New Covid variant to push back UK economic recovery

- GDP growth could more than halve next year if more restrictions are introduced

- Disruption to Christmas trading season a major blow to hospitality and travel businesses

- Latest developments will cause the Bank of England to hold off raising interest rates this month

As the emergence of a potentially more contagious strain of coronavirus brings new uncertainties around the short-term economic outlook, GDP growth could be between 1.8% and 4.2% next year, according to the latest analysis in KPMG’s UK Economic Outlook.

While growth momentum is expected to decelerate until a booster is rolled out to halt the rise in cases, the full impact of the new variant will depend on the rise in the number of acute Covid cases and any social distancing restrictions that are introduced.

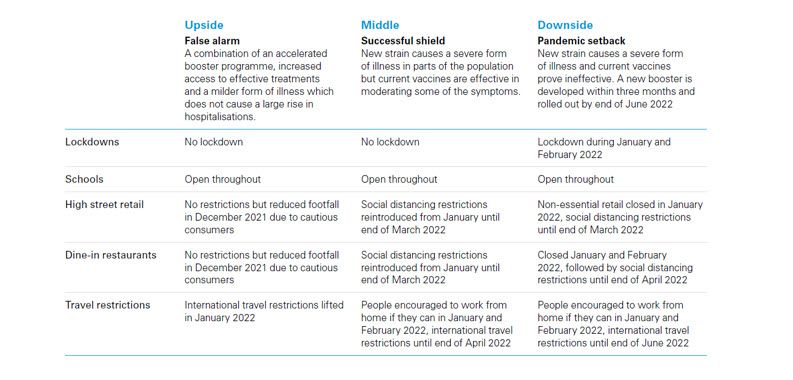

KPMG has developed three scenarios* based on assumptions around the severity of the new coronavirus strain and the way the Government will respond in order to contain it. The variation in GDP forecasts for next year are dependent on the extent social distancing restrictions are introduced in the first half of the year. Current measures by the Government to control the pandemic with minimal restrictions could see a relatively small impact on economic growth, as depicted in the ‘Upside’ scenario.

Table 1: KPMG UK GDP growth forecasts

Yael Selfin, Chief Economist at KPMG UK, commented on the report: “The Omicron variant has elevated the level of uncertainty about the recovery path from the pandemic. While the impact is not expected to be as severe as at the start of the pandemic, or even the beginning of this year, increased uncertainty and the potential reintroduction of social distancing measures could see output fall this month and during the first quarter of 2022.”

Outlook for the labour market, inflation and interest rates

Assuming that no further restrictions are introduced by the Government as part of measures to tackle the spread of the Omicron variant, unemployment might rise only gently. The labour market appears to have withstood the end of the furlough scheme with the unemployment rate expected to peak at 4.5% in our Upside scenario. However, new restrictions to combat the Omicron variant could see unemployment peak at 5-5.7% in 2022.

The path of inflation will depend in part on the potential economic fallout of the new variant. A deteriorating pandemic outlook could once again increase the demand for goods and put more pressure on supply chains in the short-term but at the same time, cooling demand for energy and some services could ease inflationary pressures. Inflation is therefore expected to average between 4.3 - 4.8% in 2022 and 2.3 - 2.5% in 2023.

The high level of uncertainty about the new variant is expected to see the Bank of England hold off raising interest rates in December 2021. However, rates are expected to rise to 1-1.25% by the end of 2023 in order to prevent a ratcheting up of wage growth as the recovery gathers renewed momentum.

Jon Holt, Chief Executive of KPMG UK, said: “Long term economic growth remains reliant on the UK’s ability to increase productivity, decrease uncertainty and give businesses the confidence they need to invest. We need to create the conditions to accelerate companies’ investment in technology and power the UK’s recovery.

“While companies have been grappling with global supply chain problems for some months, we expect these to ease gradually as increased capacity comes on board. Nevertheless, growth momentum could stall if businesses find it harder to recruit more staff and a more sustained pick-up in UK GDP growth would require productivity to rise.”

For media enquiries, please contact:

Gill Carson, KPMG Corporate Communications

Tel: +44 (0) 20 3078 4189

Mob: +44 (0) 7768 635843

Follow us on twitter: @kpmguk

KPMG Press Office: +44 (0)207 694 8773

Email: gill.carson@kpmg.co.uk

Notes to Editors:

Table 2 - Alternative Omicron scenarios

About the research

The forecasts were produced by the KPMG macroeconomics team using a suite of external and in-house models capturing the main inter-relationships in the UK economy. As with all forecasts, these are subject to considerable uncertainty and the outturn may differ significantly.

About KPMG

KPMG LLP, a UK limited liability partnership, operates from 21 offices across the UK with approximately 16,000 partners and staff. The UK firm recorded a revenue of £2.3 billion in the year ended 30 September 2020. KPMG is a global organisation of independent professional services firms providing Audit, Legal, Tax and Advisory services. It operates in 147 countries and territories and has more than 219,000 people working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. KPMG International Limited is a private English company limited by guarantee. KPMG International Limited and its related entities do not provide services to clients.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Save, Curate and Share

Save what resonates, curate a library of information, and share content with your network of contacts.