Retail Health Continues Slow Decline as Golden quarter fails to deliver festive cheer on the high street

Cost of living Christmas worse than Covid Christmas for retailers

Cost of living Christmas worse than Covid Christmas for retailers

- Cost of living Christmas worse than Covid Christmas for retailers

- Margin pressures continue as some retailers look to clear down excess stock

- Retail health set to deteriorate further in opening months of 2023 as higher interest rates depress the housing market

The health of the retail sector continued to decline in the final few months of 2022, as the golden quarter failed to deliver a festive boost for retailers, according to the latest assessment by KPMG/Ipsos Retail Think Tank (RTT) members.

Demand, costs and margins continued to be put under pressure, as savvy shoppers used Black Friday to bring Christmas gift purchasing forward and grocery sales failed to hit the higher volume levels associated with Christmas time. Promotional driven demand through Black Friday sales saw spending on non-food items such as clothing, health and furniture keep retail sales relatively healthy through November. However, rather than a sales boost, Black Friday enabled many consumers to bring Christmas gift buying forward, and came at a cost for some retailers, biting further into stretched margins, as some looked to clear down excess inventory, or buy market share in the face of tough competition for each sale.

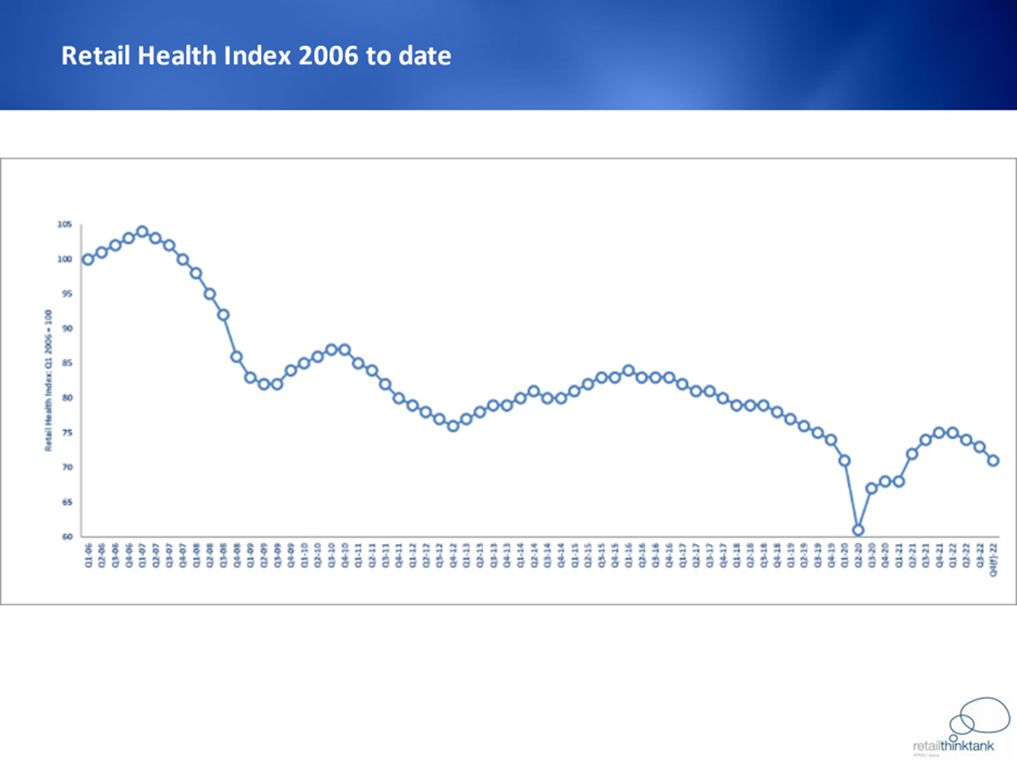

According to the RTT, the health of the retail sector fell by a further two points in Q4 22 (Oct – Dec) putting the latest Retail Health Index (RHI) at 71 points in the final quarter of this year - a drop in Christmas trading not seen since 2011 where growing uncertainty in the European and global markets kept consumer confidence low. The fall in demand during the golden quarter makes it one of the most challenging Christmases in recent times and was more severe than the two golden quarters of 2021 and 2020 where consumers were confined by Covid restrictions.

