Accounting and financial reporting

Accounting and financial reporting

The accounting for cryptoassets is an emerging area with limited industry guidance. How should a crypto business account for crypto transactions and assets? Authored by Coinbase and KPMG.

Cryptoassets challenge traditional financial reporting boundaries. The accounting for these assets is an emerging area, and so far, neither the FASB nor the IASB have provided specific accounting guidance. As the technology continues to evolve, it may not always be clear how to apply accounting requirements to these transactions.

Cryptoassets like Bitcoin may exhibit certain characteristics of assets covered by different accounting codification topics. For example, some have suggested that Bitcoin is akin to traditional currencies like those backed by sovereign governments. Others view Bitcoin as a commodity, such as "digital gold." However, we believe that under Generally Accepted Accounting Principles (GAAP) in the United States cryptoassets would generally meet the definition of an indefinite-lived intangible asset because they do not convey specific rights to cash or ownership in a legal entity in the same way as financial instruments.

Some have noted that the accounting guidance for intangible cryptoassets was not written with crypto in mind. That is true. While we believe many cryptoassets fall within the scope of those standards based on the specific rights conveyed, this is an innovative and emergent area that could benefit from reexamination by standard setters.

Recognition and measurement

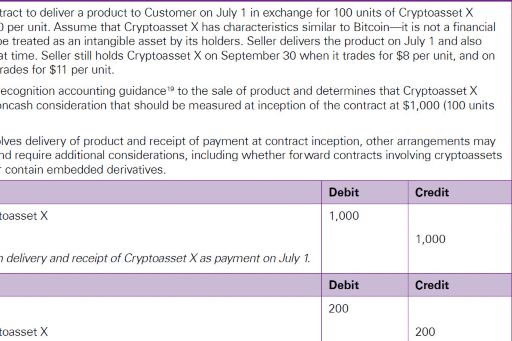

While many believe cryptoassets like bitcoin would be better measured at fair value each period, there are only limited circumstances in which U.S. GAAP currently supports this, such as when bitcoin is held as an investment by an investment company. In other circumstances, indefinite-lived intangible assets are not amortized, but are required to be recognized and measured at their historical cost; impairment is recognized when their carrying amount exceeds fair value. The subsequent reversal of previously recognized impairment losses is prohibited.

Also important is that each asset needs to be evaluated based on its specific characteristics. For example, as interest in crypto has grown, so have the number of intermediaries that allow the purchase, sale, and custody of these assets. In some cases these holdings may represent direct ownership of a crypto held in custody by a counterparty, while in others they may simply represent a contractual right that could be a financial contract (i.e., a loan receivable tied to the value of crypto). Similarly, derivative contracts such as forwards, futures, and investments in funds that hold interests in cryptoassets would generally be accounted for as financial instruments.

To accurately value crypto that is received in exchange for goods or services, a company may need to seek the expertise of specialists and use judgment. While Bitcoin currently trades regularly and in high volume, this may vary for other digital assets. It may be necessary to evaluate and consider information from many sources to determine the fair value of cryptoasset holdings.

The recognition and derecognition of cryptoassets is generally based on the concept of control. That is, crypto is recognized as an asset when control over that asset is obtained and derecognized when control is lost. When evaluating the transfer of control and ownership, it may be important to consider the relevant legal environment, especially in situations that are more complicated than a simple sale (e.g., a transaction that involves ongoing custodial services by the seller). For crypto, this evaluation may require special attention to legal issues, which is complicated by the fact that case law is only beginning to develop.

Tokenization

In the case of Bitcoin, we believe what has been tokenized is an intangible asset (a specific number of units of Bitcoin), because ownership does not come with any other rights and obligations. In contrast, other cryptoassets, such as tokens or coins in an initial coin offering, may convey specific utility or financial characteristics, such as rights to goods or services or a share of profits of a company or project. In each case, we believe the accounting should follow the rights and obligations conveyed. Issuers and holders of cryptoassets should carefully evaluate the specific characteristics of the asset to determine the appropriate accounting.

Issuers would determine whether the token or coin should be accounted for as debt, equity, or a right to goods or services in the financial statements. Holders would determine whether the token or coin represents a financial asset, a right to goods or services, or something else. For example, a token that conveys specific rights to cash over time may meet the definition of a debt security or loan irrespective of whether ownership of the token is represented on a blockchain.

Of course, it is also critical to evaluate cryptoasset transactions to verify that they comply with relevant legal and regulatory requirements. For example, an issuance of tokens may represent a security that would require registration with the SEC, unless the issuance qualifies for an exemption.

Other accounting issues

Crypto raises novel accounting questions, many of which are just starting to be examined. For instance, holders of crypto may need to evaluate how best to account for blockchain forks and other such events. Crypto miners must determine how best to account for the receipt of assets related to their mining efforts. Because of the limited accounting guidance in this area and the dynamic and evolving nature of the industry, crypto participants should stay tuned in to financial reporting developments.

Internal control and the future of accounting

Some have asked how blockchain technologies might change accounting and financial reporting. While that may be difficult to predict, we believe blockchain fits into a broader wave of automation technologies that have the potential to improve the efficiency and effectiveness of financial reporting. Those effects may extend across the spectrum of preparing, controlling, and analyzing financial information.

Nevertheless, while blockchain and other systems could ultimately make verifying a transaction and its amount more automated, internal control over financial reporting involves considerations that extend beyond the integrity of software systems. Companies must maintain responsibility for their own control environment and assess and respond to new risks in their processes.

Further, where external organizations provide services related to blockchain technologies, due diligence, and analysis are performed to ensure that the service organization has the appropriate controls in place.

Crypto in particular raises unusual books and records challenges that require an effective system of internal control to answer key questions, such as:

- How does the organization evidence that its cryptoassets are secure and that private keys have not been compromised?

- How does the organization evidence its ownership of cryptoassets?

- If third-party custodians are used, how is the organization confident that the custodian has the appropriate controls in place?

- Given the potential anonymity of blockchain participants, how does the organization ensure all related party transactions are identified, accounted for, and reported?

- How does the organization ensure crypto transactions are measured at an appropriate fair value?

- How does the organization ensure that all crypto transactions are captured and appropriately reflected in the financial statements and footnotes?

- Has the organization evaluated whether its engagement with crypto creates additional risks of material misstatement (includingfraud risks) and designed and implemented controls to mitigate those risks?

- How does the organization ensure compliance with all relevant laws and regulations?

As the pace of automation accelerates, we believe the financial reporting function will play an important role in assessing and addressing the risks that accompany innovation.

© 2024 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.