Momentum builds for autonomous vehicles

Connected and Autonomous Vehicles (CAVs) offer an opportunity to transform the world by fundamentally altering the way people and goods are moved. It could improve safety and congestion, while opening up independent mobility to excluded people such as younger or older travellers. It could also increase productivity, bring a new travel experience, change the roles of future employees and free up valuable urban land like parking lots.

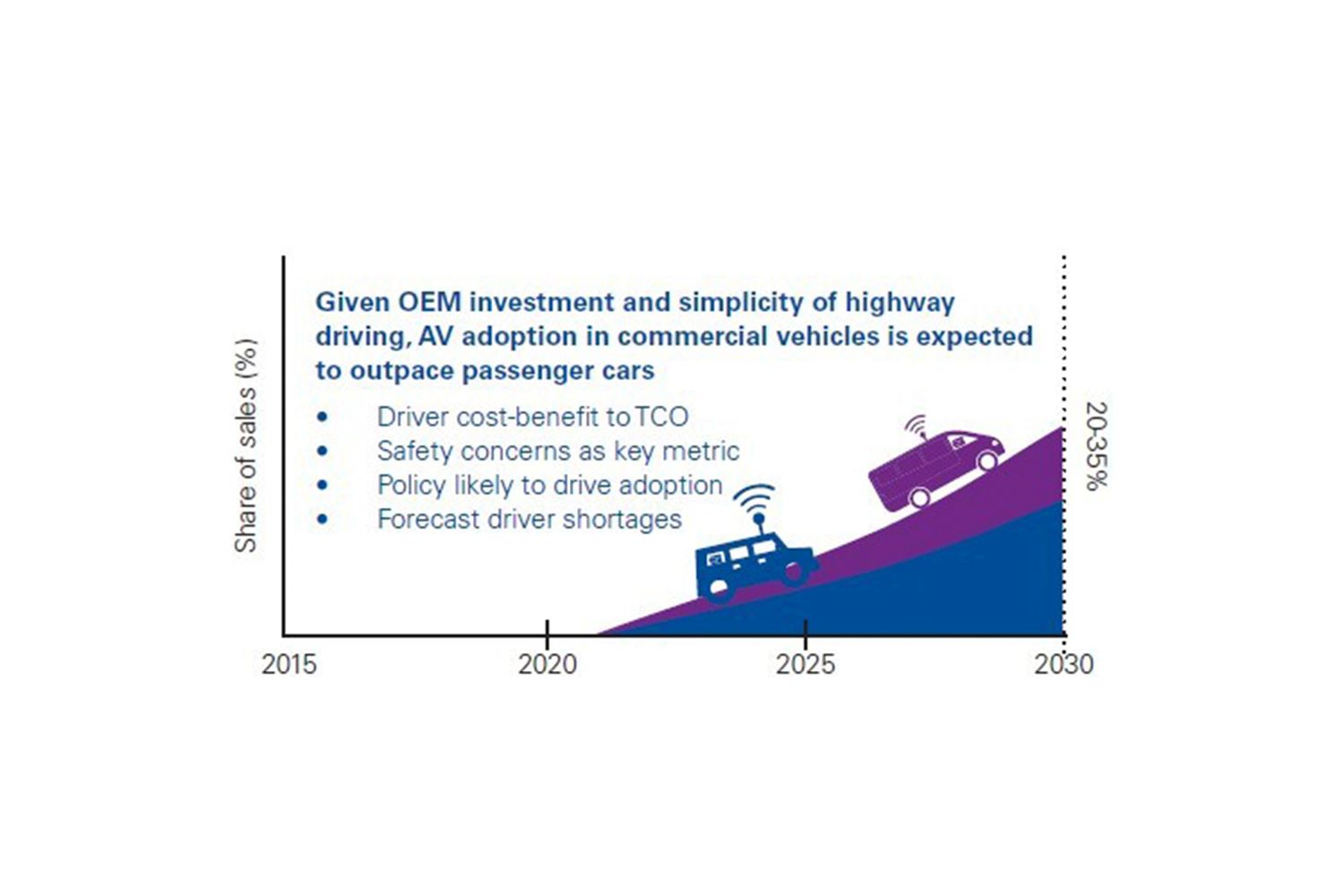

Momentum towards highly automated (Level 4) CAVs continues apace (For more information on levels of driving automation, view SAE International's J3016 automated-driving graphic update). At least 15 OEMs have pledged to release Level 4 AVs between 2019-2025, with much of the early deployment expected to be in urban areas (KPMG Mobility 2030 analysis). Alphabet subsidiary Waymo has already formally launched its commercial self-driving car service in Arizona (Waymo starts charging autonomous car riders in Arizona, Financial Times, 5th December 2018).

Level 5 autonomy – full autonomy in all locations and conditions – may not arrive before 2030. Even this may be an unrealistic target, with the market instead launching iterations of Level 4 autonomy, gradually expanding the areas where such vehicles can travel.

Although the onset of CAV should decrease the overall number of vehicles, the number of journeys and total distance travelled is likely to increase. Initial projections for the UK suggest that total passenger miles travelled could rise by as much as 10 percent between 2015 and 2030 (KPMG Mobility 2030 analysis). This will be driven by more affordable on-demand mobility services, as well as greater access to groups currently excluded (e.g. the young and elderly).

These vehicles will increasingly be owned by fleets and, like taxis, will be heavily utilised assets. This is in stark contrast to the average passenger car, which currently stands idle 95 percent of the time (Spaced out: Perspectives on parking policy, RAC Foundation, July 2012). With less need to own a vehicle, we expect a pronounced decline in car sales by 2030.

Scenario for forecast UK AV (L4/5) growth in new car and LCV sales

Click here to view the enlarged image.

But the speed of adoption is likely to vary significantly by region, based on four key pillars underlying AV adoption: availability of infrastructure, AV technology research & development (R&D), public acceptance of the technology, and the regulatory environment. These factors are considered in detail within KPMG’s AV Readiness Index.

Value opportunities emerge

The emergence of CAV, supported by new technologies and a maturing digital and physical infrastructure, will create an explosion in new value opportunities.

As increasingly connected cars evolve to become “computers on wheels”, they will generate more data than ever before, which can benefit consumers by increasing the safety, convenience and enjoyment of journeys. Maintenance can go from being reactive to predictive, new parts can be ordered automatically and whole fleets can be dynamically managed. In addition, over-the-air software updates can improve vehicle performance without anyone even coming into contact with the vehicle.

From a passenger experience perspective, connectivity should significantly broaden the scope of in-vehicle entertainment, commerce, health and working opportunities. CAV should also enhance road management, enabling transport authorities to manage capacity on busy routes, using CAV communications infrastructure to keep traffic flowing and reduce congestion.

But this scale and breadth of connectivity also has implications for cyber security, which is likely to be a major issue area to be addressed through to 2030 (Your connected car is talking: who’s listening?, KPMG, December 2016).

Read the next chapter: