The case for crypto and institutionalization

The case for crypto and institutionalization

The staying power of many cryptoassets will be defined by their ability to reduce friction and inefficiencies that currently exist within the global economy.

Of the 2,000+ cryptoassets issued or mined, many, including those with lofty valuations, don t even have a functional product associated with them. Further, these are also not yet currencies as we discuss in the Crypto economics section.

So, is crypto a solution looking for a problem? No, there are real problems in the global financial services ecosystem that cryptoassets are looking to address. More participation from the broader financial services ecosystem, will help drive trust and scale for the tokenized economy and help the crypto market grow and mature.

Examples of crypto use cases

- Bitcoin, which is becoming an investible asset class like unallocated gold, has the potential to become a store of value that is natively digital, generationally relevant, and an alternative to traditional asset classes.

- Ethereum has enabled Initial Coin Offerings (ICOs) as an alternate means of raising capital. The ICO space suffers from fraudulent activity and a lack of governance, accountability, and investor protection afforded by regulated capital markets. But ICOs represent an important innovation, providing new pathways and more efficient flows for capital from a significantly wider group of investors.

- Litecoin has been used to transfer the equivalent of $99 million for less than $1 of transaction fees within minutes. This transaction could have been initiated by anyone located anywhere around the world without the need for any intermediaries or third parties. While transaction times were still fairly slow compared to a Visa or a MasterCard transaction, this example represents a significant improvement compared to the speed and accessibility of existing cross-border payment rails such as wire transfers.

- Tokenization: The creation of natively digital tokenized representations of traditional (and emerging) assets that are issued, traded, and managed on a blockchain can reduce friction and overhead costs associated with the issuance, transfer, and management of traditional assets such as securities, commodities, and real estate assets. Cryptoassets that are tokenized versions of traditional assets could also fit well within existing regulatory frameworks, which may mitigate some regulatory uncertainty surrounding newer cryptoassets. Tokenization of traditional assets could also help increase liquidity, codify rules and regulations, and increase transparency throughout the asset lifecycle.

The staying power of many cryptoassets will be defined by their ability to reduce friction and inefficiencies that currently exist within the global economy. Volatility is widely quoted as a significant limitation for the use of crypto for any use case. While volatility is certainly a problem, it is important to recognize that these assets are still fairly immature and will become less volatile as they mature. There are also significant efforts that are underway across the industry for the creation of what are called “stablecoins” to address the volatility problem.

Advancing the tokenized economy

Cryptoassets may change the financial services landscape significantly with the emergence of the tokenized economy. While it's still early stages and it's hard to predict how the next 10 years will play out, the tokenized economy will likely be one of the more impactful innovations enabled by crypto.

Alongside a wave of interest frominstitutions in popular cryptoassetssuch as Bitcoin, there has beenan increasing market focus ontokenization. Crypto products andservices are starting to pivot and theglobal financial services ecosystem isalso beginning to re-tool itself for the tokenized economy. See the Crypto Landscape and Token Economy

Products and services

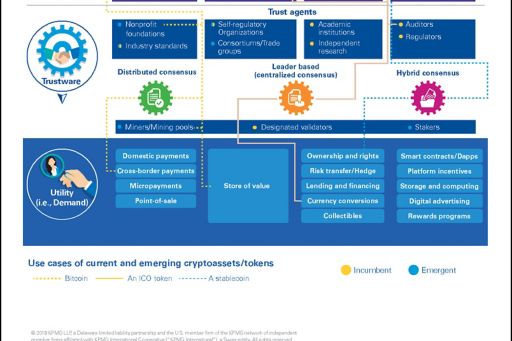

Two types of products and services are emerging for this economy: the cryptoassets or tokens represented by the dotted lines flowing through the various layers in the illustration and the infrastructure that enables the issuance, facilitation (e.g., exchange and custody), and utility (e.g., store of value, ownership, and rights) of these tokens. Token generation is relatively easy, and more tokens will continue to proliferate within the ecosystem.

However, that does not mean that every token can be trusted to meet market needs. “Trustware” will be an especially important layer for this economy. Unlike traditional financial assets, trust will be driven not only by independent organizations like regulators and auditors, but also by technology through innovations such as consensus mechanisms.

Institutional participation is required to facilitate scale and increase trust for this emerging economy. A single institution may take on multiple roles, but there are certain information barriers that will need to be maintained. For instance, a token issuer cannot also play the role of the only trust agent for that issuance. While the industry is building infrastructure in anticipation of widespread use of tokens, a greater demand for these tokens must be developed. This will happen only if products meet market needs.

Product-market fit

Achieving product-market fit is a journey, and cryptoassets are in promising but mostly early stages of this journey. It is important for token issuers and generators to ask some key questions about product-market fit:

- What problem is this cryptoasset or token solving?

- Does this token and the product associated with it truly meet a market need? Is there natural demand?

- Is this better than existing technologies, assets, financial products, or services?

- Is this product creating a truly compelling user experience?

- What are the processes and controls for token acquirability, transferability, and redeemability?

As tokens evolve and their respective use cases achieve adoption, the associated infrastructure will also improve to enable greater institutionalization.

Today’s internet leaders look different than they did in the late 1990s or did not even exist when the dot-com era began. We recognize and expect a lot of pivots, mergers, acquisitions, and failures that will redefine the crypto landscape in a few years. Just as internet protocols like TCP/ IP and HTTP enabled the sharing of information in an open way, the blockchain-based tokenized economy will enable the digitization, storage, and trusted exchange of value.

© 2024 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.