Despite consumer confidence moving more positively throughout the quarter, RTT members concluded that conditions across the three drivers of retail health (demand, cost and margin) had continued to deteriorate from Q3 22 into Q4 22 as inflation and interest rates continued to climb, household incomes were further squeezed by rising utility costs and labour costs remained high. The deterioration is set to continue into 2023 according to RTT members.

Commenting on the quarter, Paul Martin, UK Head of Retail at KPMG said :

“Despite consumers choosing to protect their Christmases this year, retail health continued to slide during the vital golden quarter as rising inflation, rising costs and flattened sales all took their toll on the health of the sector.

“It has been a weak Christmas period for many retailers, particularly in the food sector which accounts for more than half of retail, and where high inflation has not led to the uptick in grocery volumes that we would usually see at this time of year. Margins have been under increasing pressure and for some retailers, such as those selling big ticket items, this has been unavoidable as consumers tighten their belts, whilst others with excess inventory have been forced to start promotions early, and some are choosing to sacrifice margin to capture market share.

“We are seeing a slow and steady decline in retail health and whilst there is still potentially worse to come as it takes time for inflation to settle and falling costs to feed into the system, we are not expecting retail health to decline as rapidly as we have seen in previous recessions. Demand across some categories has been surprising and is protecting some retailers so we can expect more consolidation and high street casualties as we head into the new year. It will be yet another tough year for retail and a case of survival of the fittest, but we expect to see demand increase as 2023 progresses.”

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Save, Curate and Share

Save what resonates, curate a library of information, and share content with your network of contacts.

New year – same old woes

Looking ahead, many of 2022’s themes will remain front of mind in 2023 with the short to mid-term outlook of the sector remaining challenging. The opening quarter of 2023 is likely to be the most challenging quarter for many retailers and after a more muted Christmas trading period this could result in a flurry of business failures according to RTT members.

The RHI in Q1 23 is expected to see a further two-point decline to 69 points, around the same level seen in the first quarter of 2021, as household expenses remain elevated due to the cost of energy and increased interest rates negate any benefit from lower inflation elsewhere. Wage rises will continue to drag behind price increases, further impacting disposable income and retail spending and with house prices predicted to fall, consumer confidence could be dented in the opening quarter of the year. Consumer confidence will remain low, with most consumers continuing to be cautious with whatever is left of their disposable income and be more inclined to save than spend. Further rises in interest rates, perhaps from 3.50 per cent now to a peak of 4.50 per cent in early 2023, will leave the cost of buying a home with a mortgage high and falling house prices will weigh further on consumer confidence and consumer spending.

Cost pressures for retailers are expected to remain elevated and even though global freight, agriculture and supply chain costs have already started to fall, they will take time to feed into the real retail economy. The supply chain is beginning to return to pre-COVID levels of cost as supply increases and freight costs reduce but Brexit and COVID have left the UK with a much-reduced working-age population and labour shortages across the whole economy. Labour costs will continue to prove a challenge for the retail sector even as starting salary inflation starts to slow, in order to attract and maintain workforces, retailers will have to provide attractive packages and increase wages to remain competitive.

Commenting on the outlook for retail, Joe Marshall – Managing Director, Customer Experience and Channel Performance, Ipsos Retail Performance said :

“Off the back of weak Christmas trading, the sector is facing a very challenging opening quarter to 2023 with retail health expected to slide further, putting it on par with the opening of 2021 but without the business and employee support available in the Covid years. Despite inflation hitting lower income households the hardest, consumers across the board will become more considered with their spending as the year opens, which will have an impact on demand – the key driver of retail health. Consumers will be looking for value, buying less, and shifting to the discounters and value players, for food and necessities. Trading down to cheaper products, buying more private label, and managing budgets by careful buying will be key coping strategies. As shoppers` batten down the hatches this will put more pressure on the operating margins of food retailers particularly in the first few months of the year.”

With demand expected to fall further as cautious consumers hold on to the pennies, Q1 23 could be a highly promotional period in a bid for retailers to generate greater footfall. Any excess stock not sold before Christmas could be further reduced leading to big January sales, and potentially having an even greater impact on already tight margins. Some food inflation held back to tempt consumers to buy more ahead of Christmas could also start to come through in the opening months of 2023, having an impact on volumes.

