From vehicle ownership to Mobility as a Service

In many markets, we see a clear shift in the way consumers view mobility, not least in their views towards vehicle ownership. This trend is particularly pronounced within urban areas, where people have greater mobility choice. In KPMG’s Global Automotive Executive Survey 2019, the opinion of decreasing ownership of vehicles is also shared by 39% of surveyed consumers, which shows that half of car owners know today they will no longer want to own a personal vehicle by 2025.

Similarly, UK Department for Transport figures show the percentage of men in England aged 17-20 with a full UK driver’s licence has fallen from 51% in the mid-1990s to just 29% in 2017 (and from 81% to 69% for men aged 21-29) (Department for Transport National Travel Survey, 26 July 2018).

These shifts can be partly attributed to the demand for consumer 'mobility-as-a-service’ as an alternative to ownership. Most notably through the emergence of on-demand private car hire firms such as Uber and Lyft, which have rapidly become commonplace in cities worldwide.

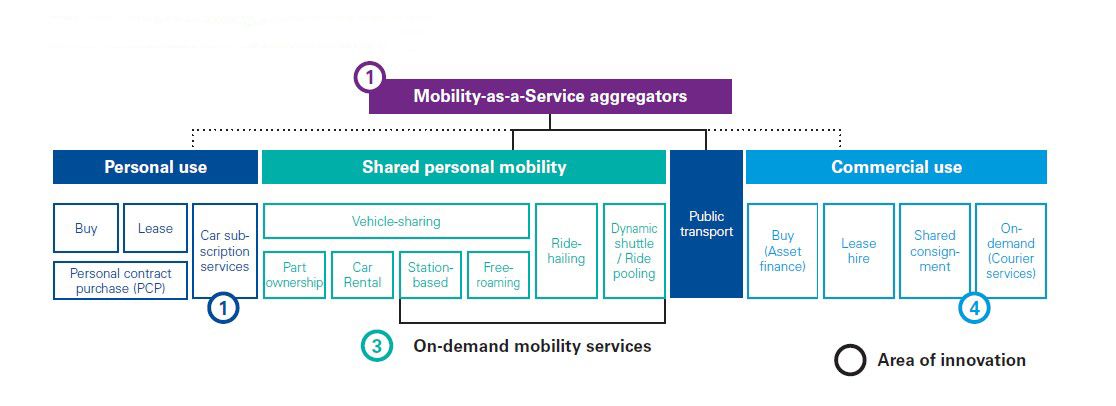

Mobility-as-a-Service (MaaS) is an evolving concept of how consumers and businesses move away from vehicle ownership towards service-based transport. In this sense, MaaS includes multi-modal aggregation of transport modes as well as on-demand mobility.

In the overall landscape of mobility we highlight four areas where organisations are innovating to create new business and service models.

The emerging mobility services landscape

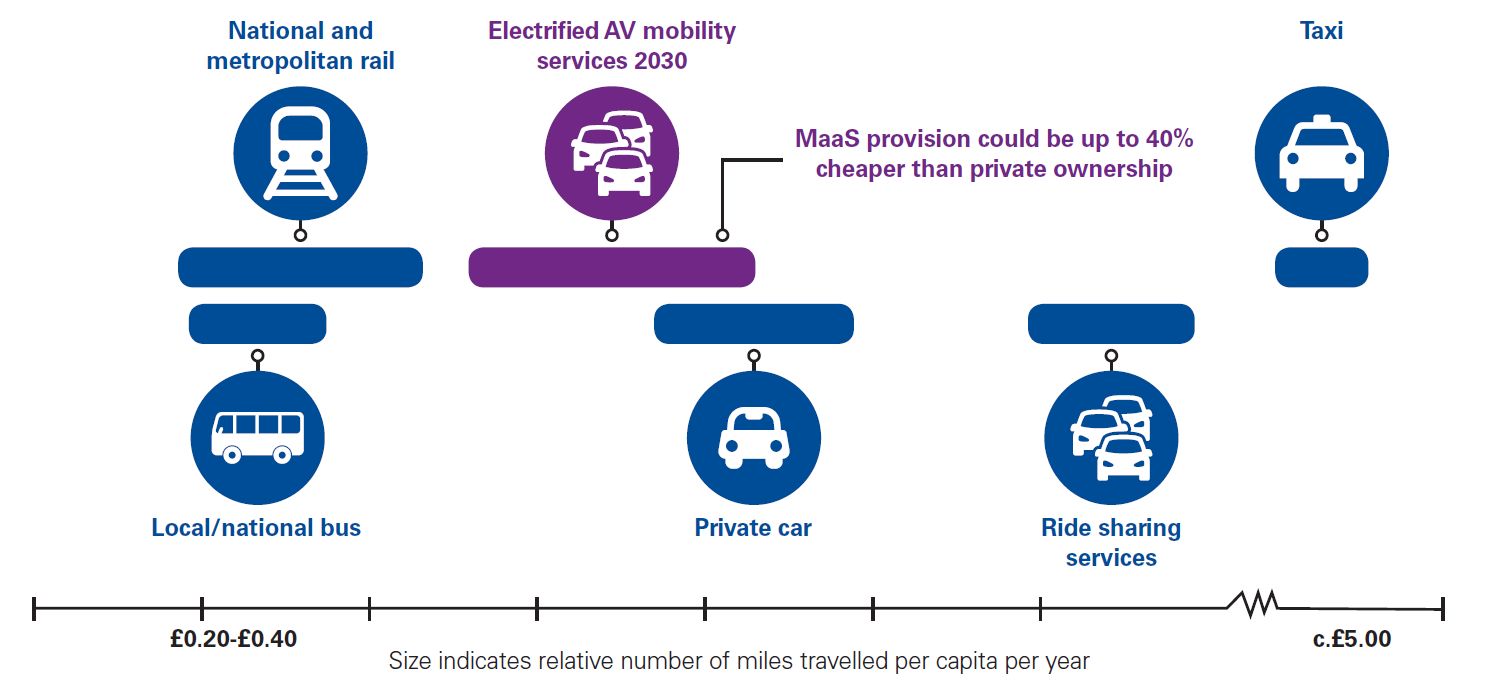

Cost per mile – UK nodes

Read the next chapter: