Why do banks find this challenging

The purpose of benefits tracking is to provide in-flight information to accurately assess the value of on-going investment and transformation programmes. A proactive approach is required to enable banks to monitor the progress and performance of strategic initiatives long before P&L benefits are realised.

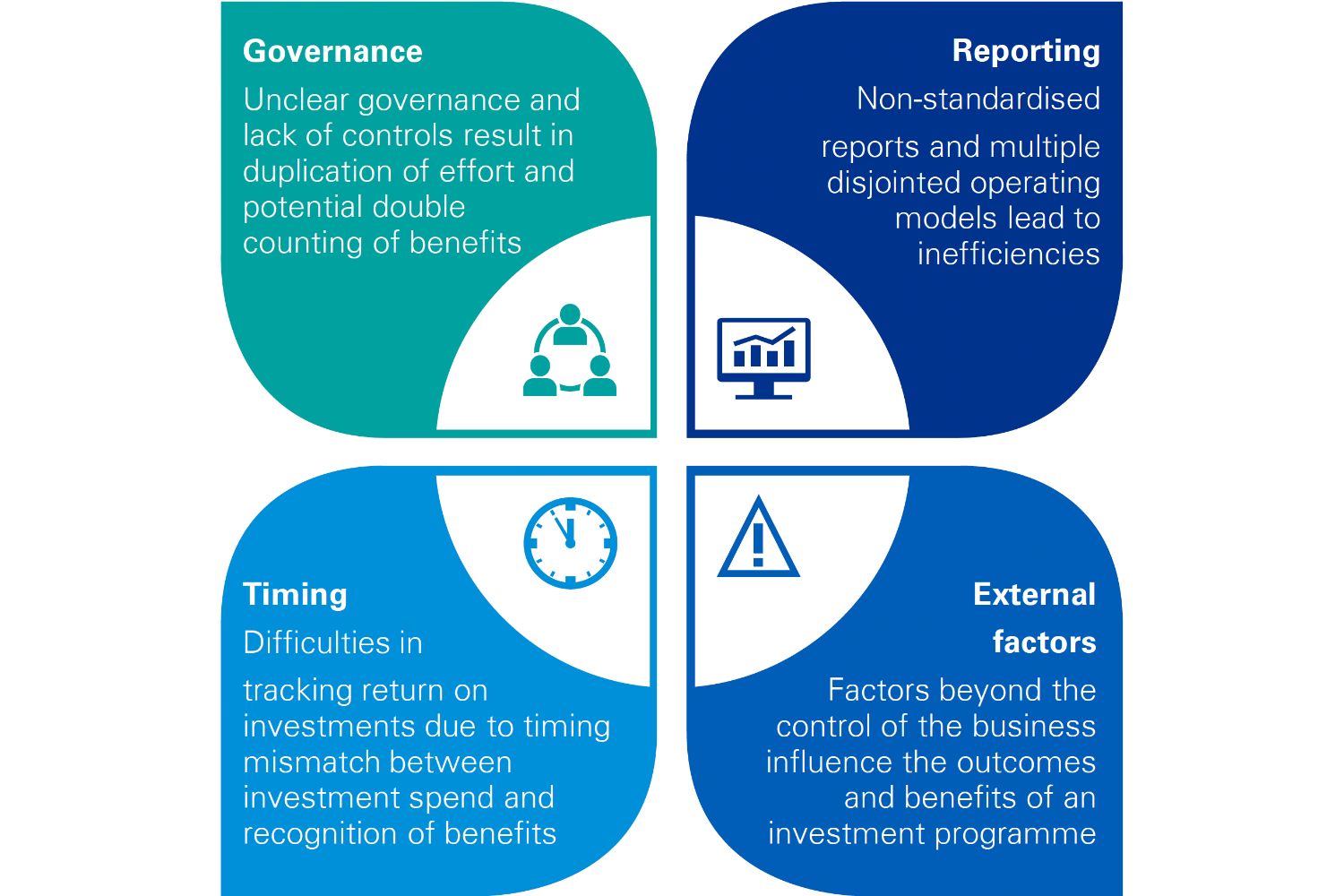

Based on our industry experience, we have identified four key challenges that banks face in effectively tracking and reporting benefits currently.

Based on our industry knowledge we have a defined methodology that can transform business planning and reporting by gaining access to meaningful financial and non-financial information. By leveraging quantitative data, organisations are able to anticipate corrective remedies in order to achieve goals and objectives at a programme and organisational level.

Understanding your strategy –what things you should be measuring

Your strategic aims are likely to be wider than merely growing revenue or cutting costs. Therefore in order to best track therealization of your strategy there are likely to be several benefit categories to track performance using a combination of financial and non-financial metrics:

- Customers

- Employees

- System infrastructure

- Operational efficiency

- Risk

- Innovation

Why are banks working with us on this now?

As banks shift their focus back to revenue growth there is an increased demand for demonstrating the benefits of investment programmes. Banks have previously tracked and reported cost savings, but there is not a consistent methodology for tracking other benefits.

Changing market conditions, including the surge in digital initiatives, have encouraged high-value investments in banks; however projects often fail to deliver on promised outcomes. As a result, organisations are under greater pressure to ensure transparency in reporting.

This calls for an alignment of strategic initiatives such as a benefits tracking framework and effective operating model to demonstrate realised benefits to key internal and external stakeholders.