Paul Martin concluded :

“As we head into 2023, financing business debt and investment is also becoming more expensive because of higher interest rates which, combined with a more competitive, value led, lower volume, retail environment, will lead to more casualties and asset disposals among those businesses that do have high debt levels and low cash reserves. Online players and mid-tier retailers who experienced a rapid increase in demand during the Covihd-19 pandemic and are now facing a slowing market and increased cost-base could find the year ahead very challenging. However, there will be opportunities and some organisations will benefit from the current situation through market-share growth and consolidation opportunities that will arise.”

ENDS

Note to Editors:

For media enquiries, please contact:

Emma Murray, KPMG Corporate Communications

T: 020 7 694 6506

KPMG Press Office: +44 (0)207 694 8773

About the KPMG/Ipsos Retail Think Tank (RTT) and Retail Health Index:

The RTT panellists rely on their depth of personal experience and sector knowledge, and review a comprehensive bank of industry and government datasets and include the following:

Members of the RTT are:

- Nick Bubb – Independent Retail Analyst

- Joe Marshall – Managing Director, Customer Experience and Channel Performance, Ipsos Retail Performance

- Martin Hayward – Hayward Strategy and Futures

- Maureen Hinton – GlobalData Retail

- Paul Martin – KPMG

- James Sawley – HSBC

- Mike Watkins – NielsenIQ

- Ruth Gregory – Capital Economics

- Jonathan De Mello – Founder & CEO, JDM Retail Consulting LLP

- Martin Newman – The Consumer Champion

The intellectual property within the RTT is jointly owned by KPMG (www.kpmg.co.uk) and Ipsos Retail Performance.

First mentions of the Retail Think Tank should be as follows: the KPMG/Ipsos Retail Think Tank. The abbreviations Retail Think Tank and RTT are acceptable thereafter.

The RTT was founded by KPMG and Ipsos Channel Performance in February 2006. It now meets quarterly to provide authoritative ‘thought leadership’ on matters affecting the retail industry. All outputs are consensual and arrived at by simple majority vote and moderated discussion. Quotes are individually credited. The Retail Think Tank has been created because it is widely accepted that there are so many mixed messages from different data sources that it is difficult to establish with any certainty the true health and status of the sector. The aim of the RTT is to provide the authoritative, credible and most trusted window on what is really happening in retail and to develop thought leadership on the key areas influencing the future of retailing in the UK. Its executive members have been rigorously selected from non-aligned disciplines to highlight issues, propose solutions, learn from the past, signpost the road ahead and put retail into its rightful context within the British social/economic matrix.

Definitions: The RTT assesses the state of health of the UK retail sector by considering the factors which influence its three key drivers.

- Demand– Demand for retail goods and services. From a retro-perspective, retail sales, volumes and prices are the primary indicators. When considering future prospects, economic factors such as interest rates, employment levels and house prices as well as others such as consumer confidence, footfall and preferences are used.

- Margin (Gross) – Sales less cost of sales; the buying margin less markdowns and shrinkage. Cost of sales include product purchase costs, associated costs of indirect taxes and duty and discounts.

- Costs– All other costs associated with the retail operations, including freight and logistics, marketing, property and people.

The Retail Health Index – how is it assessed?

Every quarter each member of the RTT makes quantitative assessments of the impact on retail health of demand, margins and costs for the quarter just completed and a forecast of the quarter ahead. These scores are submitted individually, collated and aggregated in time for the RTT’s quarterly meeting. The individual judgments on what to score are ultimately a combination of objective and subjective ones, drawing upon a wide range of hard datasets and softer qualitative material available to each member. The framework follows the example of The Bank of England Agents’ scoring system on economic intelligence provided to the Monetary Policy Committee.

The aggregate scores are combined to form the Retail Health Index (‘RHI’) which is reviewed at that meeting and occasionally revised after debate if members feel it appropriate. The RHI tracks quarter-on-quarter changes in the health of the UK retail sector and as such provides a useful and unique measured indicator of retail health. The index ‘base’ of 100 was set on 1 April 2006. Each quarter, it assesses whether the state of health has improved or deteriorated since the previous quarter. An improvement will lead to a higher RHI score than that recorded in the previous quarter, and with a deterioration leading to a lower score. The larger the index movement, the more marked the shift in the state of health.

The RHI has two main benefits. Firstly, it aims to quantify the knowledge of the RTT members in a systematic way. Secondly, it assesses the overall state of health of the UK retail sector for which there is no official data.