CEOs see a need for digital transformation to stay competitive in pursuing revenue growth. A sense of ‘purpose’ and environmental, social, governance (ESG) gain momentum.

Despite supply chain disruptions, overtaxed employees, and a world in quarantine, CEOs are aggressively pursuing digital transformation strategies to improve operations and gain insights for better business decisions. Propelled in part by a renewed sense of corporate purpose, they are generally confident about their economic prospects over the next three years.

The KPMG 2021 Life Sciences CEO Survey features insights from 500 CEOs at leading global companies, including 120 CEOs representing the life sciences industry. They offered their opinions on the key challenges and opportunities driving their businesses over the next three years.

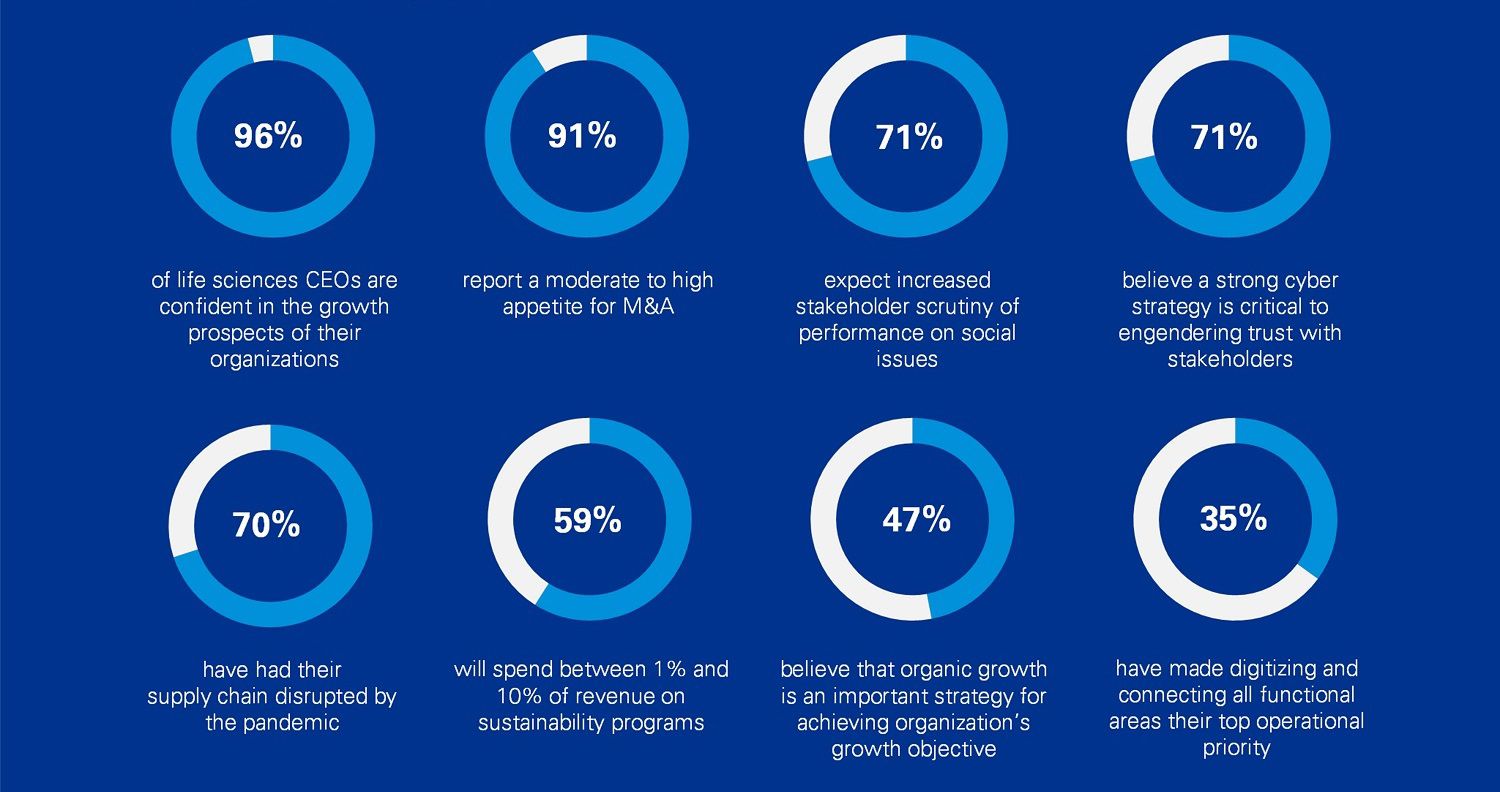

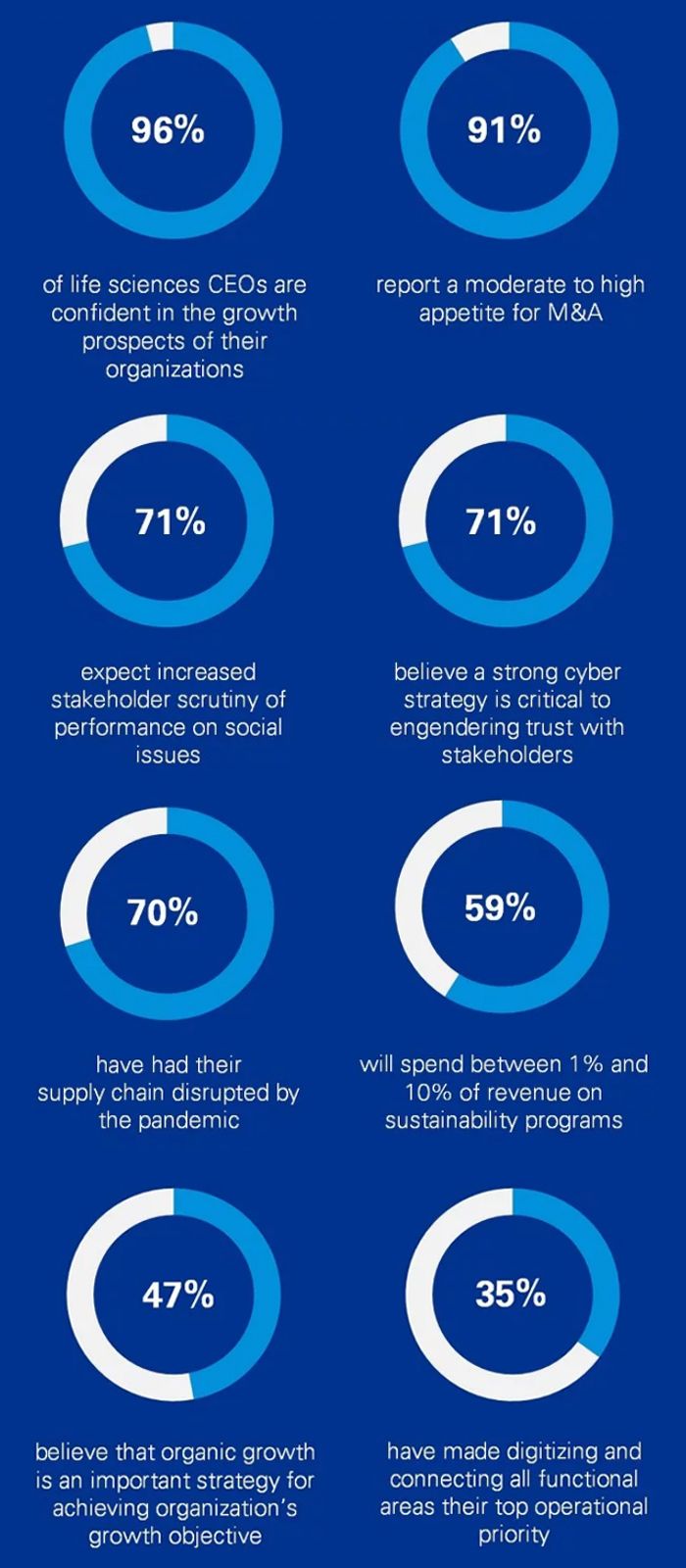

Among the survey’s finding, the following points stood out for life sciences:

- Four out of five firms are accelerating their digital transformation

Almost 80% of the firms are pursuing an aggressive digital investment strategy to attain first-mover or fast-follower status. Industry leaders are focused on enabling healthy lives, and modern technology is the engine that will reshape life sciences. - Intensified competition ahead

CEOs are moving to lock in innovation and revenue drivers, secure supply chains, and upgrade digital capabilities to reinforce and expand their existing capabilities. They are pursuing alliances, partnerships, acquisitions, and internal investments in pursuit of these aims. - CEOs strongly endorse a defined corporate purpose

The life sciences industry is purpose-driven; dedicated to helping people live healthy lives. More than four in five CEOs believe corporate purpose to be important—or even key—to achieving their objectives. Commitment to transparent ESG reporting bolsters these efforts. - Leaders expected to break away from the pack

The top 5% of life sciences organizations expect earnings growth of 10-20% per annum for the next three years, whereas almost half the industry’s companies lag the market, anticipating at most a 2.5% yearly gain and losing ground to the leaders. - To build or to buy: It depends

As organizations evaluate strategies to defend their positions and capitalize on their opportunities, they are affected by both internal and external realities. Half will continue to strengthen themselves through acquisition and/or third-party alliances. The other half are focused on integrating and optimizing the acquisitions and alliances they have already made.