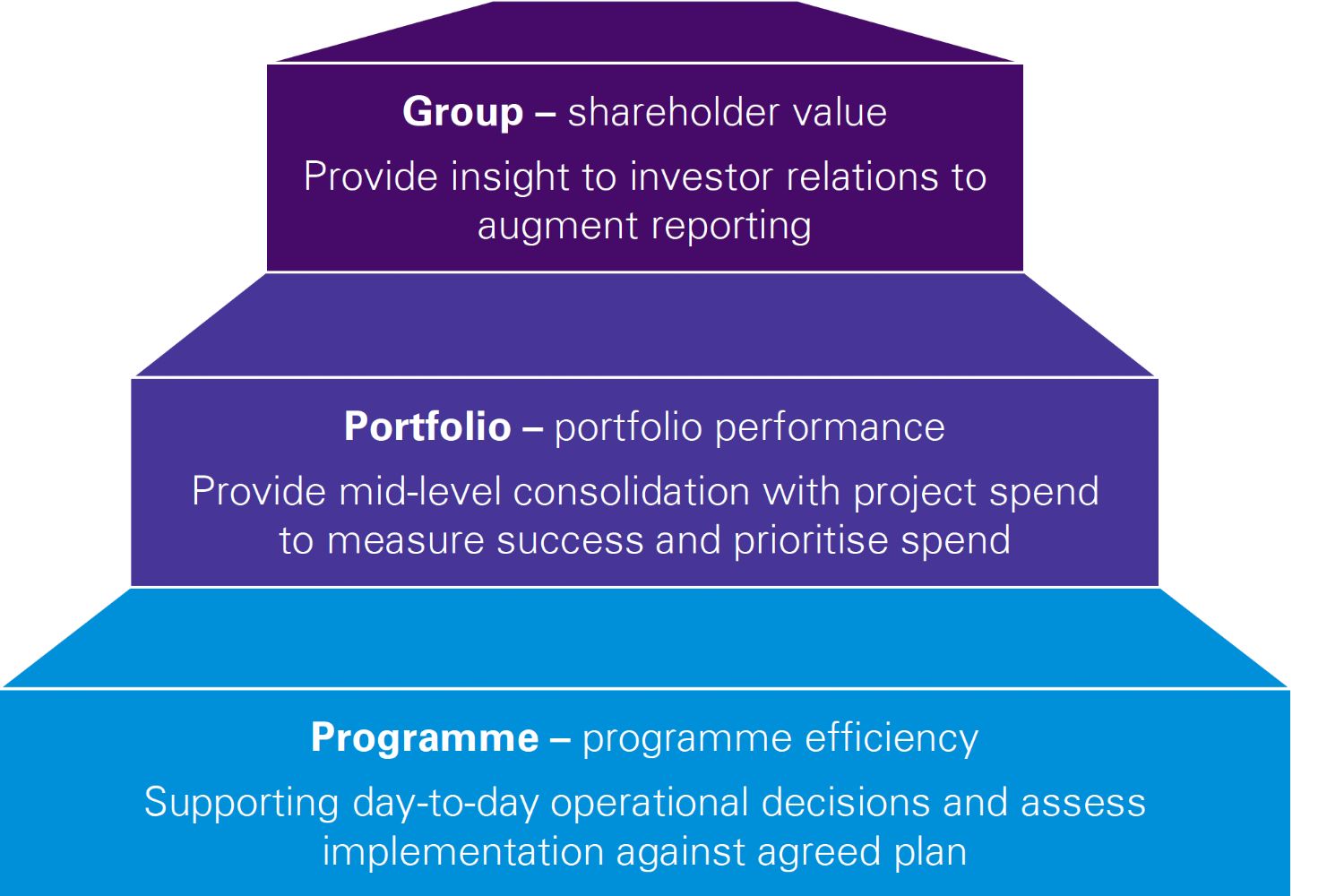

Benefits reporting level and respective priorities

Technology implementation focus

Technology driven change is pervasive within financial services organisations and cannot be ignored. In order for finance to understand whether sound investment decisions are being made, they have to make an effort to get to grips with technology andthe implications of change. Agile methodologies and new technology can be a challenge for existing finance processes and mind-set. Therefore finance must change in order to effectively partner the business.

Why is tracking technology change challenging?

Cultural change – There are a number of cultural changes that need to happen in order the track benefits successfully (especially if moving to an agile methodology). For finance it may be getting used to the idea of tracking non-financial measures, for technologists it may be getting used to reporting on operational measures or key results rather than milestones.

Measuring drivers of benefits rather than benefits themselves – By measuring the drivers of benefits you get anearly indication of whether a programme is on track to achieve their benefits or not and can make early interventions where appropriate.

Providing the salient information, not all the information – While it can be tempting to believe that more information is better, it is important not to overwhelm decision makers with all possible measures; only relevant measures should be included and they should be updated to maintain relevancy.

Understanding the technology – Finance needs to help holding technologists to account and ensure that the measures selected are encouraging the right behaviours and that they do not end up marking their own homework by picking their own measures without suitable challenge.

Case study

A global bank was seeking to track their investment benefits in alignment with their future growth strategy to track progress of the bank’s strategic initiatives.

KPMG partnered with the bank to support them with their investment benefits tracking and improve their investor confidence with benefits reporting over two phases:

Pilot

Following a successful pilot of five strategic initiatives, a suitable framework and a complementary methodology for the bank were established. We worked together with the senior stakeholders to determine the types of initiatives to be tracked and respective metrics.

Roll-out

Once comfortable with the methodology and framework, an operating model was developed to consolidate the approach. A material coverageof strategic initiatives was then captured to roll out benefits tracking across the business.

The next steps were to assist the bank in reporting the findings from the investment benefits tracking process.