KPMG AND REC, UK REPORT ON JOBS - February 2022

Starting salaries continue to rise at near-record pace amid sharper drop in candidate supply.

Starting salaries continue to rise at near-record pace amid sharper drop in candidate

Key findings

- Substantial increases in permanent placements and temp billings

- Pay pressures remain elevated as candidate availability falls rapidly

- Overall vacancy growth eases, but remains sharp

Summary

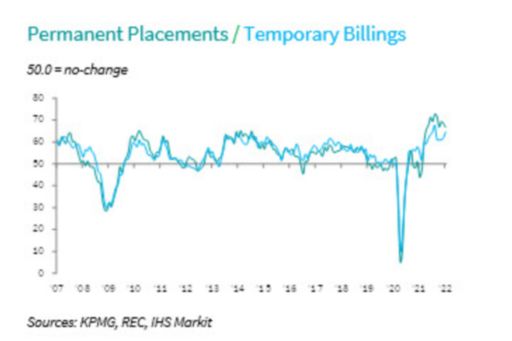

The latest KPMG and REC, UK Report on Jobs survey signalled a further steep increase in hiring activity at the start of 2022. Permanent placement growth eased slightly since December, however, while the upturn in temp billings gathered pace.

The overall availability of candidates deteriorated at a quicker pace in January, driven by a steeper fall in permanent staff supply. Robust demand for workers and scarce candidates led to further marked upward pressure on rates of starting pay. Starting salaries increased at the third-fastest pace on record, while temp pay growth remained sharp despite easing to a seven-month low. Vacancies data meanwhile showed that demand for workers continued to rise at a historically sharp pace, despite overall growth edging down to its lowest for nine months.

The report is compiled by IHS Markit from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Recruitment activity continues to rise sharply at start of 2022

The easing of pandemic restrictions, improved market confidence and strong demand for workers drove a further steep increase in recruitment activity across the UK during January. Permanent placement growth remained sharp, despite easing to a three-month low, while temp billings expanded at the quickest rate since last August.

Starting salary inflation remains close to record pace

Robust demand for staff and candidate scarcity drove up rates of starting pay for both permanent and temporary staff at the start of the year. Starting salaries rose at the third-sharpest rate on record (since October 1997), beaten only by those seen last October and November. Temp wage inflation also remained rapid, despite the pace of increase easing to a seven-month low.

Quicker fall in overall supply of candidates

The rate of decline in overall candidate availability quickened for the first time in five months in January. Though not as steep as those seen during last summer, the rate of deterioration remained substantial overall. The downturn was driven by a quicker drop in permanent staff supply, as temp candidate numbers fell at a softer pace.

Vacancy growth eases, but remains historically sharp

Demand for staff continued to rise at a historically sharp pace in January, despite growth of overall vacancies edging down to a nine-month low. Underlying data showed that the softer upturn was due to a weaker rise in permanent staff demand, as short-term vacancies expanded at a quicker rate.

Regional and Sector Variations

The steepest increase in permanent staff appointments was seen in the South of England, though rates of expansion softened across all four monitored English regions.

All four monitored English regions saw sharper increases in temp billings in January, bar London. The quickest rate of growth was seen in the North of England.

Demand for staff continued to rise sharply across both the private and public sector during January. The quickest increase in vacancies was signalled for permanent roles in the private sector, while the softest was seen for temporary workers in the public sector.

Demand for permanent workers rose across all ten monitored job sectors at the start of 2022. The quickest increase in demand was seen for IT & Computing, followed by Nursing/Medical/Care. The slowest upturn in vacancies was seen in the Retail sector.

The increase in demand for temporary staff was also broad-based across all ten monitored sectors in January. The quickest expansions were seen in the Nursing/Medical/Care, Blue Collar and Hotel/Catering categories.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Save, Curate and Share

Save what resonates, curate a library of information, and share content with your network of contacts.

Commenting on the latest survey results, Claire Warnes, Head of Education, Skills and Productivity at KPMG UK, said:

“The new year has seen the jobs market continuing where it left off, with a steep climb in permanent and temporary hiring. Meanwhile, a sustained decline in the number of suitable candidates has pushed starting salaries up for yet another month.

“It will be important to monitor how these dynamic features of the job market respond to the competing pressures being felt by both businesses and candidates – the desire to make the most of the reduction in Covid restrictions on the one hand; and the understandable concern over the cost of living and inflationary rises on the other.

“Some sectors are continuing to show the strain of high demand for permanent and temporary roles. In particular, the IT and Computing, and Nursing, Healthcare and Medical sectors saw the greatest vacancy increases for yet another month, reflecting the significant workforce and skills challenges which these sectors have faced, and which the pandemic has accelerated.”

Neil Carberry, Chief Executive of the REC, said:

"The jobs market is still growing strongly at the start of 2022. Recruiters are working hard to place people into work as demand from employers continues to rise. With competition for staff still hot, companies are having to raise pay rates for new starters to attract the best people. And the cost of living crisis means there is also more pressure from jobseekers who want a pay rise. But pay is not the only important factor - companies must think about all aspects of their offer to candidates to ensure they get the staff they need. This will be important as firms’ spending is under pressure from inflation as well.

"Government's role is to manage inflation, but also to ensure that they do not discourage investment - that is what will drive the economy to grow through this year. Now is the wrong time to be raising National Insurance, the biggest business tax. But politicians should also be thinking about longer-term workforce planning, making sure we have the skills the country needs for the future. This will take a collaborative effort between the public and private sectors, and the recruitment industry stands ready to help."

Contact :

KPMG

Chris Mostyn

Deputy Head of Media Relations

T: +44 (0)7512 448000

REC

Josh Prentice

Comms Manager

T: +44 (0)20 7009 2129

IHS Markit

Joanna Vickers

Corporate Communications

T: +44 207 260 2234

IHS Markit

Annabel Fiddes

Economics Associate Director

T: +44 (0)1491 461 010

Methodology

The KPMG and REC, UK Report on Jobs is compiled by IHS Markit from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Survey responses are collected in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

For further information on the survey methodology, please contact economics@ihsmarkit.com.

Full reports and historical data from the KPMG and REC, UK Report on Jobs are available by subscription. Please contact economics@ihsmarkit.com.

About KPMG

KPMG LLP, a UK limited liability partnership, operates from 21 offices across the UK with approximately 16,000 partners and staff. The UK firm recorded a revenue of £2.3 billion in the year ended 30 September 2020.

KPMG is a global organization of independent professional services firms providing Audit, Legal, Tax and Advisory services. It operates in 147 countries and territories and has more than 219,000 people working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. KPMG International Limited is a private English company limited by guarantee. KPMG International Limited and its related entities do not provide services to clients.

About REC

The REC is the voice of the recruitment industry, speaking up for great recruiters. We drive standards and empower recruitment businesses to build better futures for their candidates and themselves. We are champions of an industry which is fundamental to the strength of the UK economy. Find out more about the Recruitment & Employment Confederation at www.rec.uk.com.

About IHS Markit

IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2022 IHS Markit Ltd. All rights reserved.

Disclaimer

The intellectual property rights to these data are owned by or licensed to IHS Markit and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. IHS Markit is a registered trademark of IHS Markit Ltd and/or its affiliates.