Let’s examine these findings more closely.

Corporate purpose and ESG gain importance

In 2021, ESG moved into the mainstream, as most CEOs felt stakeholder pressure to increase their ESG reporting and transparency. With the vast majority being held personally responsible, almost half are struggling to articulate a compelling ESG story.

More than three quarters of CEOs would be comfortable if their pay, and that of other senior leaders, were linked to trust and reputation metrics.

More than four in five CEOs believe this corporate purpose to be important or very important in everything from driving financial performance and shareholder return to building customer relationships and brand reputation. It also factors into strengthening employee engagement, recruiting, shaping alliances, forging partnerships, and planning M&A strategy.

Trust in the industry and in ESG is tied to the corporate purpose. Our industry cannot live up to its purpose without equity and access for all. ESG metrics show how well organizations are meeting their stated ESG goals.

The economic outlook

Our industry is facing a major threat and a significant opportunity. As competition intensifies, we will continue unbundling the health market and we will see new competitors enter.

- Twenty percent of surveyed organizations expect to outpace the field

One in five firms anticipates yearly revenue growth of more than 5% per annum. A quarter of those—five percent of the total—anticipate annual revenue gains of 10-20% over that period. Meanwhile, 40% of companies lag the market, expecting annual growth of no more than 2.5%. - CEOs see M&A as major priority

Nine in ten surveyed CEOs report a moderate to high appetite for M&A, and 13% plan to make it the most important element in their growth strategy over the next three years. While acquisitions will play a major role in growth, approximately half of CEOs are putting a significant emphasis on optimizing the resources in their existing portfolios. - Disruption will be a key lever

With that in mind, well over half the CEOs plan to drive growth by investing in disruption detection and innovation, by partnering with third-party cloud providers, and by partnering to develop new technologies. - By a 2:1 margin, CEOs’ top operational priority is advancing their company’s digital transformation

Other objectives include attracting and retaining talented personnel, integrating ESG into measurements and reporting, and inflation-proofing their capital and input costs. - After COVID-19, CEOs prepare for the next crisis

Seven in ten CEOs noted the stress caused by the pandemic. One-third of them are now conducting deep analyses to prepare for potential future events. Others are diversifying sources of input, increasing their strategic planning, and bringing more of their inputs onshore to enhance production and resilience. - There’s no consensus on risk

With a number of challenges facing the life sciences industry, no one risk dominates the CEO agenda. Environmental and climate risk were named the single greatest organizational threats, but with only 17% of the vote. Supply chain risk came second, followed by threats from emerging and disruptive technologies. Operational risk and cyber security risk were the only other threats mentioned by more than 10% of the respondents.

2021 KPMG CEO Survey - 120 CEOs representing the life sciences industry

Over the next three years:

The push to get smarter, faster

The accelerating demand for digital transformation is raising the bar for the industry.

- Eighty percent of CEOs are pursuing aggressive digital strategies to attain first-mover or fast-follower status

They are shifting investments out of legacy businesses and into digital opportunities. They recognize that they will need new partnerships—and they plan to pursue them—to maintain their pace of digital transformation. - Two-thirds of life sciences CEOs prioritize investing in new technology over developing the skills and capabilities of their workforce

Four in five see technological disruption as opportunity more than threat, and they are eagerly disrupting the sectors in which they work. Digital transformation is infiltrating many aspects of life science companies, from R&D to commercial operations. - Almost four in ten CEOs believe their organizations are insufficiently protected against ransomware

Though 80% of CEOs view cybersecurity as a strategic function with potential competitive advantages, only 62% consider themselves ready for a ransomware attack. A big push for CEOs will be to strengthen the governance around their operations, and to invest in secure cloud-based technology infrastructure.

About the survey

The KPMG 2021 CEO Survey includes responses from the CEOs of 120 organizations in the life sciences industry. Of these CEOs, 44% headed organizations with under $1 billion in revenue, 26% with revenues of between $1 and $10 billion, and 30% with over $10 billion annually. As a group, they are overwhelmingly male (89%), and the majority is in their fifties (57%). Three-quarters head public companies.

Life Sciences executives are devoted to delivering the industry's promise of enabling health lives. They endorse a strong sense of purpose and are accelerating their investment in modern technologies that will increase their efficiencies and enable better business decisions.