Expected strong recovery marred by medium-term risks ahead

Robust recovery in the short-term to see UK economy return to pre-Covid

Robust recovery in the short-term to see UK economy return to pre-Covid

- Robust recovery in the short-term to see UK economy return to pre-Covid level by Q1 2022, with GDP growth of 6.6% forecast for 2021 and 5.4% for 2022.

- Despite interest rates remaining low in the short term, the withdrawal of government support schemes could coincide with a significant uptick in the number of company insolvencies.

- Recovery is unlikely to be even across the UK with strongest growth expected in the West Midlands, London, and the East of England.

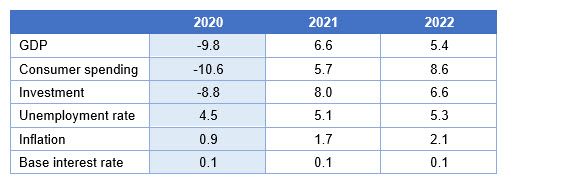

A combination of restrictions lifting, pent-up consumer demand, accumulated excess savings and a range of government incentives are expected to spark a strong lift-off for the UK economy this summer. This will see GDP grow by 6.6% (up from 4.6% forecast in March) in 2021 and 5.4% in 2022*, allowing the economy to reach its pre-Covid level by the first quarter of next year, according to the latest analysis in KPMG’s UK Economic Outlook.

Meanwhile, rising cost pressures and the reversal of temporary tax cuts will add to inflation this year, but the analysis shows it should moderate towards the second half of next year, and average 1.7% in 2021 and 2.1% in 2022. With spare capacity still in place, KPMG expect the Bank of England to keep interest rates on hold in the short-term in order to allow the economy to fully recover and mitigate the downside risks to the outlook.

From the onset of the pandemic, businesses have been partially shielded from insolvency both by the direct financial support on offer as well as by temporary measures suspending and relaxing insolvency procedures. So, once the temporary regime is over and businesses are forced to confront a new normal, there could be a significant uptick in the number of company insolvencies, despite interest rates remaining low in the short term. This could mean a peak of about 8,000 insolvencies around the turn of the year before numbers fall back again to around 4,000 per quarter.

The outlook beyond the short-term paints a less strong picture, with the end of the super deduction allowance and the rise in corporate tax causing a sharp fall in business investment from 2023, while consumers readjust their spending patterns.

Yael Selfin, Chief Economist at KPMG UK, commented on the report: “As restrictions are lifted and consumers flock back, we expect a robust recovery ahead. Some sectors, such as manufacturing and construction, have already recovered most of the ground lost last year, while for others such as hospitality, the big times are now.

“But the possible emergence of new variants of the virus that are less responsive to the current vaccines is still a downside risk, albeit less severe than previously, as the economy has adapted to operating under social distancing restrictions. An expected rise in the level of insolvencies, as government support programmes are withdrawn, could also impact recovery.”

Table 1. KPMG’s June forecasts for the UK economy

Source: ONS, KPMG forecasts. Average % change on previous calendar year except for unemployment rate, which is average annual rate. Investment represents Gross Fixed Capital Formation, inflation measure used is the CPI and unemployment measure is LFS. Interest rate represents level at the end of calendar year.

UK regions: widespread recovery

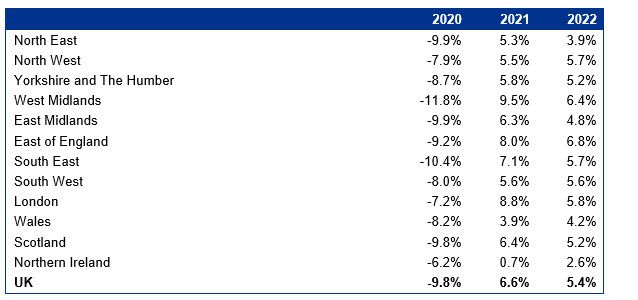

The outlook for all regions and nations of the UK is one of a recovery in both 2021 and 2022, although at varying speed, with strongest growth expected in the West Midlands, London and the East of England. This reflects the uneven impact of the pandemic across sectors and regions, with a relatively quick bounce-back in manufacturing leading much of the early gains in output. However, as the economy re-opens and restrictions lift, the shift towards a services-based economy will resume across most of the UK.

Table 2: All regions to see a recovery in output in 2021 and 2022

Source: ONS, Scottish Government, NISRA, KPMG analysis. Note: Forecasts for Northern Ireland are based on Northern Ireland Composite Economic Index (NICEI).

Chris Hearld, Head of Regions at KPMG UK, concludes: “The recovery should provide an opportunity for the government to address its levelling up agenda by targeting investment to improve the long-term prospects of regions with the biggest economic challenges, focusing on a range of areas that require specific support, from education and skills to technology infrastructure, housing, and social amenities.”

-ENDS-

For media enquiries, please contact:

Gill Carson, KPMG Corporate Communications

Tel: +44 (0) 20 3078 4189

Mob: +44 (0) 7768 635843

Follow us on twitter: @kpmguk

KPMG Press Office: +44 (0)207 694 8773

Email: gill.carson@kpmg.co.uk

Notes to Editors:

*The forecasts assume government restrictions are lifted in line with earlier announcements.

About the research

The forecasts were produced by the KPMG macroeconomics team using a suite of external and in-house models capturing the main inter-relationships in the UK economy. As with all forecasts, these are subject to considerable uncertainty and the outturn may differ significantly.

About KPMG

KPMG LLP, a UK limited liability partnership, operates from 21 offices across the UK with approximately 16,000 partners and staff. The UK firm recorded a revenue of £2.3 billion in the year ended 30 September 2020. KPMG is a global organisation of independent professional services firms providing Audit, Legal, Tax and Advisory services. It operates in 147 countries and territories and has more than 219,000 people working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. KPMG International Limited is a private English company limited by guarantee. KPMG International Limited and its related entities do not provide services to clients.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia