between monetary policy, financial stability and banking supervision and the usage of additional preventive measures in prudential regulation. However, for banks the data required by AnaCredit will result in changes in reporting systems, credit databases and processes, and, in some cases, subsequent data collection exercises to provide the requested data. Furthermore enhanced IT-capabilities are likely to be needed to handle the excessive data volume. Taken together, AnaCredit without any doubt is one of the biggest challenges in bank management which also will bring the dialog between banks and supervisors to a new level.

Even if AnaCredit were the only data and reporting change facing banks, the sector would be hard pressed to meet the timelines set by the new regulation. But the industry is also having to respond to BCBS 239 requirements, and so we aren't looking merely at compliance requirements now. Banks who haven't factored AnaCredit into their data and analytics strategies will need to make significant changes to their plans and course of action. KPMG's ECB Office estimates that the cost of meeting these requirements will run between €5-10 million per year, while other industry participants have estimated this could cost larger banks as much as €50 million. Implementation is likely to take no less than a year for banks that have already started preparations under the draft regulation – and potentially more than 2 years for those who have only just started.

For more information on this, please contact:

Dirk König

dirkkoenig@kpmg.com

Mehdi Bouih

mbouih@kpmg.fr

Footnotes:

1https://www.ecb.europa.eu/ecb/legal/pdf/en_2016_13_f_sign.pdf (PDF 424 KB)

2 Feedback statement (PDF 220 KB)

3 Explanatory note on the ECB Regulation on the collection of granular credit and credit risk data (PDF 80 KB)